Construction spending rallied in January as private nonresidential construction increased for the first time in seven months, according to an analysis of new federal construction spending data by the Associated General Contractors of America. Association officials said that nonresidential construction spending remains below pre-pandemic levels and that rising materials prices and proposed labor law changes threaten the sector’s recovery.

“Despite a modest upturn in January, spending on private nonresidential construction remained at the second-lowest level in more than three years and was 10% below the January 2020 spending rate,” said Ken Simonson, the association’s chief economist. “All 11 of the private nonresidential categories in the government report were down, compared to a year earlier.”

Construction spending in January totaled $1.52 trillion at a seasonally adjusted annual rate, an increase of 1.7% from the pace in December and 5.8% higher than in January 2020. Residential construction jumped 2.5% for the month and 21% year-over-year. Meanwhile, combined private and public nonresidential spending climbed 0.9% from December but remained 5.0% below the year-ago level.

Private nonresidential construction spending rose 0.4% from December to January, although declines continued for the three largest components. The largest private nonresidential segment, power construction, fell 10.0% year-over-year and 0.8% from December to January. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—slumped 8.3% year-over-year and 1.8% for the month. Office construction decreased 4.4% year-over-year and 0.2% in January. Manufacturing construction tumbled 14.7% from a year earlier despite a 4.9% pickup in January.

Public construction spending increased 2.9% year-over-year and 1.7% for the month. Results were mixed among the largest segments. Highway and street construction rose 6.5% from a year earlier and 5.8% for the month, possibly reflecting unseasonably mild weather conditions in January 2021 compared to December and January 2020. Educational construction increased 0.9% year-over-year but dipped 0.1% in January. Spending on transportation facilities declined 0.6% for the year and 1.0% in January.

Private residential construction spending increased for the eighth-straight month, jumping 21% year-over-year percent and 2.5% in January. Single-family homebuilding leaped 24.2% compared to January 2020 and 3.0% for the month. Multifamily construction spending climbed 16.9% for the year and 0.7% for the month.

Association officials said that many construction firms report they are being squeezed by rising materials prices, particularly for lumber and steel, yet are having a hard time increasing what they charge to complete projects. They urged the Biden administration to explore ways to boost domestic supply and eliminate trade barriers for those key materials. They also cautioned that the proposed PRO Act and its significant changes to current labor laws could undermine labor harmony at a time when the industry is struggling to rebound.

“Contractors are getting caught between rising materials prices and stagnant bid levels,” said Stephen E. Sandherr, the association’s chief executive officer. “Add to that the possible threat of a new era of labor unrest, and many contractors are worried that the recovery will end before it really starts.”

Related Stories

Market Data | Apr 4, 2016

ABC: Nonresidential spending slip in February no cause for alarm

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. The figure is a step back but still significantly higher than one year ago.

Market Data | Mar 30, 2016

10 trends for commercial real estate: JLL report

The report looks at global threats and opportunities, and how CRE firms are managing their expectations for growth.

Market Data | Mar 23, 2016

AIA: Modest expansion for Architecture Billings Index

Business conditions softening most in Midwest in recent months.

Retail Centers | Mar 16, 2016

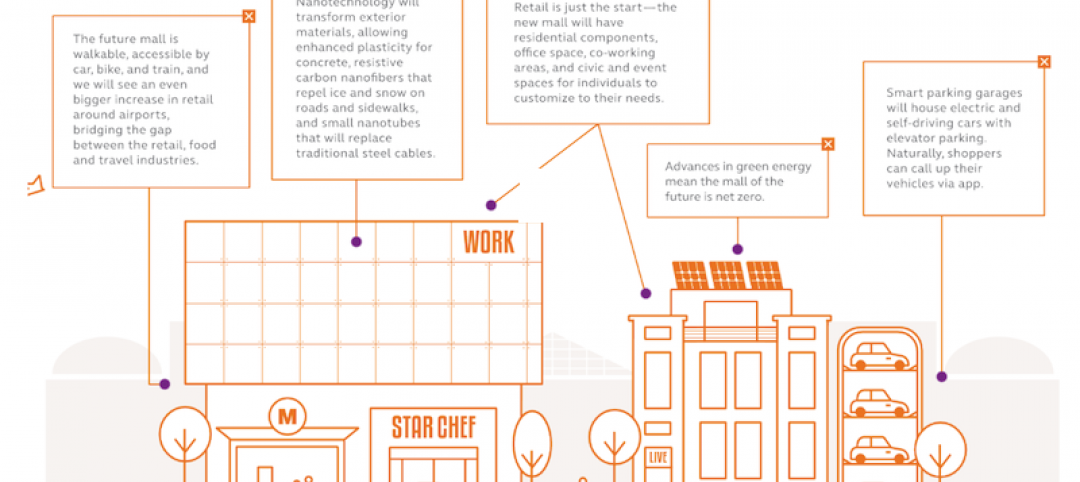

Food and technology will help tomorrow’s malls survive, says CallisonRTKL

CallisonRTKL foresees future retail centers as hubs with live/work/play components.

Market Data | Mar 6, 2016

Real estate execs measure success by how well they manage ‘talent,’ costs, and growth

A new CBRE survey finds more companies leaning toward “smarter” workspaces.

Market Data | Mar 1, 2016

ABC: Nonresidential spending regains momentum in January

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. Spending increased in January in 10 of 16 nonresidential construction sectors.

Market Data | Mar 1, 2016

Leopardo releases 2016 Construction Economics Report

This year’s report shows that spending in 2015 reached the highest level since the Great Recession. Total spending on U.S. construction grew 10.5% to $1.1 trillion, the largest year-over-year gain since 2007.

Market Data | Feb 26, 2016

JLL upbeat about construction through 2016

Its latest report cautions about ongoing cost increases related to finding skilled laborers.

Market Data | Feb 17, 2016

AIA reports slight contraction in Architecture Billings Index

Multifamily residential sector improving after sluggish 2015.

Market Data | Feb 11, 2016

AIA: Continued growth expected in nonresidential construction

The American Institute of Architects’ semi-annual Consensus Construction Forecast indicates a growth of 8% in construction spending in 2016, and 6.7% the following year.