Both Nonresidential and Residential Spending Retreat from January Levels amid Extreme Winter Weather; Association Posts Inflation Alert to Aid Understanding of Squeeze on Nonresidential Construction Firms

Construction spending slumped in February as unseasonably severe weather hammered the industry and a decline in new projects squeezed nonresidential contractors experiencing rising costs and delivery times, according to an analysis of new federal construction spending data by the Associated General Contractors of America. The association posted a Construction Inflation Alert to inform project owners and government officials about the threat to project completion dates and contractors’ financial health.

“The downturn in February reflects both an unfavorable change from mild January weather and an ongoing decline in new nonresidential projects,” said Ken Simonson, the association’s chief economist. “Unfortunately, it will take more than mild weather to help nonresidential contractors overcome the multiple challenges of falling demand for many project types, steeply rising costs, and lengthening or uncertain delivery times for key materials.”

Construction spending in February totaled $1.52 trillion at a seasonally adjusted annual rate, a decrease of 0.8% from the pace in January. Although the overall total was 5.3% higher than in February 2020, the year-over-year gain was limited to residential construction, Simonson noted. That segment slipped 0.2% for the month but jumped 21% year-over-year. Meanwhile, combined private and public nonresidential spending declined 1.3% from January and 6.1% over 12 months.

Private nonresidential construction spending fell 1.0% from January to February and 9.7% since February 2020, with year-over-year decreases in all 11 subsegments. The largest private nonresidential category, power construction, retreated 9.7% year-over-year and 0.4% from January to February. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—slumped 7.1% year-over-year and 1.2% for the month. Manufacturing construction tumbled 10.4% from a year earlier despite a pickup of 0.3% in February. Office construction decreased 5.0% year-over-year and 0.5% in February.

Public construction spending dipped 0.9% year-over-year and 1.7% for the month. Among the largest segments, highway and street construction declined 1.0% from a year earlier and 0.6% for the month, while educational construction decreased 2.3 percent year-over-year and 3.2 percent in February. Spending on transportation facilities declined 2.3 percent over 12 months and 2.5 percent in February.

Association officials said that rising materials prices and unreliable delivery schedules are making it hard for firms to remain profitable as they have difficulty passing raising prices for construction work. They said that proposed new infrastructure projects will help boost demand for many types of construction projects. But they urged Washington officials to also take steps to address supply-chain challenges, including by ending tariffs on key materials like lumber and steel.

“Contractors are having a hard time finding work, and when they do, they are getting squeezed by rapidly rising materials prices,” said Stephen E. Sandherr, the association’s chief executive officer. “New infrastructure investments will certainly help with demand, but the industry also needs Washington to help address supply-chain problems and rising costs.”

Related Stories

Market Data | May 2, 2023

Nonresidential construction spending up 0.7% in March 2023 versus previous month

National nonresidential construction spending increased by 0.7% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $997.1 billion for the month.

Hotel Facilities | May 2, 2023

U.S. hotel construction up 9% in the first quarter of 2023, led by Marriott and Hilton

In the latest United States Construction Pipeline Trend Report from Lodging Econometrics (LE), analysts report that construction pipeline projects in the U.S. continue to increase, standing at 5,545 projects/658,207 rooms at the close of Q1 2023. Up 9% by both projects and rooms year-over-year (YOY); project totals at Q1 ‘23 are just 338 projects, or 5.7%, behind the all-time high of 5,883 projects recorded in Q2 2008.

Market Data | May 1, 2023

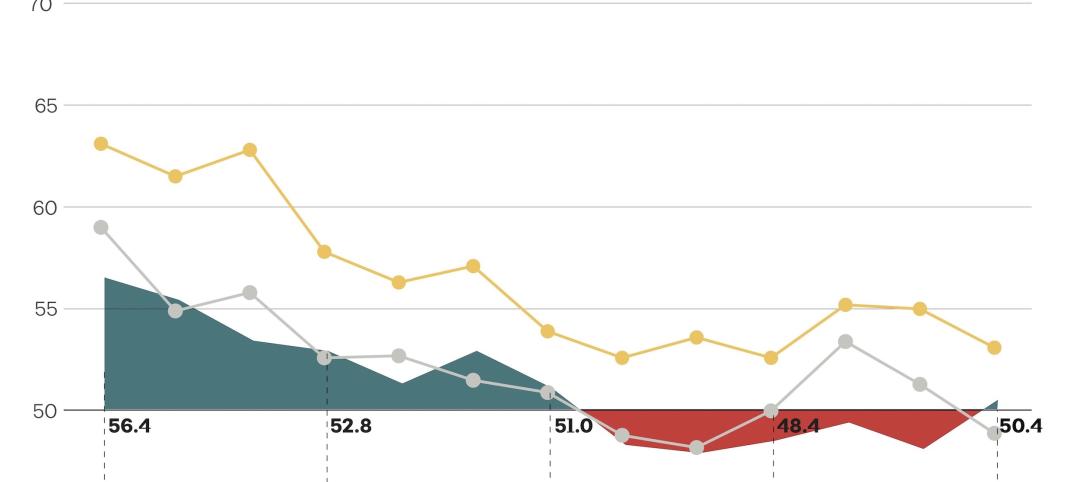

AEC firm proposal activity rebounds in the first quarter of 2023: PSMJ report

Proposal activity for architecture, engineering and construction (A/E/C) firms increased significantly in the 1st Quarter of 2023, according to PSMJ’s Quarterly Market Forecast (QMF) survey. The predictive measure of the industry’s health rebounded to a net plus/minus index (NPMI) of 32.8 in the first three months of the year.

Industry Research | Apr 25, 2023

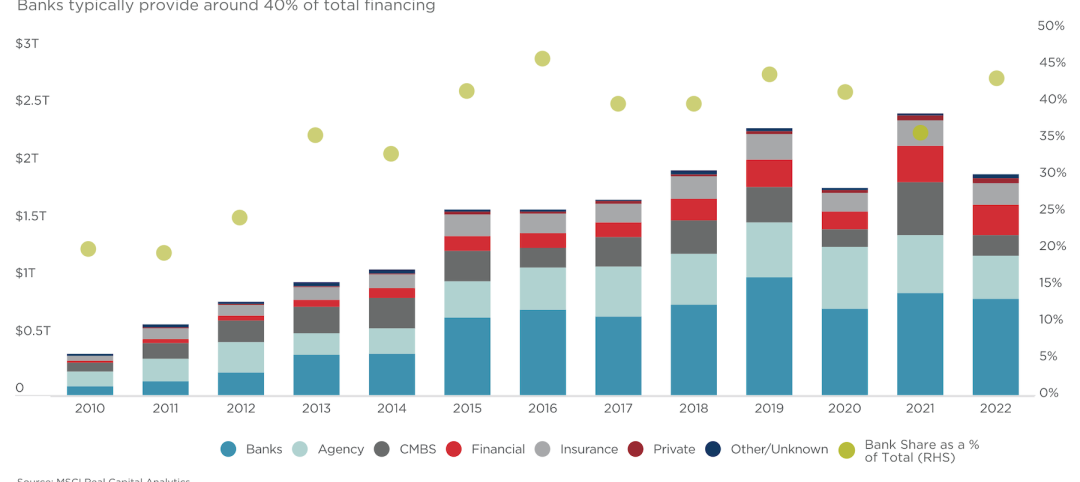

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Architects | Apr 21, 2023

Architecture billings improve slightly in March

Architecture firms reported a modest increase in March billings. This positive news was tempered by a slight decrease in new design contracts according to a new report released today from The American Institute of Architects (AIA). March was the first time since last September in which billings improved.

Contractors | Apr 19, 2023

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

Market Data | Apr 13, 2023

Construction input prices down year-over-year for first time since August 2020

Construction input prices increased 0.2% in March, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices rose 0.4% for the month.