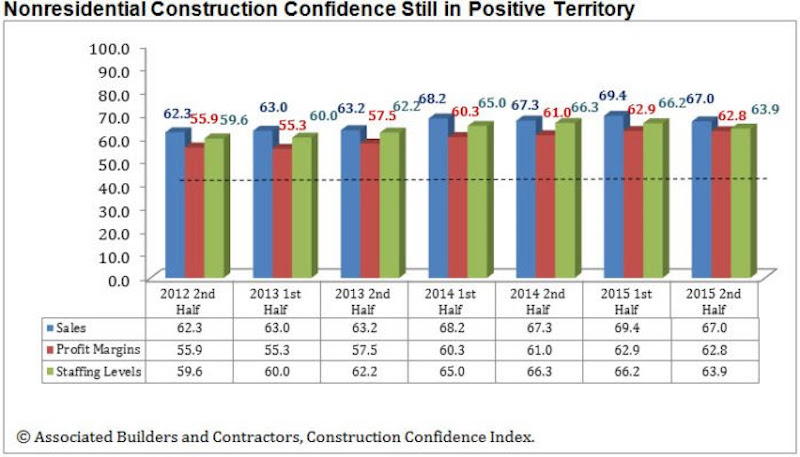

Associated Builders and Contractors' (ABC) Construction Confidence Index (CCI) showed a slight dip in the second half of 2015, although all three components of the index showed optimism for continued economic growth. The diffusion index measures forward-looking construction industry expectations in sales, profit margins and staffing levels, with readings above 50 indicating growth.

"An abundance of considerations have rendered the typical nonresidential construction executive somewhat less confident regarding near-term business prospects," said ABC Chief Economist Anirban Basu. "These include jittery financial markets, stubbornly low commodity prices, unpredictable Federal Reserve policy and rising consumer delinquencies and corporate defaults. Outside of financial concerns, the industry is concerned by skilled construction worker shortages, the unpredictable presidential election cycle and expanding geopolitical risk. Still, construction executives collectively expect nonresidential construction's impressive recovery to persist, in large measure because backlog remains high.

"Still, construction executives are well aware that the business cycle can end abruptly," warned Basu. "Asset prices continue to be unsettled and credit availability could tighten going forward if markets remain wobbly. The direction of interest rates is naturally of enormous concern to construction leaders since real estate and construction are among the sectors most sensitive to shifts in the cost of capital and the availability of financing."

Here is a snapshot of the results for the most recent survey administration:

- Sales expectations fell from 69.4 to 67.0;

- Profit margin expectations edged lower from 62.9 to 62.8;

- Staffing level intentions dipped from 66.2 to 63.9.

Related Stories

Multifamily Housing | Feb 14, 2024

Multifamily rent remains flat at $1,710 in January

The multifamily market was stable at the start of 2024, despite the pressure of a supply boom in some markets, according to the latest Yardi Matrix National Multifamily Report.

Industry Research | Feb 8, 2024

New multifamily development in 2023 exceeded expectations

Despite a problematic financing environment, 2023 multifamily construction starts held up “remarkably well” according to the latest Yardi Matrix report.

Industry Research | Jan 31, 2024

ASID identifies 11 design trends coming in 2024

The Trends Outlook Report by the American Society of Interior Designers (ASID) is the first of a three-part outlook series on interior design. This design trends report demonstrates the importance of connection and authenticity.

Apartments | Jan 26, 2024

New apartment supply: Top 5 metros delivering in 2024

Nationally, the total new apartment supply amounts to around 1.4 million units—well exceeding the apartment development historical average of 980,000 units.

Self-Storage Facilities | Jan 25, 2024

One-quarter of self-storage renters are Millennials

Interest in self-storage has increased in over 75% of the top metros according to the latest StorageCafe survey of self-storage preferences. Today, Millennials make up 25% of all self-storage renters.

Industry Research | Jan 23, 2024

Leading economists forecast 4% growth in construction spending for nonresidential buildings in 2024

Spending on nonresidential buildings will see a modest 4% increase in 2024, after increasing by more than 20% last year according to The American Institute of Architects’ latest Consensus Construction Forecast. The pace will slow to just over 1% growth in 2025, a marked difference from the strong performance in 2023.

Adaptive Reuse | Jan 23, 2024

Adaptive reuse report shows 55K impact of office-to-residential conversions

The latest RentCafe annual Adaptive Reuse report shows that there are 55,300 office-to-residential units in the pipeline as of 2024—four times as much compared to 2021.

Construction Costs | Jan 22, 2024

Construction material prices continue to normalize despite ongoing challenges

Gordian’s most recent Quarterly Construction Cost Insights Report for Q4 2023 describes an industry still attempting to recover from the impact of COVID. This was complicated by inflation, weather, and geopolitical factors that resulted in widespread pricing adjustments throughout the construction materials industries.

Multifamily Housing | Jan 15, 2024

Multifamily rent growth rate unchanged at 0.3%

The National Multifamily Report by Yardi Matrix highlights the highs and lows of the multifamily market in 2023. Despite strong demand, rent growth remained unchanged at 0.3 percent.

Apartments | Jan 9, 2024

Apartment developer survey indicates dramatic decrease in starts this year

Over 56 developers, operators, and investors across the country were surveyed in John Burns Research and Consulting's recently-launched Apartment Developer and Investor Survey.