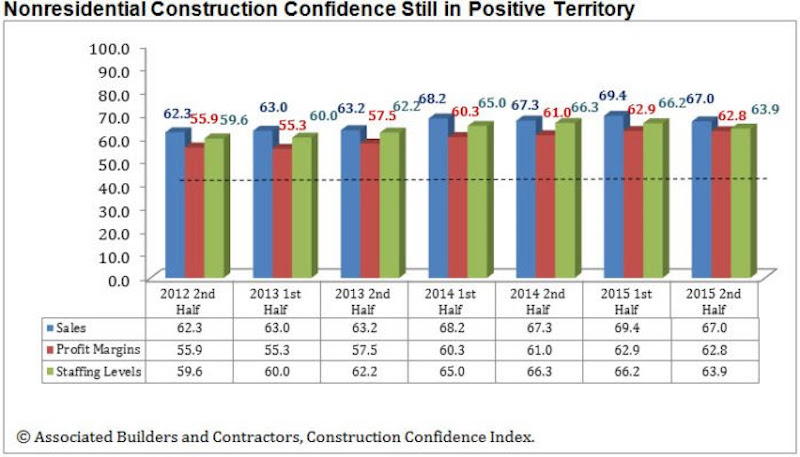

Associated Builders and Contractors' (ABC) Construction Confidence Index (CCI) showed a slight dip in the second half of 2015, although all three components of the index showed optimism for continued economic growth. The diffusion index measures forward-looking construction industry expectations in sales, profit margins and staffing levels, with readings above 50 indicating growth.

"An abundance of considerations have rendered the typical nonresidential construction executive somewhat less confident regarding near-term business prospects," said ABC Chief Economist Anirban Basu. "These include jittery financial markets, stubbornly low commodity prices, unpredictable Federal Reserve policy and rising consumer delinquencies and corporate defaults. Outside of financial concerns, the industry is concerned by skilled construction worker shortages, the unpredictable presidential election cycle and expanding geopolitical risk. Still, construction executives collectively expect nonresidential construction's impressive recovery to persist, in large measure because backlog remains high.

"Still, construction executives are well aware that the business cycle can end abruptly," warned Basu. "Asset prices continue to be unsettled and credit availability could tighten going forward if markets remain wobbly. The direction of interest rates is naturally of enormous concern to construction leaders since real estate and construction are among the sectors most sensitive to shifts in the cost of capital and the availability of financing."

Here is a snapshot of the results for the most recent survey administration:

- Sales expectations fell from 69.4 to 67.0;

- Profit margin expectations edged lower from 62.9 to 62.8;

- Staffing level intentions dipped from 66.2 to 63.9.

Related Stories

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.

Market Data | Oct 23, 2023

New data finds that the majority of renters are cost-burdened

The most recent data derived from the 2022 Census American Community Survey reveals that the proportion of American renters facing housing cost burdens has reached its highest point since 2012, undoing the progress made in the ten years leading up to the pandemic.

Giants 400 | Oct 23, 2023

Top 115 Multifamily Construction Firms for 2023

Clark Group, Suffolk Construction, Summit Contracting Group, Whiting-Turner Contracting, and McShane Companies top the ranking of the nation's largest multifamily housing sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Giants 400 | Oct 23, 2023

Top 75 Multifamily Engineering Firms for 2023

Kimley-Horn, WSP, Tetra Tech, Olsson, and Langan head the ranking of the nation's largest multifamily housing sector engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Giants 400 | Oct 23, 2023

Top 190 Multifamily Architecture Firms for 2023

Humphreys and Partners, Gensler, Solomon Cordwell Buenz, Niles Bolton Associates, and AO top the ranking of the nation's largest multifamily housing sector architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Senior Living Design | Oct 19, 2023

Senior living construction poised for steady recovery

Senior housing demand, as measured by the change in occupied units, continued to outpace new supply in the third quarter, according to NIC MAP Vision. It was the ninth consecutive quarter of growth with a net absorption gain. On the supply side, construction starts continued to be limited compared with pre-pandemic levels.

Warehouses | Oct 19, 2023

JLL report outlines 'tremendous potential' for multi-story warehouses

A new category of buildings, multi-story warehouses, is beginning to take hold in the U.S. and their potential is strong. A handful of such facilities, also called “urban logistics buildings” have been built over the past five years, notes a new report by JLL.

Contractors | Oct 19, 2023

Crane Index indicates slowing private-sector construction

Private-sector construction in major North American cities is slowing, according to the latest RLB Crane Index. The number of tower cranes in use declined 10% since the first quarter of 2023. The index, compiled by consulting firm Rider Levett Bucknall (RLB), found that only two of 14 cities—Boston and Toronto—saw increased crane counts.

Office Buildings | Oct 19, 2023

Proportion of workforce based at home drops to lowest level since pandemic began

The proportion of the U.S. workforce working remotely has dropped considerably since the start of the Covid 19 pandemic, but office vacancy rates continue to rise. Fewer than 26% of households have someone who worked remotely at least one day a week, down sharply from 39% in early 2021, according to the latest Census Bureau Household Pulse Surveys.

Contractors | Oct 19, 2023

Poor productivity cost U.S contractors as much as $40 billion last year

U.S. contractors lost between $30 billion and $40 billion in 2022 due to poor labor productivity, according to a new report from FMI Corp. The survey focused on self-performing contractors, those typically engaged as a trade partner to a general contractor.