Nearly half of the respondents (46.1%) to an exclusive Building Design+Construction survey of AEC professionals reported that revenues had increased this year compared to 2012, with another 24.2% saying cash flow had stayed the same.

The majority (56.8%) of respondents—architects, engineers, contractors, building owners, and others in the commercial, industrial, multifamily, and institutional field—said their firms will bump up revenues next year, with 31.4% saying business will stay the same and only 11.8% predicting it will decline. A majority (55.5%) rated the health of their firms as good (35.6%) or very good (19.9%).

As has been the case in recent years, the overwhelming majority (71.2%) rated “general economic conditions (i.e., recession)” as the most important concern their firms will face in 2014.

Competition from other firms went up as a factor for the third year in a row, to 47.6% (44.9% in 2012, 40.1% in 2011). Nearly four in five respondents (79.3%) described the current business climate for their firms as “very” to “intensely” competitive; that’s up somewhat from 73.4% in 2012 and 74.8% in 2011. But “having insufficient capital funding for projects” declined slightly, to 24.1% of respondents, down from 29.7% in 2012 and 34.5% in 2011.

AEC respondents to this third annual survey of BD+C subscribers were still worried about the economy. On the other hand, “avoiding layoffs” (17.6%), “avoiding benefit reductions” (16.4%), and “keeping staff motivated” (14.6%) were of less concern.

DATA CENTERS CONTINUE THEIR SURGE INTO 2014

Asked to rate their firms’ prospects in specific construction sectors on a five-point scale from “excellent” to “very weak,” respondents gave data centers high marks. (Note: Respondents who checked “Not applicable/No opinion/Don’t know” are not counted here.) Among the findings:

• Data centers and mission-critical facilities continued to show strength, with the majority (56.0%) of respondents in the good/excellent category, compared to 52.1% last year and 45.2% the year before.

• Healthcare continued its leadership as the most highly desirable sector, with more than three in five respondents (62.5%) giving it a good to excellent rating, up from 58.8% last year.

• The apartment boom registered with AEC professionals, who gave multifamily housing a 56.1% good/excellent rating.

• Industrial/warehouse facilities keep moving up in the AEC psyche, registering a 33.0% interest level on the good/excellent scale, a significant climb from last year’s 25.5%.

• Retail commercial construction also showed vitality. Nearly a third of respondents (31.4%) came out on the good/excellent side for the coming year, well up from last year’s 19.9% rating.

• Nearly two-thirds of those surveyed (66.0%) said senior and assisted-living facilities look like good/excellent prospects for their firms, significantly up from last year’s healthy 50.5%. Hello, baby boomers!

• College and university facilities got the nod from 44.8% of respondents on the good to excellent scale, up from 37.8% last year.

As for government/military projects, the survey was taken before the full impact of the sequestration was known. The sector was rated good to excellent by 33.7% of respondents, much along the lines of last year’s 36.1% of respondents, down slightly from the previous year’s 41.1%.

While the construction of new office buildings drew tepid response (26.9%) in the good/excellent scale, that was still up significantly from last year’s 15.6% rating. However, a solid majority (52.1%) of respondents said office fitouts and interior renovations look good to excellent for 2014. That was likely a statistically significant leap from last year’s 35.7% who said office interiors would be a strong sector.

Respondents said their firms will likely use multiple strategies to stay ahead of the game in 2014. Only a small percentage (3.2%) said they think their companies will open a new office in the U.S. or Canada, while 4.5% said their firms might open an international office.

In fact, reconstruction, historic preservation, and renovations accounted for at least 25% of work for more than a third (38.5%) of respondents, up slightly from the 34.6% of respondents’ firms in 2012 and roughly the same as in 2011 (36.3%).

K-12 schools perked up a bit, with 30.9% saying the sector looks good to excellent for 2014, compared with 22.9% last year and 23.2% the year before.

TAKING ON THE DEMANDS OF BIM/VDC TECHNOLOGY

What about BIM? Is its promise holding true? Somewhat surprisingly, more than one in five respondents (22.7%) said their firms do not use building information modeling, about what was recorded over the previous two years.

Remarkably, precisely the same percentage of respondents (26.8%) said their firms used BIM in the majority of projects based on dollar value as in the last two annual surveys. Nearly two in five (39.8%) said their firms’ use of BIM will rise in the coming year; similarly, two-fifths (42.2%) of respondents said their companies will be investing more in technology in 2014.

As for social media, LinkedIn remained the top choice of respondents, at 53.1%, but that was a steep decline from last year’s 85.1% for LinkedIn. Facebook also took a hit, dropping to 32.5% in popularity, versus 49.5% last year, while Twitter dropped from 21.1% last year to 13.4%. Once again, a big chunk of respondents (31.3%) said they did not use social media channels.

Of the 400 who gave their professional description, 45.0% were architects; 8.0%, engineers; 28.8%, contractors; 9.8%, building owners, developers, or facility managers; and 8.6%, consultants or “other.” The margin of error was 4.8% at the 95% confidence level.

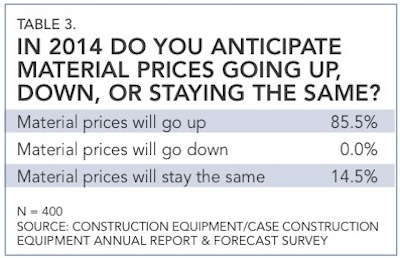

Respondents overwhelmingly said they expect prices of materials to rise in the coming year, with no respondents saying they expect such prices to fall.

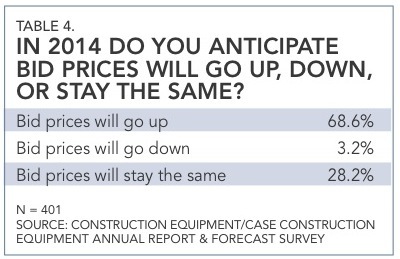

More than two-thirds of respondents (68.6%) said they expect bid prices to go up next year. Survey results have a margin of error of 4.8%.

For more on AEC firms' financial performance, see BD+C's 2013 Giants 300 Report.

Related Stories

Government Buildings | May 10, 2024

New federal buildings must be all-electric by 2030

A new Biden Administration rule bans the use of fossil fuels in new federal buildings beginning in 2030. The announcement came despite longstanding opposition to the rule by the natural gas industry.

Sustainable Development | May 10, 2024

Nature as the city: Why it’s time for a new framework to guide development

NBBJ leaders Jonathan Ward and Margaret Montgomery explore five inspirational ideas they are actively integrating into projects to ensure more healthy, natural cities.

Mass Timber | May 8, 2024

Portland's Timberview VIII mass timber multifamily development will offer more than 100 affordable units

An eight-story, 72,000-sf mass timber apartment building in Portland, Ore., topped out this winter and will soon offer over 100 affordable units. The structure is the tallest affordable housing mass timber building and the first Type IV-C affordable housing building in the city.

Architects | May 8, 2024

Ivan O’Garro, AIA joins LEO A DALY as a vice president

Integrated design firm LEO A DALY welcomes Ivan O’Garro, AIA, as a vice president and managing principal of its Atlanta studio.

K-12 Schools | May 7, 2024

World's first K-12 school to achieve both LEED for Schools Platinum and WELL Platinum

A new K-12 school in Washington, D.C., is the first school in the world to achieve both LEED for Schools Platinum and WELL Platinum, according to its architect, Perkins Eastman. The John Lewis Elementary School is also the first school in the District of Columbia designed to achieve net-zero energy (NZE).

Healthcare Facilities | May 6, 2024

Hospital construction costs for 2024

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Biophilic Design | May 6, 2024

The benefits of biophilic design in the built environment

Biophilic design in the built environment supports the health and wellbeing of individuals, as they spend most of their time indoors.

MFPRO+ Special Reports | May 6, 2024

Top 10 trends in affordable housing

Among affordable housing developers today, there’s one commonality tying projects together: uncertainty. AEC firms share their latest insights and philosophies on the future of affordable housing in BD+C's 2023 Multifamily Annual Report.

Retail Centers | May 3, 2024

Outside Las Vegas, two unused office buildings will be turned into an open-air retail development

In Henderson, Nev., a city roughly 15 miles southeast of Las Vegas, 100,000 sf of unused office space will be turned into an open-air retail development called The Cliff. The $30 million adaptive reuse development will convert the site’s two office buildings into a destination for retail stores, chef-driven restaurants, and community entertainment.

Codes and Standards | May 3, 2024

New York City considering bill to prevent building collapses

The New York City Council is considering a proposed law with the goal of preventing building collapses. The Billingsley Structural Integrity Act is a response to the collapse of 1915 Billingsley Terrace in the Bronx last December.