Despite rising demand, the construction industry is expected to see a serious falloff in building starts, according Jones Lang Lasalle’s Construction Trends and Midyear Update, which JLL released this morning.

The report takes a fresh look at the industry’s overall health, the current availability and pricing for labor and materials, and the direction that total construction costs may be headed.

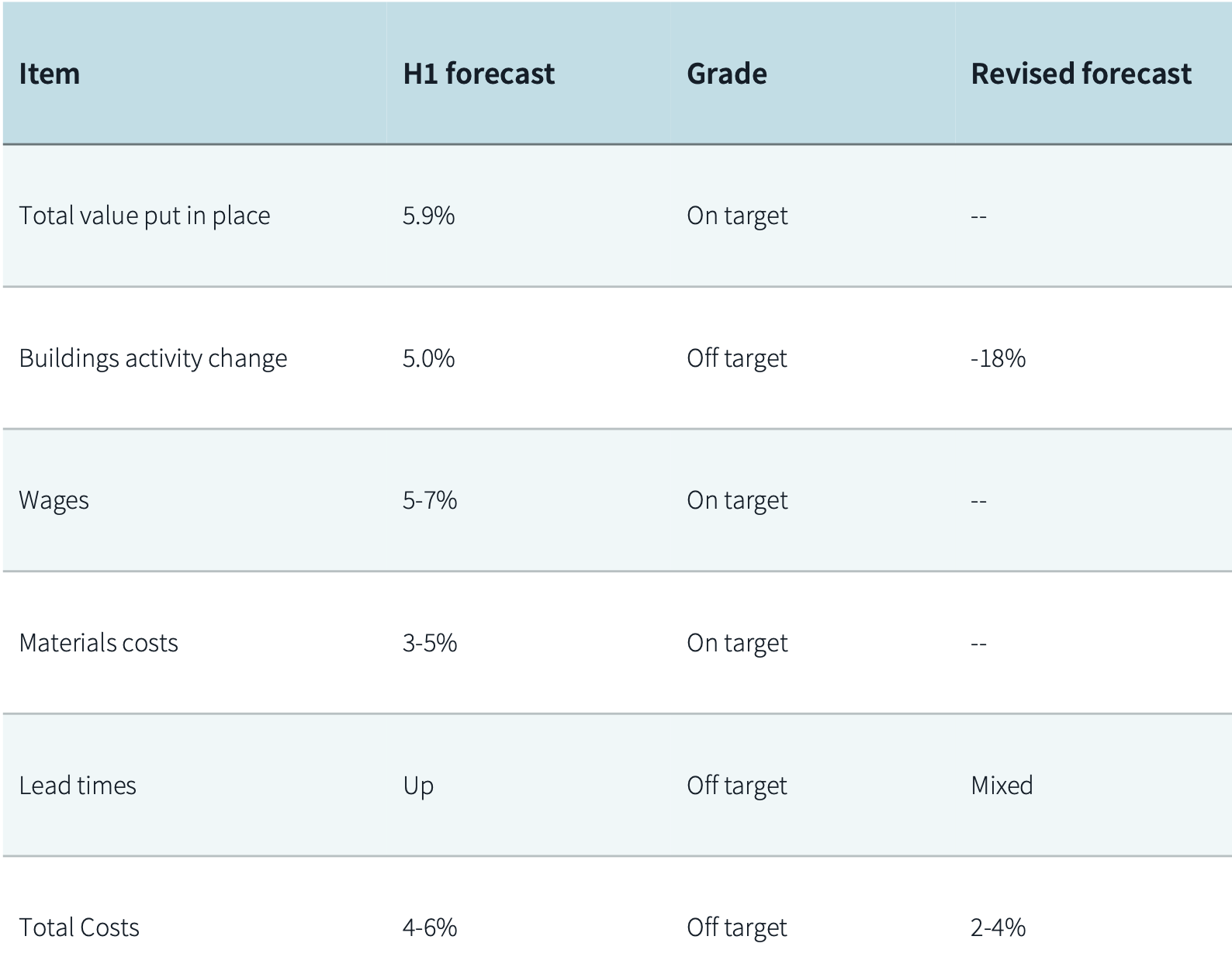

JLL still sees the construction sector in “uncharted economic territory,” as global threats remain unrealized “but full of disruptive potential” even as construction continues at breakneck speed to address post-pandemic built-environment needs. Consequently, JLL updated its projections for three of the seven barometers it tracks (see chart).

The outlook’s four key takeaways are:

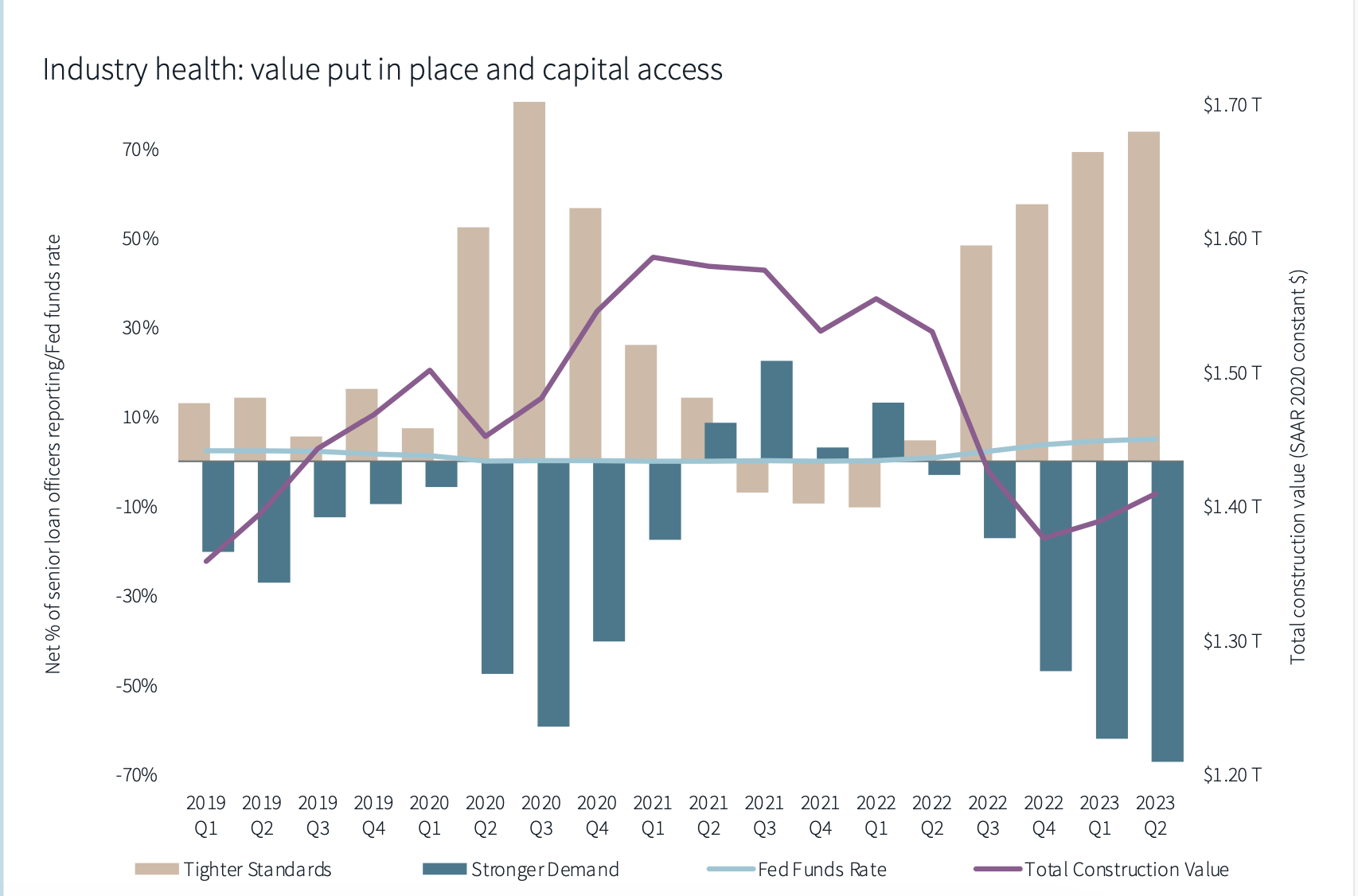

•Industry Health: Financing constraints have driven a rapid decline in construction starts over the last quarter;

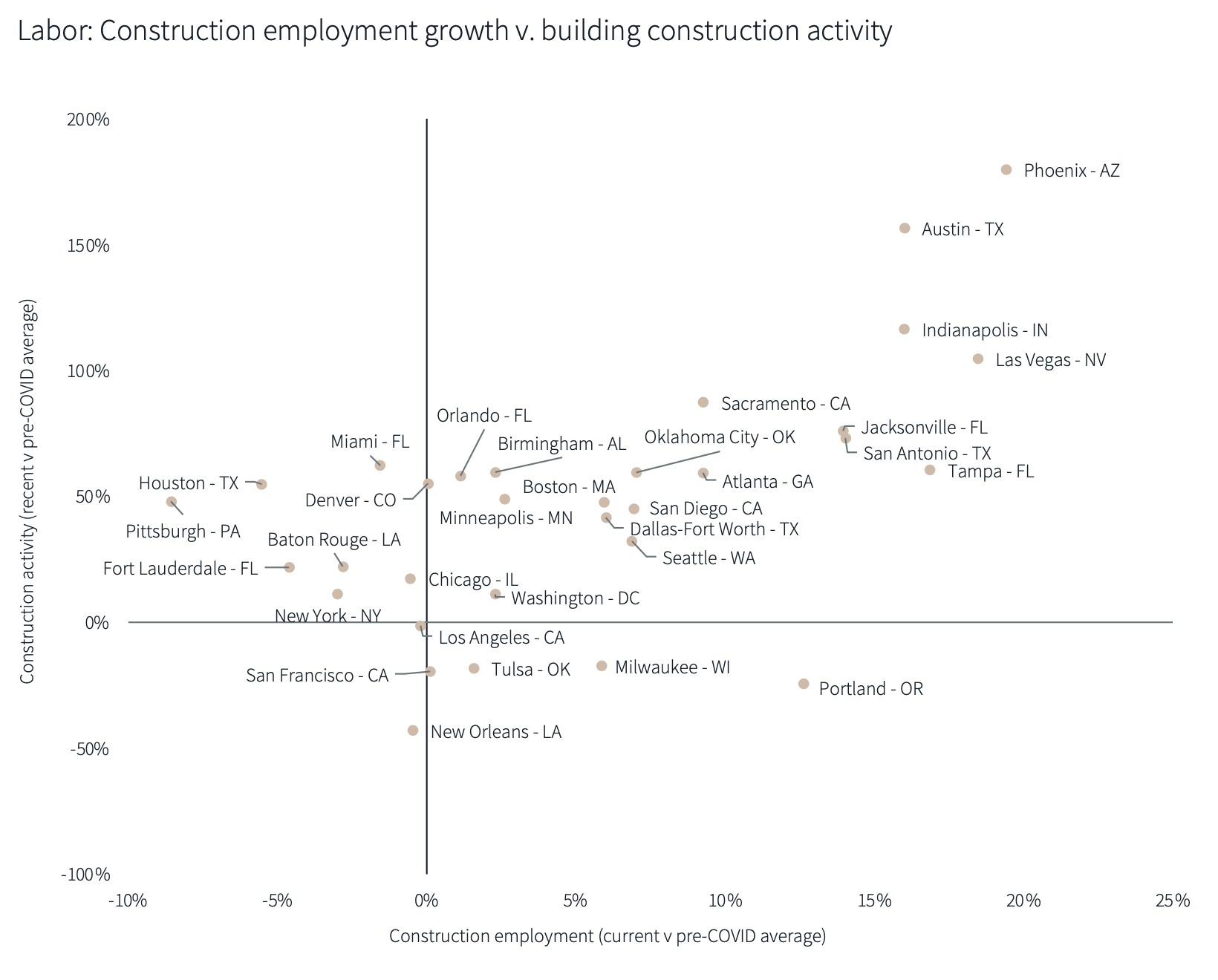

•Labor: Firms are prioritizng talent retention strategies;

•Materials: Supply chain issues have largely stabilized, and future cost increases should be manageable;

•Total Costs: Firms' responses to the impending slowdown have led to a drop in total costs during the third quarter, prompting JLL to revise its total cost growth forecast down to 2-4%, from 4-6% in the first half of the year.

Interest rates are curtailing building starts

Based on midyear data, JLL’s forecast for construction value put in place aligns with its previous expectations. Overall, industry sentiment is strong, but construction is expected to cool depending on resolution or escalation of threats ranging from inflation to geopolitical turmoil. JLL’s revised forecast anticipates an 18% decline in building activity, compared with its 5% growth forecast for the first half of the year.

Rising interest rates are slowing construction starts. But demand for infrastructure and other non-building projects remains strong. JLL predicts interest rates will peak near the end of this year, and construction activity should rev up, “with specialization and complexity management playing vital roles.“

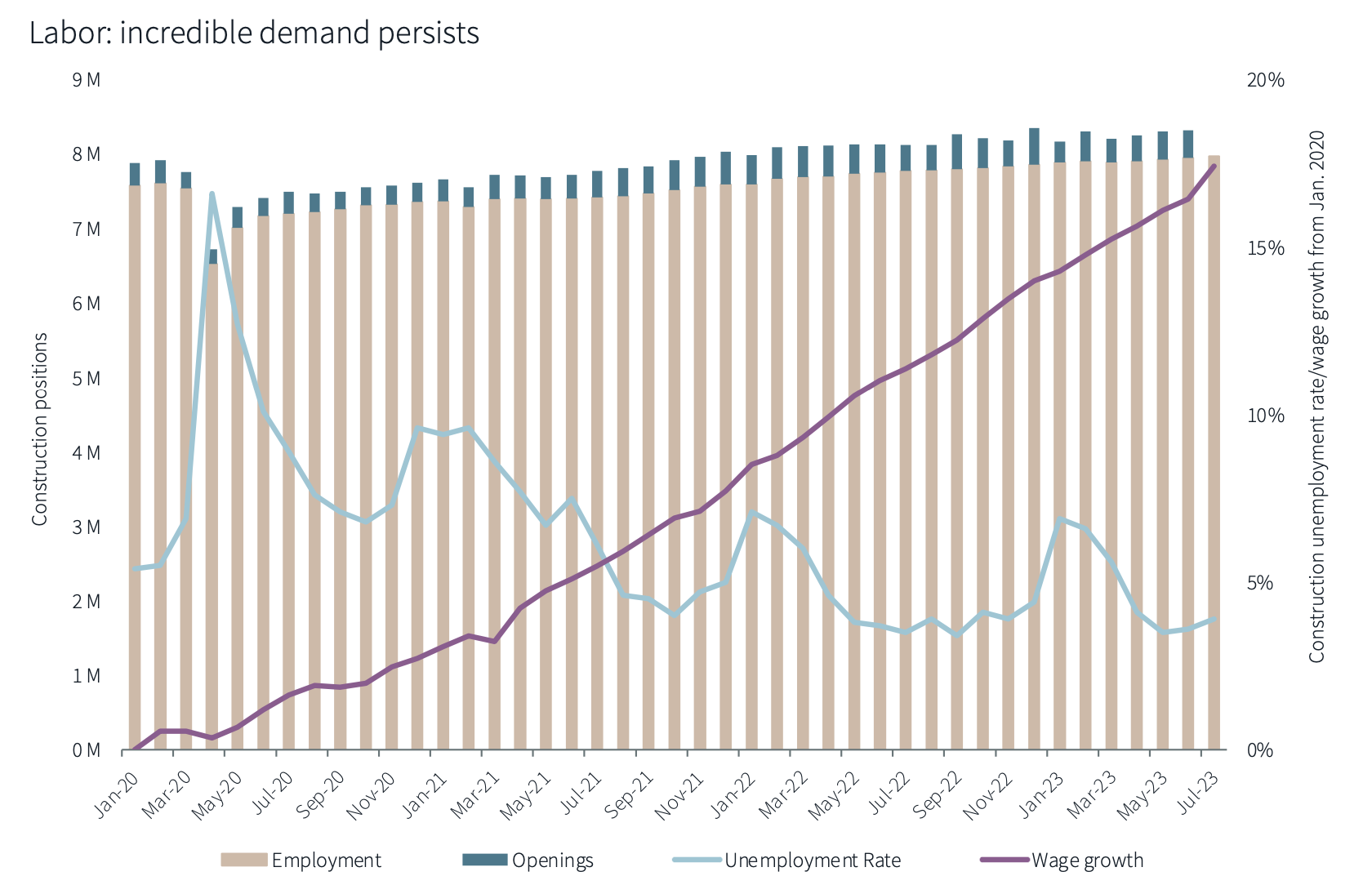

JLL continues to stand by its forecast of 5-7% growth in labor costs. Job openings remain high, and unemployment is unusually low. There is “persistent” wage competition for skilled workers. However, contractors remain confident about their ability to weather the expected downturn. JLL foresees minimal disruption in sectors buoyed by public sector spending; other sectors could see more of a dropoff, though. Construction activity per employee will remain above pre-pandemic levels for the foreseeable future.

Total costs are stabilizing

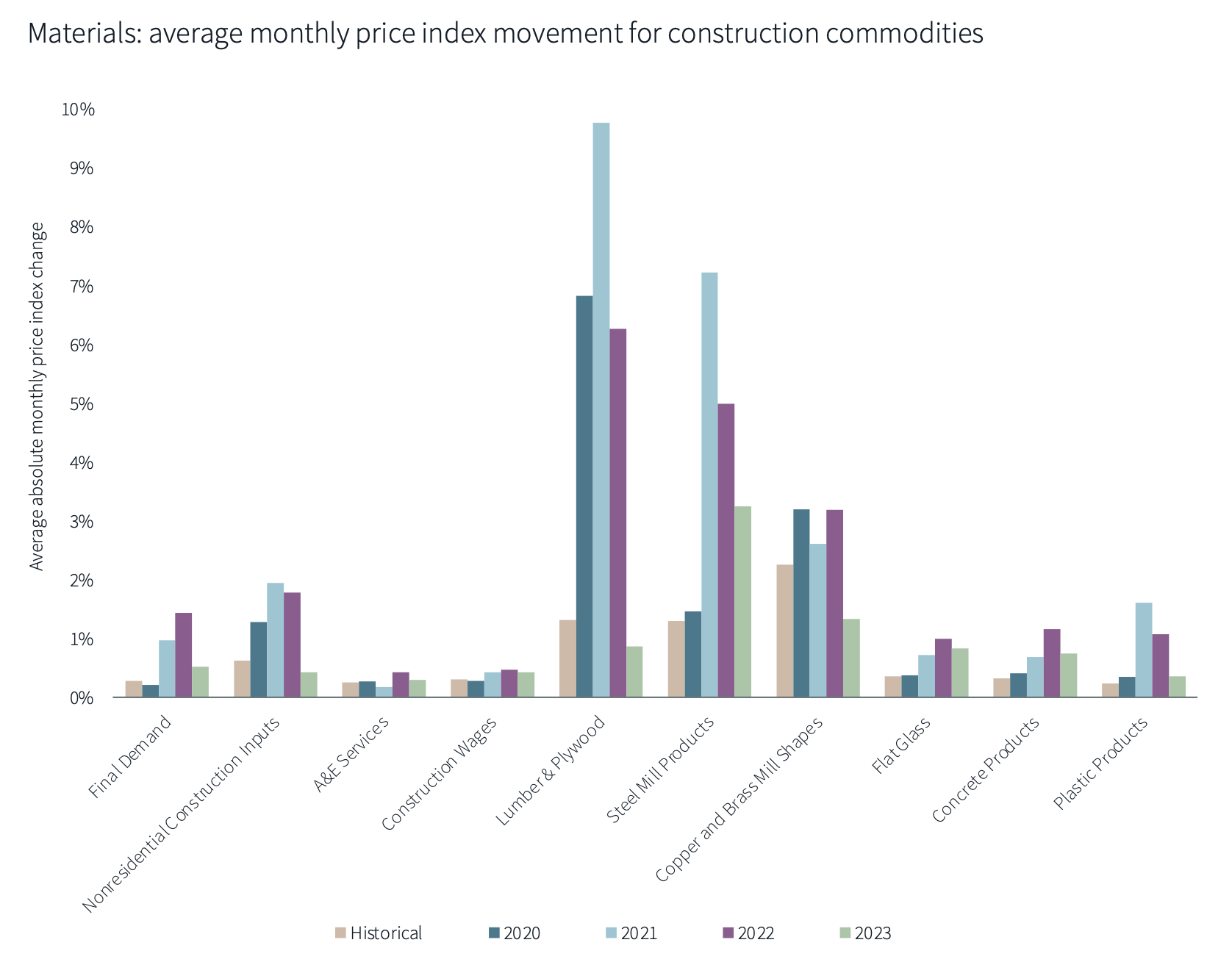

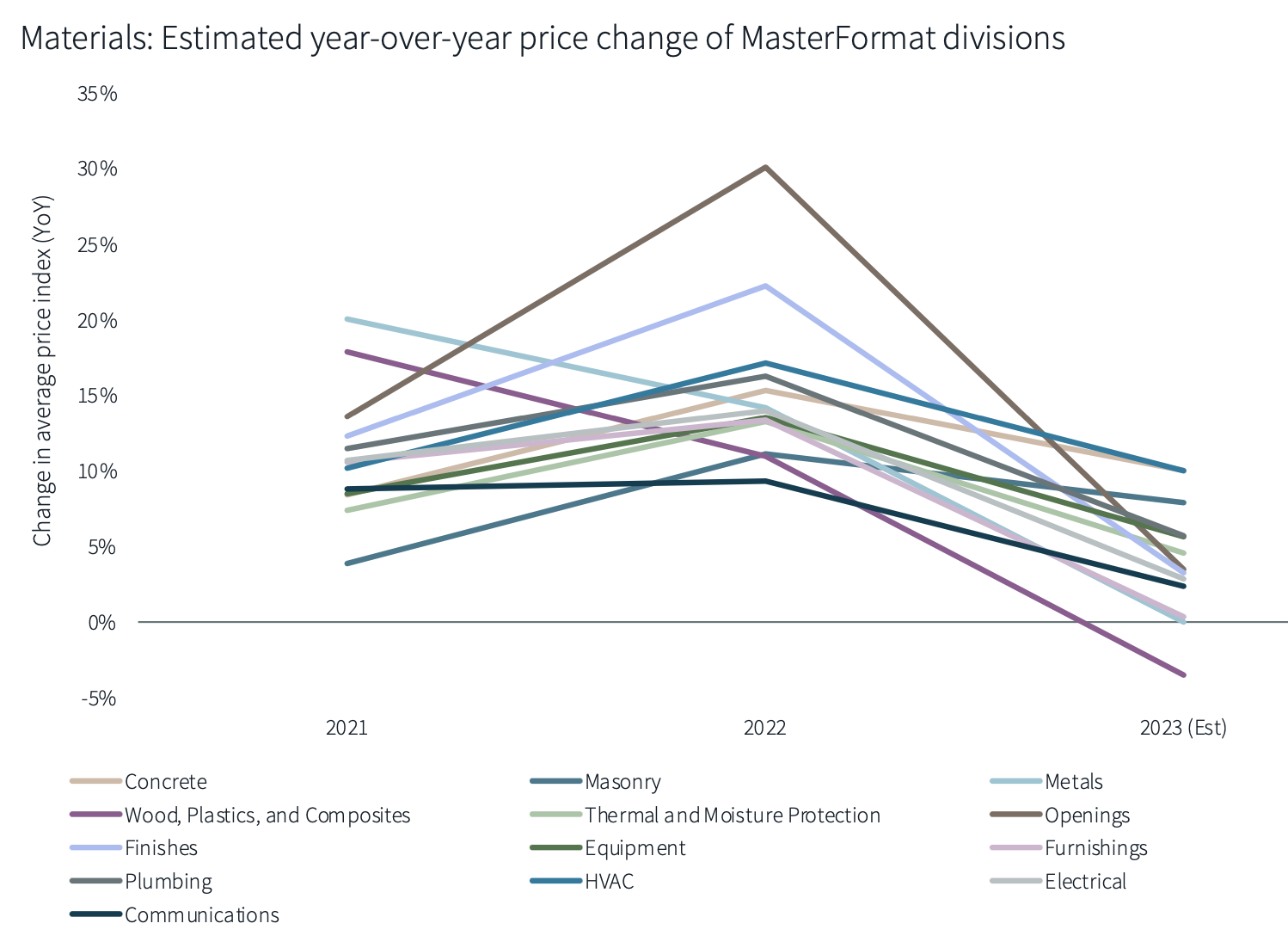

JLL also believes that its prediction of a 3-5% increase in materials costs remains on target. Commodities are exhibiting varying price fluctuations. Lead times were high in the first half of 2023, especially for MEP goods, making it harder for contractors to keep up with electrification and data center demand. Steel, concrete, glass, and plastic products’ price movements are also above historic levels. JLL expects materials costs to continue to rise at their current modest (single-digit) pace, having less impact on demand. But summer wildfires are likely to impact the supply of Canadian softwood.

Mixing these factors, JLL concludes that total construction costs have stabilized, having recorded the slowest period of growth (and the first declines) since the immediate aftermath of COVID-19 being declared a global emergency. Firms are navigating wage hikes, and expect sales and profit to grow modestly and stabilize, respectively. Labor retention is a priority to hold the line on costs. JLL adjusts its projection for total cost growth down to between 2-4%, from 4-6% in the first half.

Related Stories

Building Team | Oct 26, 2022

The U.S. hotel construction pipeline shows positive growth year-over-year at Q3 2022 close

According to the third quarter Construction Pipeline Trend Report for the United States from Lodging Econometrics (LE), the U.S. construction pipeline stands at 5,317 projects/629,489 rooms, up 10% by projects and 6% rooms Year-Over-Year (YOY).

Designers | Oct 19, 2022

Architecture Billings Index moderates but remains healthy

For the twentieth consecutive month architecture firms reported increasing demand for design services in September, according to a new report today from The American Institute of Architects (AIA).

Market Data | Oct 17, 2022

Calling all AEC professionals! BD+C editors need your expertise for our 2023 market forecast survey

The BD+C editorial team needs your help with an important research project. We are conducting research to understand the current state of the U.S. design and construction industry.

Market Data | Oct 14, 2022

ABC’s Construction Backlog Indicator Jumps in September; Contractor Confidence Remains Steady

Associated Builders and Contractors reports today that its Construction Backlog Indicator increased to 9.0 months in September, according to an ABC member survey conducted Sept. 20 to Oct. 5.

Market Data | Oct 12, 2022

ABC: Construction Input Prices Inched Down in September; Up 41% Since February 2020

Construction input prices dipped 0.1% in September compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Laboratories | Oct 5, 2022

Bigger is better for a maturing life sciences sector

CRB's latest report predicts more diversification and vertical integration in research and production.

Market Data | Aug 25, 2022

‘Disruptions’ will moderate construction spending through next year

JLL’s latest outlook predicts continued pricing volatility due to shortages in materials and labor

Market Data | Aug 2, 2022

Nonresidential construction spending falls 0.5% in June, says ABC

National nonresidential construction spending was down by 0.5% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Jul 28, 2022

The latest Beck Group report sees earlier project collaboration as one way out of the inflation/supply chain malaise

In the first six months of 2022, quarter-to-quarter inflation for construction materials showed signs of easing, but only slightly.

Hotel Facilities | Jul 28, 2022

As travel returns, U.S. hotel construction pipeline growth follows

According to the recently released United States Construction Pipeline Trend Report from Lodging Econometrics (LE), the total U.S. construction pipeline stands at 5,220 projects/621,268 rooms at the close of 2022’s second quarter, up 9% Year-Over-Year (YOY) by projects and 4% YOY by rooms.