In the recent report released by Lodging Econometrics (LE), at the close of the second quarter of 2020, the top five U.S. markets with the largest total hotel construction pipelines are Los Angeles, leading for the fourth consecutive quarter, with 163 projects/27,415 rooms; followed by Dallas with 158 projects/19,314 rooms; New York City with 151 projects/26,302 rooms; Atlanta with 135 projects/18,634 rooms; and Houston with 122 projects/12,486 rooms. Despite these top five markets being located in states that have been heavily impacted by COVID-19, combined, they still account for 15% of the rooms in the total U.S. pipeline and, with the exception of Houston, have pipelines that remain steady and primarily unchanged quarter-over-quarter.

New York City continues to have the greatest number of projects under construction, with 106 projects/18,354 rooms. Los Angeles follows with 48 projects/8,070 rooms, and then Atlanta with 48 projects/6,604 rooms, Dallas with 46 projects/5,344 rooms, and Nashville with 37 projects/6,597 rooms. These five markets collectively account for nearly 20% of the total number of rooms currently under construction in the U.S.

According to LE’s research, many hotel owners, who have capital on hand, are taking this opportunity of decreased demand to upgrade and renovate their hotels or redefine their hotels with a brand conversion. In the second quarter of 2020, LE recorded a combined renovation and conversion total of 1,276 active projects with 217,865 rooms for the U.S. The markets with the largest combined number of renovations and conversions is Chicago with 28 projects/4,717 rooms, Los Angeles with 26 projects/4,548 rooms, New York City with 22 projects/8,817 rooms, Washington DC with 21 projects/4,850 rooms, and Atlanta with 19 projects/3,273 rooms.

Despite the impact COVID-19 has had on operating performance, development in the lodging industry continues. In the first half of 2020, Dallas recorded the highest count of new projects announced into the pipeline with 18 projects/2,018 rooms. Washington DC followed with 14 projects/1,978 rooms, then Phoenix with 13 projects/1,397 rooms, Miami with 10 projects/2,472 rooms, and the Florida Panhandle with 9 projects/1,178 rooms.

Related Stories

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

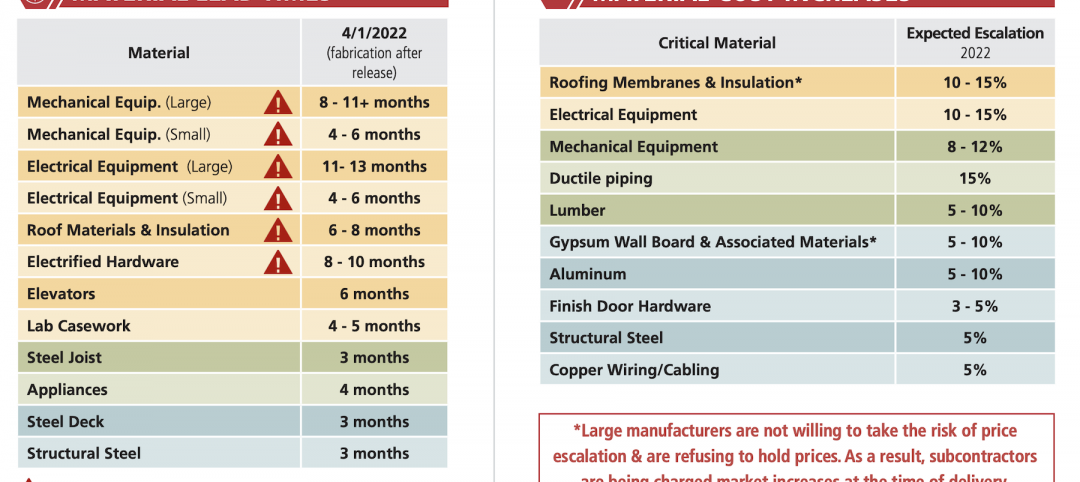

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment