In the recent report released by Lodging Econometrics (LE), at the close of the second quarter of 2020, the top five U.S. markets with the largest total hotel construction pipelines are Los Angeles, leading for the fourth consecutive quarter, with 163 projects/27,415 rooms; followed by Dallas with 158 projects/19,314 rooms; New York City with 151 projects/26,302 rooms; Atlanta with 135 projects/18,634 rooms; and Houston with 122 projects/12,486 rooms. Despite these top five markets being located in states that have been heavily impacted by COVID-19, combined, they still account for 15% of the rooms in the total U.S. pipeline and, with the exception of Houston, have pipelines that remain steady and primarily unchanged quarter-over-quarter.

New York City continues to have the greatest number of projects under construction, with 106 projects/18,354 rooms. Los Angeles follows with 48 projects/8,070 rooms, and then Atlanta with 48 projects/6,604 rooms, Dallas with 46 projects/5,344 rooms, and Nashville with 37 projects/6,597 rooms. These five markets collectively account for nearly 20% of the total number of rooms currently under construction in the U.S.

According to LE’s research, many hotel owners, who have capital on hand, are taking this opportunity of decreased demand to upgrade and renovate their hotels or redefine their hotels with a brand conversion. In the second quarter of 2020, LE recorded a combined renovation and conversion total of 1,276 active projects with 217,865 rooms for the U.S. The markets with the largest combined number of renovations and conversions is Chicago with 28 projects/4,717 rooms, Los Angeles with 26 projects/4,548 rooms, New York City with 22 projects/8,817 rooms, Washington DC with 21 projects/4,850 rooms, and Atlanta with 19 projects/3,273 rooms.

Despite the impact COVID-19 has had on operating performance, development in the lodging industry continues. In the first half of 2020, Dallas recorded the highest count of new projects announced into the pipeline with 18 projects/2,018 rooms. Washington DC followed with 14 projects/1,978 rooms, then Phoenix with 13 projects/1,397 rooms, Miami with 10 projects/2,472 rooms, and the Florida Panhandle with 9 projects/1,178 rooms.

Related Stories

Market Data | Nov 22, 2021

Only 16 states and D.C. added construction jobs since the pandemic began

Texas, Wyoming have worst job losses since February 2020, while Utah, South Dakota add the most.

Market Data | Nov 10, 2021

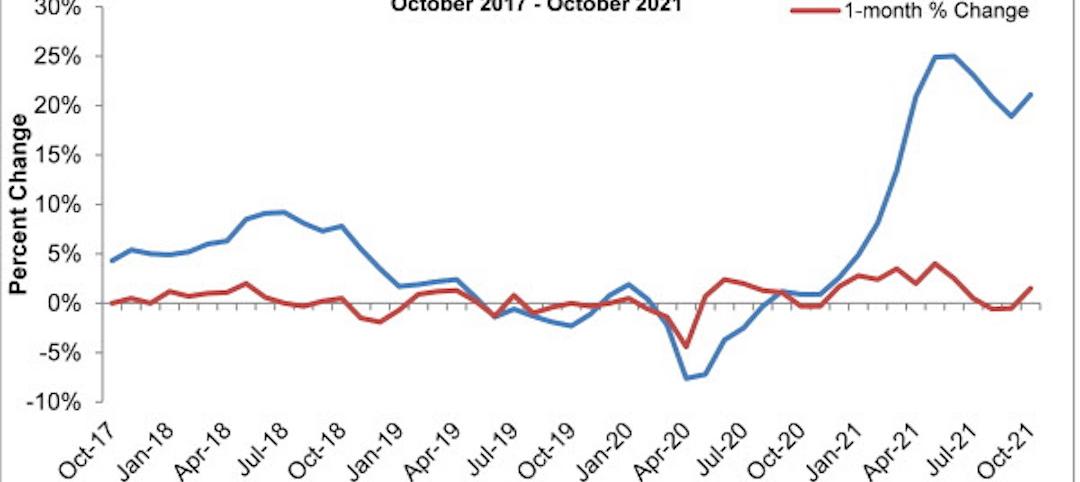

Construction input prices see largest monthly increase since June

Construction input prices are 21.1% higher than in October 2020.

Market Data | Nov 9, 2021

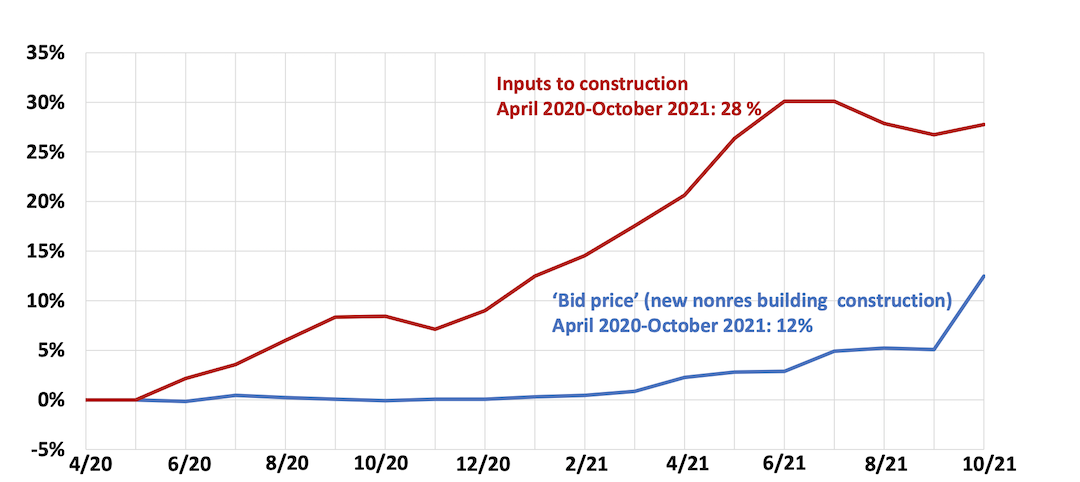

Continued increases in construction materials prices starting to drive up price of construction projects

Supply chain and labor woes continue.

Market Data | Nov 5, 2021

Construction firms add 44,000 jobs in October

Gain occurs even as firms struggle with supply chain challenges.

Market Data | Nov 3, 2021

One-fifth of metro areas lost construction jobs between September 2020 and 2021

Beaumont-Port Arthur, Texas and Sacramento--Roseville--Arden-Arcade Calif. top lists of gainers.

Market Data | Nov 2, 2021

Construction spending slumps in September

A drop in residential work projects adds to ongoing downturn in private and public nonresidential.

Hotel Facilities | Oct 28, 2021

Marriott leads with the largest U.S. hotel construction pipeline at Q3 2021 close

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S.

Hotel Facilities | Oct 28, 2021

At the end of Q3 2021, Dallas tops the U.S. hotel construction pipeline

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline.

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.