According to the Kroll Annual Global Fraud and Risk Report 2016/17, construction, engineering, and infrastructure companies around the globe are experiencing fraud, cyber, and security incidents so frequently it has become the “new normal.”

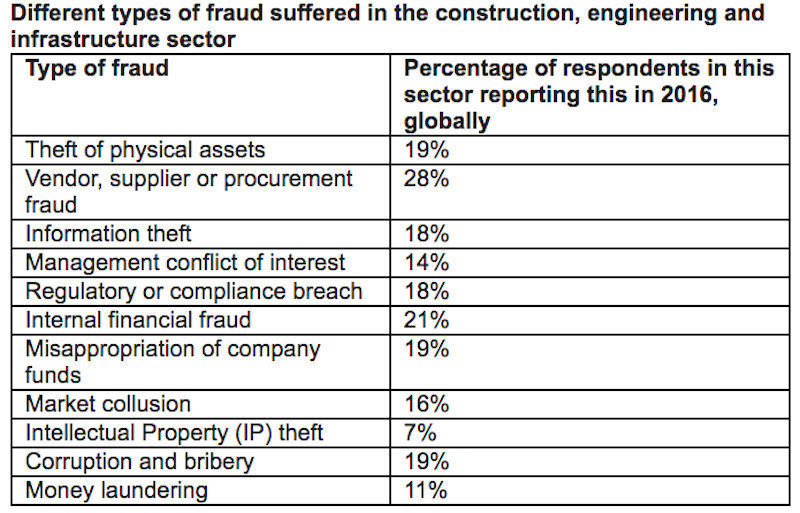

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year with vendor, supplier, or procurement fraud being the most prevalent kind of fraud suffered at 28%. Internal financial fraud followed at 21%, and corruption and bribery, theft of physical assets, and misappropriation of company funds were next with each one being reported by 19% of respondents.

Cyber attacks became increasingly common in 2016, as well. 77% of respondents reported their company suffered a cyber incident in the past 12 months with a virus or worm infestation being the most common at 35%. Email based phishing attacks were the next most common at 30%.

“This year’s Kroll Global Fraud and Risk Report shows that it’s becoming an increasingly risky world, with the largest ever proportion of companies reporting fraud and similarly high levels of cyber and security breaches,” said Tommy Helsby, Co-Chairman, Kroll Investigations & Disputes, in a press release.

Often, companies worry about attacks originating from external sources, but according to the report, across all sectors, the most common perpetrators of fraud, cyber, and security incidents in 2016 were current and former employees. On the reverse side, insiders were also the most likely people to discover fraud occurring. 44% of respondents across all sectors said a recent fraud has been discovered through a whistleblowing program. Additionally, 39% said it was detected through an internal audit.

You can receive a full copy of the report by clicking here.

Related Stories

Market Data | Jan 6, 2022

A new survey offers a snapshot of New York’s construction market

Anchin’s poll of 20 AEC clients finds a “growing optimism,” but also multiple pressure points.

Market Data | Jan 3, 2022

Construction spending in November increases from October and year ago

Construction spending in November totaled $1.63 trillion at a seasonally adjusted annual rate.

Market Data | Dec 22, 2021

Two out of three metro areas add construction jobs from November 2020 to November 2021

Construction employment increased in 237 or 66% of 358 metro areas over the last 12 months.

Market Data | Dec 17, 2021

Construction jobs exceed pre-pandemic level in 18 states and D.C.

Firms struggle to find qualified workers to keep up with demand.

Market Data | Dec 15, 2021

Widespread steep increases in materials costs in November outrun prices for construction projects

Construction officials say efforts to address supply chain challenges have been insufficient.

Market Data | Dec 15, 2021

Demand for design services continues to grow

Changing conditions could be on the horizon.

Market Data | Dec 5, 2021

Construction adds 31,000 jobs in November

Gains were in all segments, but the industry will need even more workers as demand accelerates.

Market Data | Dec 5, 2021

Construction spending rebounds in October

Growth in most public and private nonresidential types is offsetting the decline in residential work.

Market Data | Dec 5, 2021

Nonresidential construction spending increases nearly 1% in October

Spending was up on a monthly basis in 13 of the 16 nonresidential subcategories.

Market Data | Nov 30, 2021

Two-thirds of metro areas add construction jobs from October 2020 to October 2021

The pandemic and supply chain woes may limit gains.