Lodging Econometrics (LE) recently compiled construction pipeline counts for every country and market around the world. Their analysts state that the total global construction pipeline ascended to a record high of 14,051 projects/2,327,923 rooms, a 9% increase in projects and an 8% increase in rooms year-over-year (YOY). The report summarizes development in 176 countries worldwide.

With the exception of Latin America, all regions of the globe either continued to set record high pipeline counts or have already settled into topping-out formations amidst concerns of a worldwide economic slowdown. The fallout after the on-going trade dispute between the United States and China continues to be the leading contributor.

But, low-interest rates and accommodative lending terms are the primary catalysts behind pipeline growth as the global pipeline should continue to grow for the foreseeable future, albeit at a much slower pace.

There is a record high 6,565 projects currently under construction worldwide having 1,192,398 rooms. Projects scheduled to start construction in the next 12 months; peaking at an all-time high for both projects and rooms, stands at 4,392 projects/636,080 rooms. Projects in the early planning stage continue to grow, with a 6% increase in projects and 10% increase in rooms, YOY, standing at 3,094 and 499,445 respectively.

The top countries by project count are the United States with 5,653 projects/693,207 rooms, just 230 projects shy of its all-time high of 5,883 projects set in the second quarter of 2008, and China with a current pipeline of 2,991 projects/592,884 rooms, which is a new high. The U.S. accounts for 40% of projects in the total global construction pipeline while China has 21%, resulting in 61% of all global projects being concentrated in just these two countries. Distantly following are Indonesia with 378 projects/63,196 rooms, Germany with 320 projects/57,689 rooms, and the United Kingdom with 280 projects/40,970 rooms.

Around the world, the cities with the largest pipelines by project counts are Dubai with 173 projects/50,832 rooms, New York City with 166 projects/28,231 rooms, and Dallas, TX with 162 projects/19,972 rooms. Los Angeles, CA follows with 158 projects/25,428 rooms, and Houston, TX with 146 projects/14,998 rooms.

The leading franchise company in the global construction pipeline is Marriott International with 2,534 projects/420,562 rooms. Hilton Worldwide follows closely with 2,334 projects/340,626 rooms. Next is InterContinental Hotels Group (IHG) with 1,769 projects/259,057 rooms, and AccorHotels with 980 projects/175,002 rooms. These four company brands account for 54% of all projects in the pipeline.

Leading brands in the pipeline for each of these companies are IHG’s Holiday Inn Express with 737 projects/93,415 rooms, Hampton by Hilton with 689 projects/90,634 rooms, Marriott’s Fairfield Inn with 397 projects/43,451 rooms, and AccorHotel’s Ibis Brands with 387 projects/54,683 rooms.

The first half of 2019 saw a total of 1,374 new hotels/196,237 rooms open around the world with an additional 1,675 hotels/236,334 rooms scheduled to open by year-end. With the global pipeline being at an all-time high, LE forecasts that new hotel openings will continue to climb with 3,168 hotels expected to open in 2020. In 2021, new openings are forecast to reach 3,171 hotels. Should all hotels forecast to open by 2021 come to fruition, it will be the largest surge of new hotel openings, collectively around the world, that LE has ever recorded.

Related Stories

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

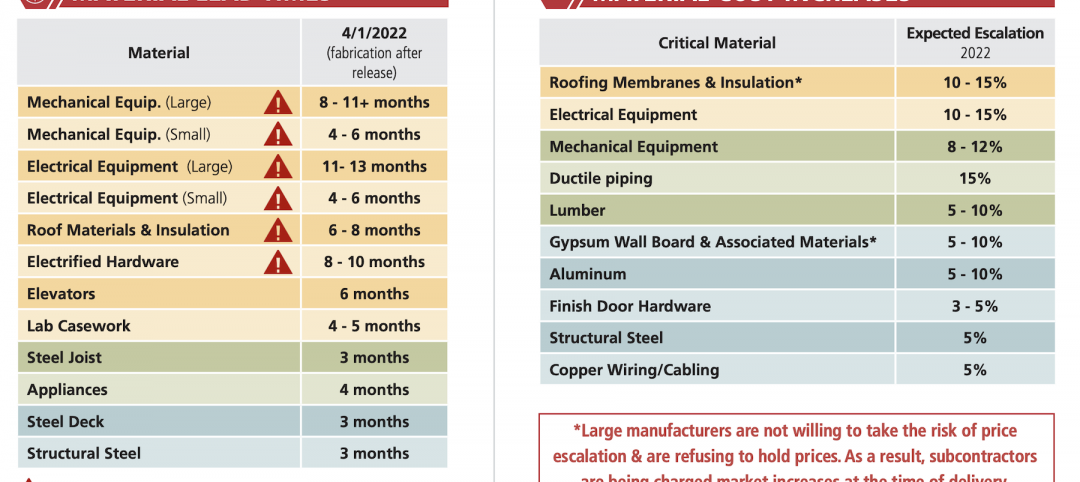

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment