Analysts at Lodging Econometrics (LE) state that Asia Pacific’s total construction pipeline, excluding China, hit a new all-time high at the close of 2019 with 1,926 projects/409,447 rooms. Project counts are up 7%, while room counts are up 8%, year-over-year (YOY).

Projects currently under construction stand at a record 991 projects with 224,354 rooms. Projects scheduled to start construction in the next 12 months and those in the early planning stage are also at all-time highs with 436 projects/85,417 rooms and 499 projects/99,676 rooms, respectively.

New projects announced into the pipeline have accelerated noticeably with 319 projects/55,165 rooms announced in the fourth quarter of 2019. This is the highest number of new projects announced since the second quarter of 2014 when 568 projects/98,738 rooms were announced.

The Asia Pacific region had 374 new hotels/69,527 rooms open in 2019. The LE forecast anticipates that 439 projects/84,188 rooms are expected to open in 2020. Should all these projects come online, this will be the highest count of new hotel openings that LE has ever recorded. Then in 2021, new hotel openings are forecast to slow to 371 projects/76,710 rooms.

Countries with the largest pipelines in Asia Pacific, excluding China, are led by Indonesia with 367 projects/60,354 rooms, which accounts for 19% of the projects in the total pipeline. Next is India with 265 projects/36,469 rooms, then Japan with 251 projects/49,869 rooms. These countries are followed by Australia, at an all-time high, with 192 projects/36,350 rooms and then Vietnam with 149 projects/59,857 rooms.

Cities in the Asia Pacific region, excluding China, with the largest construction pipelines are Jakarta, Indonesia with 86 projects/15,163 rooms, Seoul, South Korea with 68 projects/13,373 rooms and Tokyo, Japan with 61 projects/13,210 rooms. Kuala Lumpur, Malaysia follows with 50 projects/13,147 rooms and then Bangkok, Thailand with 43 projects/11,427 rooms.

The top franchise companies in Asia Pacific, excluding China, are Marriott International, at a new all-time high, with 273 projects/61,590 rooms, AccorHotels with 224 projects/46,502 rooms, and InterContinental Hotels Group (IHG) with 151 projects/32,701 rooms. Hilton Worldwide follows, also at record high counts, with 93 projects/20,762 rooms. Combined, these four companies account for 40% of the rooms in the total construction pipeline.

Top brands in Asia Pacific’s construction pipeline, excluding China, include Marriott International’s Fairfield Inn, at a record high, with 40 projects/6,563 rooms, and Courtyard with 37 projects/7,889 rooms; AccorHotels’ Ibis brands with 49 projects/9,305 rooms and Novotel with 43 projects/10,438 rooms; IHG’s Holiday Inn with 58 projects/12,457 rooms and Holiday Inn Express with 31 projects/6,281 rooms; Hilton Worldwide’s top brands are DoubleTree with 33 projects/6,514 rooms and full-service Hilton Hotel & Resorts, at an all-time high, with 30 projects/7,885 rooms.

*Please keep in mind that the COVID-19 (coronavirus) did not have an impact on fourth quarter 2019 totals reported by LE. As of the printing of this media release, countries in Asia Pacific that have been most affected by COVID-19, after China, are South Korea, Japan and Singapore. New confirmed cases continue to be added and it is still too early to predict the full impact of the outbreak on the hospitality and lodging industry. We will have more information to report in the coming months.

Related Stories

Market Data | Nov 15, 2017

Architecture Billings bounce back

Business conditions remain uneven across regions.

Market Data | Nov 14, 2017

U.S. construction starts had three consecutive quarters of positive growth in 2017

ConstructConnect’s quarterly report shows the most significant annual growth in the civil engineering and residential sectors.

Market Data | Nov 3, 2017

New construction starts in 2018 to increase 3% to $765 billion: Dodge report

Dodge Outlook Report predicts deceleration but still growth, reflecting a mixed pattern by project type.

Market Data | Nov 2, 2017

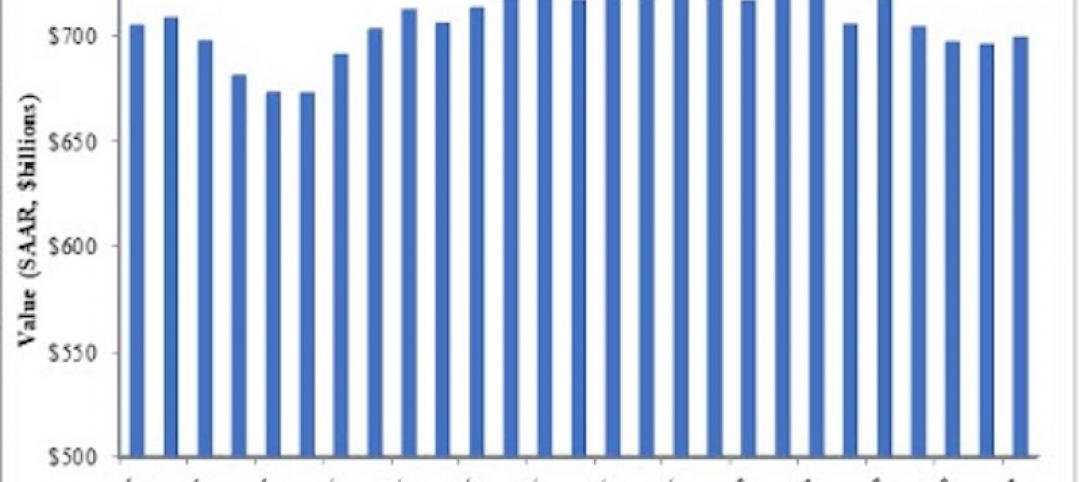

Construction spending up in September; Down on a YOY basis

Nonresidential construction spending is down 2.9% on a year-over-year basis.

Market Data | Oct 19, 2017

Architecture Billings Index backslides slightly

Business conditions easing in the West.

Industry Research | Oct 3, 2017

Nonresidential construction spending stabilizes in August

Spending on nonresidential construction services is still down on a YOY basis.

Market Data | Sep 21, 2017

Architecture Billings Index continues growth streak

Design services remain in high demand across all regions and in all major sectors.

Market Data | Sep 21, 2017

How brand research delivers competitive advantage

Brand research is a process that firms can use to measure their reputation and visibility in the marketplace.

Contractors | Sep 19, 2017

Commercial Construction Index finds high optimism in U.S. commercial construction industry

Hurricane recovery efforts expected to heighten concerns about labor scarcities in the south, where two-thirds of contractors already face worker shortages.

Multifamily Housing | Sep 15, 2017

Hurricane Harvey damaged fewer apartments in greater Houston than estimated

As of Sept. 14, 166 properties reported damage to 8,956 units, about 1.4% of the total supply of apartments, according to ApartmentData.com.