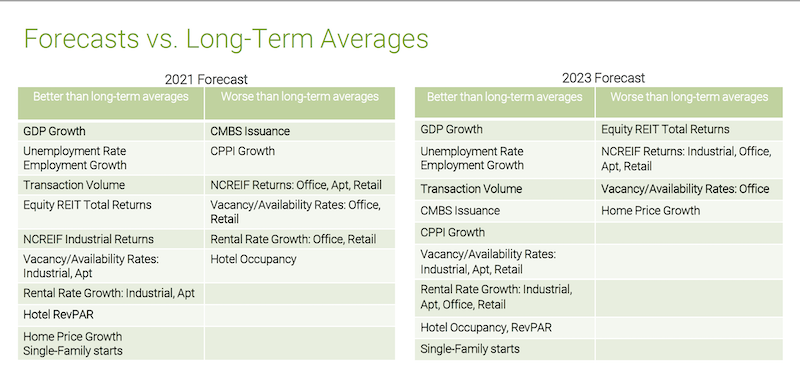

The GDP, which in 2020 contracted for the first time in 11 years, is expected to grow by 6.5% in 2021, and keep growing (albeit at a slower pace) in the proceeding two years. In 2021, the U.S. should recover about 60% of the 9.42 million jobs it lost last year, and pick up another 5.1 million jobs over the following two years. Consequently, the unemployment rate is expected to recede to 4% by the end of 2023, close to where it was pre-pandemic.

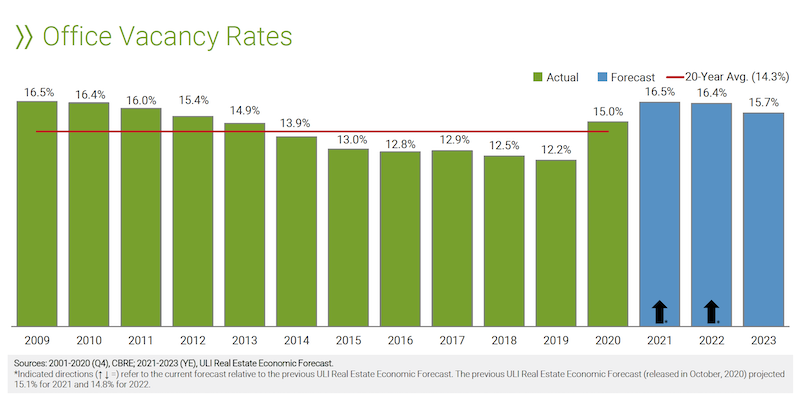

This economy and jobs picture, coupled with positive predictions about inflation, interest rates, and capitalization rates, sets the stage for the Urban Land Institute’s Real Estate Economic Forecast, released on May 19, which sees a sector poised to rebound, led by returns from single-family, hotel, and industrial assets. The biggest red flag is the office sector, whose national vacancy rates are expected to rise by a higher-than-usual three-year average, but to also recover starting in 2023.

The forecasts for 27 economic and real estate indicators, published in this report, ULI’s 19th, are derived from a survey this spring of 42 economists and analysts from 39 real estate organizations.

Commercial real estate should benefit from a strong economy through 2023. Graphic: ULI

Among the report’s notable findings are these:

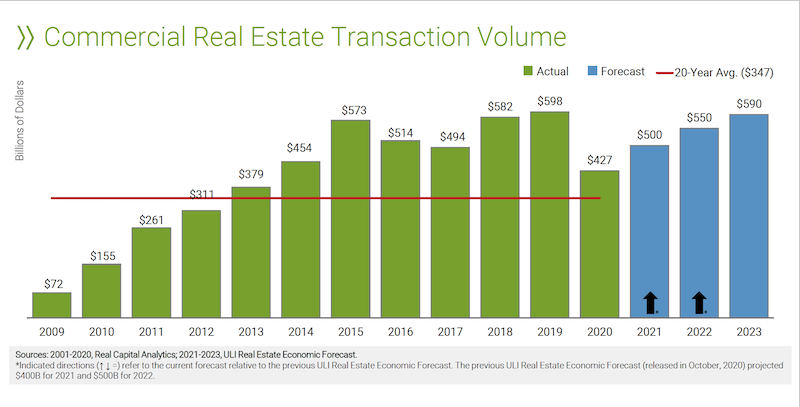

• Commercial real estate transaction volume should recover quickly. It is expected to hit $500 billion this year and $550 billion next year. (The latest peak was $598 billion in 2019.) Commercial mortgage-backed securities issuance is projected at $70 billion this year, and to rise to $90 billion in 2023, exceeding the 20-year $82 billion average.

Transaction volume from real estate is expected to approach pre-pandemic levels again by 2023. Chart: ULI

• Price growth, as measured by the RCA Commercial Property Price Index, should remain below the 2020 level during all three proceeding years. The good news is that ULI is forecasting 5% increases in each of the next two years.

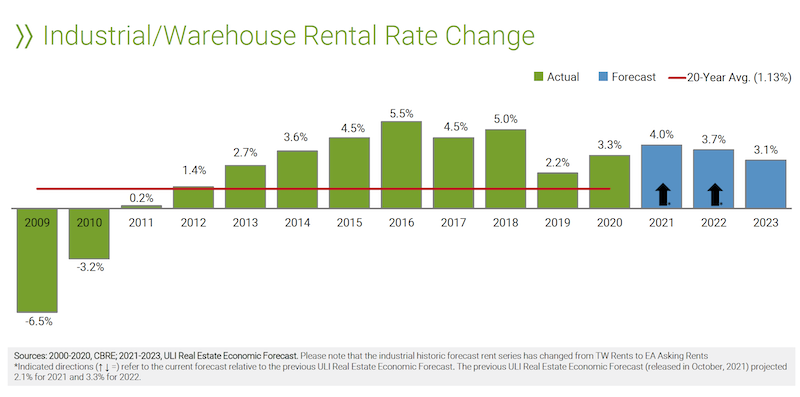

• Rent growth will be similarly volatile. Industrial rents will lead the pack with an average of 3.6% growth between 2021-2023. Multifamily rents will also rise, but office and retail rents are expected to stay in the negative column for a while.

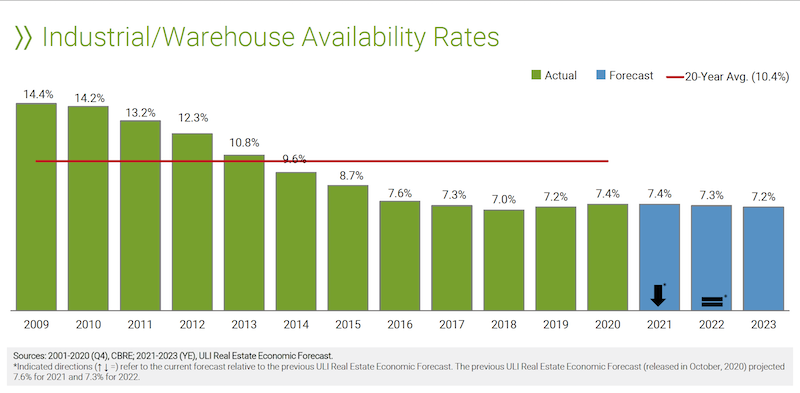

As demand for industrial space increases, so will its rental rates. Charts: ULI

• The report looks at potential vacancy rates for five property types. Availability of warehouses and apartments is expected to remain below their 20-year averages over the next three years. Offices, on the other hand, will see vacancy rates rise to a three-year average of 16.2%, substantively above the sector’s 14.3% 20-year average. Retail vacancy rates, somewhat surprisingly, are projected to average 9.8%, below the sector’s 9.9% 20-year average.

The office sector will have high vacancy rates for at least the next two years. Chart: ULI

• Last year, housing starts exceeded their 20-year average for the first time since the 2008-10 financial crisis. They are expected to hit 1.1 million units this year, and 1.2 million in 2022 and 2023.

• Real estate returns, as measured by the National Council of Real Estate Investment Fiduciaries, are forecast at 4.5%, 5.9%, and 6.5%, respectively, for 2021-2023. Industrial should lead all property types, but even office and retail are projected to generate positive returns.

Related Stories

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.

Market Data | Jan 5, 2017

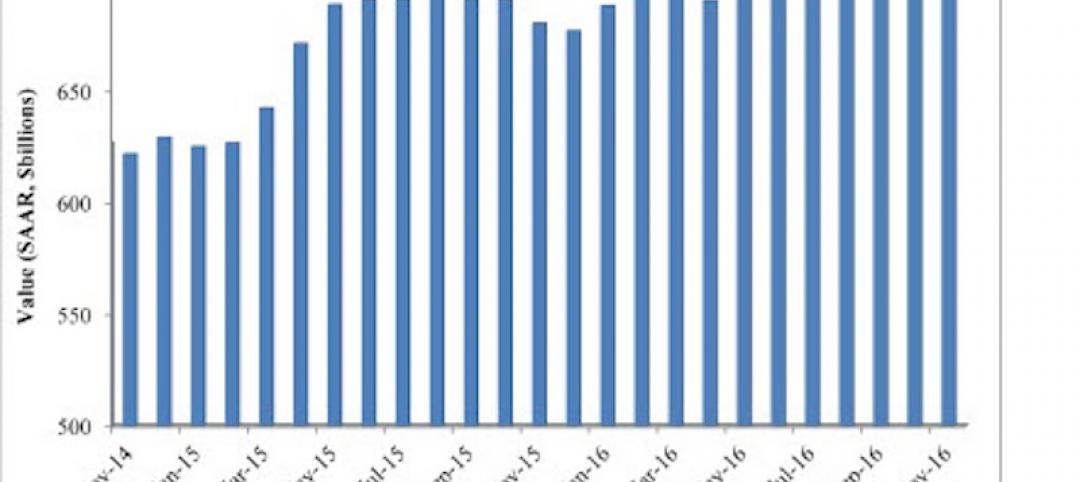

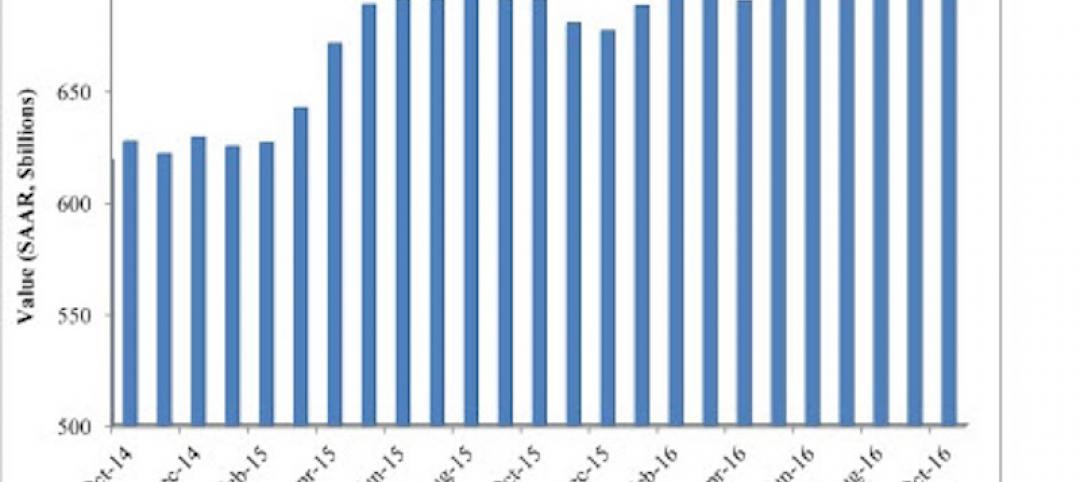

Nonresidential spending thrives in strong November spending report

Many construction firms have reported that they remain busy but have become concerned that work could dry up in certain markets in 2017 or 2018, says Anirban Basu, ABC Chief Economist.

Market Data | Dec 13, 2016

ABC predicts modest growth for 2017 nonresidential construction sector; warns of vulnerability for contractor

“The U.S. economy continues to expand amid a weak global economy and, despite risks to the construction industry, nonresidential spending should expand 3.5 percent in 2017,” says ABC Chief Economist Anirban Basu.

Market Data | Dec 2, 2016

Nonresidential construction spending gains momentum

Nonresidential spending is now 2.6 percent higher than at the same time one year ago.

Market Data | Nov 30, 2016

Marcum Commercial Construction Index reports industry outlook has shifted; more change expected

Overall nonresidential construction spending in September totaled $690.5 billion, down a slight 0.7 percent from a year earlier.

Industry Research | Nov 30, 2016

Multifamily millennials: Here is what millennial renters want in 2017

It’s all about technology and convenience when it comes to the things millennial renters value most in a multifamily facility.

Market Data | Nov 29, 2016

It’s not just traditional infrastructure that requires investment

A national survey finds strong support for essential community buildings.

Industry Research | Nov 28, 2016

Building America: The Merit Shop Scorecard

ABC releases state rankings on policies affecting construction industry.

Market Data | Nov 17, 2016

Architecture Billings Index rebounds after two down months

Decline in new design contracts suggests volatility in design activity to persist.

Industry Research | Nov 8, 2016

Austin, Texas wins ‘Top City’ in the Emerging Trends in Real Estate outlook

Austin was followed on the list by Dallas/Fort Worth, Texas and Portland, Ore.