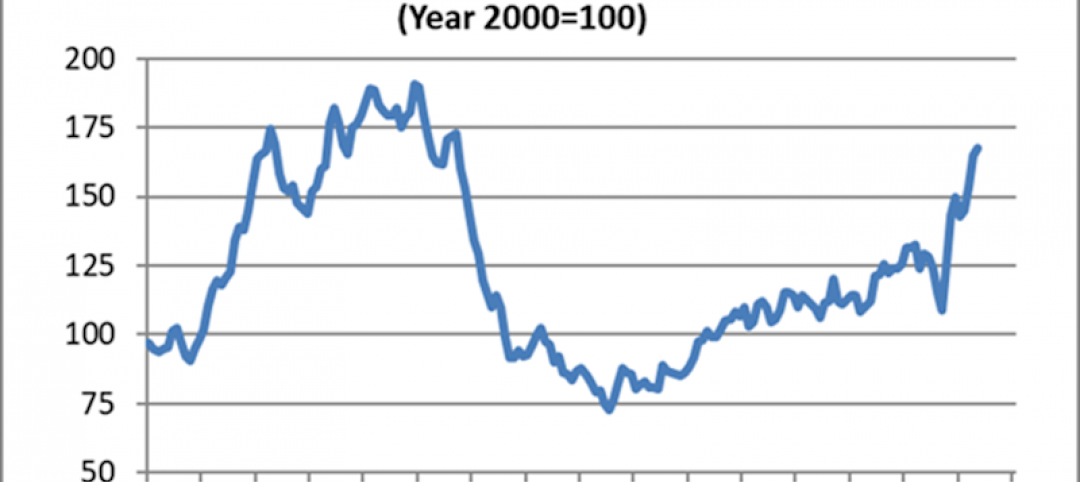

The Marcum Commercial Construction Index highlights the continued spending weakness in nonresidential construction during the first nine months of the year and points to a significant anticipated change beginning in 2017. The change is being attributed to the major infrastructure-led stimulus package expected from the new Presidential administration. The national Construction Industry Practice group of Marcum LLP, a top national accounting and advisory firm, produces the quarterly index.

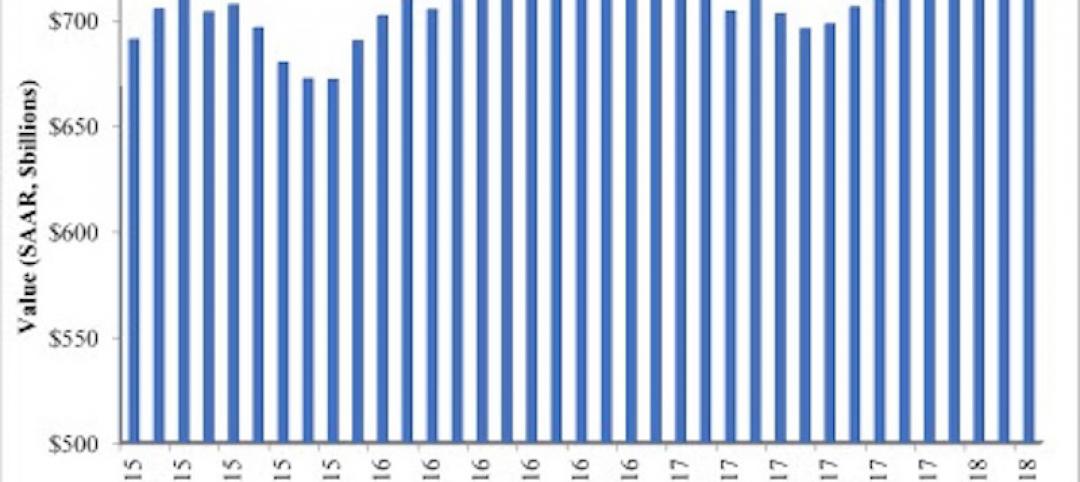

Overall nonresidential construction spending in September totaled $690.5 billion, down a slight 0.7 percent from a year earlier. Of the category’s 16 subsectors, bright spots included Office-related spending, which registered a whopping 23% gain to $70.7 billion; Lodging, up 20% year-over-year to $28.8 billion; Commercial construction, with a 6% gain to $71.7 billion; Amusement & Recreation, up 3.5% to $21.4 billion; and Educational construction, at $87.1 billion, a 3.3% percent increase.

The remaining 11 nonresidential subsectors all recorded fall-offs for the month, with the greatest declines in Sewage & Waste Disposal (-18.8%), Water Supply (-13.7%), Communication (-12.6%) and Transportation (-11.3%).

“Most construction firms report intense difficulty securing electricians, heating/cooling professionals, welders and carpenters, among others,” says Anirban Basu, Marcum’s Chief Construction Economist, in a press release. The construction worker unemployment rate in October was less than half of what it was five years ago, down to 5.7 % from 13.7 % in the same month of 2011. This compares to a national unemployment rate of 4.9% at the end of the 2016 third quarter.

Looking ahead, the Marcum report predicts that a stimulus package will put pressure on wages and inflation and lead to higher interest rates, which in turn will eventually hurt construction spending. “After a period of relatively intense construction spending due in part to a stimulus package, the nonresidential sector could face a sharp slowdown in construction spending thereafter,” it states.

For the complete Marcum Commercial Construction Index, visit www.marcumllp.com/industries/construction.

Related Stories

Market Data | Jun 26, 2018

Yardi Matrix examines potential regional multifamily supply overload

Outsize development activity in some major metros could increase vacancy rates and stagnate rent growth.

Market Data | Jun 22, 2018

Multifamily market remains healthy – Can it be sustained?

New report says strong economic fundamentals outweigh headwinds.

Market Data | Jun 21, 2018

Architecture firm billings strengthen in May

Architecture Billings Index enters eighth straight month of solid growth.

Market Data | Jun 20, 2018

7% year-over-year growth in the global construction pipeline

There are 5,952 projects/1,115,288 rooms under construction, up 8% by projects YOY.

Market Data | Jun 19, 2018

ABC’s Construction Backlog Indicator remains elevated in first quarter of 2018

The CBI shows highlights by region, industry, and company size.

Market Data | Jun 19, 2018

America’s housing market still falls short of providing affordable shelter to many

The latest report from the Joint Center for Housing Studies laments the paucity of subsidies to relieve cost burdens of ownership and renting.

Market Data | Jun 18, 2018

AI is the path to maximum profitability for retail and FMCG firms

Leading retailers including Amazon, Alibaba, Lowe’s and Tesco are developing their own AI solutions for automation, analytics and robotics use cases.

Market Data | Jun 12, 2018

Yardi Matrix report details industrial sector's strength

E-commerce and biopharmaceutical companies seeking space stoke record performances across key indicators.

Market Data | Jun 8, 2018

Dodge Momentum Index inches up in May

May’s gain was the result of a 4.7% increase by the commercial component of the Momentum Index.

Market Data | Jun 4, 2018

Nonresidential construction remains unchanged in April

Private sector spending increased 0.8% on a monthly basis and is up 5.3% from a year ago.