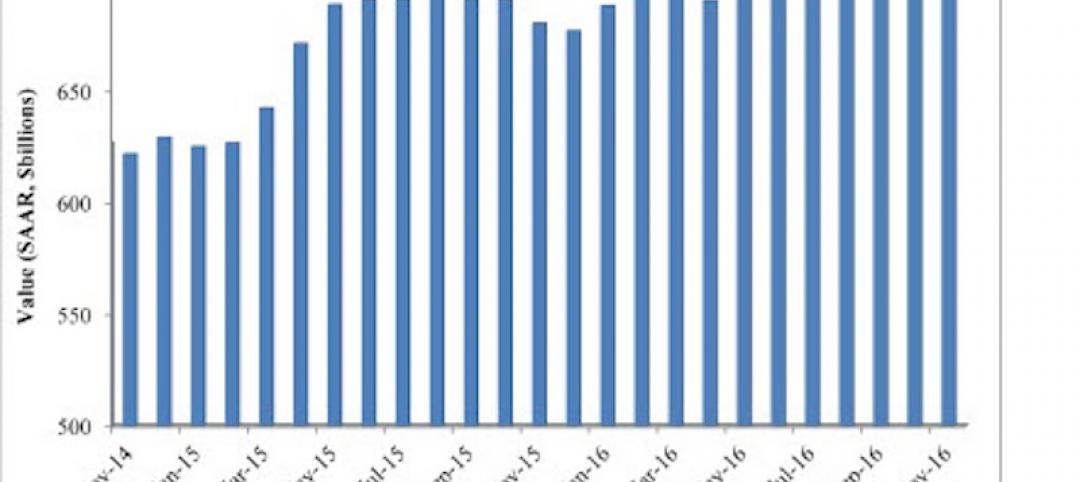

The Marcum Commercial Construction Index highlights the continued spending weakness in nonresidential construction during the first nine months of the year and points to a significant anticipated change beginning in 2017. The change is being attributed to the major infrastructure-led stimulus package expected from the new Presidential administration. The national Construction Industry Practice group of Marcum LLP, a top national accounting and advisory firm, produces the quarterly index.

Overall nonresidential construction spending in September totaled $690.5 billion, down a slight 0.7 percent from a year earlier. Of the category’s 16 subsectors, bright spots included Office-related spending, which registered a whopping 23% gain to $70.7 billion; Lodging, up 20% year-over-year to $28.8 billion; Commercial construction, with a 6% gain to $71.7 billion; Amusement & Recreation, up 3.5% to $21.4 billion; and Educational construction, at $87.1 billion, a 3.3% percent increase.

The remaining 11 nonresidential subsectors all recorded fall-offs for the month, with the greatest declines in Sewage & Waste Disposal (-18.8%), Water Supply (-13.7%), Communication (-12.6%) and Transportation (-11.3%).

“Most construction firms report intense difficulty securing electricians, heating/cooling professionals, welders and carpenters, among others,” says Anirban Basu, Marcum’s Chief Construction Economist, in a press release. The construction worker unemployment rate in October was less than half of what it was five years ago, down to 5.7 % from 13.7 % in the same month of 2011. This compares to a national unemployment rate of 4.9% at the end of the 2016 third quarter.

Looking ahead, the Marcum report predicts that a stimulus package will put pressure on wages and inflation and lead to higher interest rates, which in turn will eventually hurt construction spending. “After a period of relatively intense construction spending due in part to a stimulus package, the nonresidential sector could face a sharp slowdown in construction spending thereafter,” it states.

For the complete Marcum Commercial Construction Index, visit www.marcumllp.com/industries/construction.

Related Stories

Market Data | Jan 31, 2017

AIA foresees nonres building spending increasing, but at a slower pace than in 2016

Expects another double-digit growth year for office construction, but a more modest uptick for health-related building.

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.

Market Data | Jan 12, 2017

73% of construction firms plan to expand their payrolls in 2017

However, many firms remain worried about the availability of qualified workers.

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.

Market Data | Jan 5, 2017

Nonresidential spending thrives in strong November spending report

Many construction firms have reported that they remain busy but have become concerned that work could dry up in certain markets in 2017 or 2018, says Anirban Basu, ABC Chief Economist.

Market Data | Dec 21, 2016

Architecture Billings Index up slightly in November

New design contracts also return to positive levels, signifying future growth in construction activity.

Market Data | Dec 21, 2016

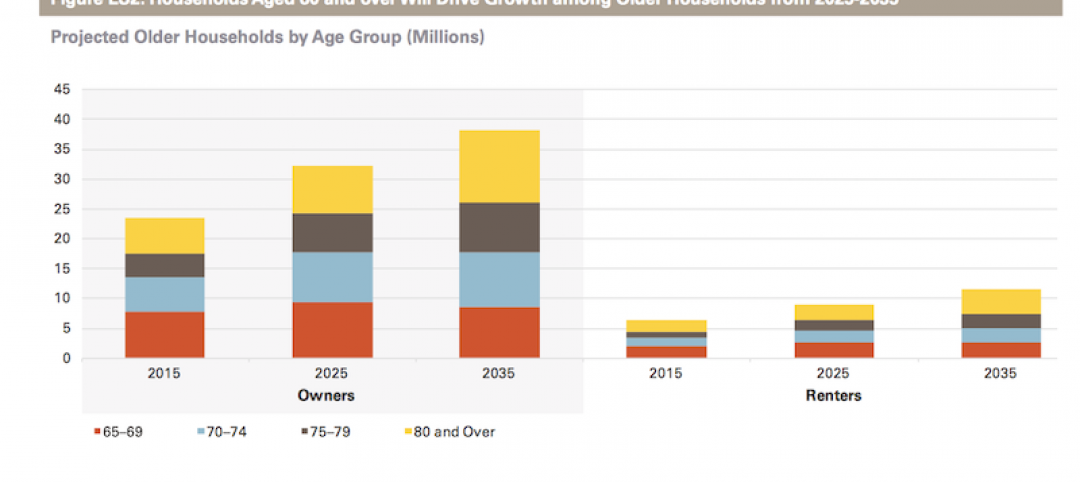

Will housing adjust to an aging population?

New Joint Center report projects 66% increase in senior heads of households by 2035.

Market Data | Dec 13, 2016

ABC predicts modest growth for 2017 nonresidential construction sector; warns of vulnerability for contractor

“The U.S. economy continues to expand amid a weak global economy and, despite risks to the construction industry, nonresidential spending should expand 3.5 percent in 2017,” says ABC Chief Economist Anirban Basu.