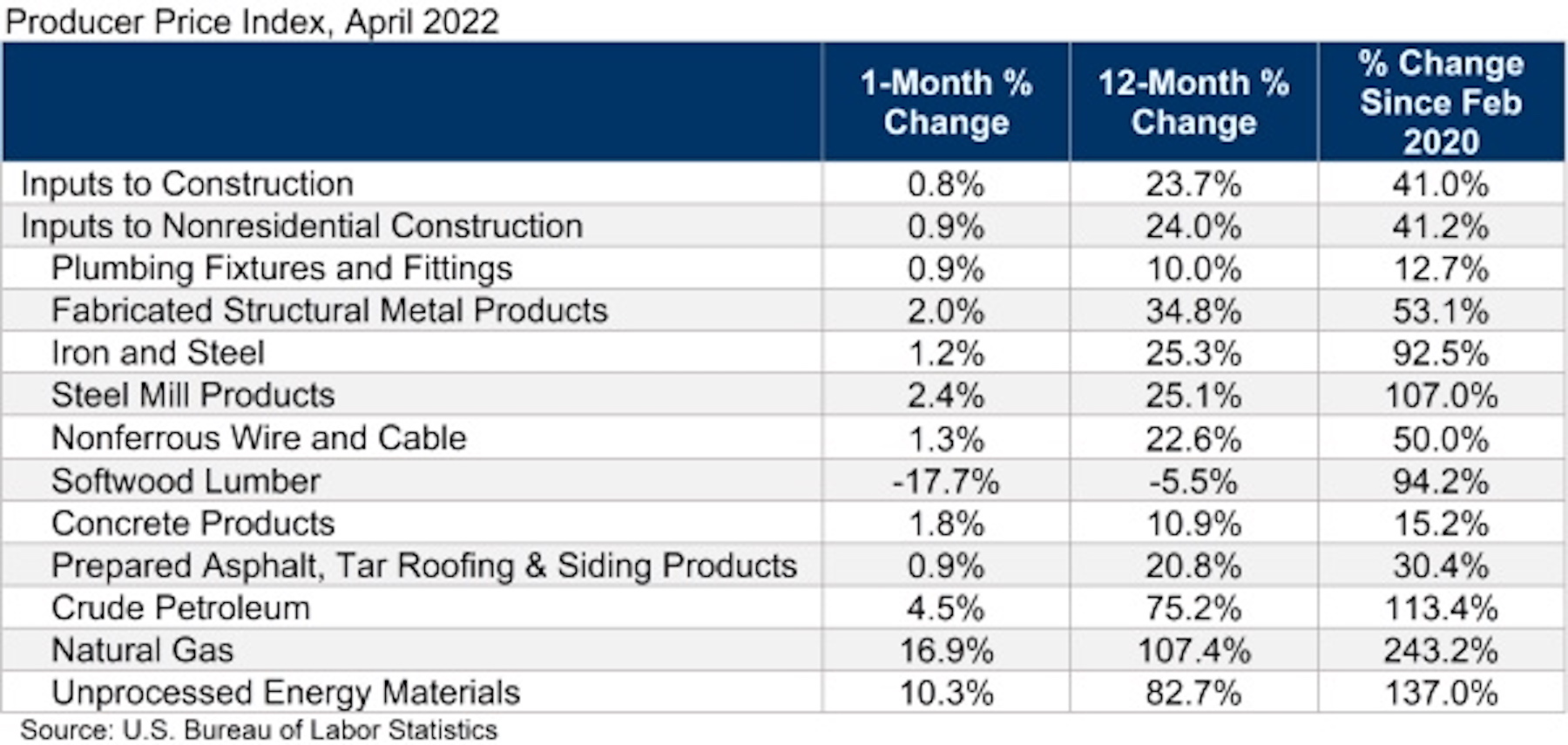

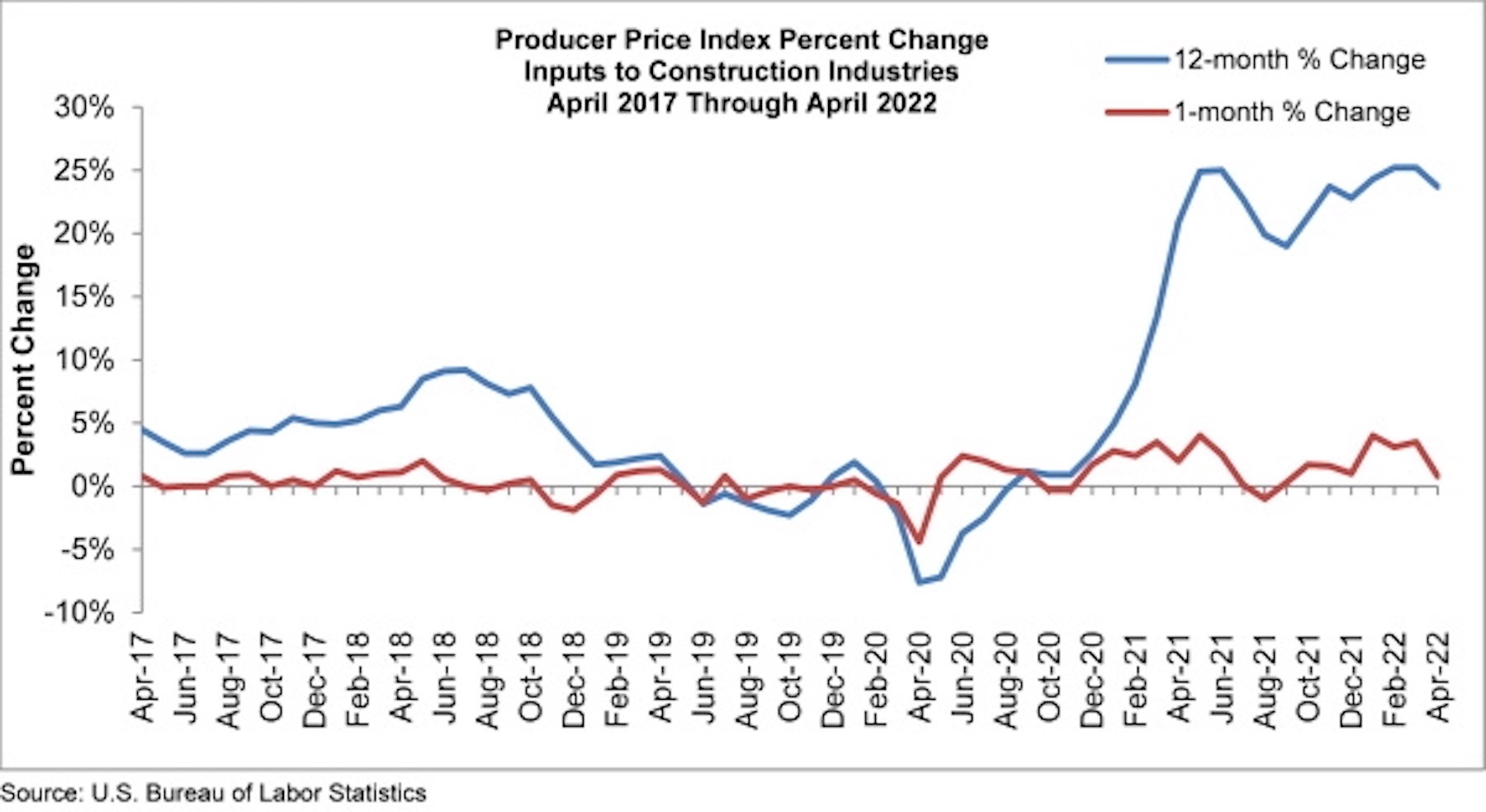

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices rose 0.9% for the month.

Construction input prices are up 23.7% from a year ago, while nonresidential construction input prices are 24.0% higher. Input prices were up in 10 of 11 subcategories in April. Softwood lumber was the only category in which prices decreased, falling 17.7% for the month. The largest price increases were in natural gas (+16.9%) and unprocessed energy materials (+10.3%).

“There are some economists who believe that inflation has peaked,” said ABC Chief Economist Anirban Basu. “Even if that were true, stakeholders should not expect dramatic declines in inflation in the near term given an array of factors placing upward pressure on prices: the Russia-Ukraine war, COVID-19, a shrunken labor force, elevated transportation costs and abundant demand for goods. Today’s PPI release indicates that producers continue to ask for and receive elevated prices for their limited production. These high input prices will continue to circulate through the economy as production continues, whether in the form of manufactured goods, buildings or infrastructure.

“According to ABC’s Construction Confidence Index, many contractors report that demand for their services remains sufficiently robust for them to pass along the bulk of their cost increases to project owners,” said Basu. “But at some point, the economy could weaken to the point that purchasers of construction services become less willing to pay elevated prices.

“The Federal Reserve is now in the middle of what will likely prove a lengthy monetary tightening process, and higher borrowing costs are rendering project starts less likely, all things being equal. That said, certain segments are likely to power through this dynamic, should it happen. That includes public construction, given the recent passage and ongoing implementation of a large-scale American infrastructure package. It should be noted that recent inflation has reduced the return taxpayers will get per dollar spent on infrastructure.”

Related Stories

Contractors | Jan 4, 2018

Construction spending in a ‘mature’ period of incremental growth

Labor shortages are spiking wages. Materials costs are rising, too.

Market Data | Dec 20, 2017

Architecture billings upturn shows broad strength

The American Institute of Architects (AIA) reported the November ABI score was 55.0, up from a score of 51.7 in the previous month.

Market Data | Dec 14, 2017

ABC chief economist predicts stable 2018 construction economy

There are risks to the 2018 outlook as a number of potential cost increases could come into play.

Market Data | Dec 13, 2017

Top world regions and markets in the global hotel construction pipeline

The top world region by project count is North America.

Market Data | Dec 11, 2017

Global hotel construction pipeline is growing

The Total Pipeline stands at 12,427 Projects/2,084,940 Rooms.

Market Data | Dec 11, 2017

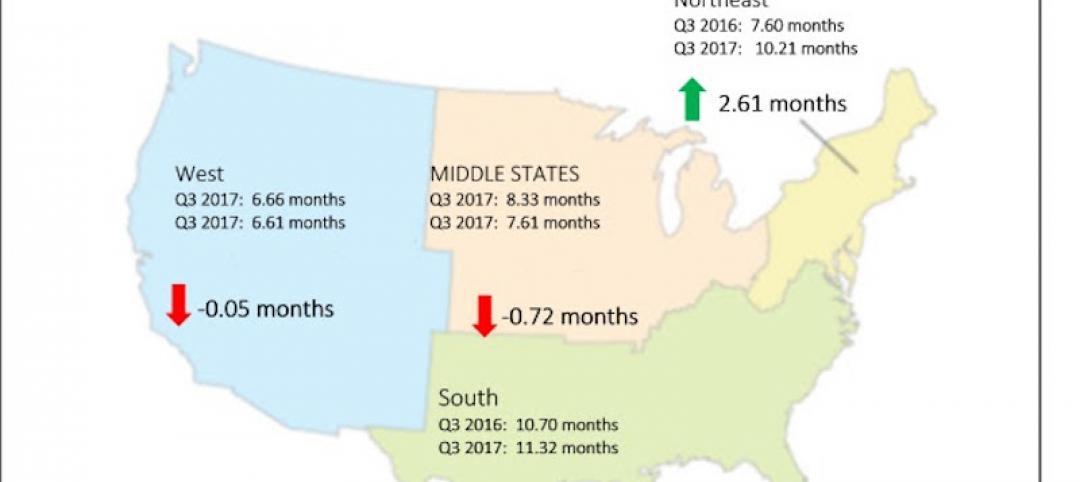

Construction backlog surges, sets record in third quarter

CBI is a leading economic indicator that reflects the amount of construction work under contract, but not yet completed.

Market Data | Dec 7, 2017

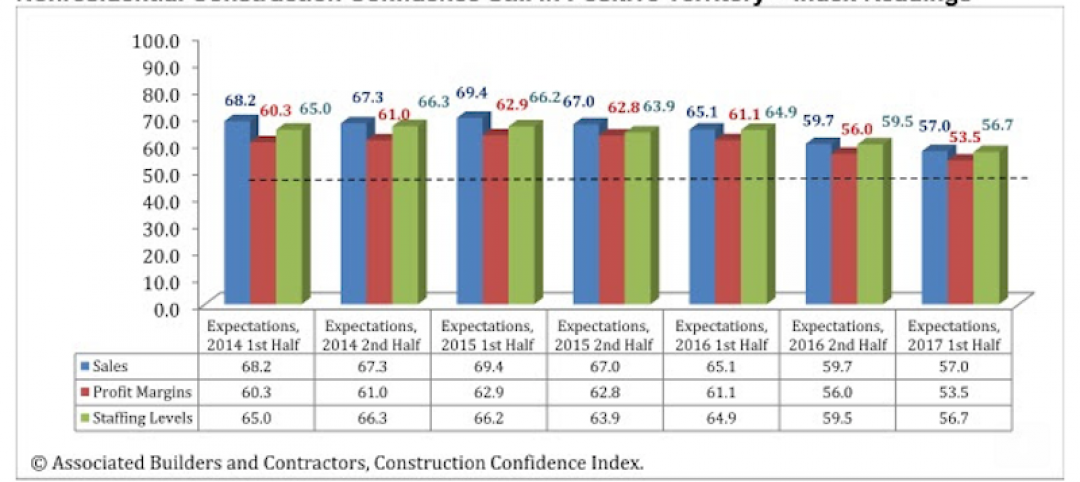

Buoyed by healthy economy, ABC Index finds contractors upbeat

Despite rising construction labor and materials costs, 55% of contractors expect their profit margins to expand in the first half of 2018.

Market Data | Dec 5, 2017

Top health systems engaged in $21 billion of U.S. construction projects

Largest active projects are by Sutter Health, New York Presbyterian, and Scripps Health.

Industry Research | Nov 28, 2017

2018 outlook: Economists point to slowdown, AEC professionals say ‘no way’

Multifamily housing and senior living developments head the list of the hottest sectors heading into 2018, according a survey of 356 AEC professionals.

Market Data | Nov 27, 2017

Construction's contribution to U.S. economy highest in seven years

Thirty-seven states benefited from the rise in construction activity in their state, while 13 states experienced a reduction in activity.