Construction firms are experiencing widespread project deferrals and cancellations, along with disruptions to ongoing work and few new project awards, as the economic damage from the pandemic drags down industry employment in metro areas across the nation, according to a new survey and an analysis of new government data that the Associated General Contractors of America released today. Association officials urged Congress to pass new coronavirus relief measures to head off further job losses.

“The survey results make it clear that the months-long pandemic is undermining demand for projects, disrupting vital supply chains and clouding the industry’s outlook,” said Ken Simonson, the association’s chief economist. “Without new federal relief measures, these challenges pose a significant threat to current construction employment levels.”

Simonson noted that three-quarters of survey respondents report having a scheduled project postponed or canceled. He added that is up from the 60% of contractors who reported a canceled project in our August survey and 32% who did so in June. Meanwhile, only 23% of contractors report working on new or expanded construction projects as a result of the pandemic, about the same percentage as in June.

The coronavirus is also disrupting projects that are still underway, Simonson noted. Seventy-eight percent of respondents report they are currently experiencing project delays or disruptions, up from 57% in June. In particular, 42% of firms are experiencing disruptions due to a shortage of construction materials, equipment or parts. In addition, 35% are experiencing disruptions because of a shortage of craftworkers and/or subcontractors. In one bit of good news, however, only 7% of firms are experiencing disruptions because of a shortage of personal protective equipment.

Shrinking demand and disrupted operations are shaking many contractors’ faith in the future, the survey showed. Thirty-four percent of respondents report they do not expect their firm’s volume of business will return to pre-pandemic levels for at least a year.

Delays, disruptions and uncertainty threaten to undermine employment levels in the construction sector. In fact, 30% of firms report they have already furloughed or terminated employees because of the coronavirus.

That is likely why construction employment fell during the past year in most metro areas, Simonson added. Construction employment fell in 234, or 65%, of 358 metro areas between September 2019 and September 2020. Construction employment was stagnant in 38 other metro areas, meanwhile, and only 86 metro areas added construction jobs during the past year.

Houston-The Woodlands-Sugar Land, Texas lost the most construction jobs over those 12 months (-24,400 jobs, -10%), followed by New York City (-19,500 jobs, -12%). Brockton-Bridgewater-Easton, Mass. had the largest percentage decline (-36%, -2,000 jobs), followed by Altoona, Pa. (-32%, -1,000 jobs) and Johnstown, Pa. (-32%, -900 jobs).

Dallas-Plano-Irving, Texas added the most construction jobs from September 2019 to September 2020 (5,100 jobs, 3%), followed by Baltimore-Columbia-Towson, Md. (4,700 jobs, 6%). Walla Walla, Wash. had the highest percentage increase (25%, 300 jobs), followed by Fond du Lac, Wisc. (15%, 500 jobs).

Simonson added that a majority of firms report they plan to cut jobs or abstain from adding new employees during the coming year. Twenty percent expect their headcount will shrink while 42% report they do not plan to add to the size of their headcount during the next twelve months.

Most firms participating in the survey, 78%, cited a preference for new federal relief measures to mitigate against the impacts of the coronavirus. Among the measures firms are hoping Washington officials will enact are new federal investments in infrastructure, liability reforms that protect responsible firms from frivolous coronavirus suits and a new highway and transportation bill.

As a result, association officials urged Congressional leaders to recall legislators right after the election to pass much-needed new coronavirus relief measures. In particular, the construction officials called on Congress to new infrastructure investments, liability reforms and an additional round of Paycheck Protection Program loans.

“As our survey shows, the pandemic and efforts to mitigate its spread have deeply wounded the economy, depressing demand for many types of commercial construction projects,” said Stephen E. Sandherr, the association’s chief executive officer. “Congress can end the downward economic slide and help create needed new construction jobs by passing measures to boost demand and protect honest employers.”

View the survey results. View the metro employment 12-month data, rankings, top 10, and map.

Related Stories

Market Data | Jul 5, 2023

Nonresidential construction spending decreased in May, its first drop in nearly a year

National nonresidential construction spending decreased 0.2% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.06 trillion.

Apartments | Jun 27, 2023

Average U.S. apartment rent reached all-time high in May, at $1,716

Multifamily rents continued to increase through the first half of 2023, despite challenges for the sector and continuing economic uncertainty. But job growth has remained robust and new households keep forming, creating apartment demand and ongoing rent growth. The average U.S. apartment rent reached an all-time high of $1,716 in May.

Industry Research | Jun 15, 2023

Exurbs and emerging suburbs having fastest population growth, says Cushman & Wakefield

Recently released county and metro-level population growth data by the U.S. Census Bureau shows that the fastest growing areas are found in exurbs and emerging suburbs.

Contractors | Jun 13, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of May 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in May, according to an ABC member survey conducted May 20 to June 7. The reading is 0.1 months lower than in May 2022. Backlog in the infrastructure category ticked up again and has now returned to May 2022 levels. On a regional basis, backlog increased in every region but the Northeast.

Industry Research | Jun 13, 2023

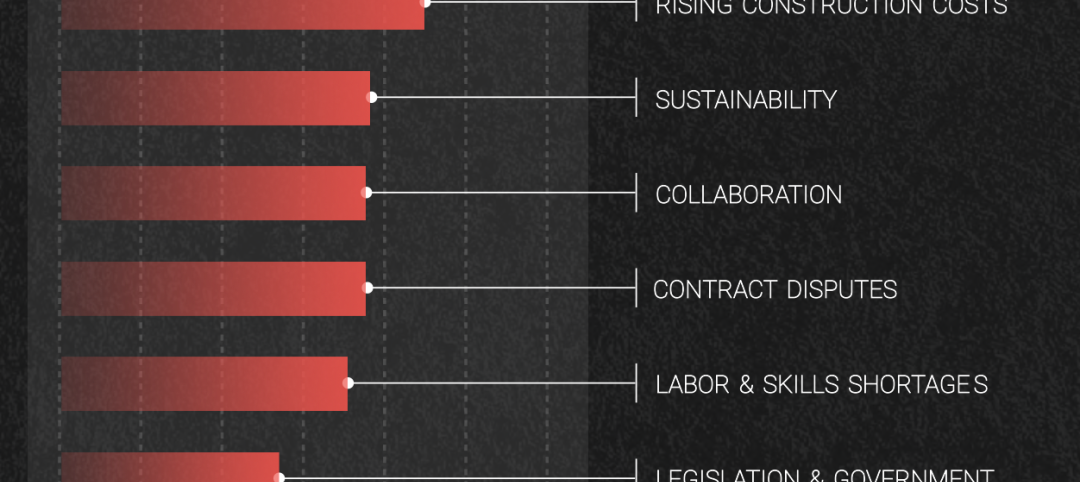

Two new surveys track how the construction industry, in the U.S. and globally, is navigating market disruption and volatility

The surveys, conducted by XYZ Reality and KPMG International, found greater willingness to embrace technology, workplace diversity, and ESG precepts.

| Jun 5, 2023

Communication is the key to AEC firms’ mental health programs and training

The core of recent awareness efforts—and their greatest challenge—is getting workers to come forward and share stories.

Contractors | May 24, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of April 2023

Contractor backlogs climbed slightly in April, from a seven-month low the previous month, according to Associated Builders and Contractors.

Multifamily Housing | May 23, 2023

One out of three office buildings in largest U.S. cities are suitable for residential conversion

Roughly one in three office buildings in the largest U.S. cities are well suited to be converted to multifamily residential properties, according to a study by global real estate firm Avison Young. Some 6,206 buildings across 10 U.S. cities present viable opportunities for conversion to residential use.

Industry Research | May 22, 2023

2023 High Growth Study shares tips for finding success in uncertain times

Lee Frederiksen, Managing Partner, Hinge, reveals key takeaways from the firm's recent High Growth study.

Multifamily Housing | May 8, 2023

The average multifamily rent was $1,709 in April 2023, up for the second straight month

Despite economic headwinds, the multifamily housing market continues to demonstrate resilience, according to a new Yardi Matrix report.