Multifamily rents continued to increase through the first half of 2023, despite challenges for the sector and continuing economic uncertainty. But job growth has remained robust and new households keep forming, creating apartment demand and ongoing rent growth.

“We anticipate that rents will continue to increase modestly over the course of the year as demand has firmed, albeit at a more moderate rate in line with historic growth levels,” say Yardi Matrix experts in a newly released U.S. Multifamily Outlook.

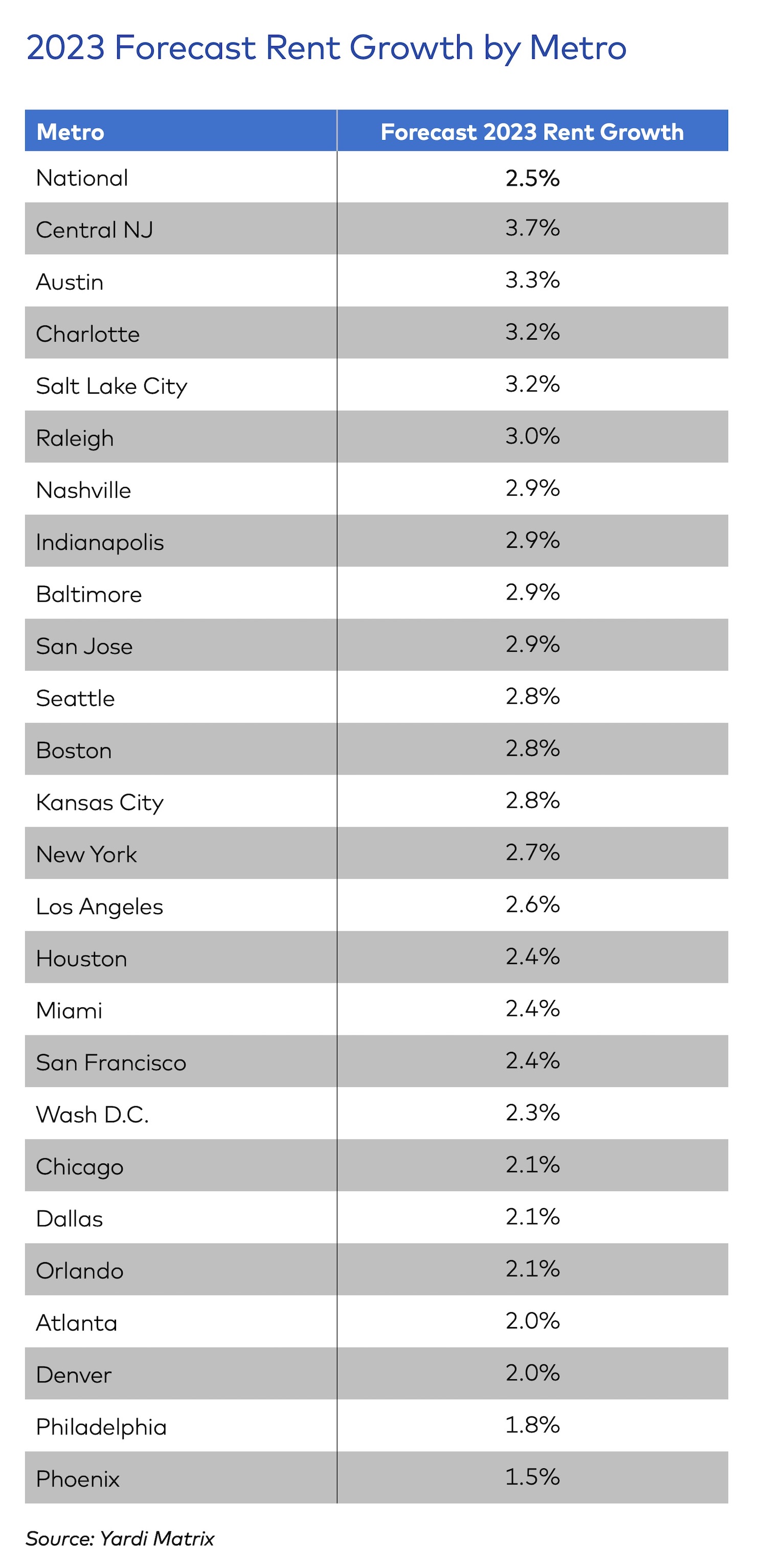

Through the first five months of 2023, U.S. asking rents rose $17, or 0.9%, with year-over-year growth falling to 2.6%.

“We expect continued deceleration, with rent growth of 2.5% for the full year,” states the outlook. The average U.S. apartment rent reached an all-time high of $1,716 in May.

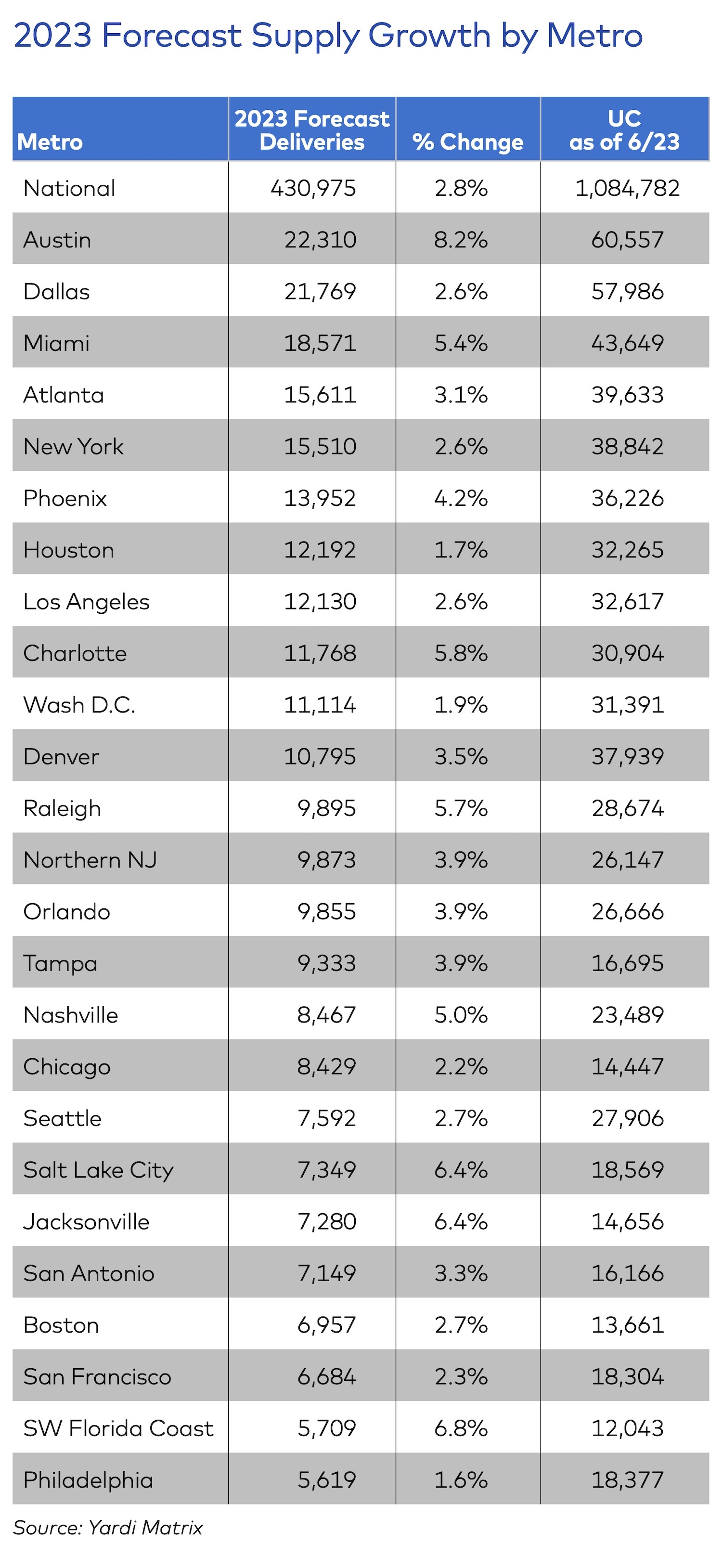

Challenges for the sector include slowing demand, growing issues with affordability, slower population growth and competition from a large number of new units coming online through 2024.

The capital side of the industry has suffered due to heightened interest rates, which show little sign of decreasing in the near-term. Property values are down 15-20% from their peak and are still declining due to the higher cost of capital.

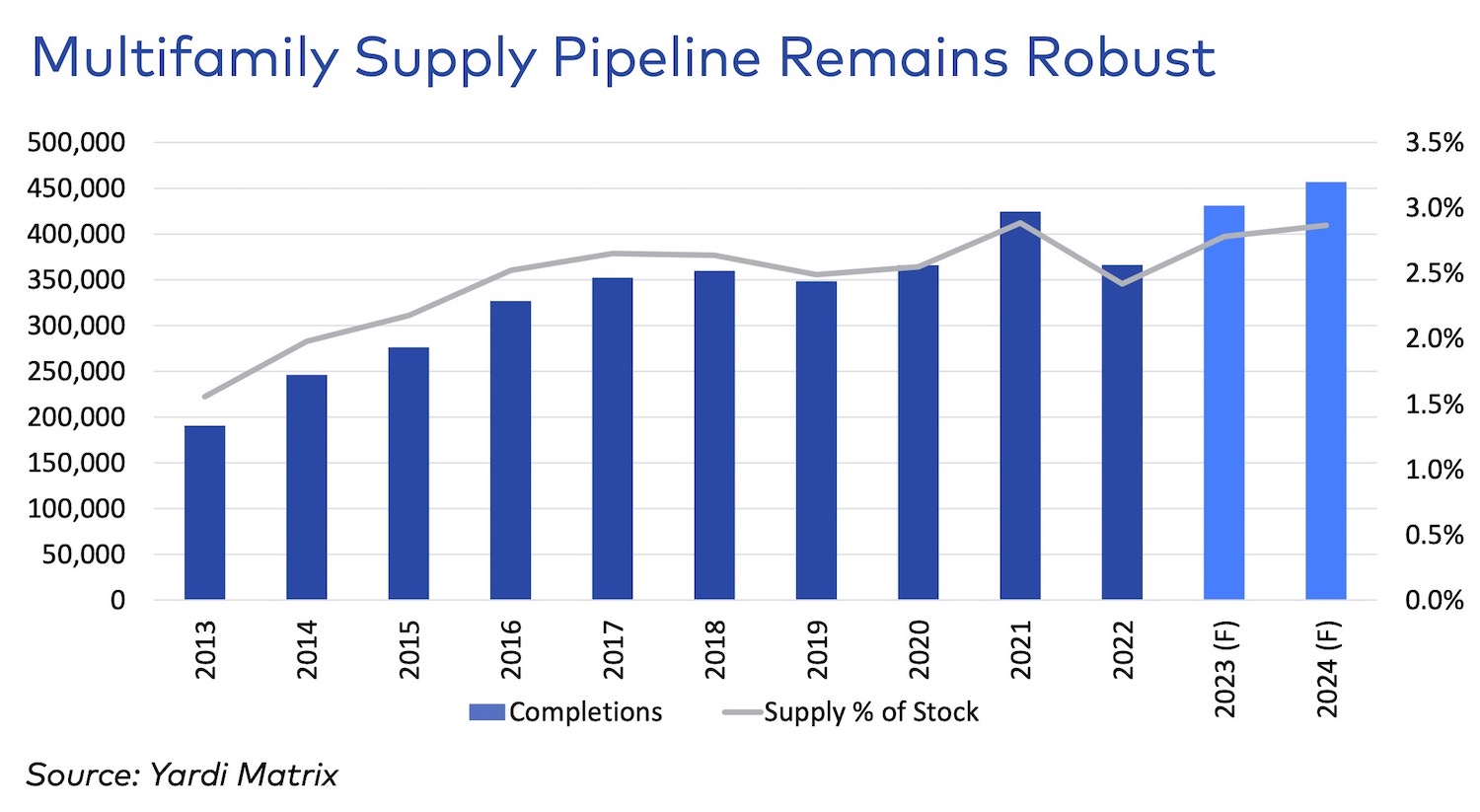

New deliveries will be high at least through the end of 2024, as the 1 million units under construction come online. New starts are now declining, however, because debt is more expensive and fewer banks are financing construction.

Household formation, which drove the 22% cumulative growth in U.S. asking rents over 2021 and 2022, has slowed but remains positive. Although some pandemic demographic trends are moderating, the desire for more space to balance living, working and family appears to have staying power and should continue to drive demand.

Demand is also boosted by the sharp drop in home sales, which keeps renters in apartments. High mortgage rates also create an affordability hurdle for first-time buyers and middle-income families looking to trade up.

Home mortgage rates rose to 6.5% in March 2023, up 230 basis points from March 2022, increasing monthly mortgage costs by 29% and overall ownership costs by 20%, according to the Harvard Joint Center of Housing Studies.

Related Stories

MFPRO+ New Projects | Oct 30, 2024

Luxury waterfront tower in Brooklyn features East River and Manhattan skyline views

Leasing recently began for The Dupont, a 41-story luxury rental property along the Brooklyn, N.Y., waterfront. Located within the 22-acre Greenpoint Landing, where it overlooks the newly constructed Newtown Barge Park, the high-rise features East River and Manhattan skyline views along with 20,000 sf of indoor and outdoor communal space.

Office Buildings | Oct 29, 2024

Editorial call for Office Building project case studies

BD+C editors are looking to feature a roundup of office building projects for 2024, including office-to-residential conversions. Deadline for submission: December 6, 2024.

Multifamily Housing | Oct 28, 2024

A case for mid-rise: How multifamily housing can reshape our cities

Often referred to as “five-over-ones,” the mid-rise apartment type is typically comprised of five stories of apartments on top of a concrete “podium” of ground-floor retail. The main criticism of the “five-over-one” is that they are often too predictable.

Adaptive Reuse | Oct 22, 2024

Adaptive reuse project transforms 1840s-era mill building into rental housing

A recently opened multifamily property in Lawrence, Mass., is an adaptive reuse of an 1840s-era mill building. Stone Mill Lofts is one of the first all-electric mixed-income multifamily properties in Massachusetts. The all-electric building meets ambitious modern energy codes and stringent National Park Service historic preservation guidelines.

MFPRO+ News | Oct 22, 2024

Project financing tempers robust demand for multifamily housing

AEC Giants with multifamily practices report that the sector has been struggling over the past year, despite the high demand for housing, especially affordable products.

Products and Materials | Oct 17, 2024

5 multifamily tech products for your next project

Multifamily housing and technological upgrades go hand-in-hand. From the rise in electric vehicle charging needs to the sophistication of smart home accessories, tech products are abound in the multifamily space.

Codes and Standards | Oct 16, 2024

North Carolina’s code policies likely worsened damage caused by Hurricane Helene

The North Carolina Legislature’s rejection of building code updates likely worsened the damage caused by Hurricane Helene, code experts say. Over the past 15 years, lawmakers rejected limits on construction on steep slopes, which might have reduced the number of homes destroyed by landslides.

MFPRO+ Research | Oct 15, 2024

Multifamily rents drop in September 2024

The average multifamily rent fell by $3 in September to $1,750, while year-over-year growth was unchanged at 0.9 percent.

MFPRO+ News | Oct 9, 2024

San Francisco unveils guidelines to streamline office-to-residential conversions

The San Francisco Department of Building Inspection announced a series of new building code guidelines clarifying adaptive reuse code provisions and exceptions for converting office-to-residential buildings. Developed in response to the Commercial to Residential Adaptive Reuse program established in July 2023, the guidelines aim to increase the viability of converting underutilized office buildings into housing by reducing regulatory barriers in specific zoning districts downtown.

Mixed-Use | Oct 7, 2024

New mixed-use tower by Studio Gang completes first phase of San Francisco waterfront redevelopment

Construction was recently completed on Verde, a new mixed-use tower along the San Francisco waterfront, marking the end of the first phase of the Mission Rock development. Verde is the fourth and final building of phase one of the 28-acre project that will be constructed in several phases guided by design principles developed by a design cohort led by Studio Gang.