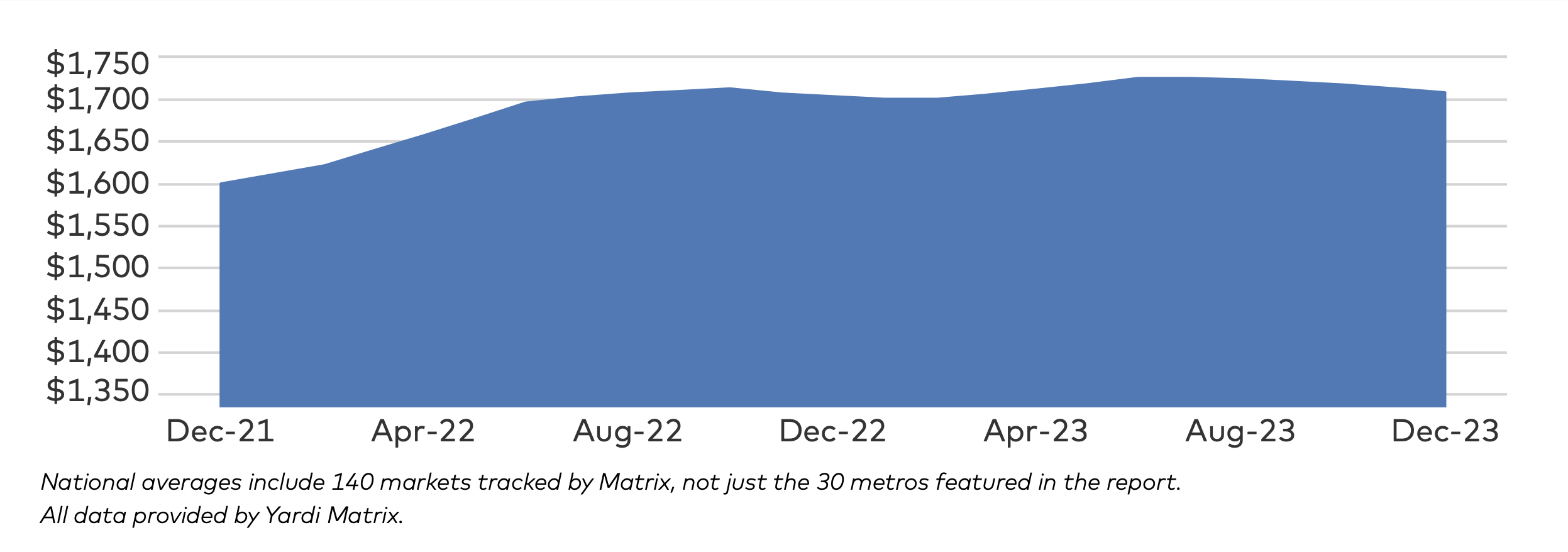

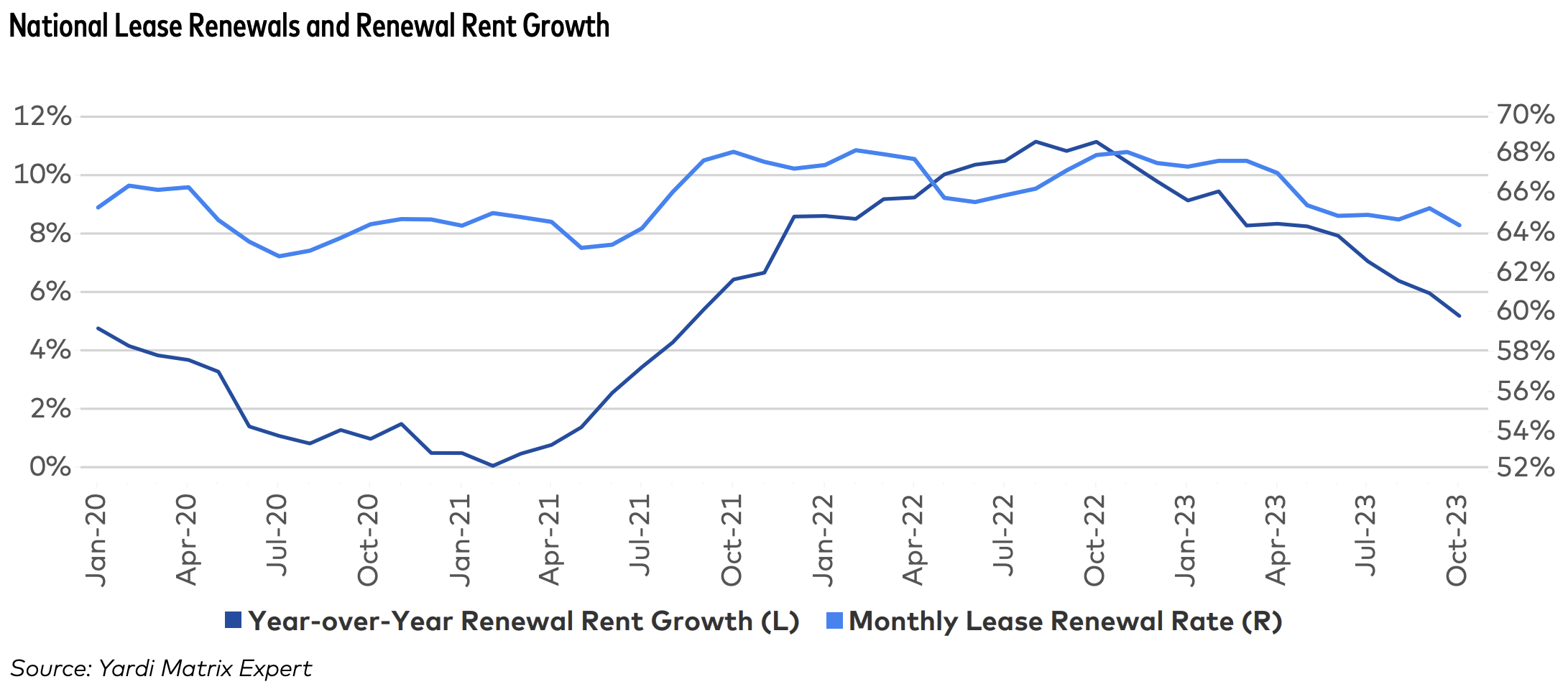

The December 2023 National Multifamily Report by Yardi Matrix highlights the highs and lows of the multifamily market in 2023. Despite strong demand, the year-over-year (YOY) growth for rent remained largely unchanged at 0.3 percent—a stark contrast to December 2022's 6.4% YOY increase.

According to Yardi Matrix, 2023's full-year rent growth of 0.3% is the weakest rent performance since the 0.2% increase in 2010 (barring the 2020 pandemic year's 0.1% gain). Negative rent growth is affecting several major metropolitan areas as well, with Austin, Texas, ending the year at a -5.7% growth rate. Other metros such as Orlando, Fla.; Portland, Ore.; Phoenix, Ariz.; and Atlanta, Ga.; all are down by at least 3% year-over-year.

Strong job market

Despite the multifamily market ending 2023 on a downswing, conditions may not be as weak as they appear. A strong job market continues to drive demand and shows signs of holding up following the Federal Reserve's rate hikes.

Also aiding in demand is net immigration, which has increased by more than one million annually, according to the report.

Occupancy rates

The national occupancy rate left December 2023 at 94.8 percent, unchanged from the previous month. Rates were either unchanged or down YOY in all but five markets: Chicago, Ill. (+0.2% YOY), Seattle, Wash. (+0.2% YOY), Denver, Colo. (+0.1% YOY), Washington, D.C. (+0.1% YOY), and the Twin Cities (+0.1% YOY).

Atlanta had the largest decline of the year, down 1.3 percent.

Overall outlook for multifamily housing in 2024

- Expenses, income, deliveries, and interest rates pose key challenges for the multifamily industry this year

- Though the market is expected to deliver over 500,000 units this year, there is a dramatic decrease in starts

- Recent interest rate declines alleviate potential distress for multifamily owners, but long-term stability remains uncertain

Related Stories

Mixed-Use | Oct 7, 2024

New mixed-use tower by Studio Gang completes first phase of San Francisco waterfront redevelopment

Construction was recently completed on Verde, a new mixed-use tower along the San Francisco waterfront, marking the end of the first phase of the Mission Rock development. Verde is the fourth and final building of phase one of the 28-acre project that will be constructed in several phases guided by design principles developed by a design cohort led by Studio Gang.

MFPRO+ News | Sep 24, 2024

Major Massachusetts housing law aims to build or save 65,000 multifamily and single-family homes

Massachusetts Gov. Maura Healey recently signed far-reaching legislation to boost housing production and address the high cost of housing in the Bay State. The Affordable Homes Act aims to build or save 65,000 homes through $5.1 billion in spending and 49 policy initiatives.

MFPRO+ News | Sep 23, 2024

Minnesota bans cannabis smoking and vaping in multifamily housing units

Minnesota recently enacted a first-in-the-nation statewide ban on smoking and vaping cannabis in multifamily properties including in individual living units. The law has an exemption for those using marijuana for medical purposes.

The Changing Built Environment | Sep 23, 2024

Half-century real estate data shows top cities for multifamily housing, self-storage, and more

Research platform StorageCafe has conducted an analysis of U.S. real estate activity from 1980 to 2023, focusing on six major sectors: single-family, multifamily, industrial, office, retail, and self-storage.

Mixed-Use | Sep 19, 2024

A Toronto development will transform a 32-acre shopping center site into a mixed-use urban neighborhood

Toronto developers Mattamy Homes and QuadReal Property Group have launched The Clove, the first phase in the Cloverdale, a $6 billion multi-tower development. The project will transform Cloverdale Mall, a 32-acre shopping center in Toronto, into a mixed-use urban neighborhood.

Codes and Standards | Sep 17, 2024

New California building code encourages, but does not mandate heat pumps

New California homes are more likely to have all-electric appliances starting in 2026 after the state’s energy regulators approved new state building standards. The new building code will encourage installation of heat pumps without actually banning gas heating.

Adaptive Reuse | Sep 12, 2024

White paper on office-to-residential conversions released by IAPMO

IAPMO has published a new white paper titled “Adaptive Reuse: Converting Offices to Multi-Residential Family,” a comprehensive analysis of addressing housing shortages through the conversion of office spaces into residential units.

MFPRO+ Research | Sep 11, 2024

Multifamily rents fall for first time in 6 months

Ending its six-month streak of growth, the average advertised multifamily rent fell by $1 in August 2024 to $1,741.

Legislation | Sep 9, 2024

Efforts to encourage more housing projects on California coast stall

A movement to encourage more housing projects along the California coast has stalled out in the California legislature. Earlier this year, lawmakers, with the backing of some housing activists, introduced a series of bills aimed at making it easier to build apartments and accessory dwelling units along California’s highly regulated coast.

MFPRO+ New Projects | Sep 5, 2024

Chicago's Coppia luxury multifamily high-rise features geometric figures on the façade

Coppia, a new high-rise luxury multifamily property in Chicago, features a distinctive façade with geometric features and resort-style amenities. The 19-story, 315,000-sf building has more than 24,000 sf of amenity space designed to extend resident’s living spaces. These areas offer places to work, socialize, exercise, and unwind.