All leading indicators show that the multifamily sector is shrugging off rising interest rates, inflationary pressures and other economic challenges, and will continue to be a torrid market for design and construction firms for at least the rest of 2022.

CBRE reported that Multifamily remained the most preferred commercial real estate sector for investment in the 2nd Quarter, with a 32% year-over-year increase in volume to $78 billion, and the Federal Reserve reported strong multifamily results across all districts in its 2022 July Beige Book. At the same time, Rent.com reported that year-over-year rents grew 25.3% and 26.5% for one- and two-bedroom apartments, respectively, and the U.S. Census Department announced that apartment vacancy rates remained near record lows (5.6% in the 2nd Quarter of 2022).

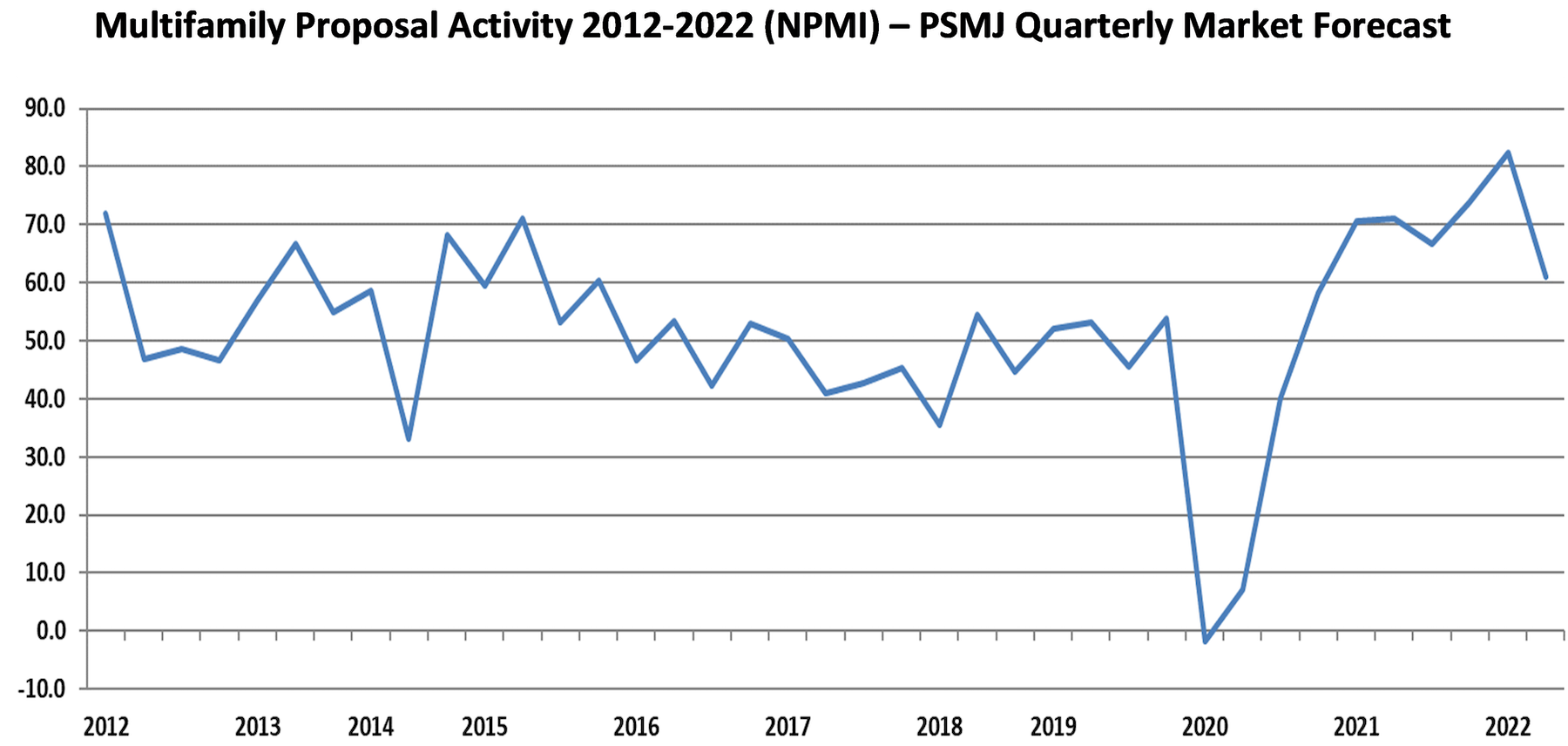

The PSMJ Resources Quarterly Market Forecast (QMF) survey of architects, engineers and contractors reinforces this view. While more than two-thirds (67.2%) of the firm leaders surveyed said that proposal activity in the multifamily market increased from the 1st Quarter of 2022, only 6.3% reported a decline. The resulting net plus/minus index (NPMI) of 60.9 – which is the delta between the percentage of respondents seeing a rise and fall in proposal activity – is down from the record-setting 1st Quarter NPMI of 82.4, but is still among the best quarters since PSMJ began measuring proposal opportunities in submarkets in 2006.

PSMJ Director and Senior Consultant David Burstein, PE, acknowledges the current strength of the entire housing market, but expects a turnaround in the not-too-distant future, albeit a minor to moderate one. “The housing market, including multifamily housing, has been red hot. But it may be on the verge of cooling off a bit,” he says. “A recent analysis by CNBC indicated that the average mortgage payments for a house purchased in 2019 was $1,192 per month. With the increase in home prices and interest rates, the mortgage on that same house is now $1,991 – an increase of almost $800 per month. Wages have gone up since 2019, but they haven’t gone up enough to account for that difference in mortgage costs. The net result will be fewer families able to afford a new home.”

This will have an impact on multifamily as well, adds Burstein. “The increase in interest rates also affects developers’ ability to finance new multifamily rental buildings. And the Fed has indicated that they aren’t close to topping out on their rate increases. So I expect the pace of new multifamily to slow significantly in the next few months. And those projects that do move forward will probably be for lower-cost properties.”

To Burstein’s point, the National Association of Home Builders (NAHB) Multifamily Market Survey weakened in the 1st Quarter of 2022 (the latest figures available), with confidence in market-rate rentals and for-sale apartments sliding. Only lower-rent properties supported by government programs showed a small increase in confidence among the builders responding to the survey.

Despite this caution, the forward-looking QMF survey also anticipates relatively healthy futures for two other multifamily submarkets it measures – condominiums and senior/assisted living.

Condominiums recorded an NPMI of 47.9 in the 2nd Quarter of 2022, its second-highest reading ever. Only the 2nd Quarter of 2021, when condos scored an NPMI of 59.2, was better. More than 54% of respondents working in the condo market saw higher proposal activity in the 1st Quarter, compared with about 6% that saw a decrease.

Proposal opportunities in senior/assisted living facilities also impressed, recording an NPMI of 58.8 – 62.7% saw an increase in activity, while only 3.9% reported a decline.

PSMJ has been conducting the Quarterly Market Forecast survey of its members since 2003. The A/E/C consulting and publishing company chose proposal activity as the basis for its QMF because it represents the earliest stage of the project lifecycle. For more information, go to https://www.psmj.com.

Related Stories

| Feb 5, 2013

8 eye-popping wood building projects

From 100-foot roof spans to novel reclaimed wood installations, the winners of the 2013 National Wood Design Awards push the envelope in wood design.

| Jan 31, 2013

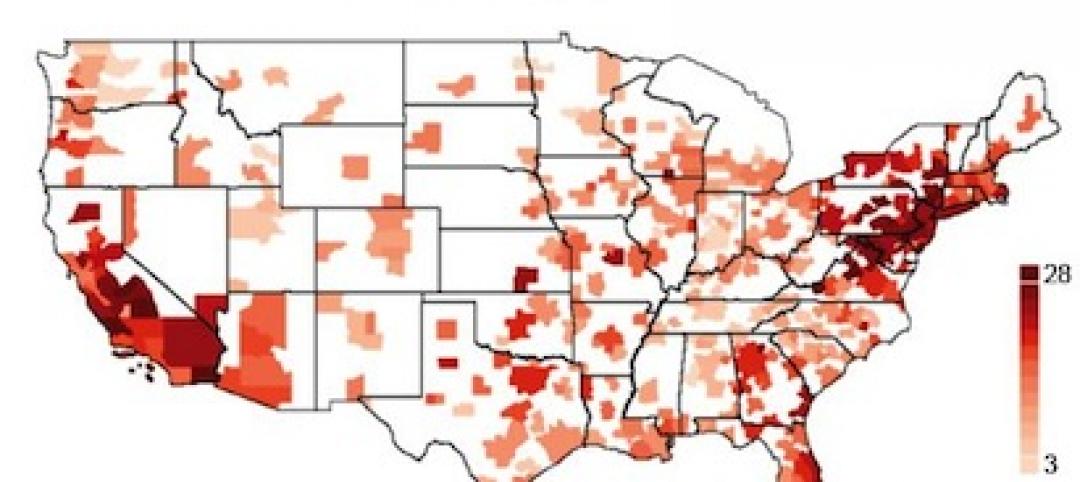

Map of U.S. illustrates planning times for commercial construction

Stephen Oliner, a UCLA professor doing research for the Federal Reserve Board, has made the first-ever estimate of planning times for commercial construction across the United States.

| Jan 31, 2013

More severe wind storms should prompt nationwide reexamination of building codes, says insurance expert

The increased number and severity of storms with high winds nationally should prompt a reexamination of building codes in every community, says Mory Katz, vice president, Verisk Insurance Solutions Commercial Property, Jersey City, N.J.

| Jan 29, 2013

Trinitas and Harrison Street Break Ground Near University of Kentucky

The 699-bed Collegiate on Angliana, with an anticipated opening date of August 2013, will serve students attending the University of Kentucky (UK).

| Jan 23, 2013

Music-Inspired Apartment Complex Completed in Tampa's Tempo District

Named in honor of jazz artist Ella Fitzgerald, Ella at Encore is the first building to rise from plans to develop a mixed-use, mixed-income urban village in the community.

| Dec 6, 2012

Suffolk Construction awarded Phase Two of Boston’s Old Colony redevelopment project

Project team breaks ground on South Boston public housing project designed for energy efficiency.

| Nov 13, 2012

2012 LEED for Homes Award recipients announced

USGBC recognizes excellence in the green residential building community at its Greenbuild Conference & Expo in San Francisco

| Nov 11, 2012

Greenbuild 2012 Report: Multifamily

Sustainably designed apartments are apples of developers’ eyes

| Oct 5, 2012

2012 Reconstruction Award Silver Winner: 220 Water Street, Brooklyn, N.Y.

The recent rehabilitation of 220 Water Street transforms it from a vacant manufacturing facility to a 134-unit luxury apartment building in Brooklyn’s DUMBO neighborhood.

| Aug 1, 2012

C.W. Driver forms Driver URBAN

Driver URBAN specializes in the construction of multi-family apartments, mixed-use developments, affordable housing, student and senior housing, and hospitality projects.