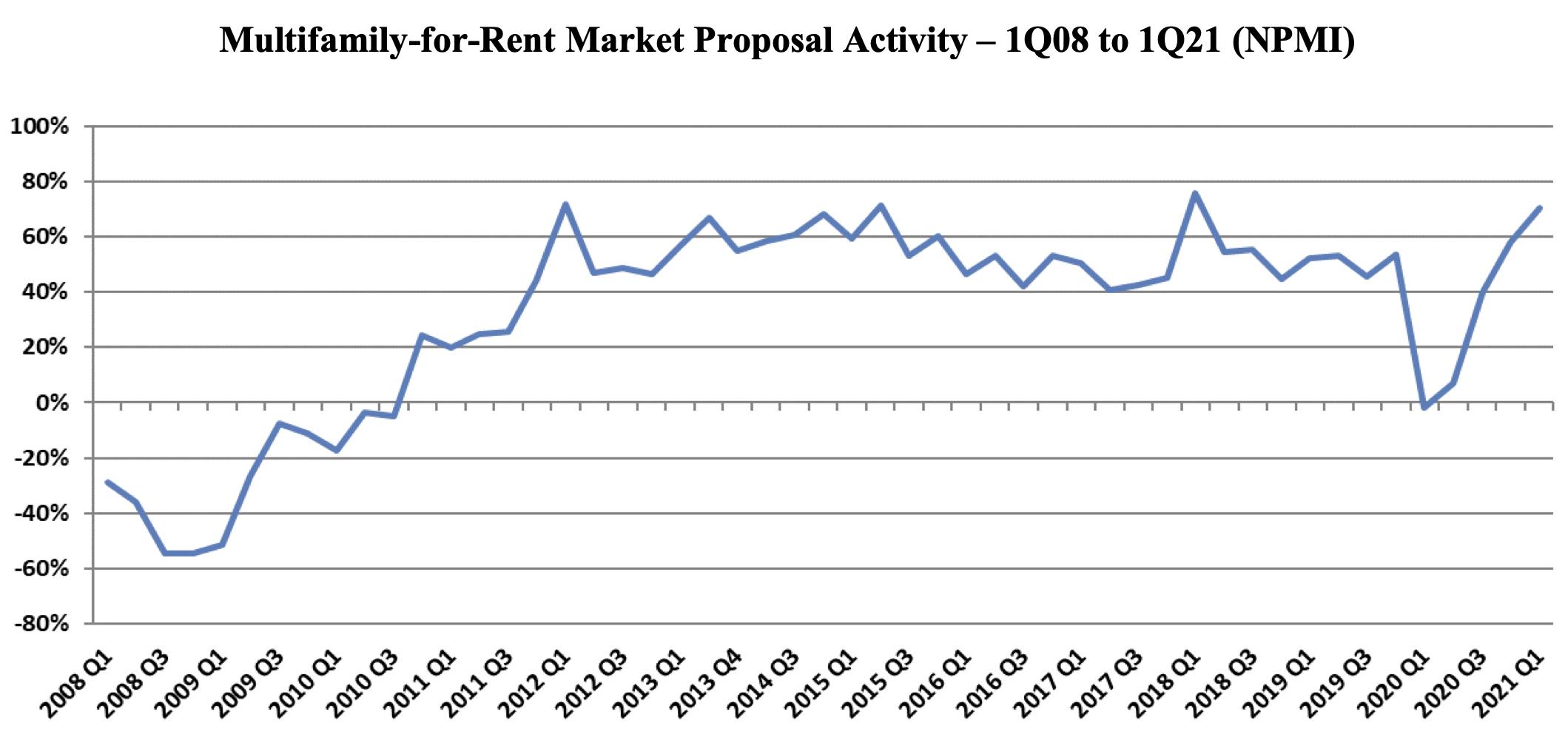

First-quarter proposal activity for multifamily housing added to prior quarter gains, reaching a near-record Net Plus/Minus Index (NPMI) of 71%. Multifamily topped the four other housing submarkets, though all performed well.

The first three months of the year saw housing lead all 12 major markets in the PSMJ Resources Quarterly Market Forecast survey of architecture, engineering, and construction (AEC) firms.

PSMJ’s NPMI expresses the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease. The QMF has proven to be a solid predictor of market health for the industry since its inception in 2003. A consistent group of over 300 AEC firm leaders participate regularly, with 183 contributing to the most recent survey.

Up 13 percentage points from the final quarter of 2020, multifamily’s NPMI of 71% tied its third-highest score since PSMJ added submarkets to its QMF survey in 2006. In addition to the record-high 76% in the 1st Quarter of 2018 and 72% in the 1st Quarter of 2012, Multifamily hit 71% in the 1st Quarter of 2015.

The 2021 performance marked a remarkable rebound for Multifamily, which dipped to -2% in the 1st Quarter of 2020, its first time in negative figures since 2010. In fact, before the COVID-driven drop a year ago, Multifamily’s NPMI had not fallen below 40% since the 3rd Quarter of 2011.

PSMJ Senior Principal David Burstein, PE, AECPM, noted that the strong performance of Multifamily and the entire Housing sector illustrates the industry’s overall economic health, as Housing growth often leads to activity in commercial, institutional and industrial markets as well. Should Congress pass an infrastructure stimulus bill, adds Burstein, the market could see even more historic growth.

Among respondents that work in the Multifamily sector, only 1% said that they saw a decrease in proposal opportunities in the 1st Quarter, compared with 72% that saw a noticeable increase. The remainder said that activity was about the same as the prior quarter.

The Assisted/Independent Senior Living submarket was another highflyer in the 1st Quarter, climbing 32 NPMI percentage points to 59%, tied for 12th -best among all submarkets. Condominiums bounced another 15 NPMI points to 30%, its best showing in three years.

The two other Housing markets measured in the PSMJ survey remain in rarefied air. The Housing Subdivision market recorded an NPMI of 68%, eclipsing its record-tying 4th -Quarter 2020 performance by 17 percentage points. Single-Family Homes dipped 8 NPMI percentage points to 51% – one of only 3 submarkets to see a decline – but that was still good enough for its second-best NPMI performance in the history of the QMF survey.

Related Stories

MFPRO+ News | Jun 3, 2024

Seattle mayor wants to scale back energy code to spur more housing construction

Seattle’s mayor recently proposed that the city scale back a scheduled revamping of its building energy code to help boost housing production. The proposal would halt an update to the city’s multifamily and commercial building energy code that is scheduled to take effect later this year.

Resiliency | Jun 3, 2024

Houston’s buyout program has prevented flood damage but many more homes at risk

Recent flooding in Houston has increased focus on a 30-year-old program to buy out some of the area’s most vulnerable homes. Storms dropped 23 inches of rain on parts of southeast Texas, leading to thousands of homes being flooded in low-lying neighborhoods around Houston.

MFPRO+ New Projects | May 29, 2024

Two San Francisco multifamily high rises install onsite water recycling systems

Two high-rise apartment buildings in San Francisco have installed onsite water recycling systems that will reuse a total of 3.9 million gallons of wastewater annually. The recycled water will be used for toilet flushing, cooling towers, and landscape irrigation to significantly reduce water usage in both buildings.

MFPRO+ News | May 28, 2024

ENERGY STAR NextGen Certification for New Homes and Apartments launched

The U.S. Environmental Protection Agency recently launched ENERGY STAR NextGen Certified Homes and Apartments, a voluntary certification program for new residential buildings. The program will increase national energy and emissions savings by accelerating the building industry’s adoption of advanced, energy-efficient technologies, according to an EPA news release.

MFPRO+ News | May 24, 2024

Austin, Texas, outlaws windowless bedrooms

Austin, Texas will no longer allow developers to build windowless bedrooms. For at least two decades, the city had permitted developers to build thousands of windowless bedrooms.

Mass Timber | May 22, 2024

3 mass timber architecture innovations

As mass timber construction evolves from the first decade of projects, we're finding an increasing variety of mass timber solutions. Here are three primary examples.

Mixed-Use | May 22, 2024

Multifamily properties above ground-floor grocers continue to see positive rental premiums

Optimizing land usage is becoming an even bigger priority for developers. In some city centers, many large grocery stores sprawl across valuable land.

MFPRO+ News | May 21, 2024

Massachusetts governor launches advocacy group to push for more housing

Massachusetts’ Gov. Maura Healey and Lt. Gov. Kim Driscoll have taken the unusual step of setting up a nonprofit to advocate for pro-housing efforts at the local level. One Commonwealth Inc., will work to provide political and financial support for local housing initiatives, a key pillar of the governor’s agenda.

MFPRO+ News | May 21, 2024

Baker Barrios Architects announces new leadership roles for multifamily, healthcare design

Baker Barrios Architects announced two new additions to its leadership: Chris Powers, RA, AIA, NCARB, EDAC, as Associate Principal and Director (Healthcare); and Mark Kluemper, AIA, NCARB, as Associate Principal and Technical Director (Multifamily).

MFPRO+ News | May 20, 2024

Florida condo market roiled by structural safety standards law

A Florida law enacted after the Surfside condo tower collapse is causing turmoil in the condominium market. The law, which requires buildings to meet certain structural safety standards, is forcing condo associations to assess hefty fees to make repairs on older properties. In some cases, the cost per unit runs into six figures.