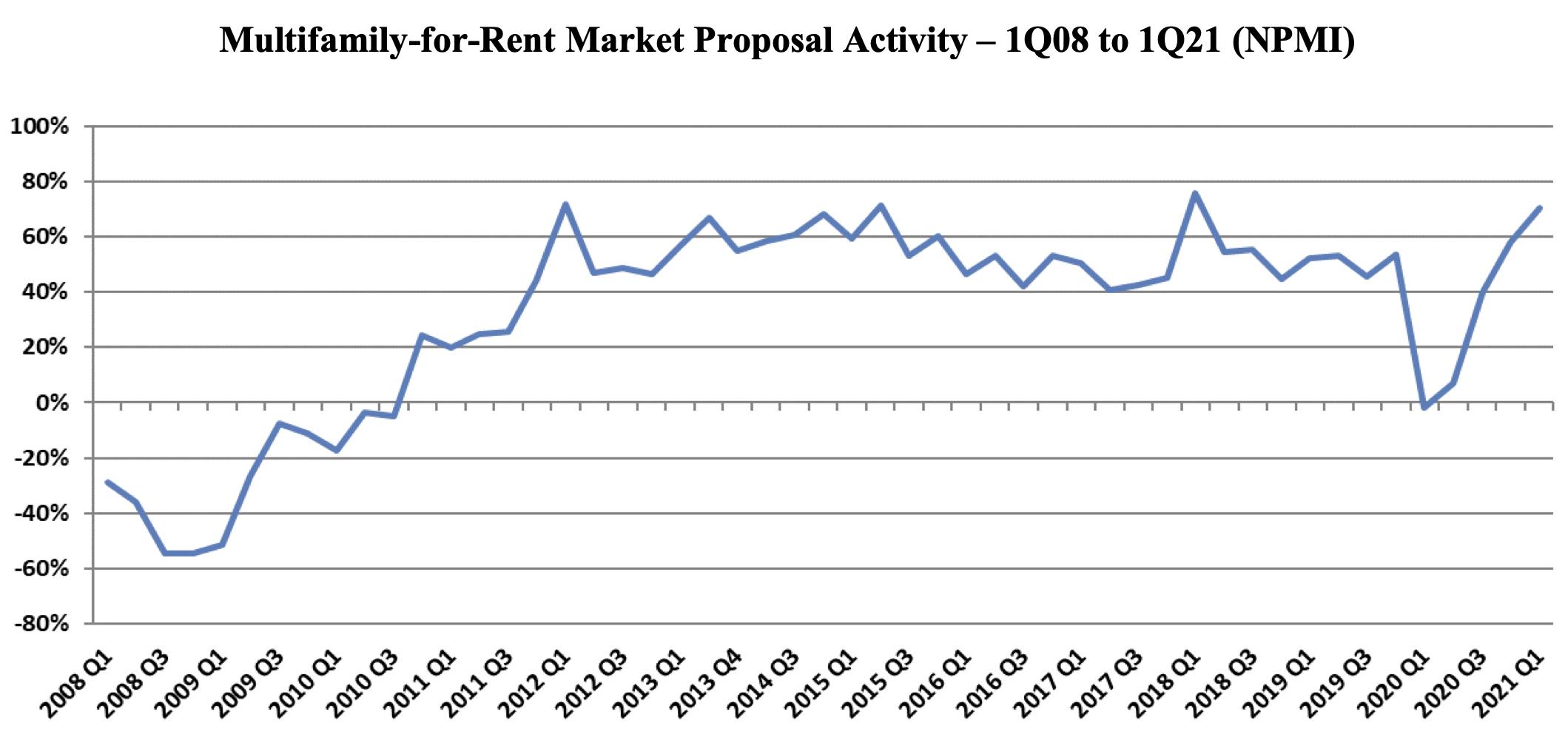

First-quarter proposal activity for multifamily housing added to prior quarter gains, reaching a near-record Net Plus/Minus Index (NPMI) of 71%. Multifamily topped the four other housing submarkets, though all performed well.

The first three months of the year saw housing lead all 12 major markets in the PSMJ Resources Quarterly Market Forecast survey of architecture, engineering, and construction (AEC) firms.

PSMJ’s NPMI expresses the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease. The QMF has proven to be a solid predictor of market health for the industry since its inception in 2003. A consistent group of over 300 AEC firm leaders participate regularly, with 183 contributing to the most recent survey.

Up 13 percentage points from the final quarter of 2020, multifamily’s NPMI of 71% tied its third-highest score since PSMJ added submarkets to its QMF survey in 2006. In addition to the record-high 76% in the 1st Quarter of 2018 and 72% in the 1st Quarter of 2012, Multifamily hit 71% in the 1st Quarter of 2015.

The 2021 performance marked a remarkable rebound for Multifamily, which dipped to -2% in the 1st Quarter of 2020, its first time in negative figures since 2010. In fact, before the COVID-driven drop a year ago, Multifamily’s NPMI had not fallen below 40% since the 3rd Quarter of 2011.

PSMJ Senior Principal David Burstein, PE, AECPM, noted that the strong performance of Multifamily and the entire Housing sector illustrates the industry’s overall economic health, as Housing growth often leads to activity in commercial, institutional and industrial markets as well. Should Congress pass an infrastructure stimulus bill, adds Burstein, the market could see even more historic growth.

Among respondents that work in the Multifamily sector, only 1% said that they saw a decrease in proposal opportunities in the 1st Quarter, compared with 72% that saw a noticeable increase. The remainder said that activity was about the same as the prior quarter.

The Assisted/Independent Senior Living submarket was another highflyer in the 1st Quarter, climbing 32 NPMI percentage points to 59%, tied for 12th -best among all submarkets. Condominiums bounced another 15 NPMI points to 30%, its best showing in three years.

The two other Housing markets measured in the PSMJ survey remain in rarefied air. The Housing Subdivision market recorded an NPMI of 68%, eclipsing its record-tying 4th -Quarter 2020 performance by 17 percentage points. Single-Family Homes dipped 8 NPMI percentage points to 51% – one of only 3 submarkets to see a decline – but that was still good enough for its second-best NPMI performance in the history of the QMF survey.

Related Stories

Student Housing | Jun 20, 2024

How student housing developments are evolving to meet new expectations

The days of uninspired dorm rooms with little more than a bed and a communal bathroom down the hall are long gone. Students increasingly seek inclusive design, communities to enhance learning and living, and a focus on wellness that encompasses everything from meditation spaces to mental health resources.

MFPRO+ News | Jun 20, 2024

National multifamily outlook: Summer 2024

The multifamily sector continues to be strong in 2024, even when a handful of challenges are present. That is according to the Matrix Multifamily National Report for Summer 2024.

Multifamily Housing | Jun 17, 2024

Elevating multifamily properties through quiet luxury

As the demands of urban living continue to evolve, the need for a tranquil and refined home environment has never been more pronounced.

Multifamily Housing | Jun 14, 2024

AEC inspections are the key to financially viable office to residential adaptive reuse projects

About a year ago our industry was abuzz with an idea that seemed like a one-shot miracle cure for both the shockingly high rate of office vacancies and the worsening housing shortage. The seemingly simple idea of converting empty office buildings to multifamily residential seemed like an easy and elegant solution. However, in the intervening months we’ve seen only a handful of these conversions, despite near universal enthusiasm for the concept.

Adaptive Reuse | Jun 13, 2024

4 ways to transform old buildings into modern assets

As cities grow, their office inventories remain largely stagnant. Yet despite changes to the market—including the impact of hybrid work—opportunities still exist. Enter: “Midlife Metamorphosis.”

Affordable Housing | Jun 12, 2024

Studio Libeskind designs 190 affordable housing apartments for seniors

In Brooklyn, New York, the recently opened Atrium at Sumner offers 132,418 sf of affordable housing for seniors. The $132 million project includes 190 apartments—132 of them available to senior households earning below or at 50% of the area median income and 57 units available to formerly homeless seniors.

MFPRO+ News | Jun 11, 2024

Rents rise in multifamily housing for May 2024

Multifamily rents rose for the fourth month in a row, according to the May 2024 National Multifamily Report. Up 0.6% year-over-year, the average U.S. asking rent increased by $6 in May, up to $1,733.

Apartments | Jun 4, 2024

Apartment sizes on the rise after decade-long shrinking trend

The average size of new apartments in the U.S. saw substantial growth in 2023, bouncing back to 916 sf after a steep decline the previous year. That is according to a recent RentCafe market insight report released this month.

Multifamily Housing | Jun 3, 2024

Grassroots groups becoming a force in housing advocacy

A growing movement of grassroots organizing to support new housing construction is having an impact in city halls across the country. Fed up with high housing costs and the commonly hostile reception to new housing proposals, advocacy groups have sprung up in many communities to attend public meetings to speak in support of developments.

MFPRO+ News | Jun 3, 2024

New York’s office to residential conversion program draws interest from 64 owners

New York City’s Office Conversion Accelerator Program has been contacted by the owners of 64 commercial buildings interested in converting their properties to residential use.