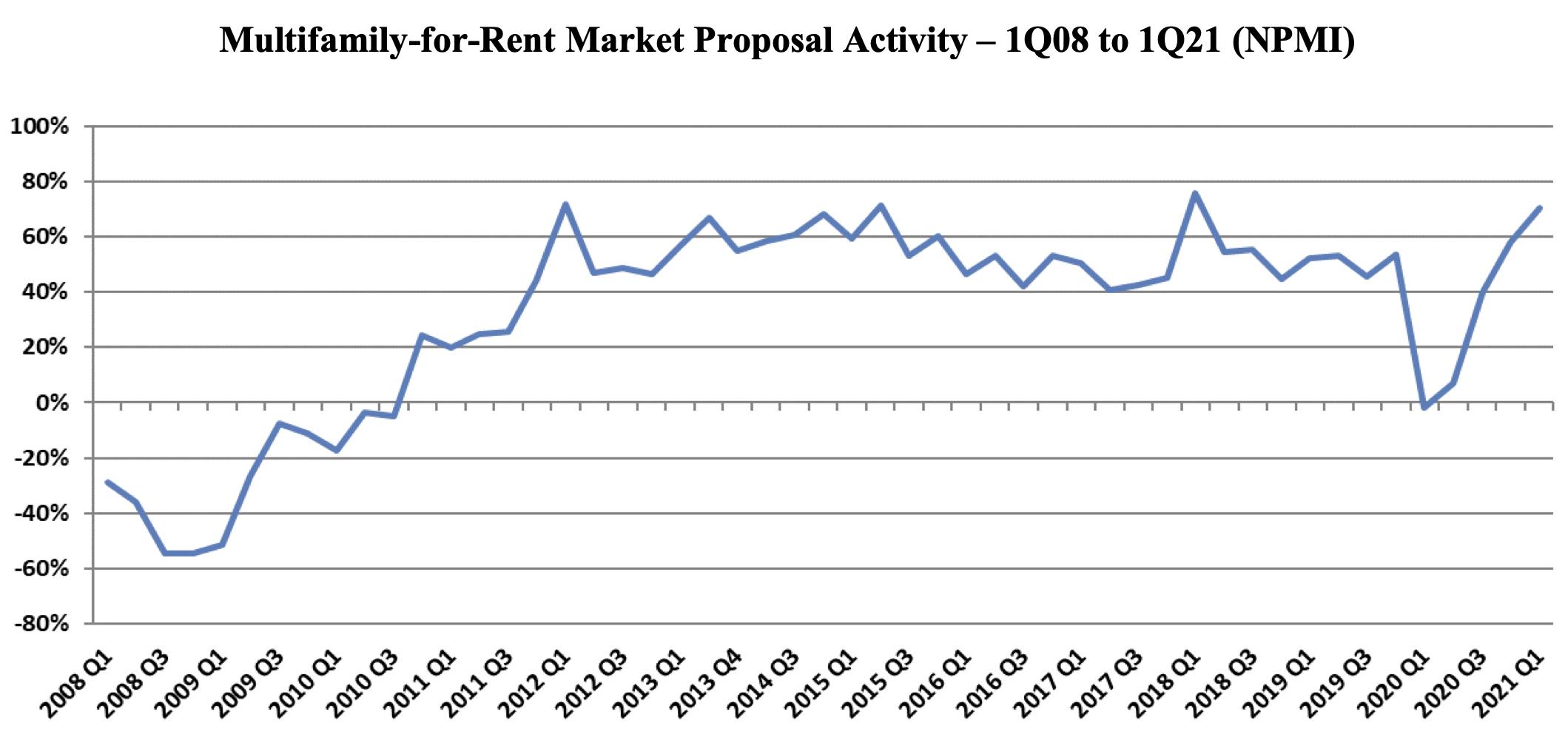

First-quarter proposal activity for multifamily housing added to prior quarter gains, reaching a near-record Net Plus/Minus Index (NPMI) of 71%. Multifamily topped the four other housing submarkets, though all performed well.

The first three months of the year saw housing lead all 12 major markets in the PSMJ Resources Quarterly Market Forecast survey of architecture, engineering, and construction (AEC) firms.

PSMJ’s NPMI expresses the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease. The QMF has proven to be a solid predictor of market health for the industry since its inception in 2003. A consistent group of over 300 AEC firm leaders participate regularly, with 183 contributing to the most recent survey.

Up 13 percentage points from the final quarter of 2020, multifamily’s NPMI of 71% tied its third-highest score since PSMJ added submarkets to its QMF survey in 2006. In addition to the record-high 76% in the 1st Quarter of 2018 and 72% in the 1st Quarter of 2012, Multifamily hit 71% in the 1st Quarter of 2015.

The 2021 performance marked a remarkable rebound for Multifamily, which dipped to -2% in the 1st Quarter of 2020, its first time in negative figures since 2010. In fact, before the COVID-driven drop a year ago, Multifamily’s NPMI had not fallen below 40% since the 3rd Quarter of 2011.

PSMJ Senior Principal David Burstein, PE, AECPM, noted that the strong performance of Multifamily and the entire Housing sector illustrates the industry’s overall economic health, as Housing growth often leads to activity in commercial, institutional and industrial markets as well. Should Congress pass an infrastructure stimulus bill, adds Burstein, the market could see even more historic growth.

Among respondents that work in the Multifamily sector, only 1% said that they saw a decrease in proposal opportunities in the 1st Quarter, compared with 72% that saw a noticeable increase. The remainder said that activity was about the same as the prior quarter.

The Assisted/Independent Senior Living submarket was another highflyer in the 1st Quarter, climbing 32 NPMI percentage points to 59%, tied for 12th -best among all submarkets. Condominiums bounced another 15 NPMI points to 30%, its best showing in three years.

The two other Housing markets measured in the PSMJ survey remain in rarefied air. The Housing Subdivision market recorded an NPMI of 68%, eclipsing its record-tying 4th -Quarter 2020 performance by 17 percentage points. Single-Family Homes dipped 8 NPMI percentage points to 51% – one of only 3 submarkets to see a decline – but that was still good enough for its second-best NPMI performance in the history of the QMF survey.

Related Stories

Mixed-Use | Oct 7, 2024

New mixed-use tower by Studio Gang completes first phase of San Francisco waterfront redevelopment

Construction was recently completed on Verde, a new mixed-use tower along the San Francisco waterfront, marking the end of the first phase of the Mission Rock development. Verde is the fourth and final building of phase one of the 28-acre project that will be constructed in several phases guided by design principles developed by a design cohort led by Studio Gang.

MFPRO+ News | Sep 24, 2024

Major Massachusetts housing law aims to build or save 65,000 multifamily and single-family homes

Massachusetts Gov. Maura Healey recently signed far-reaching legislation to boost housing production and address the high cost of housing in the Bay State. The Affordable Homes Act aims to build or save 65,000 homes through $5.1 billion in spending and 49 policy initiatives.

MFPRO+ News | Sep 23, 2024

Minnesota bans cannabis smoking and vaping in multifamily housing units

Minnesota recently enacted a first-in-the-nation statewide ban on smoking and vaping cannabis in multifamily properties including in individual living units. The law has an exemption for those using marijuana for medical purposes.

The Changing Built Environment | Sep 23, 2024

Half-century real estate data shows top cities for multifamily housing, self-storage, and more

Research platform StorageCafe has conducted an analysis of U.S. real estate activity from 1980 to 2023, focusing on six major sectors: single-family, multifamily, industrial, office, retail, and self-storage.

Mixed-Use | Sep 19, 2024

A Toronto development will transform a 32-acre shopping center site into a mixed-use urban neighborhood

Toronto developers Mattamy Homes and QuadReal Property Group have launched The Clove, the first phase in the Cloverdale, a $6 billion multi-tower development. The project will transform Cloverdale Mall, a 32-acre shopping center in Toronto, into a mixed-use urban neighborhood.

Codes and Standards | Sep 17, 2024

New California building code encourages, but does not mandate heat pumps

New California homes are more likely to have all-electric appliances starting in 2026 after the state’s energy regulators approved new state building standards. The new building code will encourage installation of heat pumps without actually banning gas heating.

Adaptive Reuse | Sep 12, 2024

White paper on office-to-residential conversions released by IAPMO

IAPMO has published a new white paper titled “Adaptive Reuse: Converting Offices to Multi-Residential Family,” a comprehensive analysis of addressing housing shortages through the conversion of office spaces into residential units.

MFPRO+ Research | Sep 11, 2024

Multifamily rents fall for first time in 6 months

Ending its six-month streak of growth, the average advertised multifamily rent fell by $1 in August 2024 to $1,741.

Legislation | Sep 9, 2024

Efforts to encourage more housing projects on California coast stall

A movement to encourage more housing projects along the California coast has stalled out in the California legislature. Earlier this year, lawmakers, with the backing of some housing activists, introduced a series of bills aimed at making it easier to build apartments and accessory dwelling units along California’s highly regulated coast.

MFPRO+ New Projects | Sep 5, 2024

Chicago's Coppia luxury multifamily high-rise features geometric figures on the façade

Coppia, a new high-rise luxury multifamily property in Chicago, features a distinctive façade with geometric features and resort-style amenities. The 19-story, 315,000-sf building has more than 24,000 sf of amenity space designed to extend resident’s living spaces. These areas offer places to work, socialize, exercise, and unwind.