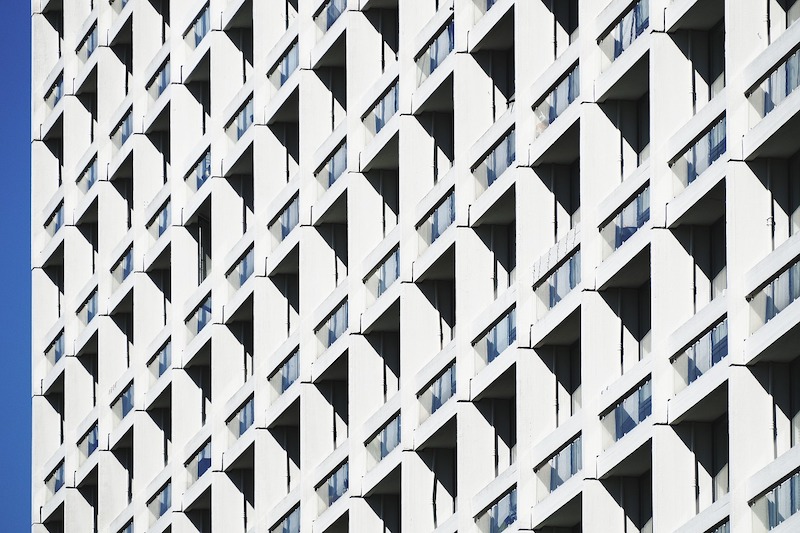

After more than nine consecutive years of steady growth, proposal activity in the U.S. Multifamily Housing market flattened in the 1st Quarter amid the COVID-19 crisis. The Quarterly Market Forecast (QMF) survey of architecture, engineering and construction (A/E/C) firms reported the first negative result for Multifamily since the 3rd Quarter of 2010.

Multifamily has consistently been one of the strongest performers among 58 submarkets measured in PSMJ Resources’ quarterly survey. This includes the 4th Quarter of 2019 when Multifamily’s Net Plus/Minus Index (NPMI) of 54% was the highest among all submarkets. Its NPMI slid to -2% in the 1st Quarter of 2020, as the percentage of respondents reporting a quarter-to-quarter decrease in proposal activity climbed from 4% to 31%.

PSMJ’s NPMI expresses the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease over the three-month period. A consistent group of over 300 A/E/C firm leaders participate regularly, with 288 contributing to the most recent survey. It was conducted from March 24-30.

Despite the drop into the negative, Multifamily held up far better than three other Housing submarkets – Single-Family Properties (-31%), Single-Family Developments (-28%) and Condominiums (-28%) were among the 12 poorest-performing submarkets in the 1st Quarter.

Prior to this crisis, the consensus among industry economists and experts was that Multifamily would stay strong in 2020, albeit with some challenges to face. National vacancy rates were creeping up and much of the supply deficit had been filled. Nonetheless, significant amounts of investment money remained available and demand persisted in varying levels regionally. The fact that Multifamily proposal activity wasn’t as negatively impacted in the 1st Quarter as other Housing submarkets were, even with the COVID-19 crisis beginning to affect the market in March, suggests that it could recover comparatively quickly and seamlessly when and where restrictions are eased.

PSMJ Senior Principal David Burstein, P.E., AECPM, said he expects all housing markets to rebound after the health crisis passes and the record-low interest rates endure. “Pent up demand should make its presence felt by the end of the 3rd Quarter, and even more so in the 4th Quarter, especially if we see movement on an infrastructure bill.”

Multifamily’s performance in the QMF reinforces how consistently lucrative the sector has been for nearly a decade. After recording an NPMI of -5% in the 3rd Quarter of 2010, the Multifamily submarket experienced four consecutive quarters with a respectable NPMI between 20% and 26%. It jumped to a healthy 44% in the 4th Quarter of 2012 and remained at or above 42% for the next 28 quarters, all the way through 2019.

For the 4th Quarter of 2019, 58% of respondents said that proposal opportunities had increased in the Multifamily market, with only 4% reporting a decrease. For the 1st Quarter of 2020, increases were halved to 29%, compared with 31% that saw a drop in proposal activity.

Consulting and publishing firm PSMJ Resources, Inc., has been conducting the QMF survey each quarter since 2003. You can find more information at https://www.psmj.com/surveys/quarterly-market-forecast-2.

Related Stories

Multifamily Housing | Feb 23, 2021

Rising costs push developers to consider modular construction

The mainstreaming of modular construction offers a cost-effective and creative solution to develop new types of urban developments.

Multifamily Housing | Feb 21, 2021

Multifamily Amenities Survey 2021: Early results show COVID-19 impact on apartment amenities

Survey of multifamily developers, owners, architects, and contractors shows many adjusting their amenities to deal with the impact of the pandemic on property occupiers.

Multifamily Housing | Feb 19, 2021

Former motorcycle factory converted into affordable housing

The Architectural Team designed the project.

Multifamily Housing | Feb 12, 2021

Benefits of a factory-installed ceiling radiation damper explained

Greenheck applications engineer Craig Kulski explains the benefits of a factory-installed ceiling radiation damper.

Multifamily Housing | Feb 10, 2021

The Weekly show, Feb 11, 2021: Advances in fire protection engineering, and installing EV ports in multifamily housing

This week on The Weekly show, BD+C editors speak with AEC industry leaders from Bozzuto Management Company and Goldman Copeland about advice on installing EV ports in multifamily housing, and advances in fire protection engineering.

Multifamily Housing | Feb 10, 2021

10 significant multifamily developments to open in late 2020 and early 2021

Seattle's new twisting condo tower and Rem Koolhaas's first residential building are among 10 notable multifamily housing projects to debut in late 2020 and early 2021.

Multifamily Housing | Feb 8, 2021

Vista Railing Systems expands its senior management team

Chris Dooley and Tom Killy join Vista Railings, the British Columbia manufacturer of commercial/multifamily railings.

Multifamily Housing | Feb 8, 2021

Veterans Village supplies 51 units of supportive housing for U.S. military veterans in Carson, Calif.

Withee Malcolm Architects designed the supportive housing community for developer Thomas Safran & Associates.

Multifamily Housing | Feb 2, 2021

Tahanan supportive housing development brings 145 apartments to San Francisco

David Baker Architects designed the project.

AEC Tech | Jan 28, 2021

The Weekly show, Jan 28, 2021: Generative design tools for feasibility studies, and landscape design trends in the built environment

This week on The Weekly show, BD+C editors speak with AEC industry leaders from Studio-MLA and TestFit about landscape design trends in the built environment, and how AEC teams and real estate developers can improve real estate feasibility studies with real-time generative design.