Recently, millennials have supplanted Baby Boomers as the largest generation on the planet. With such a huge number of people, many of who are 20-somethings beginning to get a little spending power, you better believe companies are doing everything they can to try and crack the enigma that is the millennial buyer and figure out what they value most (beyond ironic t-shirts, protesting, and coffee shops).

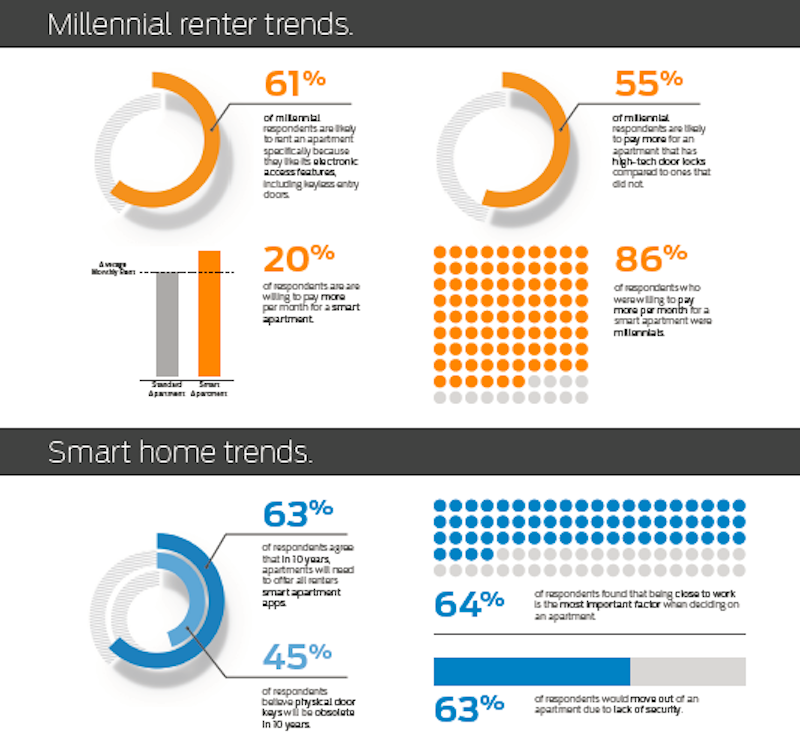

Perhaps unsurprisingly, when it comes to a place to live, what millennials value most is technology. A recent survey from Wakefield Research and Schlage of 1,000 U.S. renters in multifamily dwellings revealed that 86% of millennial renters who live in multifamily dwellings would pay higher rent for a “smart” apartment. For comparison, only 65% of Baby Boomers would pay more for an apartment packed with automated or remote-controlled devices.

The survey also found that over 61% of millennial renters would rent an apartment specifically for electronic access features, such as keyless entry doors, and 55% would pay more for an apartment with high-tech door locks compared to traditional door locks. Another 44% of Millennials said they would sacrifice having a parking spot if it meant they could live in a high-tech apartment. Overall, millennials would pay about one-fifth more for smart home features than other generations.

It isn’t just technology millennial renters are after, however. Convenience and security are also important. 63% of millennial respondents said they would move out of an apartment because of poor security. Additionally, 64% of millennials feel it is more important for an apartment to be closer to work than friends and family.

At least according to this survey, the average millennial renter is more concerned with technology and convenience than anything else in an apartment, and are willing to pay for the things they desire.

The Schlage survey was conducted in October 2016 via email and an online survey.

Related Stories

Market Data | May 2, 2017

Nonresidential Spending loses steam after strong start to year

Spending in the segment totaled $708.6 billion on a seasonally adjusted, annualized basis.

Market Data | May 1, 2017

Nonresidential Fixed Investment surges despite sluggish economic in first quarter

Real gross domestic product (GDP) expanded 0.7 percent on a seasonally adjusted annualized rate during the first three months of the year.

Industry Research | Apr 28, 2017

A/E Industry lacks planning, but still spending large on hiring

The average 200-person A/E Firm is spending $200,000 on hiring, and not budgeting at all.

Architects | Apr 27, 2017

Number of U.S. architects holds steady, while professional mobility increases

New data from NCARB reveals that while the number of architects remains consistent, practitioners are looking to get licensed in multiple states.

Market Data | Apr 6, 2017

Architecture marketing: 5 tools to measure success

We’ve identified five architecture marketing tools that will help your firm evaluate if it’s on the track to more leads, higher growth, and broader brand visibility.

Market Data | Apr 3, 2017

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.

Market Data | Mar 29, 2017

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Industry Research | Mar 24, 2017

The business costs and benefits of restroom maintenance

Businesses that have pleasant, well-maintained restrooms can turn into customer magnets.

Industry Research | Mar 22, 2017

Progress on addressing US infrastructure gap likely to be slow despite calls to action

Due to a lack of bipartisan agreement over funding mechanisms, as well as regulatory hurdles and practical constraints, Moody’s expects additional spending to be modest in 2017 and 2018.

Industry Research | Mar 21, 2017

Staff recruitment and retention is main concern among respondents of State of Senior Living 2017 survey

The survey asks respondents to share their expertise and insights on Baby Boomer expectations, healthcare reform, staff recruitment and retention, for-profit competitive growth, and the needs of middle-income residents.