Recently, millennials have supplanted Baby Boomers as the largest generation on the planet. With such a huge number of people, many of who are 20-somethings beginning to get a little spending power, you better believe companies are doing everything they can to try and crack the enigma that is the millennial buyer and figure out what they value most (beyond ironic t-shirts, protesting, and coffee shops).

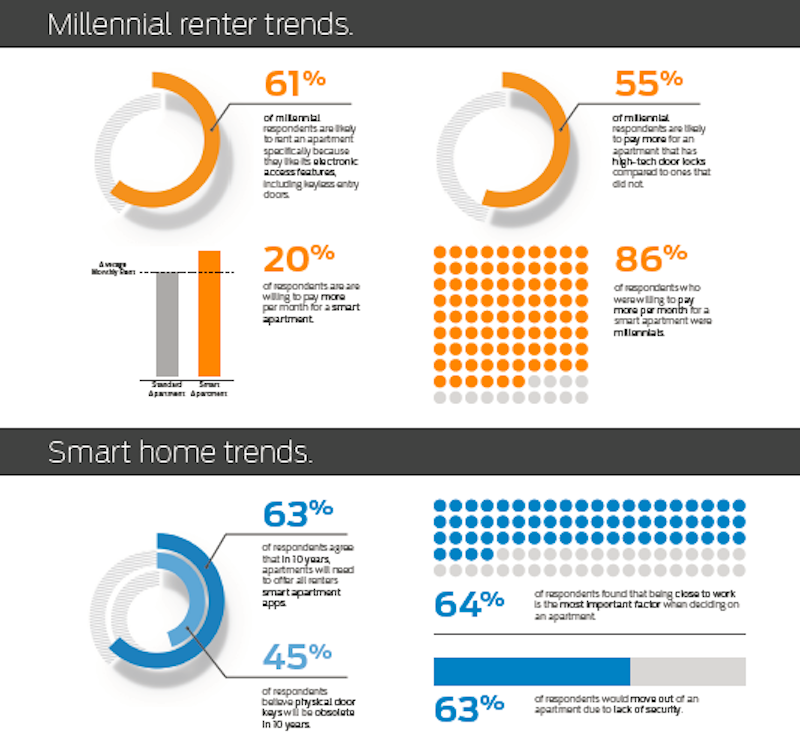

Perhaps unsurprisingly, when it comes to a place to live, what millennials value most is technology. A recent survey from Wakefield Research and Schlage of 1,000 U.S. renters in multifamily dwellings revealed that 86% of millennial renters who live in multifamily dwellings would pay higher rent for a “smart” apartment. For comparison, only 65% of Baby Boomers would pay more for an apartment packed with automated or remote-controlled devices.

The survey also found that over 61% of millennial renters would rent an apartment specifically for electronic access features, such as keyless entry doors, and 55% would pay more for an apartment with high-tech door locks compared to traditional door locks. Another 44% of Millennials said they would sacrifice having a parking spot if it meant they could live in a high-tech apartment. Overall, millennials would pay about one-fifth more for smart home features than other generations.

It isn’t just technology millennial renters are after, however. Convenience and security are also important. 63% of millennial respondents said they would move out of an apartment because of poor security. Additionally, 64% of millennials feel it is more important for an apartment to be closer to work than friends and family.

At least according to this survey, the average millennial renter is more concerned with technology and convenience than anything else in an apartment, and are willing to pay for the things they desire.

The Schlage survey was conducted in October 2016 via email and an online survey.

Related Stories

Market Data | Jun 21, 2017

Design billings maintain solid footing, strong momentum reflected in project inquiries/design contracts

Balanced growth results in billings gains in all sectors.

Industry Research | Jun 15, 2017

Commercial Construction Index indicates high revenue and employment expectations for 2017

USG Corporation (USG) and U.S. Chamber of Commerce release survey results gauging confidence among industry leaders.

Industry Research | Jun 13, 2017

Gender, racial, and ethnic diversity increases among emerging professionals

For the first time since NCARB began collecting demographics data, gender equity improved along every career stage.

Industry Research | May 25, 2017

Project labor agreement mandates inflate cost of construction 13%

Ohio schools built under government-mandated project labor agreements (PLAs) cost 13.12 percent more than schools that were bid and constructed through fair and open competition.

Market Data | May 24, 2017

Design billings increasing entering height of construction season

All regions report positive business conditions.

Market Data | May 24, 2017

The top franchise companies in the construction pipeline

3 franchise companies comprise 65% of all rooms in the Total Pipeline.

Industry Research | May 24, 2017

These buildings paid the highest property taxes in 2016

Office buildings dominate the list, but a residential community climbed as high as number two on the list.

Market Data | May 16, 2017

Construction firms add 5,000 jobs in April

Unemployment down to 4.4%; Specialty trade jobs dip slightly.

Industry Research | May 4, 2017

How your AEC firm can go from the shortlist to winning new business

Here are four key lessons to help you close more business.

Engineers | May 3, 2017

At first buoyed by Trump election, U.S. engineers now less optimistic about markets, new survey shows

The first quarter 2017 (Q1/17) of ACEC’s Engineering Business Index (EBI) dipped slightly (0.5 points) to 66.0.