Recently, millennials have supplanted Baby Boomers as the largest generation on the planet. With such a huge number of people, many of who are 20-somethings beginning to get a little spending power, you better believe companies are doing everything they can to try and crack the enigma that is the millennial buyer and figure out what they value most (beyond ironic t-shirts, protesting, and coffee shops).

Perhaps unsurprisingly, when it comes to a place to live, what millennials value most is technology. A recent survey from Wakefield Research and Schlage of 1,000 U.S. renters in multifamily dwellings revealed that 86% of millennial renters who live in multifamily dwellings would pay higher rent for a “smart” apartment. For comparison, only 65% of Baby Boomers would pay more for an apartment packed with automated or remote-controlled devices.

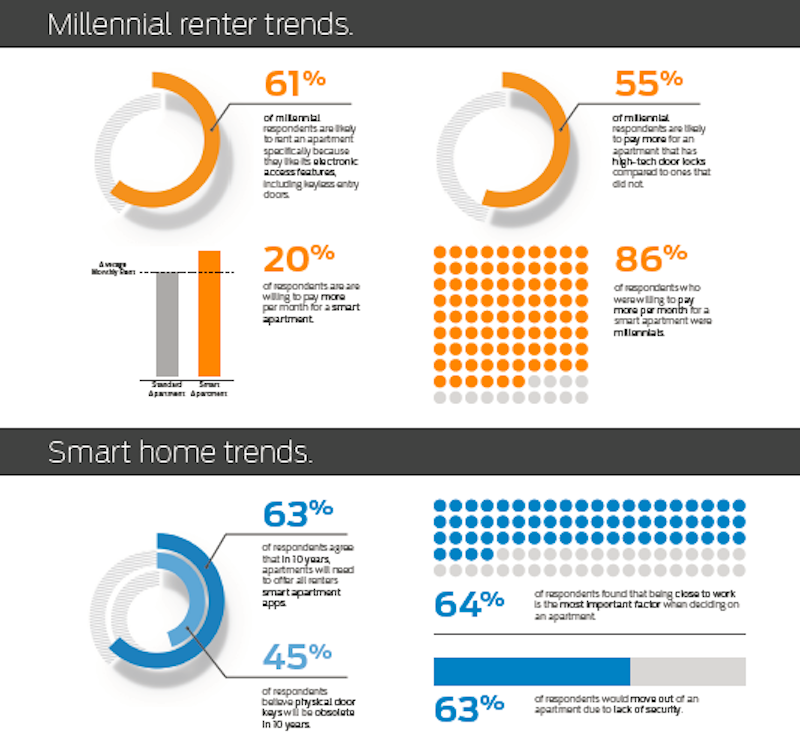

The survey also found that over 61% of millennial renters would rent an apartment specifically for electronic access features, such as keyless entry doors, and 55% would pay more for an apartment with high-tech door locks compared to traditional door locks. Another 44% of Millennials said they would sacrifice having a parking spot if it meant they could live in a high-tech apartment. Overall, millennials would pay about one-fifth more for smart home features than other generations.

It isn’t just technology millennial renters are after, however. Convenience and security are also important. 63% of millennial respondents said they would move out of an apartment because of poor security. Additionally, 64% of millennials feel it is more important for an apartment to be closer to work than friends and family.

At least according to this survey, the average millennial renter is more concerned with technology and convenience than anything else in an apartment, and are willing to pay for the things they desire.

The Schlage survey was conducted in October 2016 via email and an online survey.

Related Stories

Market Data | Jan 25, 2018

Renters are the majority in 42 U.S. cities

Over the past 10 years, the number of renters has increased by 23 million.

Market Data | Jan 12, 2018

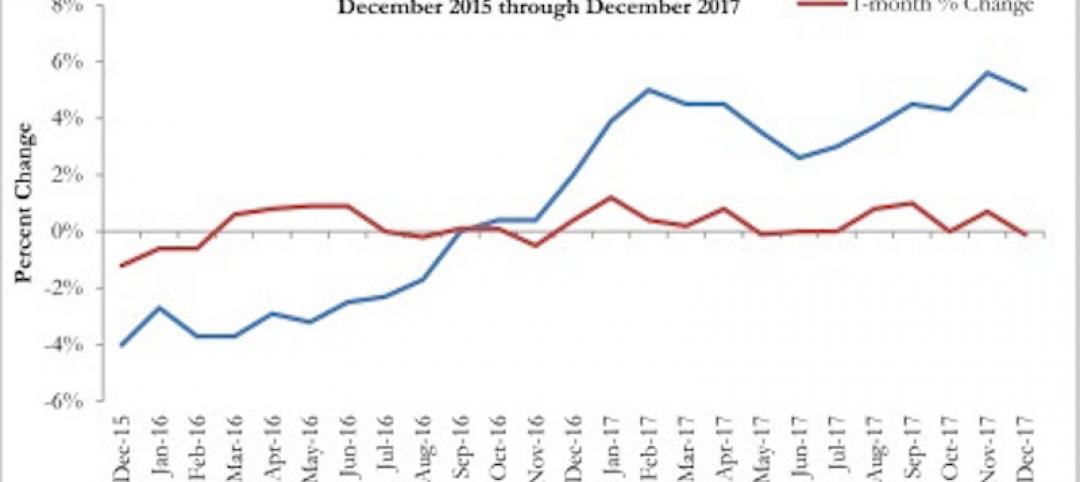

Construction input prices inch down in December, Up YOY despite low inflation

Energy prices have been more volatile lately.

Market Data | Jan 4, 2018

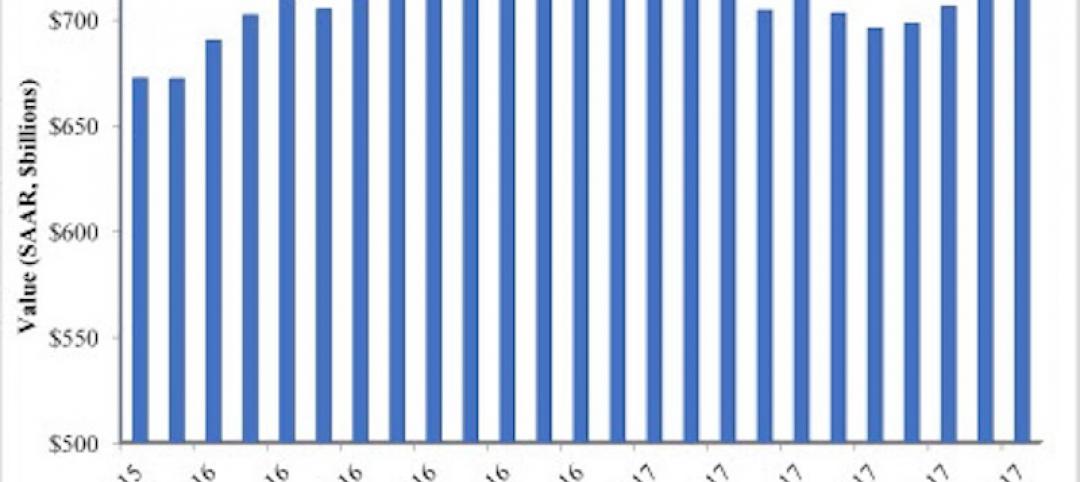

Nonresidential construction spending ticks higher in November, down year-over-year

Despite the month-over-month expansion, nonresidential spending fell 1.3 percent from November 2016.

Market Data | Dec 14, 2017

ABC chief economist predicts stable 2018 construction economy

There are risks to the 2018 outlook as a number of potential cost increases could come into play.

Market Data | Dec 11, 2017

Global hotel construction pipeline is growing

The Total Pipeline stands at 12,427 Projects/2,084,940 Rooms.

Market Data | Dec 11, 2017

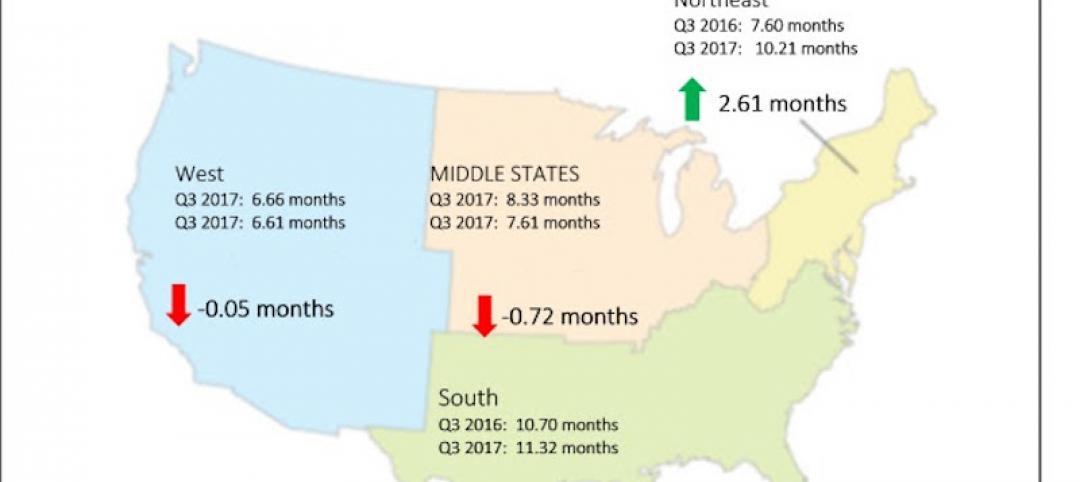

Construction backlog surges, sets record in third quarter

CBI is a leading economic indicator that reflects the amount of construction work under contract, but not yet completed.

Market Data | Dec 7, 2017

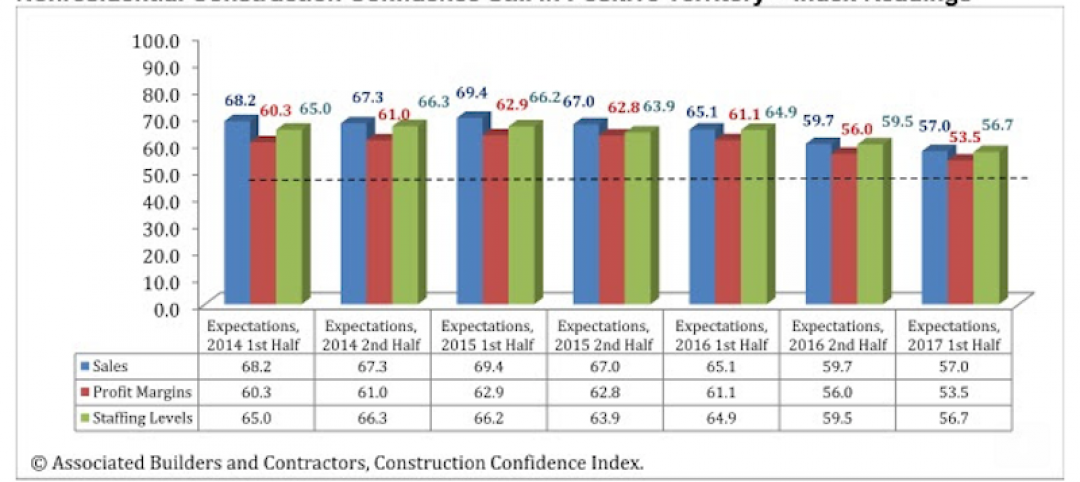

Buoyed by healthy economy, ABC Index finds contractors upbeat

Despite rising construction labor and materials costs, 55% of contractors expect their profit margins to expand in the first half of 2018.

Industry Research | Nov 28, 2017

2018 outlook: Economists point to slowdown, AEC professionals say ‘no way’

Multifamily housing and senior living developments head the list of the hottest sectors heading into 2018, according a survey of 356 AEC professionals.

Architects | Nov 28, 2017

Adding value through integrated technology requires a human touch

To help strike that delicate balance between the human and the high-tech, we must first have an in-depth understanding of our client’s needs as well as a manufacturer’s capabilities.

Market Data | Nov 27, 2017

Construction's contribution to U.S. economy highest in seven years

Thirty-seven states benefited from the rise in construction activity in their state, while 13 states experienced a reduction in activity.