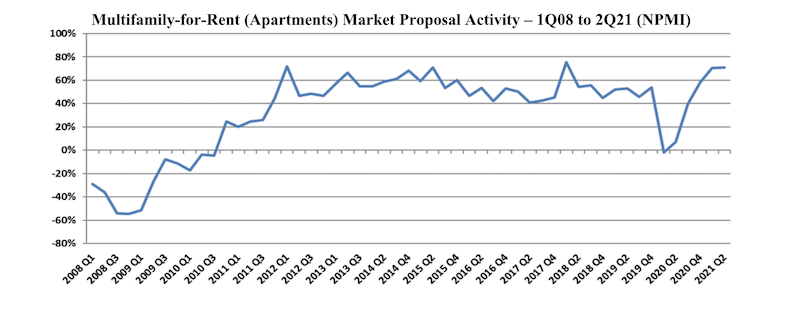

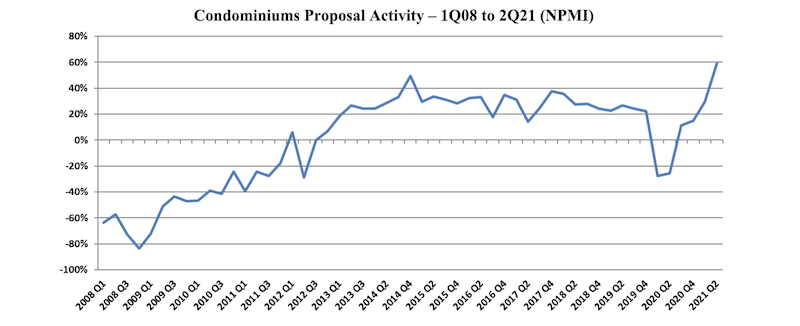

Proposal activity for Multifamily-for-Rent (Apartments) and Condominium properties continued to exceed historic norms, with Condos achieving its highest level since PSMJ Resources began tracking submarkets in its Quarterly Market Forecast (QMF) of A/E/C firm leaders. Apartments, which recorded its third-highest NPMI of 71% in the 1st Quarter, repeated that score in the 2nd Quarter.

While 61% of respondents working in the Condo market reported an increase in proposal activity from the 1st Quarter to the 2nd Quarter, only 2% saw a decline. This net plus/minus index (NPMI) of 59% exceeded the previous high for Condos of 49% achieved in the 4th Quarter of 2014.

Second-quarter proposal activity for Apartments continued to outpace all other submarkets in the Housing sector and all but one (Product Manufacturing) of the 58 submarkets measured across all construction sectors. A full three-quarters of the A/E/C firm leaders responding to PSMJ’s quarterly survey said that Multifamily proposal opportunities grew in the 2nd Quarter compared with only 4% who reported a decline.

The NPMI expresses the difference between the percentage of PSMJ member firms reporting an increase in proposal activity and those reporting a decrease. The QMF has proven to be a solid predictor of market health for 12 major markets served by the A/E/C industry since its inception in 2003, and for 58 submarkets since 2006.

The record-high NPMI for Apartments was 76% in the 1st Quarter of 2018, followed by 72% in the 1st Quarter of 2012 and 71% in the 1st Quarters of 2015 and 2021.

PSMJ Senior Principal David Burstein, PE, AECPM, says the future strength of the housing market relies heavily on the ability of state and federal government agencies to invest adequately in infrastructure. “The condo and apartment markets have been on fire for several years, resulting in a lot of new multifamily housing,” says Burstein. “This is now creating traffic and other congestion problems which, if not dealt with by the cognizant government agencies, may cause the multifamily market to slow down in the coming quarters. So it is important to continue tracking the PSMJ NPMI over the next few quarters to spot any emerging slowdowns.”

The Assisted/Independent Senior Living submarket leveled off to an NPMI of 49%, down 10 NPMI percentage points from the 1st Quarter. While 51% of respondents reported an increase in proposal activity, only 2% saw a drop and the remaining 47% said opportunities were flat.

The two other Housing submarkets measured in the PSMJ survey remained strong. The Housing Subdivision market recorded an NPMI of 68% for a second straight month, as not a single respondent in the 2nd Quarter survey reported a decline in proposal opportunities. Single-Family Homes also repeated its 1st Quarter NPMI; the 51% index score once again tied for its second-highest level since the inception of submarket data tracking in the QMF.

PSMJ Resources, a consulting and publishing company dedicated to the A/E/C industry, has conducted its Quarterly Market Forecast for more than 18 years. It includes data on 12 major markets and 58 submarkets served by A/E/C firms. For more information, go to https://www.psmj.com/surveys/quarterly-market-forecast-2.

Related Stories

Market Data | Oct 5, 2020

Construction spending rises 1.4% in August as residential boom outweighs private nonresidential decline and flat public categories

Construction officials caution that demand for non-residential construction will continue to stagnate without new federal coronavirus recovery measures, including infrastructure and liability reform.

Market Data | Oct 5, 2020

7 must reads for the AEC industry today: October 5, 2020

Zaha Hadid unveils 2 Murray Road and the AEC industry is weathering COVID-19 better than most.

Market Data | Oct 2, 2020

AEC industry is weathering COVID-19 better than most

Nearly one-third of firms have had layoffs, more than 90% have experienced project delays.

Market Data | Oct 2, 2020

6 must reads for the AEC industry today: October 2, 2020

BIG imagines how to live on the moon and smart buildings stand on good data.

Market Data | Oct 1, 2020

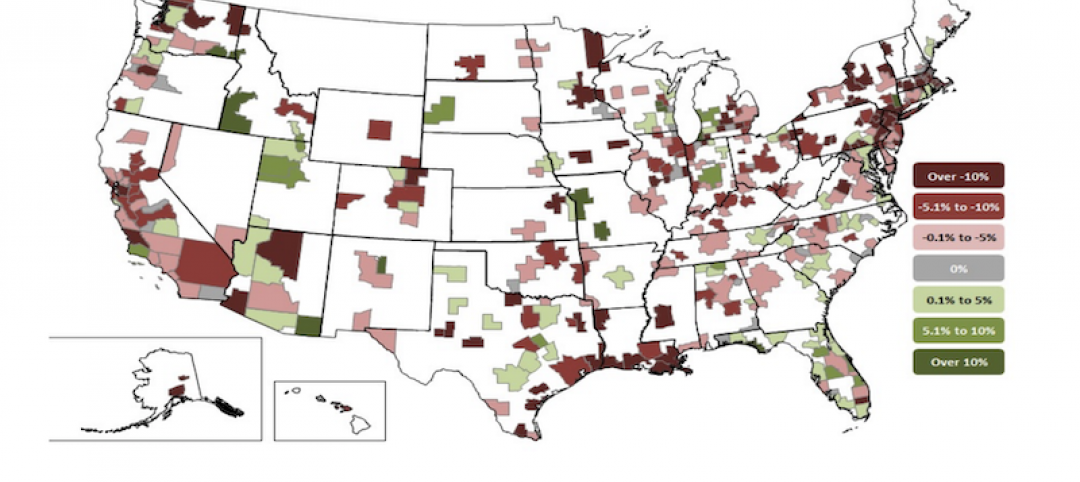

Two-thirds of metros shed construction jobs from August 2019 to August 2020

Houston-The Woodlands-Sugar Land and Brockton-Bridgewater-Easton, Mass. have worst 12-month losses, while Indianapolis-Carmel-Anderson, Ind. and Niles-Benton Harbor, Mich. top job gainers.

Market Data | Oct 1, 2020

6 must reads for the AEC industry today: October 1, 2020

David Adjaye to receive 2021 Royal Gold Medal for Architecture and SOM reimagines the former Cook County Hospital.

Market Data | Sep 30, 2020

6 must reads for the AEC industry today: September 30, 2020

Heatherwick Studio designs The Cove for San Francisco and Washington, D.C.'s first modular apartment building.

Market Data | Sep 29, 2020

6 must reads for the AEC industry today: September 29, 2020

Renovation to Providence's downtown library is completed and Amazon to build 1,500 new last-mile warehouses.

Market Data | Sep 25, 2020

5 must reads for the AEC industry today: September 25, 2020

AIA releases latest 2030 Commitment results and news delivery robots could generate trillions for U.S. economy.

Market Data | Sep 24, 2020

6 must reads for the AEC industry today: September 24, 2020

SOM's new waterfront neighborhood and a portable restroom designed for mobility.