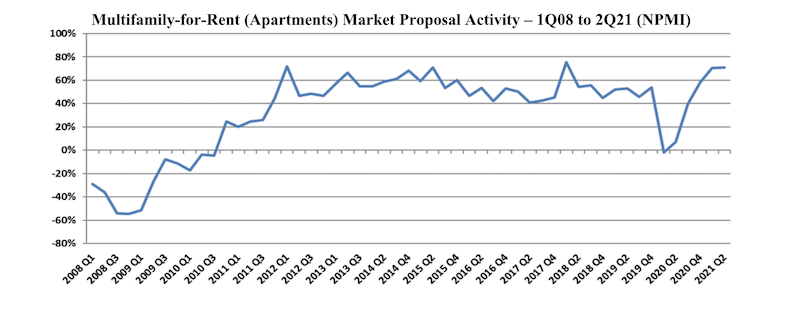

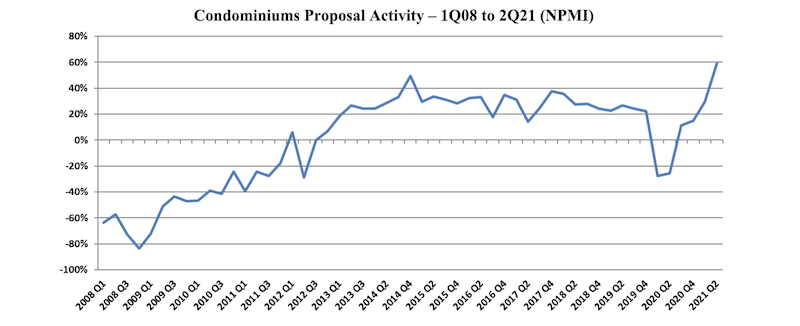

Proposal activity for Multifamily-for-Rent (Apartments) and Condominium properties continued to exceed historic norms, with Condos achieving its highest level since PSMJ Resources began tracking submarkets in its Quarterly Market Forecast (QMF) of A/E/C firm leaders. Apartments, which recorded its third-highest NPMI of 71% in the 1st Quarter, repeated that score in the 2nd Quarter.

While 61% of respondents working in the Condo market reported an increase in proposal activity from the 1st Quarter to the 2nd Quarter, only 2% saw a decline. This net plus/minus index (NPMI) of 59% exceeded the previous high for Condos of 49% achieved in the 4th Quarter of 2014.

Second-quarter proposal activity for Apartments continued to outpace all other submarkets in the Housing sector and all but one (Product Manufacturing) of the 58 submarkets measured across all construction sectors. A full three-quarters of the A/E/C firm leaders responding to PSMJ’s quarterly survey said that Multifamily proposal opportunities grew in the 2nd Quarter compared with only 4% who reported a decline.

The NPMI expresses the difference between the percentage of PSMJ member firms reporting an increase in proposal activity and those reporting a decrease. The QMF has proven to be a solid predictor of market health for 12 major markets served by the A/E/C industry since its inception in 2003, and for 58 submarkets since 2006.

The record-high NPMI for Apartments was 76% in the 1st Quarter of 2018, followed by 72% in the 1st Quarter of 2012 and 71% in the 1st Quarters of 2015 and 2021.

PSMJ Senior Principal David Burstein, PE, AECPM, says the future strength of the housing market relies heavily on the ability of state and federal government agencies to invest adequately in infrastructure. “The condo and apartment markets have been on fire for several years, resulting in a lot of new multifamily housing,” says Burstein. “This is now creating traffic and other congestion problems which, if not dealt with by the cognizant government agencies, may cause the multifamily market to slow down in the coming quarters. So it is important to continue tracking the PSMJ NPMI over the next few quarters to spot any emerging slowdowns.”

The Assisted/Independent Senior Living submarket leveled off to an NPMI of 49%, down 10 NPMI percentage points from the 1st Quarter. While 51% of respondents reported an increase in proposal activity, only 2% saw a drop and the remaining 47% said opportunities were flat.

The two other Housing submarkets measured in the PSMJ survey remained strong. The Housing Subdivision market recorded an NPMI of 68% for a second straight month, as not a single respondent in the 2nd Quarter survey reported a decline in proposal opportunities. Single-Family Homes also repeated its 1st Quarter NPMI; the 51% index score once again tied for its second-highest level since the inception of submarket data tracking in the QMF.

PSMJ Resources, a consulting and publishing company dedicated to the A/E/C industry, has conducted its Quarterly Market Forecast for more than 18 years. It includes data on 12 major markets and 58 submarkets served by A/E/C firms. For more information, go to https://www.psmj.com/surveys/quarterly-market-forecast-2.

Related Stories

Market Data | Sep 23, 2020

Architectural billings in August still show little sign of improvement

The pace of decline during August remained at about the same level as in July and June.

Market Data | Sep 23, 2020

7 must reads for the AEC industry today: September 23, 2020

The new Theodore Presidential Library and the AIA/HUD's Secretary's Awards honor affordable, accessible housing.

Market Data | Sep 22, 2020

6 must reads for the AEC industry today: September 22, 2020

Construction employment declined in 39 states and no ease of lumber prices in sight.

Market Data | Sep 21, 2020

Washington is the US state with the most value of construction projects underway, says GlobalData

Of the top 10 largest projects in the Washington state, nine were in the execution stage as of August 2020.

Market Data | Sep 21, 2020

Construction employment declined in 39 states between August 2019 and 2020

31 states and DC added jobs between July and August.

Market Data | Sep 21, 2020

6 must reads for the AEC industry today: September 21, 2020

Four projects receive 202 AIA/ALA Library Building Award and Port San Antonio's new Innovation Center.

Market Data | Sep 18, 2020

Follow up survey of U.S. code officials demonstrates importance of continued investment in virtual capabilities

Existing needs highlight why supporting building and fire prevention departments at the federal, state, and local levels is critical.

Market Data | Sep 18, 2020

6 must reads for the AEC industry today: September 18, 2020

Sagrada Familia completion date pushed back and energy code appeals could hamper efficiency progress.

Market Data | Sep 17, 2020

6 must reads for the AEC industry today: September 17, 2020

Foster + Partners-designed hospital begins construction in Cairo and heat pumps are the future for hot water.

Market Data | Sep 16, 2020

6 must reads for the AEC industry today: September 16, 2020

REI sells unused HQ building and Adjaye Associates will design The Africa Institute.