A new survey by the Associated General Contractors of America and data from construction technology firm Procore show that construction activity is returning to pre-coronavirus levels in many parts of the country and some firms are adding workers. The new economic data, however, also shows some future projects are being canceled and many others are being delayed by supply chain issues and labor shortages, underscoring the need for additional federal recovery measures, association officials noted.

“Many of the immediate economic impacts of the coronavirus have passed and, as a result, activity and hiring are up, a bit,” said Ken Simonson, the association’s chief economist. “But while the immediate crisis appears to have passed, we are just now beginning to appreciate some of the longer-term impacts of the pandemic on the industry.”

Construction activity has returned to pre-coronavirus levels in 34 states, based on data on workers’ hours analyzed by Procore. And construction has returned to pre-coronavirus levels in Dallas and Miami, according to Procore’s data on 8 large metro areas. Meanwhile, the association’s survey found that only 8% of construction firms were forced to furlough or lay off workers in June while 21% report adding employees, compared to one-in-four firms letting workers go between March and May.

“But it is important to remember that construction activity typically increases quite a bit between March 1 and the end of May as the weather improves and more work gets underway,” Simonson commented. “Getting to March 1 levels is a sign of progress, but it doesn’t mean things are back to normal.”

Simonson added that the AGC survey and Procore’s data show the severe toll the pandemic took on the construction industry. For example, 61% of firms report having had at least one project halted or canceled because of the pandemic. One in four firms report that construction materials shortages, caused by lock downs and trade disruptions, are causing delays on current projects. Meanwhile, the Procore data found that smaller firms experienced more severe declines in construction activity during the pandemic than larger firms.

"We are living in a time when change seems to be the new norm, but something that will never change is the resilience of the construction industry,” said Kristopher Lengieza, Procore’s Senior Director of Business Development. “To date, a majority of states are experiencing levels of construction activity equal to, or in some cases, much higher than they reported prior to COVID-19.”

Simonson added that, moving forward, only 12% of firms report they plan to furlough or lay off staff over the next four weeks while 17% anticipate adding to their headcount during that time span. Yet even as more construction firms predict they will expand during the next several weeks, 42% do not expect demand will recover to normal levels for at least four months, and most of those firms expect recovery will take longer than six months.

Simonson noted that construction firms are counting on additional federal help to improve demand for construction and make it easier to return people to their payrolls. Fifty-five percent of firms report they are counting on Congress and the Trump administration to enact liability reform that protects firms that are complying with coronavirus safety protocols from litigation. And 33% are counting on Congress to boost infrastructure spending to offset declining private-sector demand.

Many firms are also hoping that Congress will not extend the unemployment supplement that is currently set to expire at the end of July. Notably, 34% of firms that called back employees who had been furloughed report having some personnel refuse to return to work because of those unemployment supplements. “Extending the supplement will only make it harder for more employers to bring people back onto payrolls,” Simonson cautioned.

“Without additional help from D.C., the few gains this industry has made during the past few weeks will likely be fleeting,” Simonson added. “That is why we will continue to push Congress and the Trump administration to enact the kind of long-term economic recovery measures this industry needs to truly rebound from the coronavirus.”

The association’s new survey is based on responses from over 630 firms collected between June 9 and 17. Procore’s data is based on the transactions logged via the company’s software by tens of thousands of construction firms across the country.

Click here for the association’s survey results and here for a video summary of the survey responses. Click here for Procore’s new construction data.

Related Stories

Multifamily Housing | Aug 12, 2016

Apartment completions in largest metros on pace to increase by 50% in 2016

Texas is leading this multifamily construction boom, according to latest RENTCafé estimates.

Market Data | Jul 29, 2016

ABC: Output expands, but nonresidential fixed investment falters

Nonresidential fixed investment fell for a third consecutive quarter, as indicated by Bureau of Economic Analysis data.

Industry Research | Jul 26, 2016

AIA consensus forecast sees construction spending on rise through next year

But several factors could make the industry downshift.

Architects | Jul 20, 2016

AIA: Architecture Billings Index remains on solid footing

The June ABI score was down from May, but the figure was positive for the fifth consecutive month.

Market Data | Jul 7, 2016

Airbnb alleged to worsen housing crunch in New York City

Allegedly removing thousands of housing units from market, driving up rents.

Market Data | Jul 6, 2016

Construction spending falls 0.8% from April to May

The private and public sectors have a combined estimated seasonally adjusted annual rate of $1.14 trillion.

Market Data | Jul 6, 2016

A thriving economy and influx of businesses spur construction in downtown Seattle

Development investment is twice what it was five years ago.

Multifamily Housing | Jul 5, 2016

Apartments continue to shrink, rents continue to rise

Latest survey by RENTCafé tracks size changes in 95 metros.

Multifamily Housing | Jun 22, 2016

Can multifamily construction keep up with projected demand?

The Joint Center for Housing Studies’ latest disection of America’s housing market finds moderate- and low-priced rentals in short supply.

Contractors | Jun 21, 2016

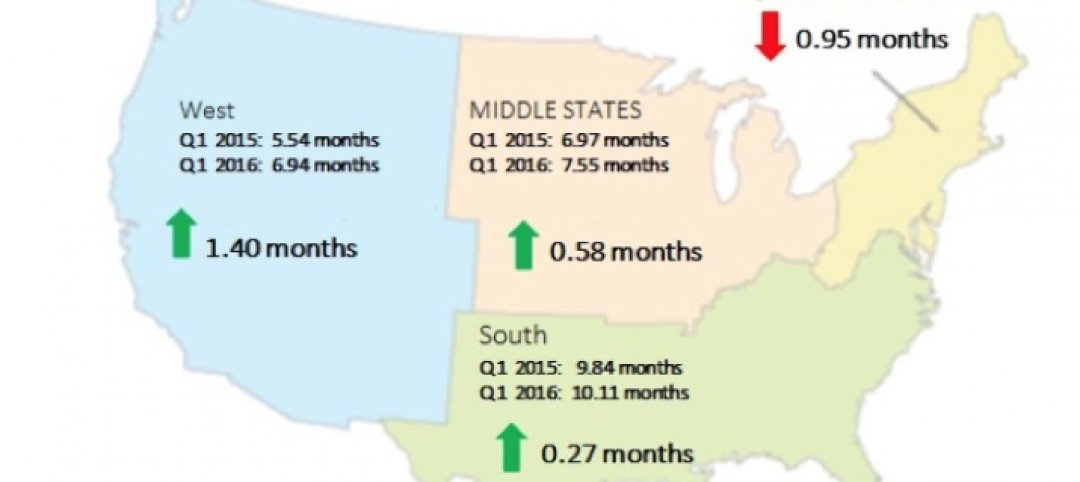

Bigness counts when it comes to construction backlogs

Large companies that can attract talent are better able to commit to more work, according to a national trade group for builders and contractors.