A new survey by the Associated General Contractors of America and data from construction technology firm Procore show that construction activity is returning to pre-coronavirus levels in many parts of the country and some firms are adding workers. The new economic data, however, also shows some future projects are being canceled and many others are being delayed by supply chain issues and labor shortages, underscoring the need for additional federal recovery measures, association officials noted.

“Many of the immediate economic impacts of the coronavirus have passed and, as a result, activity and hiring are up, a bit,” said Ken Simonson, the association’s chief economist. “But while the immediate crisis appears to have passed, we are just now beginning to appreciate some of the longer-term impacts of the pandemic on the industry.”

Construction activity has returned to pre-coronavirus levels in 34 states, based on data on workers’ hours analyzed by Procore. And construction has returned to pre-coronavirus levels in Dallas and Miami, according to Procore’s data on 8 large metro areas. Meanwhile, the association’s survey found that only 8% of construction firms were forced to furlough or lay off workers in June while 21% report adding employees, compared to one-in-four firms letting workers go between March and May.

“But it is important to remember that construction activity typically increases quite a bit between March 1 and the end of May as the weather improves and more work gets underway,” Simonson commented. “Getting to March 1 levels is a sign of progress, but it doesn’t mean things are back to normal.”

Simonson added that the AGC survey and Procore’s data show the severe toll the pandemic took on the construction industry. For example, 61% of firms report having had at least one project halted or canceled because of the pandemic. One in four firms report that construction materials shortages, caused by lock downs and trade disruptions, are causing delays on current projects. Meanwhile, the Procore data found that smaller firms experienced more severe declines in construction activity during the pandemic than larger firms.

"We are living in a time when change seems to be the new norm, but something that will never change is the resilience of the construction industry,” said Kristopher Lengieza, Procore’s Senior Director of Business Development. “To date, a majority of states are experiencing levels of construction activity equal to, or in some cases, much higher than they reported prior to COVID-19.”

Simonson added that, moving forward, only 12% of firms report they plan to furlough or lay off staff over the next four weeks while 17% anticipate adding to their headcount during that time span. Yet even as more construction firms predict they will expand during the next several weeks, 42% do not expect demand will recover to normal levels for at least four months, and most of those firms expect recovery will take longer than six months.

Simonson noted that construction firms are counting on additional federal help to improve demand for construction and make it easier to return people to their payrolls. Fifty-five percent of firms report they are counting on Congress and the Trump administration to enact liability reform that protects firms that are complying with coronavirus safety protocols from litigation. And 33% are counting on Congress to boost infrastructure spending to offset declining private-sector demand.

Many firms are also hoping that Congress will not extend the unemployment supplement that is currently set to expire at the end of July. Notably, 34% of firms that called back employees who had been furloughed report having some personnel refuse to return to work because of those unemployment supplements. “Extending the supplement will only make it harder for more employers to bring people back onto payrolls,” Simonson cautioned.

“Without additional help from D.C., the few gains this industry has made during the past few weeks will likely be fleeting,” Simonson added. “That is why we will continue to push Congress and the Trump administration to enact the kind of long-term economic recovery measures this industry needs to truly rebound from the coronavirus.”

The association’s new survey is based on responses from over 630 firms collected between June 9 and 17. Procore’s data is based on the transactions logged via the company’s software by tens of thousands of construction firms across the country.

Click here for the association’s survey results and here for a video summary of the survey responses. Click here for Procore’s new construction data.

Related Stories

Market Data | Jul 5, 2023

Nonresidential construction spending decreased in May, its first drop in nearly a year

National nonresidential construction spending decreased 0.2% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.06 trillion.

Apartments | Jun 27, 2023

Average U.S. apartment rent reached all-time high in May, at $1,716

Multifamily rents continued to increase through the first half of 2023, despite challenges for the sector and continuing economic uncertainty. But job growth has remained robust and new households keep forming, creating apartment demand and ongoing rent growth. The average U.S. apartment rent reached an all-time high of $1,716 in May.

Industry Research | Jun 15, 2023

Exurbs and emerging suburbs having fastest population growth, says Cushman & Wakefield

Recently released county and metro-level population growth data by the U.S. Census Bureau shows that the fastest growing areas are found in exurbs and emerging suburbs.

Contractors | Jun 13, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of May 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in May, according to an ABC member survey conducted May 20 to June 7. The reading is 0.1 months lower than in May 2022. Backlog in the infrastructure category ticked up again and has now returned to May 2022 levels. On a regional basis, backlog increased in every region but the Northeast.

Industry Research | Jun 13, 2023

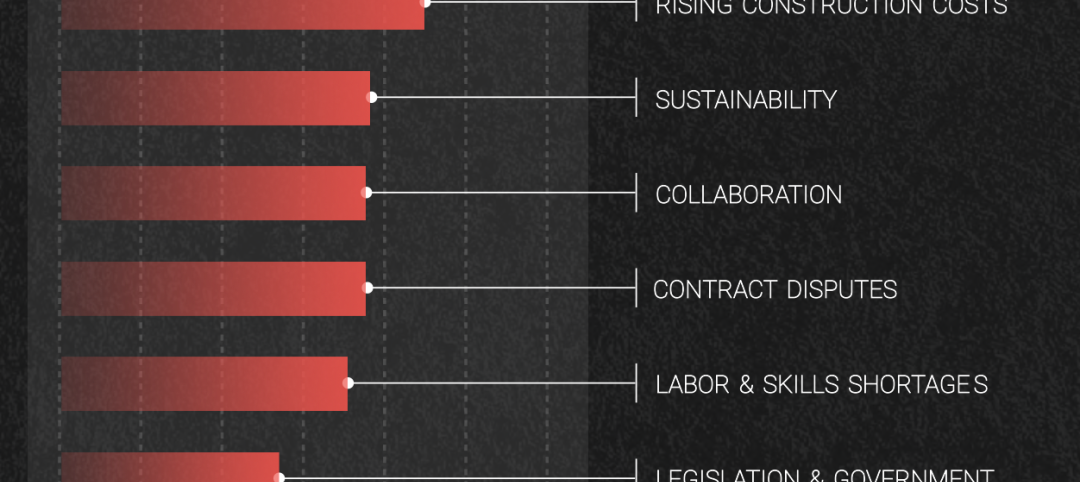

Two new surveys track how the construction industry, in the U.S. and globally, is navigating market disruption and volatility

The surveys, conducted by XYZ Reality and KPMG International, found greater willingness to embrace technology, workplace diversity, and ESG precepts.

| Jun 5, 2023

Communication is the key to AEC firms’ mental health programs and training

The core of recent awareness efforts—and their greatest challenge—is getting workers to come forward and share stories.

Contractors | May 24, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of April 2023

Contractor backlogs climbed slightly in April, from a seven-month low the previous month, according to Associated Builders and Contractors.

Multifamily Housing | May 23, 2023

One out of three office buildings in largest U.S. cities are suitable for residential conversion

Roughly one in three office buildings in the largest U.S. cities are well suited to be converted to multifamily residential properties, according to a study by global real estate firm Avison Young. Some 6,206 buildings across 10 U.S. cities present viable opportunities for conversion to residential use.

Industry Research | May 22, 2023

2023 High Growth Study shares tips for finding success in uncertain times

Lee Frederiksen, Managing Partner, Hinge, reveals key takeaways from the firm's recent High Growth study.

Multifamily Housing | May 8, 2023

The average multifamily rent was $1,709 in April 2023, up for the second straight month

Despite economic headwinds, the multifamily housing market continues to demonstrate resilience, according to a new Yardi Matrix report.