Having weathered the coronavirus pandemic somewhat better than the single-family home construction sector, new supply of multifamily housing delivered in 2021 is expected to increase by around 17% to 334,000 units, according to Yardi Matrix’s latest U.S. Outlook.

“Some 174,000 units were absorbed nationally through May, which puts 2021 on track to be among the hottest years since the 2008 recession,” states the report.

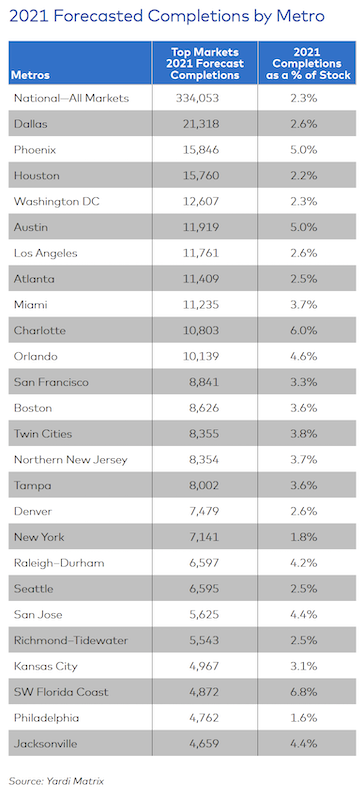

As of mid-year, some 863,500 multifamily units were under construction, representing 6% of the existing U.S. stock. That’s good and bad news, suggests Yardi Matrix, because such a large number of projects could impede the overall rent recovery in so-called “gateway” markets like Miami, whose forecasted deliveries are projected to equal 3.7% of its existing stock; Boston (3.6% of existing stock), San Francisco (3.3%), Los Angeles (2.6%), Washington D.C. (2.3%), New York (1.8%) and Chicago (1.3%).

“These new projects might have a difficult time leasing up, as there is already much supply in these metros with limited new demand, especially in the Lifestyle segment,” states the report.

The leaders in multifamily completions over the past 12 months include Austin (4.4% of total stock), Charlotte (4.3%), Minneapolis-St. Paul (3.7%) and Raleigh (3.6%). Yardi Matrix points out that among these four metros, Charlotte has been the only one able to sustain strong rent growth and deliveries simultaneously. Still, rents in all four metros have picked up in recent months, driven by a surge in migration and demand for apartments.

Yardi Matrix foresees Dallas leading the country in multifamily completions this year. Image: Yardi Matrix

SMALLER MARKETS, BIGGER DEMAND

Yardi Matrix looked at 136 markets, and found robust growth in tertiary metros like Northwest Arkansas (home to Walmart’s headquarters city of Bentonville) that led the list with 8.8% of its stock expected to be delivered this year from new construction. Next were Wilmington, N.C. (with 7% of its stock expected to be delivered), and the Southwest Florida Coast (6.8%). These metros had limited existing multifamily housing stock to begin with.

Measured by sheer units, Dallas is forecast to have the highest number of completions in 2021 (21,318 units), followed by Phoenix, Houston, Washington DC, Austin, L.A., Atlanta, and Miami. Yardi Matrix believes that while Dallas, Phoenix, and Houston should have little trouble absorbing new deliveries, “Washington DC might struggle,” because demand is lagging in part due to remote work requirements or preferences, and out-migration.

Material price hikes are the “wild card” in prognostications about apartment development, says Yardi Matrix. The extreme volatility of lumber prices over the past several months, coupled with increases in the cost of other building materials, could slow new starts and force developers “to choose between raising rents and reducing profit margins.”

RENTS RISING AT UNSUSTAINABLE RATES

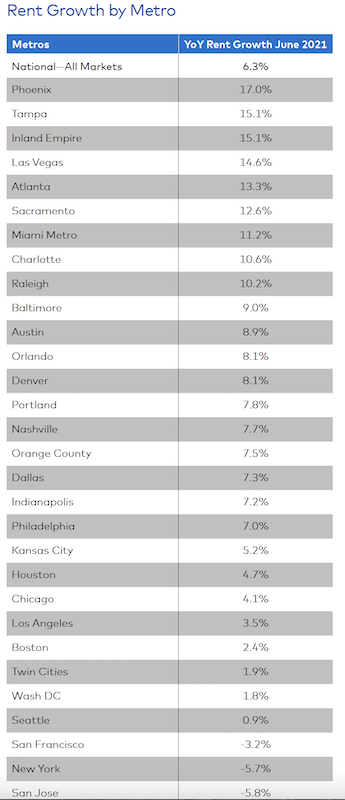

Through the first six months of 2021, national asking rents rose 5.8%. Yardi Matrix estimates that year-over-year asking rent growth, as of June, stood at 6.3%, “well above the [country’s] pre-pandemic performance.” Rent inflation is even more pronounced in tech hubs and tertiary metros, and asking rent growth in the Southwest and Southeast has been at levels “not seen in decades.”

While this escalation for multifamily units probably isn’t sustainable, Yardi Matrix expects conditions for above-average rent growth to persist in many metros “for months.” The report points out that rents are driven by “buoyant” demand. In the 12 months through May, 378,000 multifamily units were absorbed nationwide. The top markets for absorption as a percentage of total inventories were Miami (8,500 units, or 2.7% of stock), Charlotte (4,500, 2.4%) and Orlando (4,900, 2.1%).

Through June of this year, rent growth in Phoenix was nearly three times the national average. And despite its year-to-year rent decline, New York bounced back in the first half of 2021. Image: Yardi Matrix

By units, Chicago topped the list with almost 7,800 multifamily units absorbed, or 2.2 % of the Windy City’s stock. And for all the talk about New Yorkers evacuating in droves during the pandemic, rents actually rose by 6% during the first half of this year, and more companies are now requiring employees to return to office work. Rent recoveries through the first half of 2021 were also in “full swing” in Chicago (up 6.5%), Miami (6.4%), Boston (5%), Los Angeles (4%) and D.C. (3.3%).

Yardi Matrix’s report offers an economic outlook that foresees a flat labor participation market, and questions about rising inflation. Economic volatility “is likely to continue” globally until markets get a handle on controlling their virus outbreaks. “However, that does not mean there won’t be strong economic growth in certain sectors and geographies in the short term,” the report states.

Related Stories

MFPRO+ News | Jul 22, 2024

6 multifamily WAFX 2024 Prize winners

Over 30 projects tackling global challenges such as climate change, public health, and social inequality have been named winners of the World Architecture Festival’s WAFX Awards.

MFPRO+ News | Jul 15, 2024

More permits for ADUs than single-family homes issued in San Diego

Popularity of granny flats growing in California

Vertical Transportation | Jul 12, 2024

Elevator regulations responsible for some of ballooning multifamily costs

Codes and regulations for elevators in the United States are a key factor in inflating costs of multifamily development, argues a guest columnist in the New York Times.

MFPRO+ New Projects | Jul 2, 2024

Miami residential condo tower provides a deeded office unit for every buyer

A new Miami residential condo office tower sweetens the deal for buyers by providing an individual, deeded and furnished office with each condo unit purchased. One Twenty Brickell Residences, a 34-story, 240-unit tower, also offers more than 60,000 sf of exclusive residential amenities.

Student Housing | Jul 1, 2024

Two-tower luxury senior living community features wellness and biophilic elements

A new, two-building, 27-story senior living community in Tysons, Va., emphasizes wellness and biophilic design elements. The Mather, a luxury community for adults aged 62 and older, is situated on a small site surrounded by high-rises.

MFPRO+ New Projects | Jun 27, 2024

Chicago’s long-vacant Spire site will be home to a two-tower residential development

In downtown Chicago, the site of the planned Chicago Spire, at the confluence of Lake Michigan and the Chicago River, has sat vacant since construction ceased in the wake of the Great Recession. In the next few years, the site will be home to a new two-tower residential development, 400 Lake Shore.

MFPRO+ News | Jun 25, 2024

New York mayor releases multi-year plan to address affordable housing crisis

The plan seeks to create and preserve affordable housing. It will incentivize the inclusion of permanently affordable and rent stabilized housing in new, multi-family construction projects.

Student Housing | Jun 25, 2024

P3 student housing project with 176 units slated for Purdue University Fort Wayne

A public/private partnership will fund a four-story, 213,000 sf apartment complex on Purdue University Fort Wayne’s (PFW’s) North Campus in Fort Wayne, Indiana. The P3 entity was formed exclusively for this property.

Apartments | Jun 25, 2024

10 hardest places to find an apartment in 2024

The challenge of finding an available rental continues to increase for Americans nation-wide. On average, there are eight prospective tenants vying for the same vacant apartment.

MFPRO+ News | Jun 24, 2024

‘Yes in God’s Backyard’ movement could create more affordable housing

The so-called “Yes in God’s Backyard” (YIGBY) movement, where houses of worship convert their properties to housing, could help alleviate the serious housing crisis affecting many communities around the country.