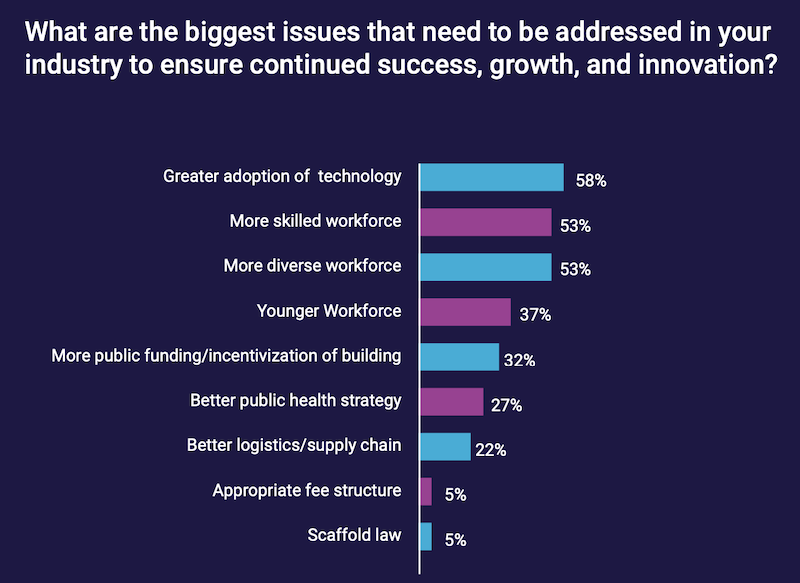

Modernization that leans heavier on technology to attract a younger, diverse, and skilled workforce is likely to determine the future success and growth of New York’s construction industry.

That is one of the key takeaways from a “State of the Construction Industry” survey of 20 New York metro-area AEC firms that the accounting consultancy Anchin, Block & Anchin conducted last November, and whose results it released earlier this month.

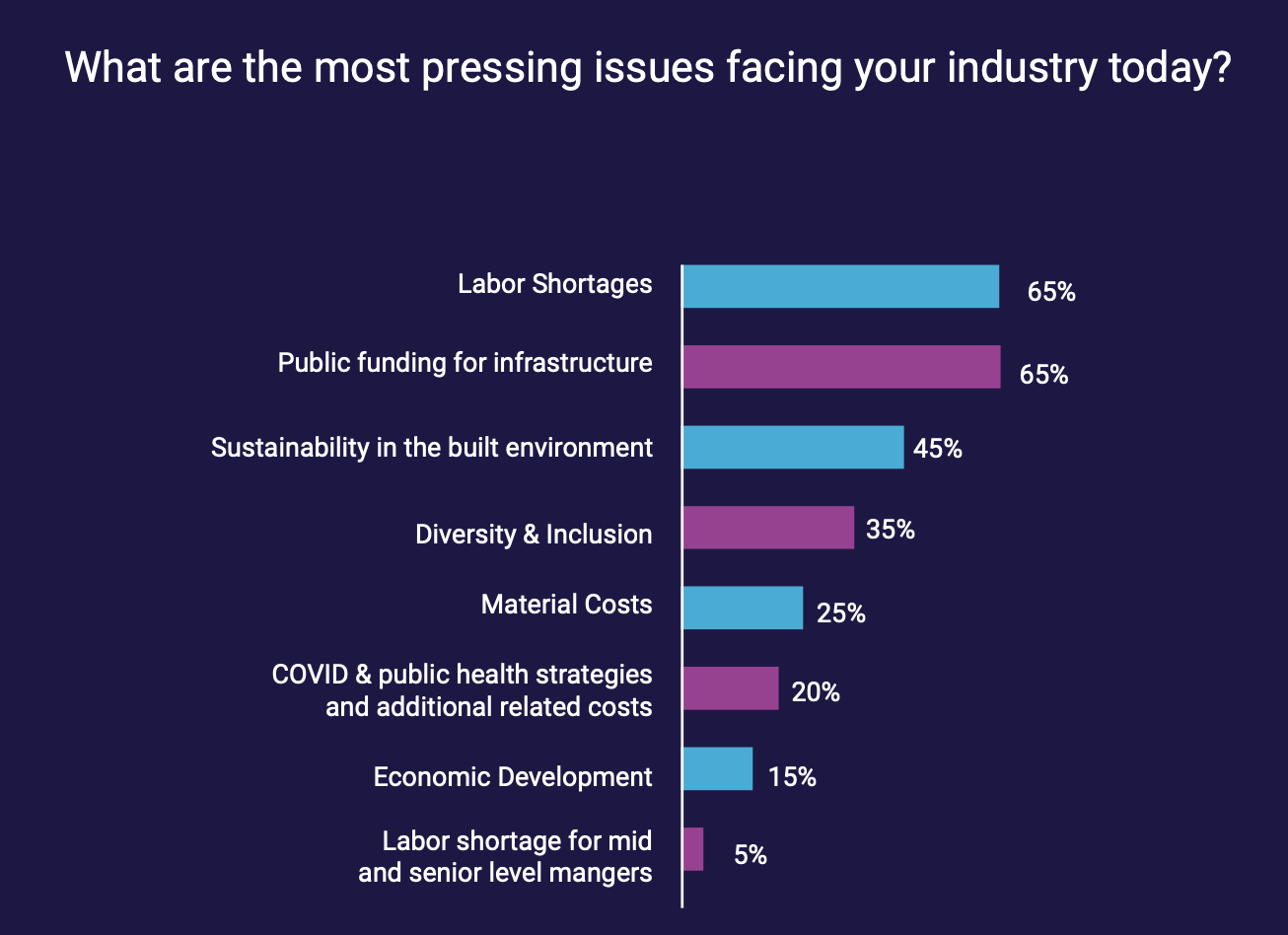

The report found a New York market that is at once resilient and facing “unprecedented challenges.” Its “most pressing” issues, as stated by nearly two-thirds of the firms polled, are labor shortages and public funding for infrastructure projects. Retaining talent is critical to these companies, and has led AEC firms toward greater flexibility about allowing remote or hybrid work, and increasing worker salaries. Thirty percent of the firms polled are focusing on management training and career development.

LIFE SCIENCES AND INDUSTRIAL SEEN AS GROWTH SECTORS

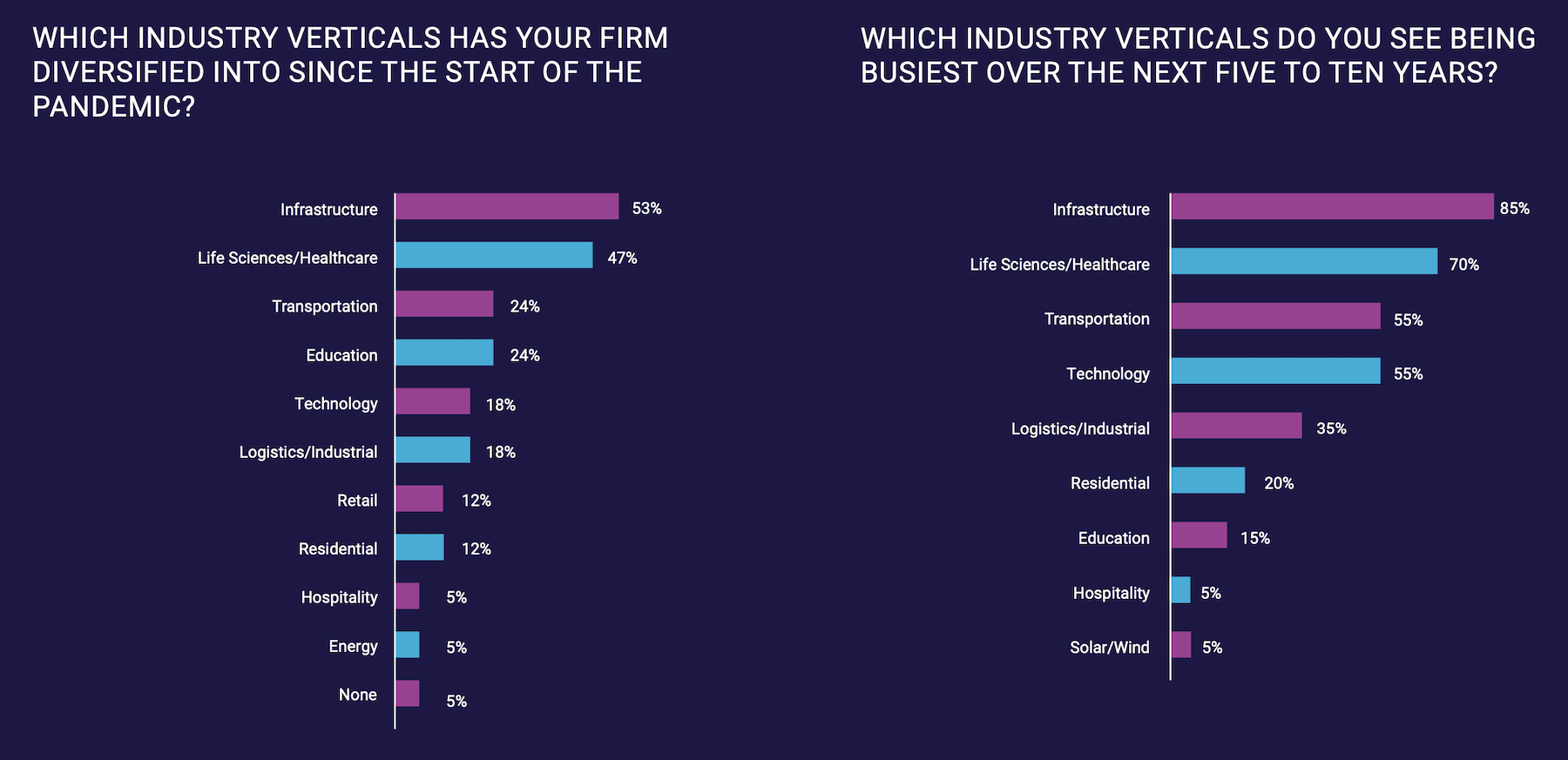

Since the coronavirus pandemic was declared in March 2020, more than half of the firms surveyed have diversified into the infrastructure sector, no doubt in anticipation of the $1.2 trillion federal infrastructure bill that President Biden signed into law last November. Eighty-five percent of the AEC firms polled expect infrastructure to be their market’s “busiest” sector over the next five to 10 years, followed by the life sciences/healthcare sector (into which nearly half of the firms polled diversified over the past 18 months}.

The survey’s authors also point to the industrial sector’s “growing momentum” as an in-demand asset driven by e-commerce.

However, AEC firms lamented the pressures being exerted on their companies’ cashflows from, most prominently, slower client payments, labor and materials cost inflation, insurance costs, and project delays.

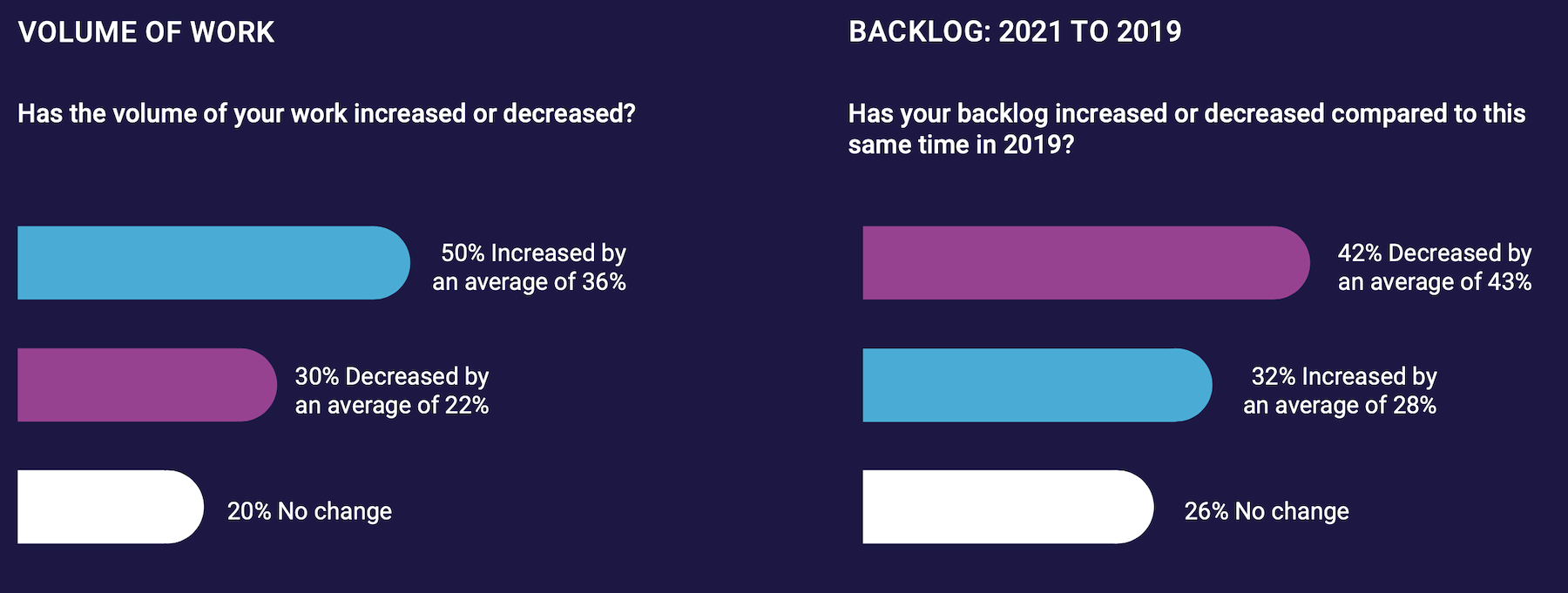

Half of the survey’s respondents said that their volume of work has increased during the pandemic, by an average of 36 percent. But 30 percent reported decreases in their companies’ work volumes, by an average of 22 percent. And 42 percent of those polled said their backlogs were down from 2019, by an average of 43 percent.

RESILIENCE AND SUSTAINABILITY ARE CENTRAL

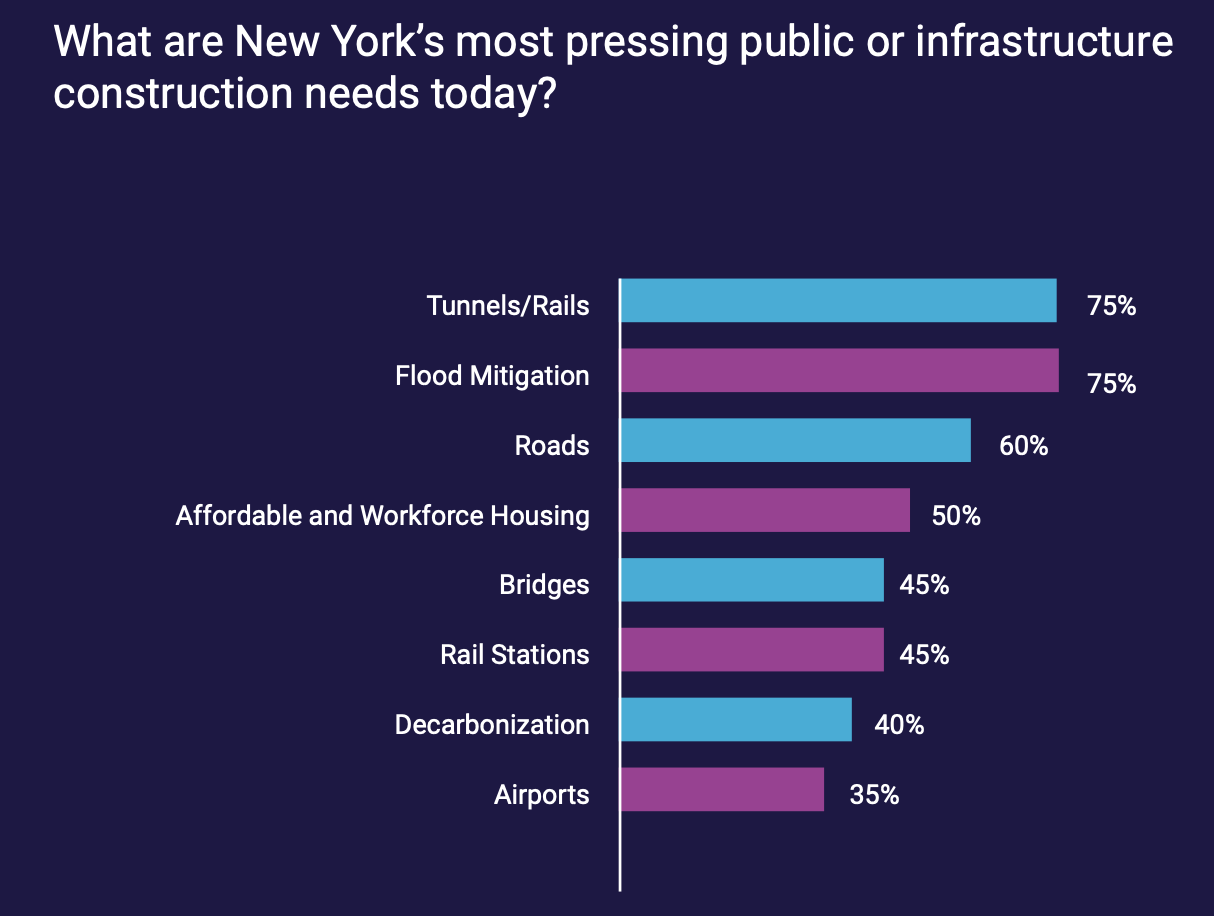

The usual suspects—tunnels, roads, bridges, rail stations—were cited by the survey’s respondents as being among the structures desperate for repair or replacement. A surprising 40 percent of the firms polled also identified “decarbonization” as a need, most probably because of New York’s Local Law 97, which passed in 2019, and creates carbon emissions limits for most commercial buildings over 25,000 sf, as well as alternative paths for the law’s two compliance periods: 2024-2029, and 2030-2034. Building owners must submit emission intensity reports, stamped by a registered design professional, every year starting in 2025 or face substantial fines.

“The overwhelming trend relates to resilience, particularly in the face of a growing urban population; and sustainability/climate change needs, which are being felt acutely,” the report states.

Related Stories

Market Data | Aug 13, 2018

First Half 2018 commercial and multifamily construction starts show mixed performance across top metropolitan areas

Gains reported in five of the top ten markets.

Market Data | Aug 10, 2018

Construction material prices inch down in July

Nonresidential construction input prices increased fell 0.3% in July but are up 9.6% year over year.

Market Data | Aug 9, 2018

Projections reveal nonresidential construction spending to grow

AIA releases latest Consensus Construction Forecast.

Market Data | Aug 7, 2018

New supply's impact illustrated in Yardi Matrix national self storage report for July

The metro with the most units under construction and planned as a percent of existing inventory in mid-July was Nashville, Tenn.

Market Data | Aug 3, 2018

U.S. multifamily rents reach new heights in July

Favorable economic conditions produce a sunny summer for the apartment sector.

Market Data | Aug 2, 2018

Nonresidential construction spending dips in June

“The hope is that June’s construction spending setback is merely a statistical aberration,” said ABC Chief Economist Anirban Basu.

Market Data | Aug 1, 2018

U.S. hotel construction pipeline continues moderate growth year-over-year

The hotel construction pipeline has been growing moderately and incrementally each quarter.

Market Data | Jul 30, 2018

Nonresidential fixed investment surges in second quarter

Nonresidential fixed investment represented an especially important element of second quarter strength in the advance estimate.

Market Data | Jul 11, 2018

Construction material prices increase steadily in June

June represents the latest month associated with rapidly rising construction input prices.

Market Data | Jun 26, 2018

Yardi Matrix examines potential regional multifamily supply overload

Outsize development activity in some major metros could increase vacancy rates and stagnate rent growth.