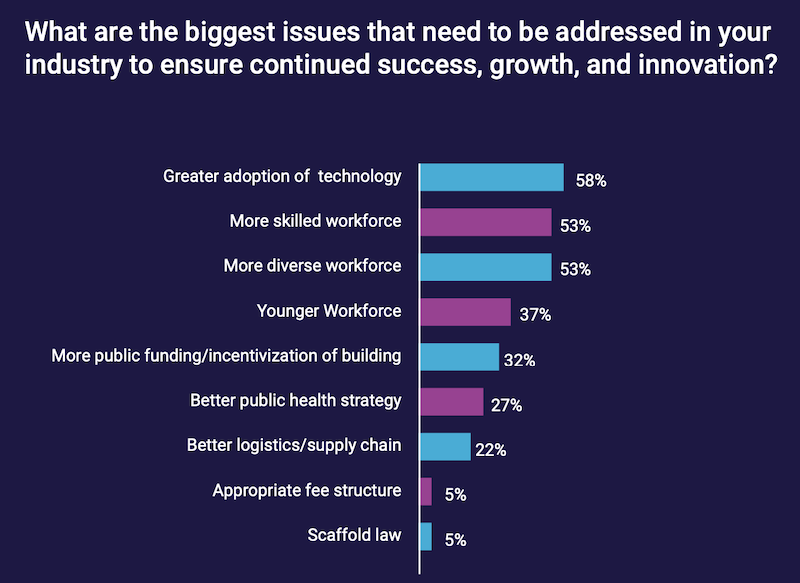

Modernization that leans heavier on technology to attract a younger, diverse, and skilled workforce is likely to determine the future success and growth of New York’s construction industry.

That is one of the key takeaways from a “State of the Construction Industry” survey of 20 New York metro-area AEC firms that the accounting consultancy Anchin, Block & Anchin conducted last November, and whose results it released earlier this month.

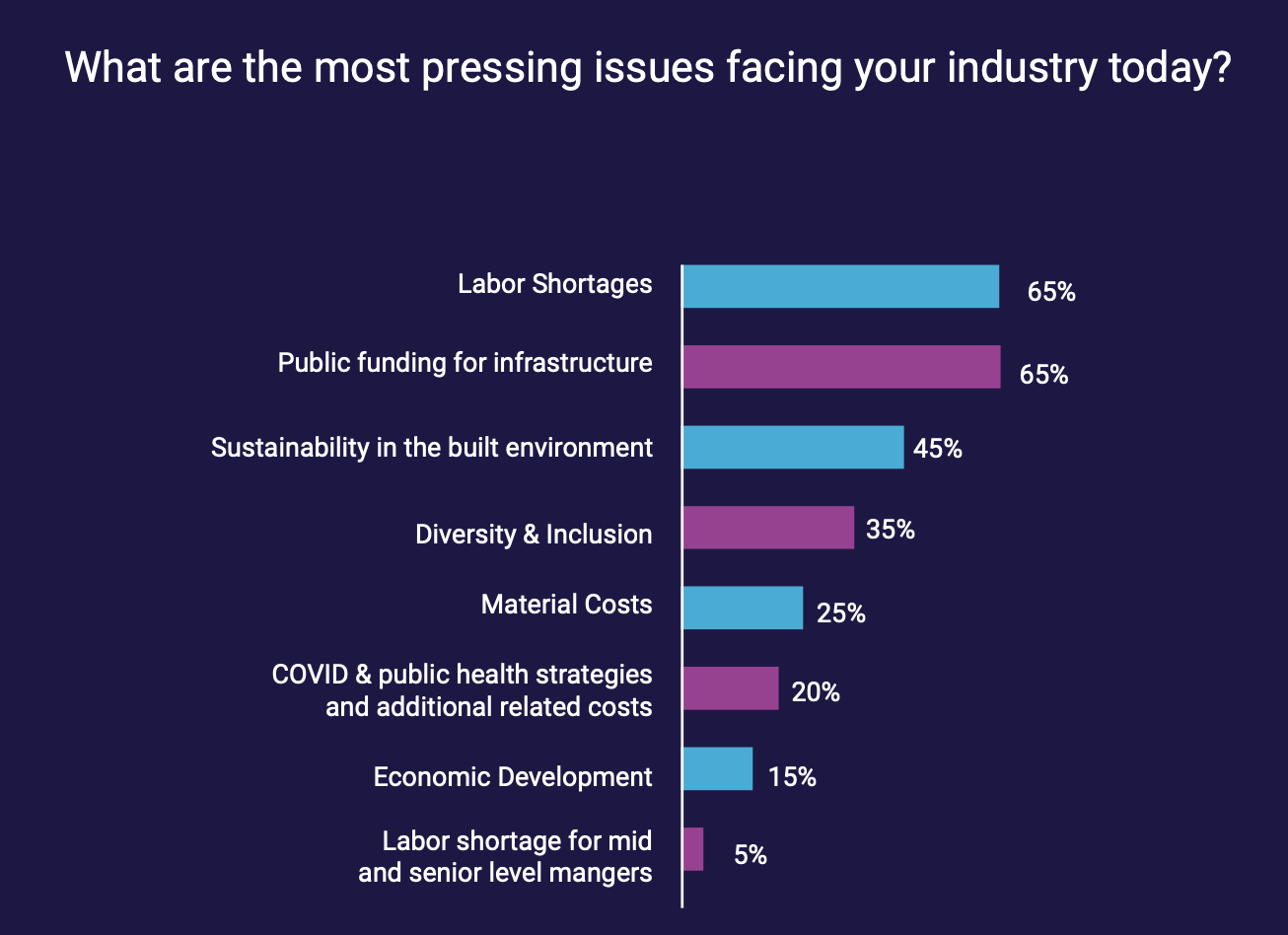

The report found a New York market that is at once resilient and facing “unprecedented challenges.” Its “most pressing” issues, as stated by nearly two-thirds of the firms polled, are labor shortages and public funding for infrastructure projects. Retaining talent is critical to these companies, and has led AEC firms toward greater flexibility about allowing remote or hybrid work, and increasing worker salaries. Thirty percent of the firms polled are focusing on management training and career development.

LIFE SCIENCES AND INDUSTRIAL SEEN AS GROWTH SECTORS

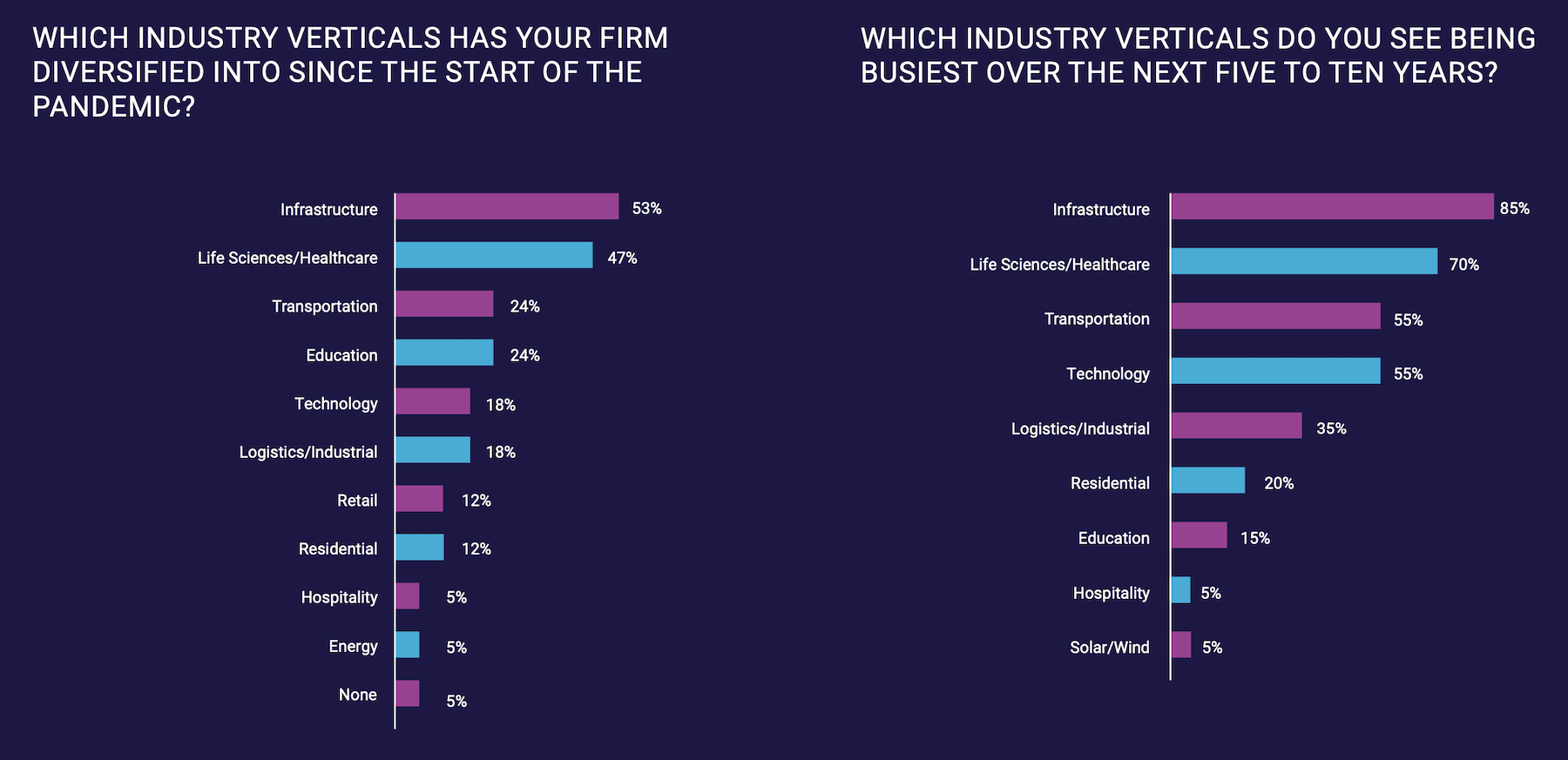

Since the coronavirus pandemic was declared in March 2020, more than half of the firms surveyed have diversified into the infrastructure sector, no doubt in anticipation of the $1.2 trillion federal infrastructure bill that President Biden signed into law last November. Eighty-five percent of the AEC firms polled expect infrastructure to be their market’s “busiest” sector over the next five to 10 years, followed by the life sciences/healthcare sector (into which nearly half of the firms polled diversified over the past 18 months}.

The survey’s authors also point to the industrial sector’s “growing momentum” as an in-demand asset driven by e-commerce.

However, AEC firms lamented the pressures being exerted on their companies’ cashflows from, most prominently, slower client payments, labor and materials cost inflation, insurance costs, and project delays.

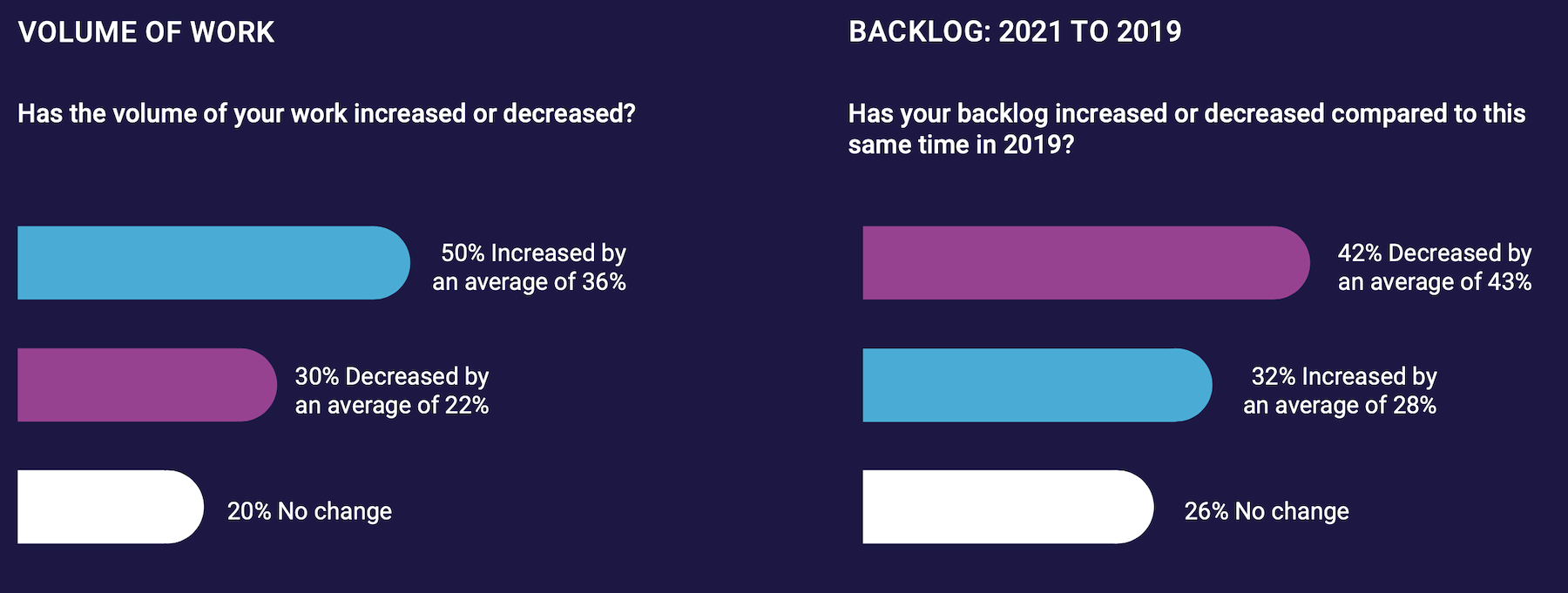

Half of the survey’s respondents said that their volume of work has increased during the pandemic, by an average of 36 percent. But 30 percent reported decreases in their companies’ work volumes, by an average of 22 percent. And 42 percent of those polled said their backlogs were down from 2019, by an average of 43 percent.

RESILIENCE AND SUSTAINABILITY ARE CENTRAL

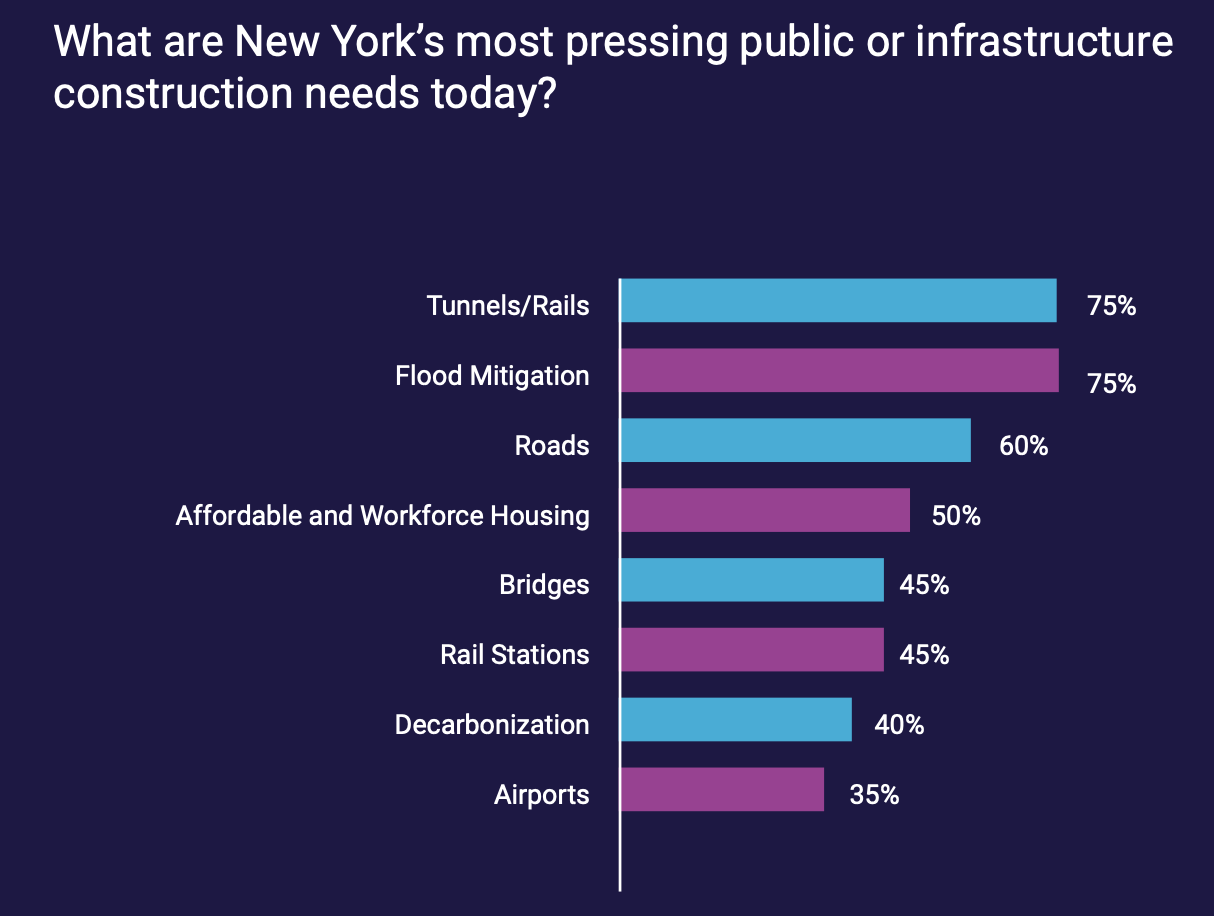

The usual suspects—tunnels, roads, bridges, rail stations—were cited by the survey’s respondents as being among the structures desperate for repair or replacement. A surprising 40 percent of the firms polled also identified “decarbonization” as a need, most probably because of New York’s Local Law 97, which passed in 2019, and creates carbon emissions limits for most commercial buildings over 25,000 sf, as well as alternative paths for the law’s two compliance periods: 2024-2029, and 2030-2034. Building owners must submit emission intensity reports, stamped by a registered design professional, every year starting in 2025 or face substantial fines.

“The overwhelming trend relates to resilience, particularly in the face of a growing urban population; and sustainability/climate change needs, which are being felt acutely,” the report states.

Related Stories

Market Data | May 2, 2018

Construction employment increases in 245 metro areas between March 2017 & 2018, as trade fights & infrastructure funding shortfalls loom

Houston-The Woodlands-Sugar Land, Texas and Weirton-Steubenville, W.Va.-Ohio experience largest year-over-year gains; Baton Rouge, La. and Auburn-Opelika, Ala. have biggest annual declines.

Market Data | May 2, 2018

Nonresidential Construction down in March, private sector falters, public sector unchanged

February’s spending estimate was revised roughly $10 billion higher.

Market Data | Apr 30, 2018

Outlook mixed for renewable energy installations in Middle East and Africa region

Several major MEA countries are actively supporting the growth of renewable energy.

Market Data | Apr 12, 2018

Construction costs climb in March as wide range of input costs jump

Association officials urge Trump administration, congress to fund infrastructure adequately as better way to stimulate demand than tariffs that impose steep costs on contractors and project owners.

Market Data | Apr 9, 2018

Construction employers add 228,000 jobs over the year despite dip in March

Average hourly earnings increase to $29.43 in construction, topping private sector by nearly 10%; Association officials urge updating and better funding programs to train workers for construction jobs.

Market Data | Apr 4, 2018

Construction employment increases in 257 metro areas between February 2017 & 2018 as construction firms continue to expand amid strong demand

Riverside-San Bernardino-Ontario, Calif. and Merced, Calif. experience largest year-over-year gains; Baton Rouge, La. and Auburn-Opelika, Ala. have biggest annual declines in construction employment.

Market Data | Apr 2, 2018

Construction spending in February inches up from January

Association officials urge federal, state and local officials to work quickly to put recently enacted funding increases to work to improve aging and over-burdened infrastructure, offset public-sector spending drops.

Market Data | Mar 29, 2018

AIA and the University of Minnesota partner to develop Guides for Equitable Practice

The Guides for Equitable Practice will be developed and implemented in three phase.

Market Data | Mar 22, 2018

Architecture billings continue to hold positive in 2018

Billings particularly strong at firms in the West and Midwest regions.

Market Data | Mar 21, 2018

Construction employment increases in 248 metro areas as new metal tariffs threaten future sector job gains

Riverside-San Bernardino-Ontario, Calif., and Merced, Calif., experience largest year-over-year gains; Baton Rouge, La., and Auburn-Opelika, Ala., have biggest annual declines in construction employment.