Construction costs are expected to increase by around 6 percent in 2021, and grow by another 4 to 7 percent in 2021, according to JLL’s Construction Cost Outlook for the second half of this year.

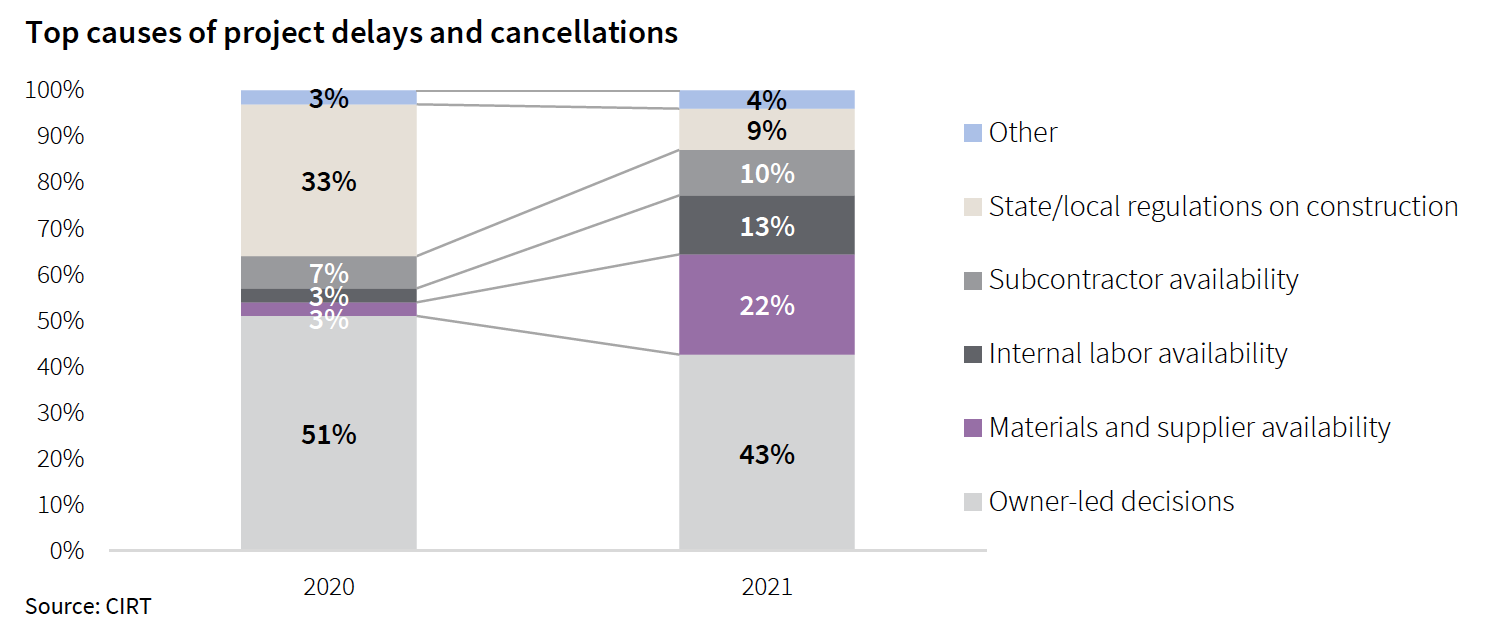

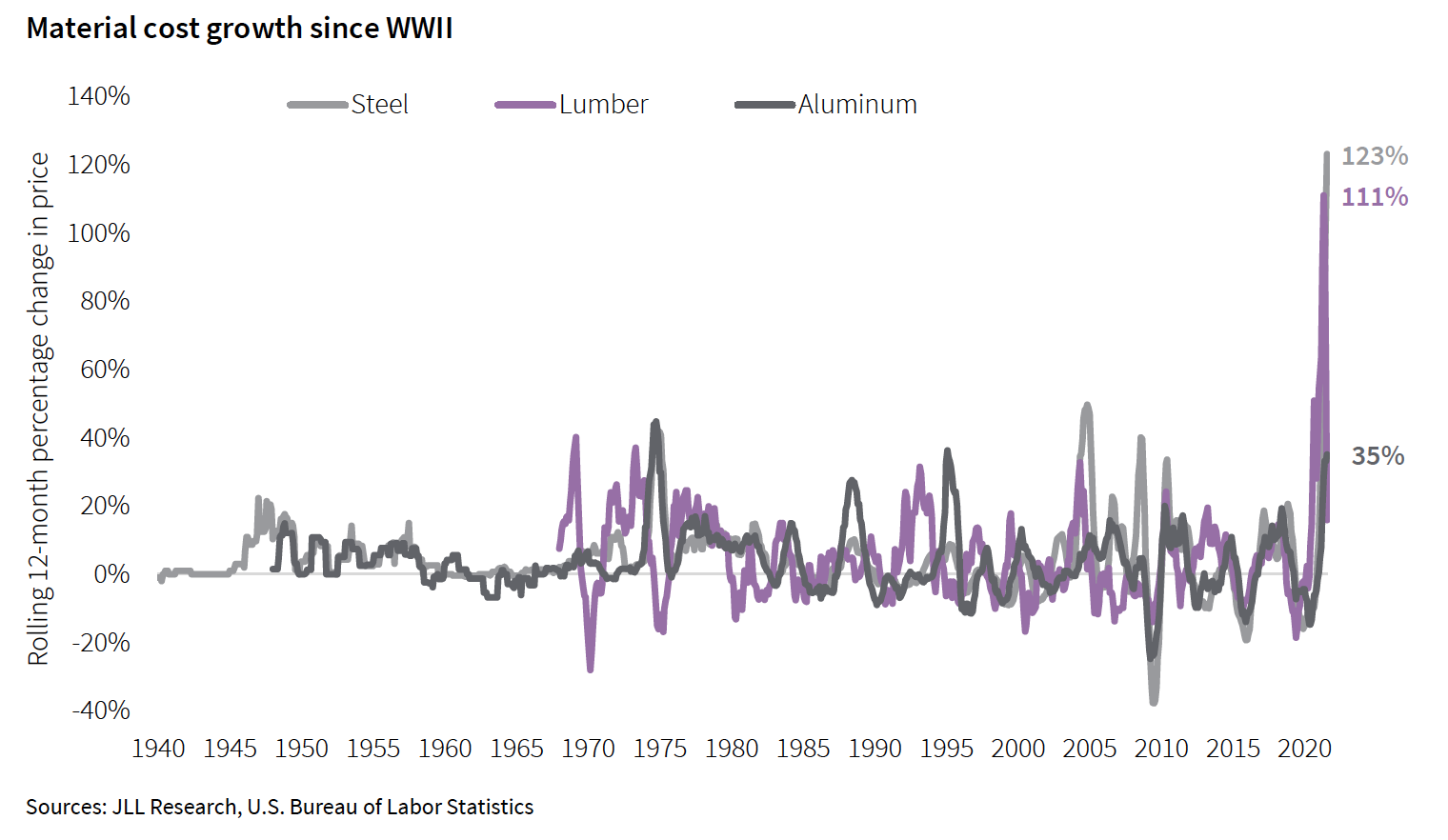

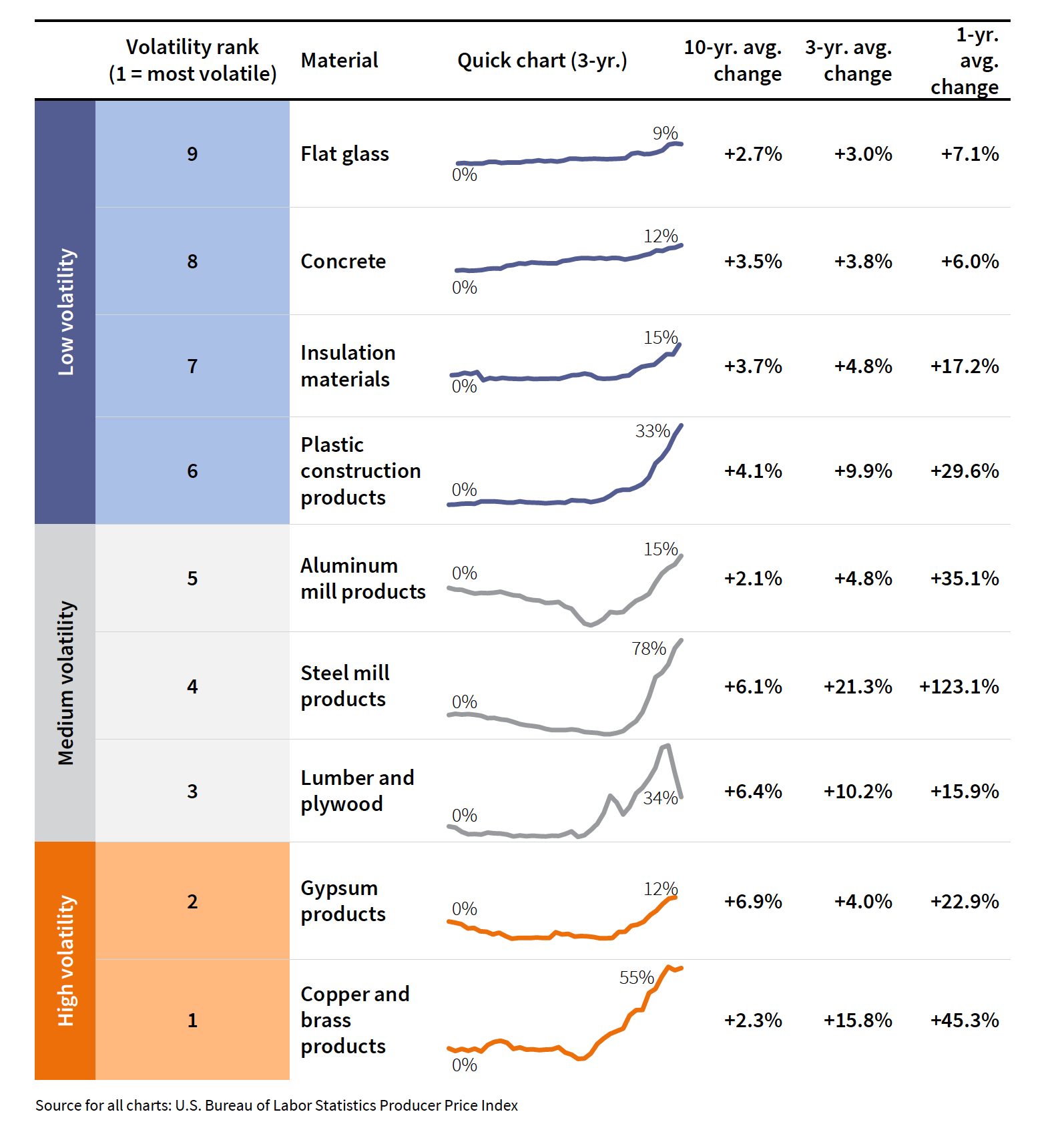

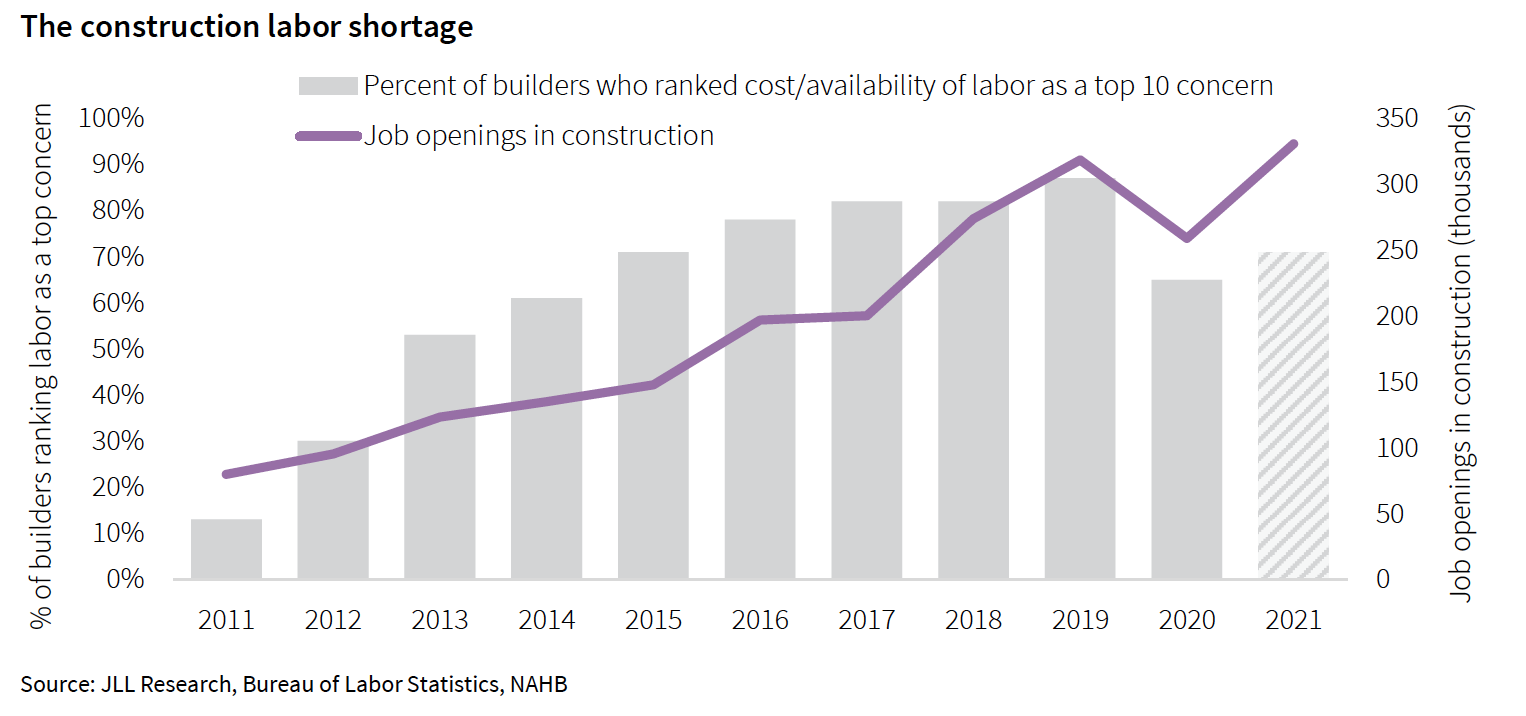

The Outlook tracks what has been “unprecedented” volatility in materials prices, which for the 12 months through August 2021 soared by 23 percent. Over that same period, labor costs rose by 4.46 percent, bringing total construction costs up by 4.51 percent. “The lack of available labor has led to more project delays so far in 2021 than a lack of materials, and conditions are expected to worsen over the coming year,” states Henry Esposito, JLL’s Construction Research Lead and the Outlook’s author.

Construction cost gains are occurring at a time when nonresidential construction spending was down by 9.5 percent for the 12 months through July 2021. JLL does not expect a “true” rebound in that spending until the Spring or Summer of next year. And don’t count on any immediate jolt from the federal infrastructure bill that, even if it passes, won’t impact construction spending or costs for two to six years out.

Construction recovery also faces two big immediate challenges:

Supply chain delays and record-high cost increases continue to put pressure on project execution and profitability. And the delta variant and future waves of the pandemic have the potential to slow economic growth, weakening the construction rebound “and calling into question some of the rosier predictions for 2022.” The Outlook states.

SHORTAGES AND DELAYS WILL CONTINUE THROUGH ‘22

As demand for new projects continues to grow and contractor backlogs fill, there will be less incentive to bid aggressively, and contractors will aim to pass through cost increases to owners as soon as the market can bear it. This combination of factors leads JLL to extend its forecasts for 4.5 to 7.5 percent final cost growth for nonresidential construction in calendar year 2021 and to predict a similar 4 to 7 percent cost growth range for 2022.

Some materials costs will ease, but the average increase will land somewhere between 5 and 11 percent. Aside from costs, the most pressing issues for most construction materials right now are lead times and delays. “Hopes for major relief during 2021 have been largely dashed, with hope for a return to normal now pushed out into 2022,” says JLL. The most pressing development might be the recent coup d’état in Guinea, which is one the world’s largest exporters of bauxite, the ore needed to produce aluminum.

The industry’s labor shortage isn’t abating, either. From 2015 to 2019, the number of open and unfilled jobs in construction across the country doubled to 300,000. And while construction was one of the fastest sectors to recover from the pandemic, its workforce numbers still fall far short of demand, which is why JLL expects labor costs to grow in the 3 to 6 percent range. Construction also has the lowest vaccination rate, and the highest vaccine hesitancy rate, of any major industry, so jobsite workers remain more vulnerable to airborne infection that might sideline them.

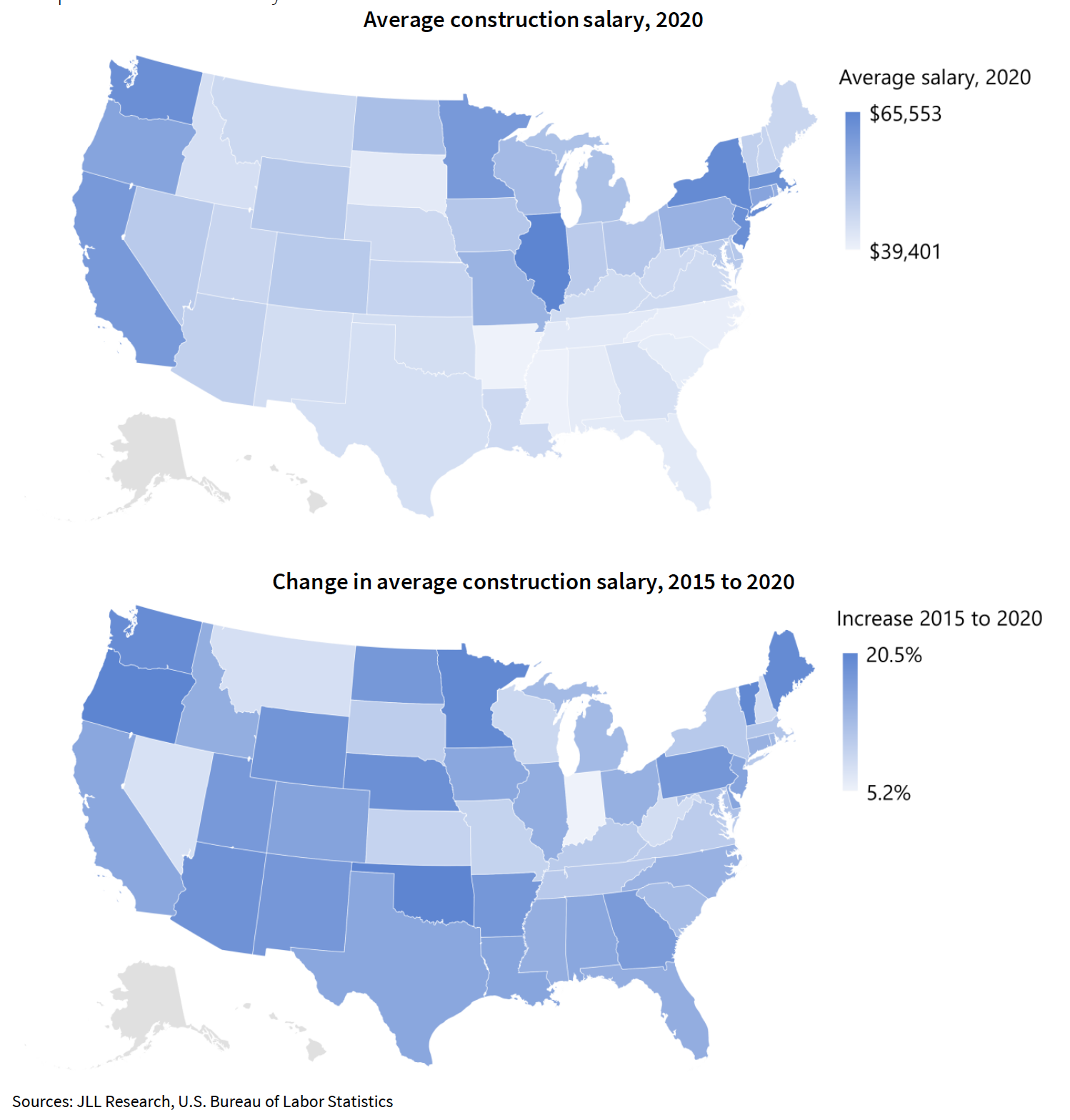

JLL shows that high-wage states are clustered in the Northeast corridor and the West Coast. The Midwest is also a high-cost region, with Illinois standing out as the top state, while the entire Southeast is the cheapest area of the country to hire workers. Wage growth across the country, on the other hand, is more evenly distributed, and some of the top states in total wages—such as Illinois, New York, and California—are only in the middle of the distribution pack.

Related Stories

Senior Living Design | May 9, 2017

Designing for a future of limited mobility

There is an accessibility challenge facing the U.S. An estimated 1 in 5 people will be aged 65 or older by 2040.

Industry Research | May 4, 2017

How your AEC firm can go from the shortlist to winning new business

Here are four key lessons to help you close more business.

Engineers | May 3, 2017

At first buoyed by Trump election, U.S. engineers now less optimistic about markets, new survey shows

The first quarter 2017 (Q1/17) of ACEC’s Engineering Business Index (EBI) dipped slightly (0.5 points) to 66.0.

Market Data | May 2, 2017

Nonresidential Spending loses steam after strong start to year

Spending in the segment totaled $708.6 billion on a seasonally adjusted, annualized basis.

Market Data | May 1, 2017

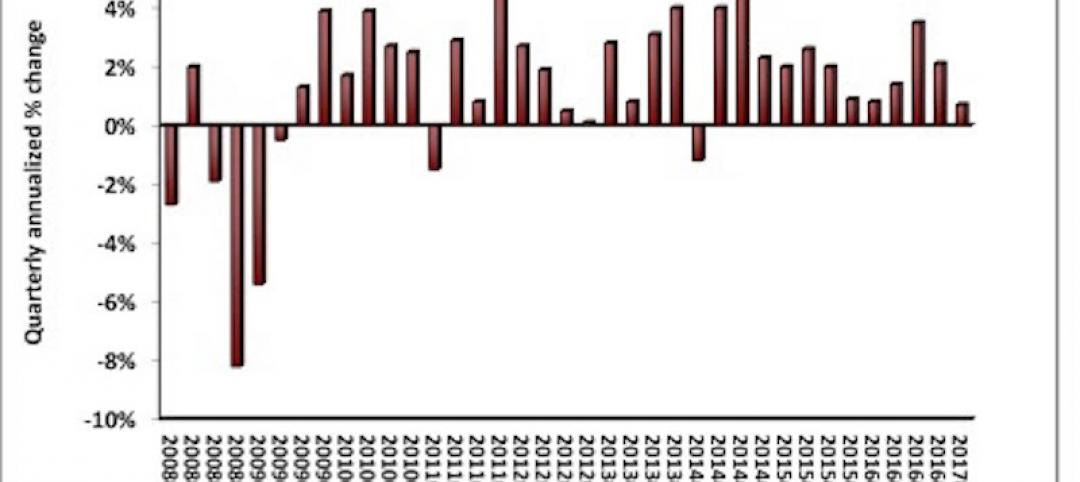

Nonresidential Fixed Investment surges despite sluggish economic in first quarter

Real gross domestic product (GDP) expanded 0.7 percent on a seasonally adjusted annualized rate during the first three months of the year.

Industry Research | Apr 28, 2017

A/E Industry lacks planning, but still spending large on hiring

The average 200-person A/E Firm is spending $200,000 on hiring, and not budgeting at all.

Market Data | Apr 19, 2017

Architecture Billings Index continues to strengthen

Balanced growth results in billings gains in all regions.

Market Data | Apr 13, 2017

2016’s top 10 states for commercial development

Three new states creep into the top 10 while first and second place remain unchanged.

Market Data | Apr 6, 2017

Architecture marketing: 5 tools to measure success

We’ve identified five architecture marketing tools that will help your firm evaluate if it’s on the track to more leads, higher growth, and broader brand visibility.

Market Data | Apr 3, 2017

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.