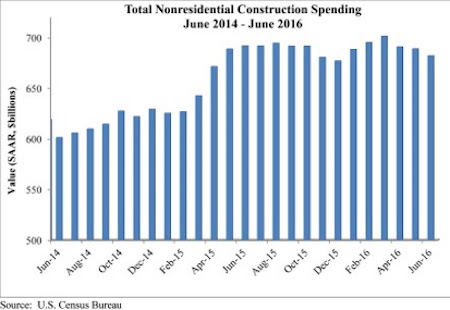

Nonresidential construction spending dipped 1 percent in June and has now contracted for three consecutive months according to analysis of U.S. Census Bureau data released today by Associated Builders and Contractors (ABC). Nonresidential spending, which totaled $682 billion on a seasonally adjusted, annualized rate, has fallen 1.1 percent on a year-over-year basis, marking the first time nonresidential spending has declined on an annual basis since July 2013.

“On a monthly basis, the numbers are not as bad as they seem, as May’s nonresidential construction spending estimate was revised higher. However, this fails to explain the first year-over-year decline in nearly three years,” says ABC Chief Economist Anirban Basu.

“Thanks in part to the investment of foreign capital in America, spending related to office space and lodging are up by more than 16 percent year-over-year,” says Basu. The global economy is weak, and international investors are searching for yield and stability. U.S. commercial real estate has become a popular destination for foreign capital. However, the weakness of the global economy may also help explain the decline in manufacturing-related construction spending of nearly 5 percent for the month and more than 10 percent year-over-year.

Consumer spending is the only significant driver of economic growth in America right now and public sector spending does not look like it will accelerate in the near future, despite a federal highway bill that was pasted last year, Basu explains.

Precisely half of the 16 nonresidential subsectors expanded in June. Two of the largest subsectors—manufacturing and commercial—experienced significant contractions in June, however, and were responsible for a majority of the dip in spending.

Tepid spending by public agencies also continues to shape the data. Despite a monthly pick-up in spending, water-supply construction spending is down 14 percent on a year-over-year basis. Public safety construction spending is down 8.4 percent from a year ago, sewage and waste disposal by nearly 15 percent, highway and street by about 6 percent, education by 4 percent and transportation by more than 3 percent.

Related Stories

Market Data | Aug 2, 2017

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Game rooms and game simulators popular amenities in multifamily developments

The number of developments providing space for physical therapy was somewhat surprising, according to a new survey.

Architects | Jul 25, 2017

AIA 2030 Commitment expands beyond 400 architecture firms

The 2016 Progress Report is now available.

Market Data | Jul 25, 2017

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.

Industry Research | Jul 6, 2017

The four types of strategic real estate amenities

From swimming pools to pirate ships, amenities (even crazy ones) aren’t just perks, but assets to enhance performance.

Market Data | Jun 29, 2017

Silicon Valley, Long Island among the priciest places for office fitouts

Coming out on top as the most expensive market to build out an office is Silicon Valley, Calif., with an out-of-pocket cost of $199.22.

Industry Research | Jun 27, 2017

What does the client really want?

In order to deliver superior outcomes to our healthcare clients, we have to know what our clients want.

Industry Research | Jun 26, 2017

Time to earn an architecture license continues to drop

This trend is driven by candidates completing the experience and examination programs concurrently and more quickly.

Industry Research | Jun 22, 2017

ABC's Construction Backlog Indicator rebounds in 2017

The first quarter showed gains in all categories.