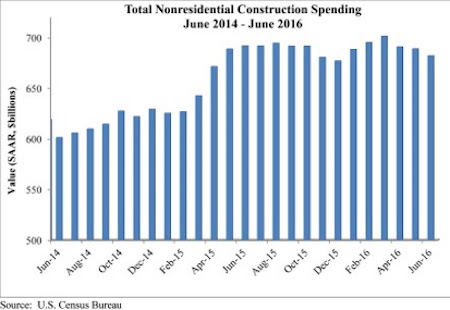

Nonresidential construction spending dipped 1 percent in June and has now contracted for three consecutive months according to analysis of U.S. Census Bureau data released today by Associated Builders and Contractors (ABC). Nonresidential spending, which totaled $682 billion on a seasonally adjusted, annualized rate, has fallen 1.1 percent on a year-over-year basis, marking the first time nonresidential spending has declined on an annual basis since July 2013.

“On a monthly basis, the numbers are not as bad as they seem, as May’s nonresidential construction spending estimate was revised higher. However, this fails to explain the first year-over-year decline in nearly three years,” says ABC Chief Economist Anirban Basu.

“Thanks in part to the investment of foreign capital in America, spending related to office space and lodging are up by more than 16 percent year-over-year,” says Basu. The global economy is weak, and international investors are searching for yield and stability. U.S. commercial real estate has become a popular destination for foreign capital. However, the weakness of the global economy may also help explain the decline in manufacturing-related construction spending of nearly 5 percent for the month and more than 10 percent year-over-year.

Consumer spending is the only significant driver of economic growth in America right now and public sector spending does not look like it will accelerate in the near future, despite a federal highway bill that was pasted last year, Basu explains.

Precisely half of the 16 nonresidential subsectors expanded in June. Two of the largest subsectors—manufacturing and commercial—experienced significant contractions in June, however, and were responsible for a majority of the dip in spending.

Tepid spending by public agencies also continues to shape the data. Despite a monthly pick-up in spending, water-supply construction spending is down 14 percent on a year-over-year basis. Public safety construction spending is down 8.4 percent from a year ago, sewage and waste disposal by nearly 15 percent, highway and street by about 6 percent, education by 4 percent and transportation by more than 3 percent.

Related Stories

Market Data | Nov 15, 2017

Architecture Billings bounce back

Business conditions remain uneven across regions.

Market Data | Nov 14, 2017

U.S. construction starts had three consecutive quarters of positive growth in 2017

ConstructConnect’s quarterly report shows the most significant annual growth in the civil engineering and residential sectors.

Market Data | Nov 3, 2017

New construction starts in 2018 to increase 3% to $765 billion: Dodge report

Dodge Outlook Report predicts deceleration but still growth, reflecting a mixed pattern by project type.

Market Data | Nov 2, 2017

Construction spending up in September; Down on a YOY basis

Nonresidential construction spending is down 2.9% on a year-over-year basis.

Sponsored | Industry Research | Oct 26, 2017

Get clients to pay you faster with these five tips

Here are 5 ways to avoid a cash crunch by doing your part to help clients make their payments on time.

Market Data | Oct 19, 2017

Architecture Billings Index backslides slightly

Business conditions easing in the West.

Industry Research | Oct 9, 2017

AEC website design trends in 2017 – Planning for 2018

A website that’s behind the times is hurting your business.

Industry Research | Oct 3, 2017

Nonresidential construction spending stabilizes in August

Spending on nonresidential construction services is still down on a YOY basis.

Market Data | Sep 21, 2017

Architecture Billings Index continues growth streak

Design services remain in high demand across all regions and in all major sectors.

Market Data | Sep 21, 2017

How brand research delivers competitive advantage

Brand research is a process that firms can use to measure their reputation and visibility in the marketplace.