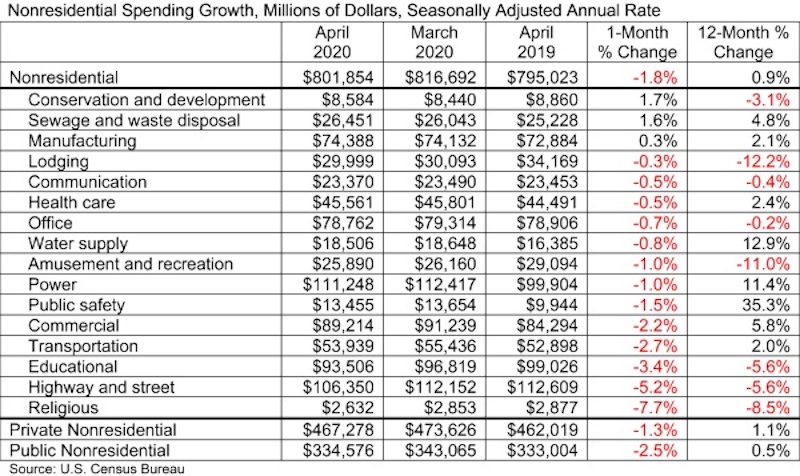

National nonresidential construction spending decreased by 1.8% in April, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, spending totaled $801.8 billion for the month, a 0.9% increase from April 2019.

Of the 16 subcategories, 13 were down on a monthly basis. Private nonresidential spending declined 1.3% in April, while public nonresidential construction spending was down 2.5% for the month.

“Nonresidential construction has fared far better than most economic segments during the COVID-19 crisis, but the industry’s headline spending numbers fail to fully capture the damage inflicted on many key segments by the pandemic,” said ABC Chief Economist Anirban Basu. “For instance, spending in the lodging category was down more than 12% in April relative to a year ago and down 11% in the amusement and recreation category. Spending is also down meaningfully in a number of categories that are public-sector intensive, including education and highway/street.

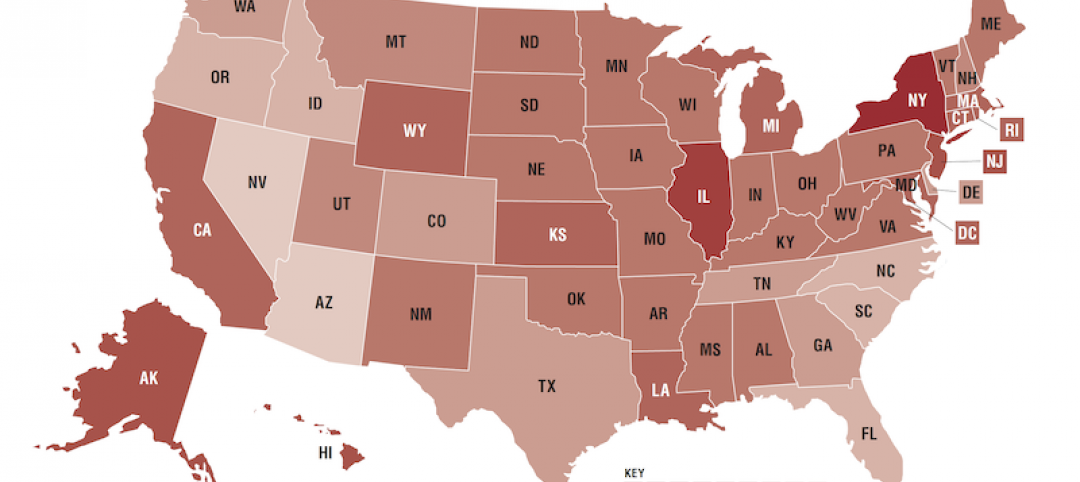

“In much of the nation, construction was deemed an essential industry, which helped to mitigate spending decreases,” said Basu. “But in many places, including in New York, New Jersey, Boston, Pennsylvania and California, construction was deemed nonessential. That has rendered ongoing work and backlog—which stood at 7.8 months in April, according to ABC’s Construction Backlog Indicator—less of an effective shield against the early stages of the broader economic downturn than it is normally. The nonresidential construction spending data would have been far worse but for a massive increase in spending in the public safety category, which is up 35% year over year due to investments made to shore up capacity to deal with COVID-19.

“As the nation slowly reopens, nonresidential contractors will face many challenges,” said Basu. “State and local government finances have been compromised, jeopardizing infrastructure spending going forward. Many office suites and storefronts have been vacated, which will suppress demand for new construction going forward. Capital will also be scarcer, resulting in greater difficulty securing financing for projects. Moreover, if the past is prologue, many dislocated construction workers will find jobs in other industries, given construction’s tendency to be among the last economic segments to fully recover.”

Related Stories

Market Data | Nov 14, 2019

Construction input prices unchanged in October

Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.

Market Data | Nov 5, 2019

Construction and real estate industry deals in September 2019 total $21.7bn globally

In terms of number of deals, the sector saw a drop of 4.4% over the last 12-month average.

Market Data | Nov 4, 2019

Nonresidential construction spending rebounds slightly in September

Private nonresidential spending fell 0.3% on a monthly basis and is down 5.7% compared to the same time last year.

Market Data | Nov 1, 2019

GDP growth expands despite reduction in nonresident investment

The annual rate for nonresidential fixed investment in structures declined 15.3% in the third quarter.

Market Data | Oct 24, 2019

Architecture Billings Index downturn moderates as challenging conditions continue

The Architecture Billings Index (ABI) score in September is 49.7.

Market Data | Oct 23, 2019

ABC’s Construction Backlog Indicator rebounds in August

The primary issue for most contractors is not a lack of demand, but an ongoing and worsening shortage of skilled workers available to meet contractual requirements.

Multifamily Housing | Oct 16, 2019

A new study wonders how many retiring adults will be able to afford housing

Harvard’s Joint Center for Housing Studies focuses on growing income disparities among people 50 or older.

Market Data | Oct 9, 2019

Two ULI reports foresee a solid real estate market through 2021

Market watchers, though, caution about a “surfeit” of investment creating a bubble.

Market Data | Oct 4, 2019

Global construction output growth will decline to 2.7% in 2019

It will be the slowest pace of growth in a decade, according to GlobalData.