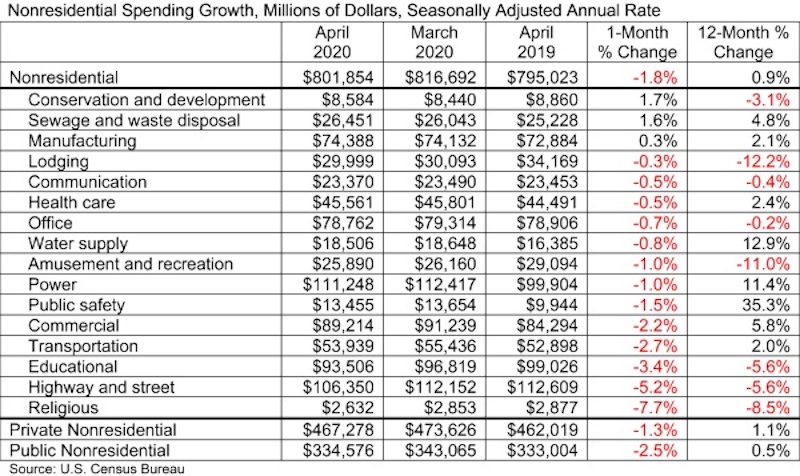

National nonresidential construction spending decreased by 1.8% in April, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, spending totaled $801.8 billion for the month, a 0.9% increase from April 2019.

Of the 16 subcategories, 13 were down on a monthly basis. Private nonresidential spending declined 1.3% in April, while public nonresidential construction spending was down 2.5% for the month.

“Nonresidential construction has fared far better than most economic segments during the COVID-19 crisis, but the industry’s headline spending numbers fail to fully capture the damage inflicted on many key segments by the pandemic,” said ABC Chief Economist Anirban Basu. “For instance, spending in the lodging category was down more than 12% in April relative to a year ago and down 11% in the amusement and recreation category. Spending is also down meaningfully in a number of categories that are public-sector intensive, including education and highway/street.

“In much of the nation, construction was deemed an essential industry, which helped to mitigate spending decreases,” said Basu. “But in many places, including in New York, New Jersey, Boston, Pennsylvania and California, construction was deemed nonessential. That has rendered ongoing work and backlog—which stood at 7.8 months in April, according to ABC’s Construction Backlog Indicator—less of an effective shield against the early stages of the broader economic downturn than it is normally. The nonresidential construction spending data would have been far worse but for a massive increase in spending in the public safety category, which is up 35% year over year due to investments made to shore up capacity to deal with COVID-19.

“As the nation slowly reopens, nonresidential contractors will face many challenges,” said Basu. “State and local government finances have been compromised, jeopardizing infrastructure spending going forward. Many office suites and storefronts have been vacated, which will suppress demand for new construction going forward. Capital will also be scarcer, resulting in greater difficulty securing financing for projects. Moreover, if the past is prologue, many dislocated construction workers will find jobs in other industries, given construction’s tendency to be among the last economic segments to fully recover.”

Related Stories

Market Data | Jun 3, 2019

Nonresidential construction spending up 6.4% year over year in April

Among the 16 sectors tracked by the U.S. Census Bureau, nine experienced an increase in monthly spending, led by water supply and highway and street.

Market Data | Jun 3, 2019

4.1% annual growth in office asking rents above five-year compound annual growth rate

Market has experienced no change in office vacancy rates in three quarters.

Market Data | May 30, 2019

Construction employment increases in 250 out of 358 metros from April 2018 to April 2019

Demand for work is outpacing the supply of workers.

Market Data | May 24, 2019

Construction contractors confidence remains high in March

More than 70% of contractors expect to increase staffing levels over the next six months.

Market Data | May 22, 2019

Slight rebound for architecture billings in April

AIA’s ABI score for April showed a small increase in design services at 50.5 in April.

Market Data | May 9, 2019

The U.S. hotel construction pipeline continues to grow in the first quarter as the economy shows surprising strength

Projects currently under construction stand at 1,709 projects/227,924 rooms.

Market Data | May 9, 2019

Construction input prices continue to rise

Nonresidential input prices rose 0.9% compared to March and are up 2.8% on an annual basis.

Market Data | May 7, 2019

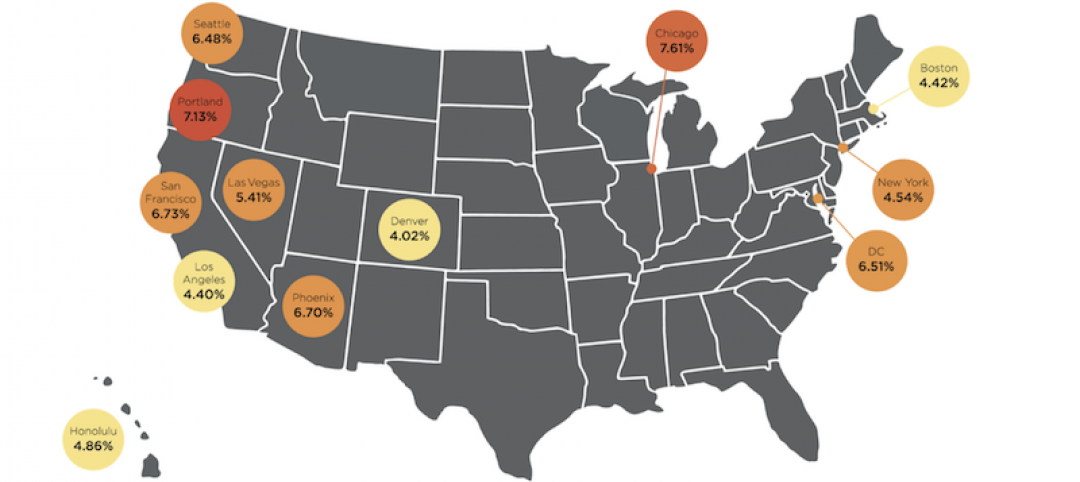

Construction costs in major metros continued to climb last year

Latest Rider Levett Bucknall report estimates rise at more than double the rate of 2018 Growth Domestic Product.

Market Data | Apr 29, 2019

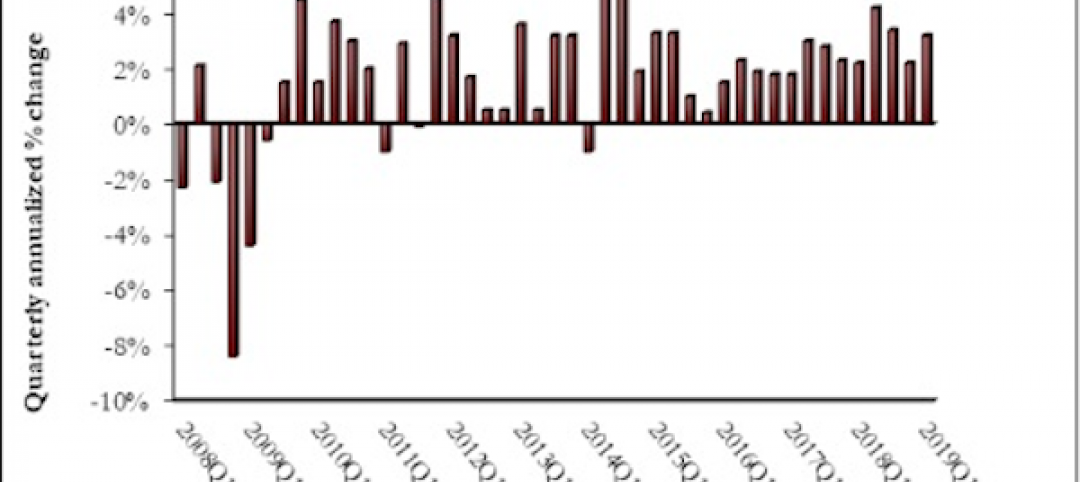

U.S. economic growth crosses 3% threshold to begin the year

Growth was fueled by myriad factors, including personal consumption expenditures, private inventory investment, surprisingly rapid growth in exports, state and local government spending and intellectual property.

Market Data | Apr 18, 2019

ABC report: 'Confidence seems to be making a comeback in America'

The Construction Confidence Index remained strong in February, according to the Associated Builders and Contractors.