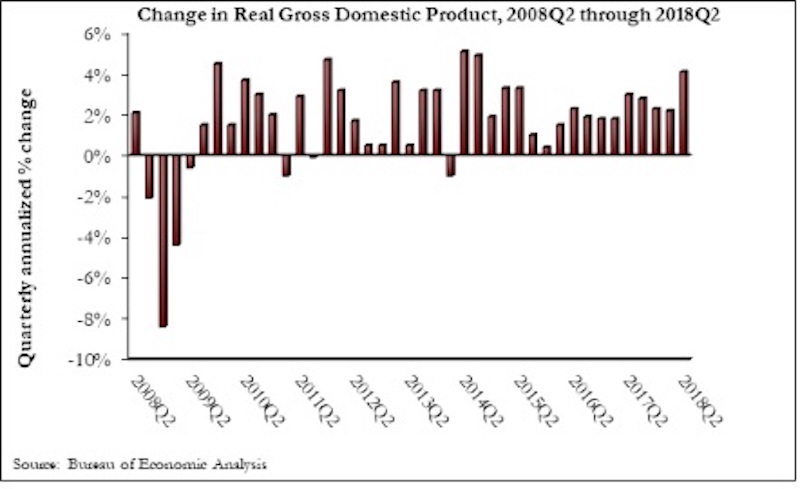

The U.S. economy expanded at an annualized 4.1% rate during the second quarter of 2018—the fastest rate of quarterly growth since the second quarter of 2014, according to an Associated Builders and Contractors analysis of U.S. Bureau of Economic Analysis data released today.

Nonresidential fixed investment represented an especially important element of second quarter strength in the advance estimate. While overall fixed investment expanded at a 5.4% annualized pace, nonresidential fixed investment grew 7.3%. The nonresidential sub-component exhibiting the most upward force was structures, which grew at a 13.3% annualized pace and by 13.9% during the year’s initial quarter.

Today’s data release helps explain why nonresidential contractors continue to report hefty backlog and scramble for human capital. By contrast, the residential segment, which continues to be impacted by rising mortgage rates and the lowest level of housing affordability in a decade, contracted at a 1.1% annualized rate and has now shrunk during three of the previous four quarters.

“It is quite remarkable that an economy now in its 10th year of economic expansion is actually gaining steam,” said ABC Chief Economist Anirban Basu. “A host of forces are at work, including elevated levels of confidence among business owners, developers and others who drive investment in America. Meanwhile, the consumer, supported by the strongest labor market in about two decades, continues to reliably contribute to economic growth. The result is an economy that is now on its way to a potential 3% growth year.

“As always, there are reasons to temper optimism,” said Basu. “Some of second quarter growth was driven by aggressive purchases of American output (e.g. soybeans) in advance of the imposition of retaliatory tariffs. That helped bulk up exports, but that pattern may not continue during the third quarter. The rapidly expanding economy is also serving to exacerbate inflationary pressures, which in turn are likely to drive borrowing costs higher. In other words, today’s strong economic growth may translate into weaker economic growth at some point in the future, and there is plenty of precedent for such a dynamic.

“Contractors can rest assured that the economy will retain its momentum through the balance of the year,” said Basu. “While financial markets may remain volatile and the global news cycle will undoubtedly continue to swirl, leading indicators, including those related to the level of observable activity among engineers, architects and other design professionals, suggest that another wave of building construction is on the way. The tax cuts passed late last year are just now beginning to have an impact. The hope is that tax reform will trigger a structural shift in the U.S. economy by helping to expand productivity and the economy’s long-term growth potential.The other possibility is that the tax reform’s primary effects will be to lift short-term growth, expand federal budget deficits, and ultimately give way to a countervailing reform at some point in the future.”

Related Stories

Industry Research | Dec 28, 2022

Following a strong year, design and construction firms view 2023 cautiously

The economy and inflation are the biggest concerns for U.S. architecture, construction, and engineering firms in 2023, according to a recent survey of AEC professionals by the editors of Building Design+Construction.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Market Data | Dec 13, 2022

Contractors' backlog of work reaches three-year high

U.S. construction firms have, on average, 9.2 months of work in the pipeline, according to ABC's latest Construction Backlog Indicator.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.

Market Data | Nov 15, 2022

Construction demand will be a double-edged sword in 2023

Skanska’s latest forecast sees shorter lead times and receding inflation, but the industry isn’t out of the woods yet.

Reconstruction & Renovation | Nov 8, 2022

Renovation work outpaces new construction for first time in two decades

Renovations of older buildings in U.S. cities recently hit a record high as reflected in architecture firm billings, according to the American Institute of Architects (AIA).

Market Data | Nov 3, 2022

Building material prices have become the calm in America’s economic storm

Linesight’s latest quarterly report predicts stability (mostly) through the first half of 2023

Building Team | Nov 1, 2022

Nonresidential construction spending increases slightly in September, says ABC

National nonresidential construction spending was up by 0.5% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Hotel Facilities | Oct 31, 2022

These three hoteliers make up two-thirds of all new hotel development in the U.S.

With a combined 3,523 projects and 400,490 rooms in the pipeline, Marriott, Hilton, and InterContinental dominate the U.S. hotel construction sector.