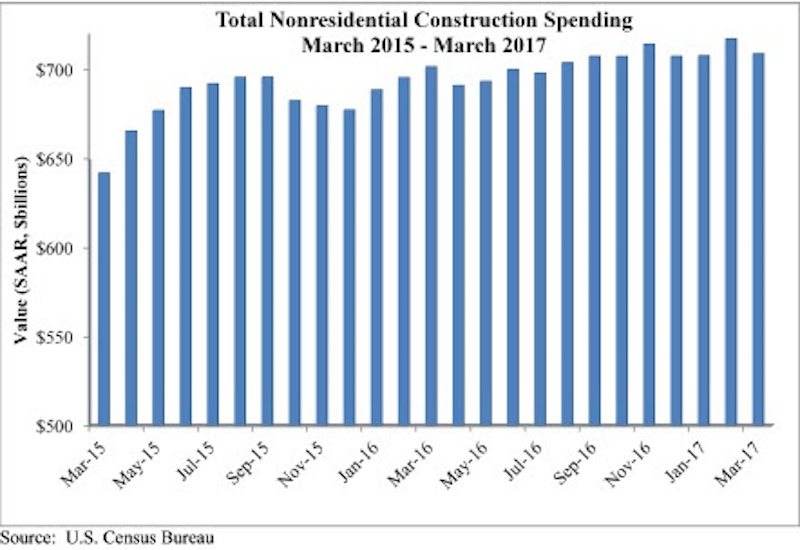

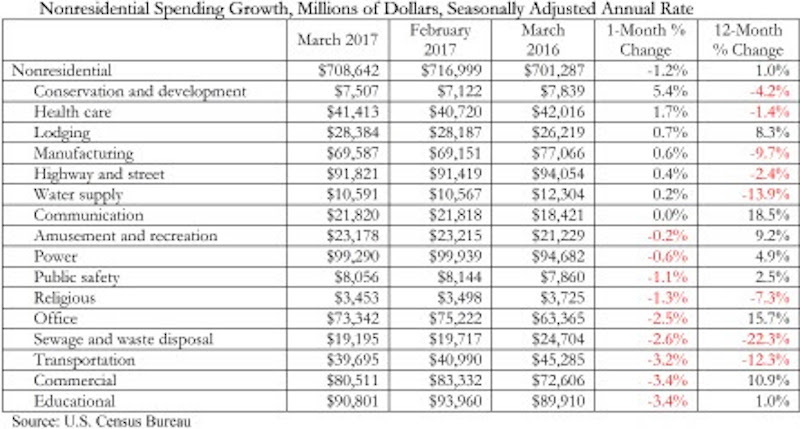

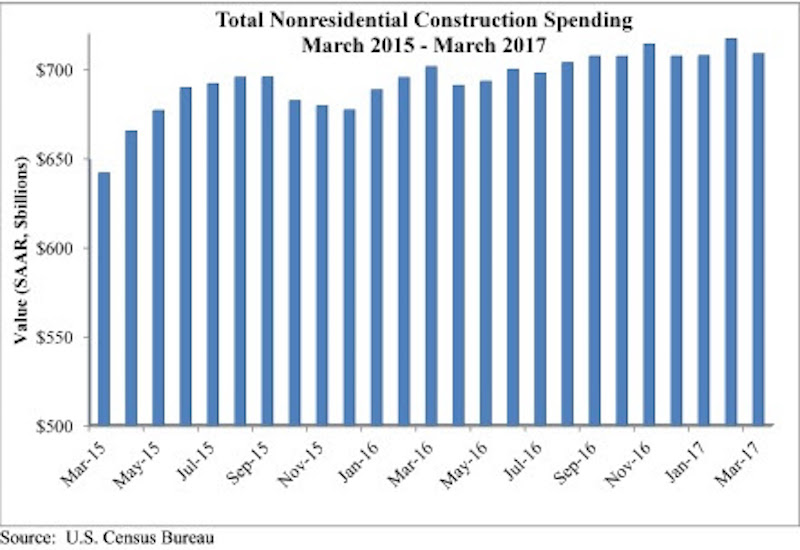

Nonresidential construction spending fell 1.2 percent in March, according to analysis of U.S. Census Bureau data recently released by Associated Builders and Contractors (ABC). Spending in the segment totaled $708.6 billion on a seasonally adjusted, annualized basis, however the decline is less dramatic than it may be perceived to be given that February’s initial estimate of $701.6 billion was upwardly revised to $717 billion, making it the highest level or spending recorded in the data series.

In March, private nonresidential construction spending fell 1.3 percent for the month, but remains up 6.4 percent on a year-ago basis. Public nonresidential spending decreased by 0.9 percent and is down 6.5 percent year over year. Were it not for the manufacturing subsector, where spending has contracted 9.7 percent from the same time last year, overall spending would have increased from February and set a new record high for construction spending.

“There are at least two tales to tell, and neither one of them is particularly uplifting,” said ABC Chief Economist Anirban Basu. “One narrative relates to public spending, which remains soft. Even categories in which one might have expected spending growth have not experienced an increase over past year. For instance, one might have anticipated stepped-up spending in the water supply category given the events in Flint, Mich. But spending in that category is down by roughly 14 percent over the past year. Similarly, one might have predicted spending increases in the highway and street category since the Fixing America’s Surface Transportation Act was passed in December 2015. However, spending in that category is down 2.4 percent on a year-over-year basis.

“Private construction spending has lost momentum as well, perhaps because developers and their financiers are becoming increasingly unnerved by the possibility of mini-bubbles in certain commercial real estate segments,” said Basu. “Many investors may also have adopted a wait-and-see attitude regarding policies coming out of Washington, D.C., including those related to proposed tax reform and infrastructure spending initiatives. Perhaps as a result, office and commercial-related construction spending declined in March. Still, other data suggest lingering momentum in various privately-financed segments, and data from the most recent GDP report indicate that investors continue to invest aggressively in structures. It is for this reason that today’s construction spending release is at least somewhat surprising with respect to private investment in structures. An upward revision to today’s data may be forthcoming.

“Looking ahead, all eyes are on Washington, D.C,” said Basu. “A pro-business agenda remains in the works, but little of it has been implemented thus far. Financial markets continue to express confidence regarding the ultimate execution of significant portions of this agenda, but if it remains bogged down politically, market confidence will wane and private construction spending will continue to be erratic.”

Related Stories

Apartments | Jun 25, 2024

10 hardest places to find an apartment in 2024

The challenge of finding an available rental continues to increase for Americans nation-wide. On average, there are eight prospective tenants vying for the same vacant apartment.

MFPRO+ News | Jun 20, 2024

National multifamily outlook: Summer 2024

The multifamily sector continues to be strong in 2024, even when a handful of challenges are present. That is according to the Matrix Multifamily National Report for Summer 2024.

MFPRO+ News | Jun 11, 2024

Rents rise in multifamily housing for May 2024

Multifamily rents rose for the fourth month in a row, according to the May 2024 National Multifamily Report. Up 0.6% year-over-year, the average U.S. asking rent increased by $6 in May, up to $1,733.

Apartments | Jun 4, 2024

Apartment sizes on the rise after decade-long shrinking trend

The average size of new apartments in the U.S. saw substantial growth in 2023, bouncing back to 916 sf after a steep decline the previous year. That is according to a recent RentCafe market insight report released this month.

HVAC | May 28, 2024

Department of Energy unveils resources for deploying heat pumps in commercial buildings

To accelerate adoption of heat pump technology in commercial buildings, the U.S. Department of Energy is offering resources and guidance for stakeholders. DOE aims to help commercial building owners and operators reduce greenhouse gas emissions and operating costs by increasing the adoption of existing and emerging heat pump technologies.

Student Housing | May 28, 2024

Student housing remains strong in May 2024

Although the pace has slowed down this year, student housing preleasing for the 2024–2025 season reached 73.5% in April, 50 basis points year-over-year (YOY).

Mixed-Use | May 22, 2024

Multifamily properties above ground-floor grocers continue to see positive rental premiums

Optimizing land usage is becoming an even bigger priority for developers. In some city centers, many large grocery stores sprawl across valuable land.

Office Buildings | May 20, 2024

10 spaces that are no longer optional to create a great workplace

Amenities are no longer optional. The new role of the office is not only a place to get work done, but to provide a mix of work experiences for employees.

Contractors | May 15, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of April 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator increased to 8.4 months in April, according to an ABC member survey conducted April 22 to May 6. The reading is down 0.5 months from April 2023, but expanded 0.2 months from the prior month.

MFPRO+ News | May 13, 2024

Special multifamily report indicates ‘two supply scenarios’

Could we be headed towards a “period of stagflation?” That's the question Andrew Semmes, Senior Research Analyst, poses in the Matrix May 2024 Multifamily Rent Forecast update.