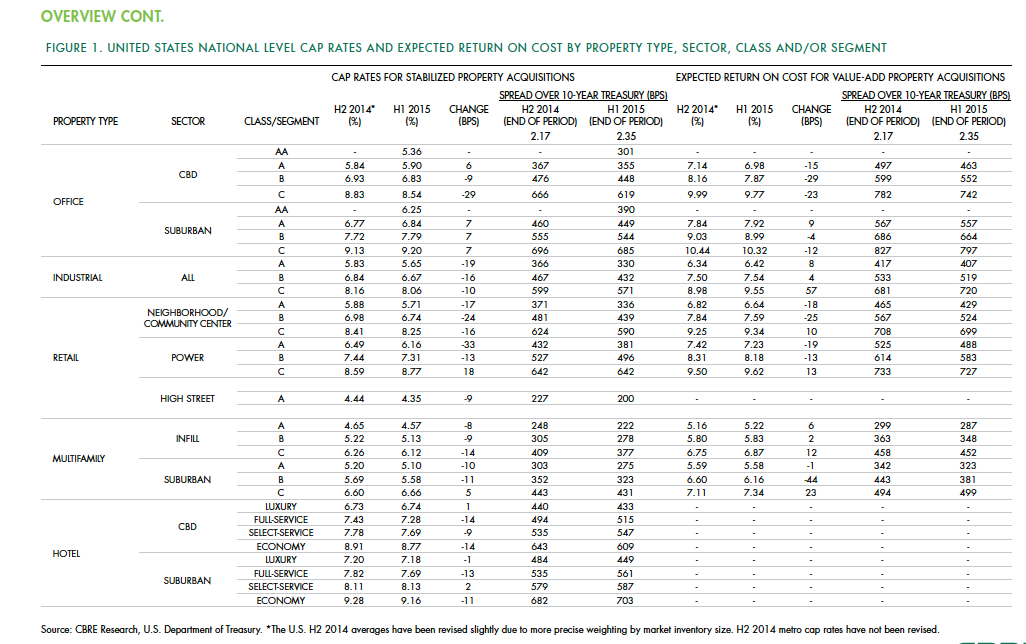

Cap rates for real estate across most asset sectors is expected to remain stable in the second half of 2015, following a first half during which the U.S. commercial real estate market continued to perform well and attract substantial investor interest.

According to the CBRE North America Cap Rate Survey, which tracks activity in 46 major U.S. markets and 10 markets in Canada during the first six months of the year, national cap rates for industrial facilities in the U.S. experienced “very modest” cap-rate declines of 10 to 19 basis points. CBRE estimates that cap rates for stabilized Class A industrial assets was 5.65%.

Class A infill multifamily cap rates were 4.57% in the first half of the year, the second-lowest of all product types. The retail sector had the most significant national cap rate compression, followed by hotels. CBRE suggests that retail and hotels were the sectors that took the longest to recover from the past recession, “therefore, it is not surprising that the cap rate declines are greater in these sectors than those more mature in the real estate cycle.”

Central Business District Class B and C office cap rates were slightly off in the first half, but not Class A offices, “one example of investors moving out of on the risk curve,” CBRE notes. And despite sales volume gains, suburban office cap rates rose, on average, by 7 basis points.

Details from this report, as well as CBRE’s near-term predictions, include the following:

• Interest rates, a big demand driver in the commercial real estate space, are expected to rise modestly. The 10-year Treasury is projected to increase to 2.61% in the second half of 2015, and to 3.19% in 2016. However, “the near-term outlook of higher interest rates is not necessarily going to translate into higher cap rates if the rates come from stronger economic growth, as expected, as opposed to an unexpected shock to the economic system,” CBRE writes.

• CRBE doesn’t expect any cap rate movement in the second half of 2015 for office assets in the majority of markets, and only modest declines in those asset classes that do change. Jacksonville and Cincinnati are expected to experience the largest cap rate declines in Class A acquisitions.

• Transaction activity in the U.S. industrial sector during the first half of 2015 rose 70% to $37 billion. CBRE expects the full-year gain over 2014 to be 40% or greater. Cap rates in this sector are expected to fall modestly in more than one-third of the markets surveyed. Larger declines of 25 basis points or more are expected in Class B and C stabilized properties in Philadelphia and St. Louis. On the other hand, 58% of the market surveyed should experience no change to stabilized industrial cap rates.

• Retail investment in the first half of 2015 rose 12% to $45.6 billion. The “mall and other” category in this sector grew by 14%. CBRE expects investment to accelerate modestly through the remainder of the year. As far as cap rates are concerned, Class B experienced the largest average decline of 24 basis points. And four markets—San Jose, San Francisco, Los Angeles, and Orange County, Calif.—all had Class A caps under 5%.

• In the first six months of 2015, sales of multifamily properties jumped 38% to 63.2 billion. One-third of that capital went to mid- and high-rise projects. For Class A infill assets, San Francisco had the lowest cap rate, at 3.75%. Of the 44 markets surveyed in this sector, 33 had cap rates of 5% or less. CRBE is predicting no cap rate change for acquisitions of stabilized infill multifamily assets in the second half of the year for more than 80% of the markets surveyed. But cap compression should occur in Nashville, Washington D.C., Baltimore, Indianapolis, and Detroit.

• Investment in U.S. hotels, at $26.9 billion, was 67% higher than in the first half of 2014. The vast majority of hotel investors are domestic, especially outside of major cities. CBRE suggests, though, that hotel pricing, as measured by cap rates, has peaked for high-end products in top-tier markets. “But it’s too early to definitively make that call,” it writes. CRBE expects cap rates for acquisitions of stabilized hotel properties to remain “broadly stable” in the second half of 2015, with 62% of markets tracked experiencing no change. Any noticeable compression is likely to occur in Tier I metros like Las Vegas and Orlando, and Tier III markets such as Tampa, Jacksonville, Austin, and Pittsburgh.

Related Stories

Mixed-Use | Jun 1, 2023

The Moore Building, a 16-story office and retail development, opens in Nashville’s Music Row district

Named after Elvis Presley’s onetime guitarist, The Moore Building, a 16-story office building with ground-floor retail space, has opened in Nashville’s Music Row district. Developed by Portman and Creed Investment Company and designed by Gresham Smith, The Moore Building offers 236,000 sf of office space and 8,500 sf of ground-floor retail.

Office Buildings | May 24, 2023

The future of work: What to expect in 2023

While no one disagrees that the workplace has undergone tectonic changes, it is less clear how to understand these shifts and synthesize them into practical action for the coming year.

Multifamily Housing | May 23, 2023

One out of three office buildings in largest U.S. cities are suitable for residential conversion

Roughly one in three office buildings in the largest U.S. cities are well suited to be converted to multifamily residential properties, according to a study by global real estate firm Avison Young. Some 6,206 buildings across 10 U.S. cities present viable opportunities for conversion to residential use.

Headquarters | May 16, 2023

Workplace HQ for party clothing company Shinesty celebrates its bold, whimsical products

The new Denver headquarters for Shinesty, a party clothing company, was designed to match the brand’s fun image with an iconic array of colors, textures, and prints curated by the design agency, Maximalist. Shinesty’s mission, to challenge the world to live more freely and “take itself less seriously,” is embodied throughout the office interior.

Office Buildings | May 15, 2023

Sixteen-story office tower will use 40% less energy than an average NYC office building

This month marks the completion of a new 16-story office tower that is being promoted as New York City’s most sustainable office structure. That boast is backed by an innovative HVAC system that features geothermal wells, dedicated outdoor air system (DOAS) units, radiant heating and cooling, and a sophisticated control system to ensure that the elements work optimally together.

Headquarters | May 15, 2023

The new definition of Class A property

Dan Cheetham, Managing Director and Founder of FYOOG, believes organizations returning to a "hub and spoke" model could have a profound effect on properties once considered Class B.

Headquarters | May 9, 2023

New Wells Fargo development in Texas will be bank’s first net-positive campus

A new Wells Fargo development in the Dallas metroplex will be the national bank’s first net-positive campus, expected to generate more energy than it uses. The 850,000-sf project on 22 acres will generate power from solar panels and provide electric vehicle charging stations.

Digital Twin | May 8, 2023

What AEC professionals should know about digital twins

A growing number of AEC firms and building owners are finding value in implementing digital twins to unify design, construction, and operational data.

Office Buildings | May 5, 2023

9 workplace design trends for 2023

HOK Director of WorkPlace Kay Sargent and Director of Interiors Tom Polucci discuss the trends shaping office design in 2023.

Office Buildings | May 4, 2023

In Southern California, a former industrial zone continues to revitalize with an award-winning office property

In Culver City, Calif., Del Amo Construction, a construction company based in Southern California, has completed the adaptive reuse of 3516 Schaefer St, a new office property. 3516 Schaefer is located in Culver City’s redeveloped Hayden Tract neighborhood, a former industrial zone that has become a technology and corporate hub.