Only 16 states and the District of Columbia have added construction jobs since just before the start of the pandemic in February 2020, according to a new analysis of federal employment data released today by the Associated General Contractors of America. Association officials noted that prospects for the sector’s recovery will be diminished should the House-passed Build Back Better bill become law.

“Although activity picked up in most states in October, construction employment remains below pre-pandemic levels in two out of three states,” said Ken Simonson, the association’s chief economist. “The record number of job openings shows contractors are eager to hire more workers but can’t find enough qualified applicants.”

From February 2020—the month before the pandemic caused projects to be halted or canceled—to last month, construction employment decreased in 33 states, stalled in Hawaii, and increased in only 16 states and D.C. Texas shed the most construction jobs over the period (-46,400 jobs or -5.9%), followed by New York (-42,800 jobs, -10.5%) and California (-21,300 jobs, -2.3%). The largest percentage losses were in Wyoming (-14.0%, -3,200 jobs), New York, and Vermont (-9.8%, -1,500 jobs),

Utah added the most construction jobs since February 2020 (8,200 jobs, 7.2%), followed by North Carolina (7,700 jobs, 3.3%), Washington (4,900 jobs, 2.2%), and Idaho (4,900 jobs, 8.9%). The largest percentage gains were in South Dakota (10.5%, 2,500 jobs), Idaho, and Utah.

From September to October construction employment decreased in 14 states, increased in 34 states and D.C., and was unchanged in Alabama and Virginia. South Carolina lost the most construction jobs over the month (-1,900 jobs, -1.7%), followed by Missouri (-1,500 jobs, -1.2%). The largest percentage decline was in New Hampshire (-2.2%, -600 jobs), followed by Vermont (-2.1%, -300 jobs).

Louisiana added the largest number and percentage of construction jobs between September and October (8,200 jobs, 7.1%). California was second in construction job gains (7,500 jobs, 0.8%), while West Virginia had the second-highest percentage increase (2.3%, 700 jobs).

Association officials cautioned that the Build Back Better measure, which passed in the House earlier today, will undermine the construction sector’s recovery. They noted that the measure’s tax and labor provisions will stifle investments in construction activity and make it even harder for firms to find qualified workers to hire. They urged Senators to reject the massive new spending bill.

“The last thing Washington should be doing is making it even harder for firms to find projects to build or workers to hire,” said Stephen E. Sandherr, the association’s chief executive officer. “Yet the hyper-partisan Build Back Better bill will hobble employers with new mandates even as it stifles private sector demand with new taxes and regulations.”

View state February 2020-October 2021 data and rankings, 1-month rankings.

Related Stories

Market Data | Apr 4, 2016

ABC: Nonresidential spending slip in February no cause for alarm

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. The figure is a step back but still significantly higher than one year ago.

Market Data | Mar 30, 2016

10 trends for commercial real estate: JLL report

The report looks at global threats and opportunities, and how CRE firms are managing their expectations for growth.

Market Data | Mar 23, 2016

AIA: Modest expansion for Architecture Billings Index

Business conditions softening most in Midwest in recent months.

Retail Centers | Mar 16, 2016

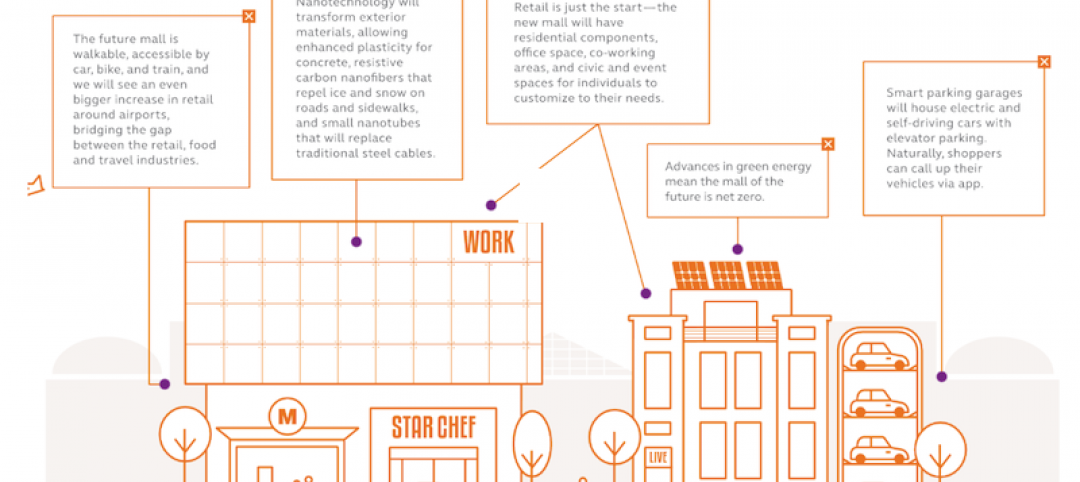

Food and technology will help tomorrow’s malls survive, says CallisonRTKL

CallisonRTKL foresees future retail centers as hubs with live/work/play components.

Market Data | Mar 6, 2016

Real estate execs measure success by how well they manage ‘talent,’ costs, and growth

A new CBRE survey finds more companies leaning toward “smarter” workspaces.

Market Data | Mar 1, 2016

ABC: Nonresidential spending regains momentum in January

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. Spending increased in January in 10 of 16 nonresidential construction sectors.

Market Data | Mar 1, 2016

Leopardo releases 2016 Construction Economics Report

This year’s report shows that spending in 2015 reached the highest level since the Great Recession. Total spending on U.S. construction grew 10.5% to $1.1 trillion, the largest year-over-year gain since 2007.

Market Data | Feb 26, 2016

JLL upbeat about construction through 2016

Its latest report cautions about ongoing cost increases related to finding skilled laborers.

Market Data | Feb 17, 2016

AIA reports slight contraction in Architecture Billings Index

Multifamily residential sector improving after sluggish 2015.

Market Data | Feb 11, 2016

AIA: Continued growth expected in nonresidential construction

The American Institute of Architects’ semi-annual Consensus Construction Forecast indicates a growth of 8% in construction spending in 2016, and 6.7% the following year.