Pent-up demand from the pandemic is creating a general spending surge that is helping to improve the outlook on construction spending over the next two years, according to a new report from the American Institute of Architects (AIA).

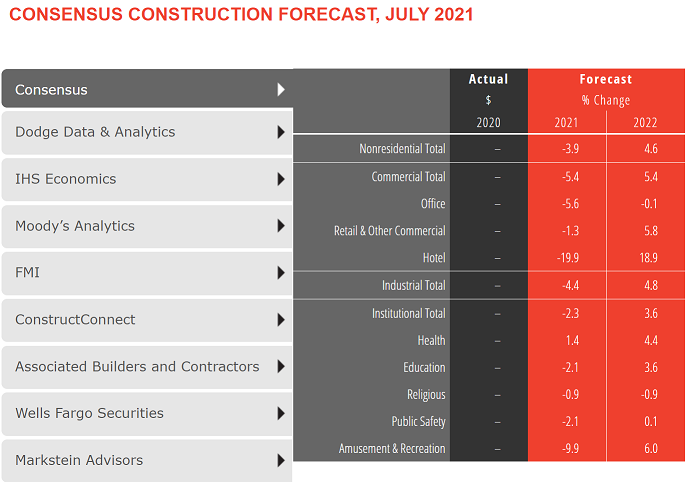

After nonresidential construction spending declined by about 2% last year, the AIA Consensus Construction Forecast Panel, in its mid-year update, is projecting that spending will decline an additional 3.9% this year, which is an improvement from the forecasted 5.7% decline reported in January. Nonresidential construction spending is expected to increase 4.6% in 2022.

The strongest design sector performers for the remainder of this year are expected to be health care facilities, up 1.4%, while a few other sectors should see only minimal declines, like retail, religious, and education. However, in 2022, virtually all the nonresidential building sectors are expected to see healthy growth, paced by lodging, as well as amusement and recreation, both of which saw steep declines during the pandemic.

“Even while momentum is developing behind most of the nonresidential building sectors, there are several potential potholes on the road to a construction recovery,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Inflation is back on the radar screen given the surge in consumer spending, as well as the growing federal debt levels. Also, the global supply chain continues to face serious challenges that persist even well after initial pandemic related disruptions have largely subsided.”

Related Stories

Market Data | Jun 16, 2021

Producer prices for construction materials and services jump 24% over 12 months

The 24.3% increase in prices for materials used in construction from May 2020 to last month was nearly twice as great as in any previous year

Market Data | Jun 15, 2021

ABC’s Construction Backlog inches higher in May

Materials and labor shortages suppress contractor confidence.

Market Data | Jun 11, 2021

The countries with the most green buildings

As the country that set up the LEED initiative, the US is a natural leader in constructing green buildings.

Market Data | Jun 7, 2021

Construction employment slips by 20,000 in May

Seasonally adjusted construction employment in May totaled 7,423,000.

Market Data | Jun 2, 2021

Construction employment in April lags pre-covid February 2020 level in 107 metro areas

Houston-The Woodlands-Sugar Land and Odessa, Texas have worst 14-month construction job losses.

Market Data | Jun 1, 2021

Nonresidential construction spending decreases 0.5% in April

Spending was down on a monthly basis in nine of 16 nonresidential subcategories.

Market Data | Jun 1, 2021

Nonresidential construction outlays drop in April to two-year low

Public and private work declines amid supply-chain woes, soaring costs.

Market Data | May 24, 2021

Construction employment in April remains below pre-pandemic peak in 36 states and D.C.

Texas and Louisiana have worst job losses since February 2020, while Utah and Idaho are the top gainers.

Market Data | May 19, 2021

Design activity strongly increases

Demand signals construction is recovering.

Multifamily Housing | May 18, 2021

Multifamily housing sector sees near record proposal activity in early 2021

The multifamily sector led all housing submarkets, and was third among all 58 submarkets tracked by PSMJ in the first quarter of 2021.