Pent-up demand from the pandemic is creating a general spending surge that is helping to improve the outlook on construction spending over the next two years, according to a new report from the American Institute of Architects (AIA).

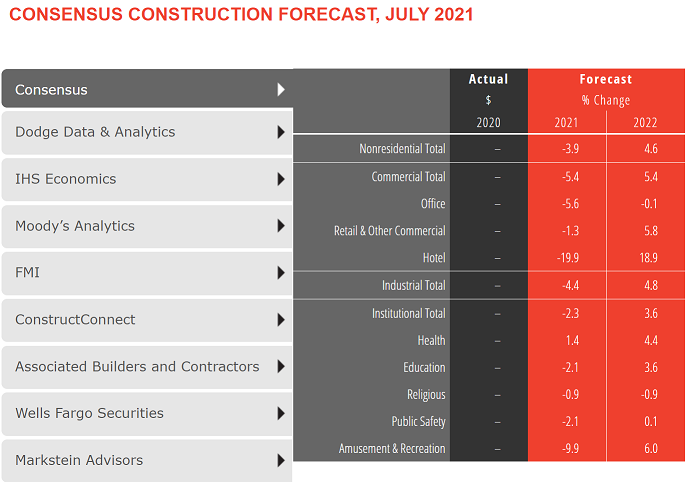

After nonresidential construction spending declined by about 2% last year, the AIA Consensus Construction Forecast Panel, in its mid-year update, is projecting that spending will decline an additional 3.9% this year, which is an improvement from the forecasted 5.7% decline reported in January. Nonresidential construction spending is expected to increase 4.6% in 2022.

The strongest design sector performers for the remainder of this year are expected to be health care facilities, up 1.4%, while a few other sectors should see only minimal declines, like retail, religious, and education. However, in 2022, virtually all the nonresidential building sectors are expected to see healthy growth, paced by lodging, as well as amusement and recreation, both of which saw steep declines during the pandemic.

“Even while momentum is developing behind most of the nonresidential building sectors, there are several potential potholes on the road to a construction recovery,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Inflation is back on the radar screen given the surge in consumer spending, as well as the growing federal debt levels. Also, the global supply chain continues to face serious challenges that persist even well after initial pandemic related disruptions have largely subsided.”

Related Stories

Market Data | May 18, 2021

Grumman|Butkus Associates publishes 2020 edition of Hospital Benchmarking Survey

The report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | May 13, 2021

Proliferating materials price increases and supply chain disruptions squeeze contractors and threaten to undermine economic recovery

Producer price index data for April shows wide variety of materials with double-digit price increases.

Market Data | May 7, 2021

Construction employment stalls in April

Soaring costs, supply-chain challenges, and workforce shortages undermine industry's recovery.

Market Data | May 4, 2021

Nonresidential construction outlays drop in March for fourth-straight month

Weak demand, supply-chain woes make further declines likely.

Market Data | May 3, 2021

Nonresidential construction spending decreases 1.1% in March

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories.

Market Data | Apr 30, 2021

New York City market continues to lead the U.S. Construction Pipeline

New York City has the greatest number of projects under construction with 110 projects/19,457 rooms.

Market Data | Apr 29, 2021

U.S. Hotel Construction pipeline beings 2021 with 4,967 projects/622,218 rooms at Q1 close

Although hotel development may still be tepid in Q1, continued government support and the extension of programs has aided many businesses to get back on their feet as more and more are working to re-staff and re-open.

Market Data | Apr 28, 2021

Construction employment declines in 203 metro areas from March 2020 to March 2021

The decline occurs despite homebuilding boom and improving economy.

Market Data | Apr 20, 2021

The pandemic moves subs and vendors closer to technology

Consigli’s latest market outlook identifies building products that are high risk for future price increases.

Market Data | Apr 20, 2021

Demand for design services continues to rapidly escalate

AIA’s ABI score for March rose to 55.6 compared to 53.3 in February.