The demand for airport security system technology will drive the North America market for “smart” airports to $7.741 billion by 2026, compared to $3.075 billion in 2016, representing a compound annual growth rate of 9.7%, according to a new report released by Market Study Report LLC, a Delaware-based hub for market intelligence products and services.

The report’s findings and predictions are based on primary and secondary research driven by extensive data mining. The estimates and forecasts were verified through primary research with key industry participants.

Airports are seeking ways to provide passengers with better and seamless personalized experiences. The report sees growing demand for automated and self-service processes, as well as for real-time information.

These substantial growth prospects can be attributed to airports enhancing their business processes to provide optimized services. “Airport operators are investing heavily on IT and digital technology for enhancing customer experience,” the report states in its technology outlook.

PASSENGER COMMUNICATIONS WILL BE KEY

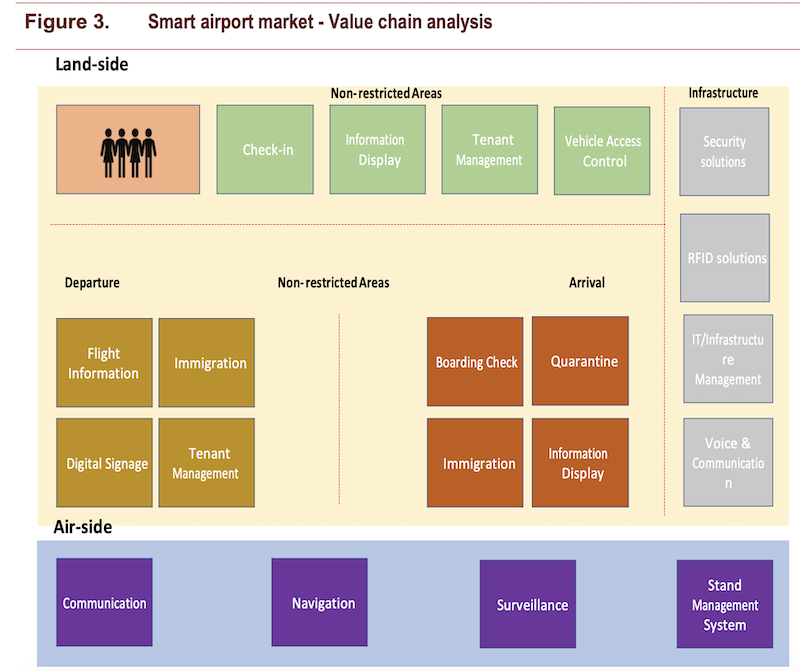

On airports’ land sides, improvements will include the adoption of digital technologies such as transport synchronization, real-time flight information, advanced booking and intelligent passenger steering for enhancing customer experiences and other features.

Airside, expected upgrades cited by the report include in-wallet scanning, geolocation of vehicles, and coordination of vehicles with real-time information of landing aircraft.

Modernization of old airports, introduction of new airports, development in commercial aviation, and increasing focus on green initiatives are other key growth drivers expected to boost market for smart airports in North America.

The new report provides analysis of where smart technology will be expanded, both on the land and air sides of the facilities. Image: Market Study Report

TECHNOLOGY WILL PERVADE THROUGHOUT AIRPORT OPERATIONS

Cyber security threats that attempt to elicit information from passengers are also a security concern for airports, as are unauthorized uses of an airport’s systems, modifications of software and hardware, and configuration and human errors.

While the U.S. still dominates airport construction, the report projects that Canada will witness faster growth in smart airports during the forecast period. That being said, the U.S. still has the busiest airports in North America, and needs better ways to process their flyers.

“Implementation of robotics, artificial intelligence, and machine learning is currently trending in the U.S. aviation industry,” the report observes, citing by way of example Miami International Airport, where beacon technology is used for sending messages and guiding locations to passeners through navigation. “The technology is helping to determine where passengers are congregating, and it further enhances indoor mapping and sending relevant information to customers.”

The report identifies the leading technology suppliers for smart airports, and provides breakdowns by market size, forecasts, and trends analyses by technology, components, applications, and locations. The categories explored include security systems, biometrics, behavioral analytics, communications, cargo and baggage handling, enpoint devices, E-passport gates, air and ground traffic control, automated operations controls, sensors and beacoms, and surveillance devices.

The growing demand for airport technology is also projected by another new report on the North America Ground Handling Software Market, just released by ResearchandMarkets.com. That report foresees 3% annual growth, through 2027, to $471.1 million for this software.

Related Stories

| Sep 22, 2014

Sound selections: 12 great choices for ceilings and acoustical walls

From metal mesh panels to concealed-suspension ceilings, here's our roundup of the latest acoustical ceiling and wall products.

| Sep 15, 2014

Ranked: Top international AEC firms [2014 Giants 300 Report]

Parsons Brinckerhoff, Gensler, and Jacobs top BD+C's rankings of U.S.-based design and construction firms with the most revenue from international projects, as reported in the 2014 Giants 300 Report.

| Sep 9, 2014

Using Facebook to transform workplace design

As part of our ongoing studies of how building design influences human behavior in today’s social media-driven world, HOK’s workplace strategists had an idea: Leverage the power of social media to collect data about how people feel about their workplaces and the type of spaces they need to succeed.

| Sep 8, 2014

First Look: Foster + Partners, Fernando Romero win competition for Mexico City's newest international airport

Designed to be the world’s most sustainable airport, the plan uses a single, compact terminal scheme in lieu of a cluster of buildings, offering shorter walking distances and fewer level changes, and eliminating the need for trains and tunnels.

| Sep 3, 2014

New designation launched to streamline LEED review process

The LEED Proven Provider designation is designed to minimize the need for additional work during the project review process.

| Sep 2, 2014

Ranked: Top green building sector AEC firms [2014 Giants 300 Report]

AECOM, Gensler, and Turner top BD+C's rankings of the nation's largest green design and construction firms.

| Sep 1, 2014

Ranked: Top federal government sector AEC firms [2014 Giants 300 Report]

Clark Group, Fluor, and HOK top BD+C's rankings of the nation's largest federal government design and construction firms, as reported in the 2014 Giants 300 Report.

| Aug 19, 2014

HOK to acquire 360 Architecture

Expected to be finalized by the end of October, the acquisition of 360 Architecture will provide immediate benefits to both firms’ clients worldwide as HOK re-enters the sports and entertainment market.

| Aug 11, 2014

Air Terminal Sector Giants: Morphing TSA procedures shape terminal design [2014 Giants 300 Report]

The recent evolution of airport terminals has been prompted largely by different patterns of passenger behavior in a post-9/11 world, according to BD+C's 2014 Giants 300 Report.

| Aug 6, 2014

25 projects win awards for design-build excellence

The 2014 Design-Build Project/Team Awards showcase design-build best practices and celebrate the achievements of owners and design-build teams in nine categories across the spectrum of horizontal and vertical construction.