The demand for airport security system technology will drive the North America market for “smart” airports to $7.741 billion by 2026, compared to $3.075 billion in 2016, representing a compound annual growth rate of 9.7%, according to a new report released by Market Study Report LLC, a Delaware-based hub for market intelligence products and services.

The report’s findings and predictions are based on primary and secondary research driven by extensive data mining. The estimates and forecasts were verified through primary research with key industry participants.

Airports are seeking ways to provide passengers with better and seamless personalized experiences. The report sees growing demand for automated and self-service processes, as well as for real-time information.

These substantial growth prospects can be attributed to airports enhancing their business processes to provide optimized services. “Airport operators are investing heavily on IT and digital technology for enhancing customer experience,” the report states in its technology outlook.

PASSENGER COMMUNICATIONS WILL BE KEY

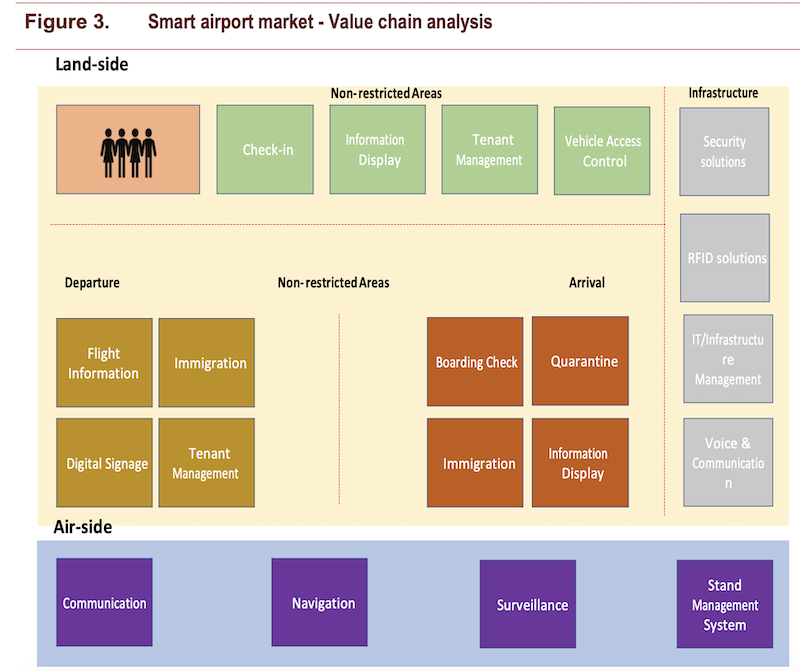

On airports’ land sides, improvements will include the adoption of digital technologies such as transport synchronization, real-time flight information, advanced booking and intelligent passenger steering for enhancing customer experiences and other features.

Airside, expected upgrades cited by the report include in-wallet scanning, geolocation of vehicles, and coordination of vehicles with real-time information of landing aircraft.

Modernization of old airports, introduction of new airports, development in commercial aviation, and increasing focus on green initiatives are other key growth drivers expected to boost market for smart airports in North America.

The new report provides analysis of where smart technology will be expanded, both on the land and air sides of the facilities. Image: Market Study Report

TECHNOLOGY WILL PERVADE THROUGHOUT AIRPORT OPERATIONS

Cyber security threats that attempt to elicit information from passengers are also a security concern for airports, as are unauthorized uses of an airport’s systems, modifications of software and hardware, and configuration and human errors.

While the U.S. still dominates airport construction, the report projects that Canada will witness faster growth in smart airports during the forecast period. That being said, the U.S. still has the busiest airports in North America, and needs better ways to process their flyers.

“Implementation of robotics, artificial intelligence, and machine learning is currently trending in the U.S. aviation industry,” the report observes, citing by way of example Miami International Airport, where beacon technology is used for sending messages and guiding locations to passeners through navigation. “The technology is helping to determine where passengers are congregating, and it further enhances indoor mapping and sending relevant information to customers.”

The report identifies the leading technology suppliers for smart airports, and provides breakdowns by market size, forecasts, and trends analyses by technology, components, applications, and locations. The categories explored include security systems, biometrics, behavioral analytics, communications, cargo and baggage handling, enpoint devices, E-passport gates, air and ground traffic control, automated operations controls, sensors and beacoms, and surveillance devices.

The growing demand for airport technology is also projected by another new report on the North America Ground Handling Software Market, just released by ResearchandMarkets.com. That report foresees 3% annual growth, through 2027, to $471.1 million for this software.

Related Stories

| Jul 28, 2014

Reconstruction market benefits from improving economy, new technology [2014 Giants 300 Report]

Following years of fairly lackluster demand for commercial property remodeling, reconstruction revenue is improving, according to the 2014 Giants 300 report.

| Jul 28, 2014

Reconstruction Sector Construction Firms [2014 Giants 300 Report]

Structure Tone, Turner, and Gilbane top Building Design+Construction's 2014 ranking of the largest reconstruction contractor and construction management firms in the U.S.

| Jul 28, 2014

Reconstruction Sector Engineering Firms [2014 Giants 300 Report]

Jacobs, URS, and Wiss, Janney, Elstner top Building Design+Construction's 2014 ranking of the largest reconstruction engineering and engineering/architecture firms in the U.S.

| Jul 28, 2014

Reconstruction Sector Architecture Firms [2014 Giants 300 Report]

Stantec, HDR, and HOK top Building Design+Construction's 2014 ranking of the largest reconstruction architecture and architecture/engineering firms in the U.S.

| Jul 23, 2014

Heathrow Airport could become a city of 190,000 inhabitants

New plans have been introduced to turn London's Heathrow Airport into a city. If those plans ever come to fruition, "Heathrow City" could support 90,000 jobs and 190,000 people. It could also add almost $13 billion to the UK economy.

| Jul 23, 2014

Architecture Billings Index up nearly a point in June

AIA reported the June ABI score was 53.5, up from a mark of 52.6 in May.

| Jul 21, 2014

Economists ponder uneven recovery, weigh benefits of big infrastructure [2014 Giants 300 Report]

According to expert forecasters, multifamily projects, the Panama Canal expansion, and the petroleum industry’s “shale gale” could be saving graces for commercial AEC firms seeking growth opportunities in an economy that’s provided its share of recent disappointments.

| Jul 18, 2014

Contractors warm up to new technologies, invent new management schemes [2014 Giants 300 Report]

“UAV.” “LATISTA.” “CMST.” If BD+C Giants 300 contractors have anything to say about it, these new terms may someday be as well known as “BIM” or “LEED.” Here’s a sampling of what Giant GCs and CMs are doing by way of technological and managerial innovation.

| Jul 18, 2014

Top Construction Management Firms [2014 Giants 300 Report]

Jacobs, Barton Malow, Hill International top Building Design+Construction's 2014 ranking of the largest construction management and project management firms in the United States.

| Jul 18, 2014

Top Contractors [2014 Giants 300 Report]

Turner, Whiting-Turner, Skanska top Building Design+Construction's 2014 ranking of the largest contractors in the United States.