U.S. retail and food services sales in July, at $696.4 billion, were up 3.2% over the same month a year ago, according to Census Bureau estimates. Luxury retail, in particular, has been ascending, the beneficary of persistent and post-COVID pent-up demand and robust retail expansion, according to a new Luxury Report 2023 released by Jones Lang Lasalle (JLL) this week.

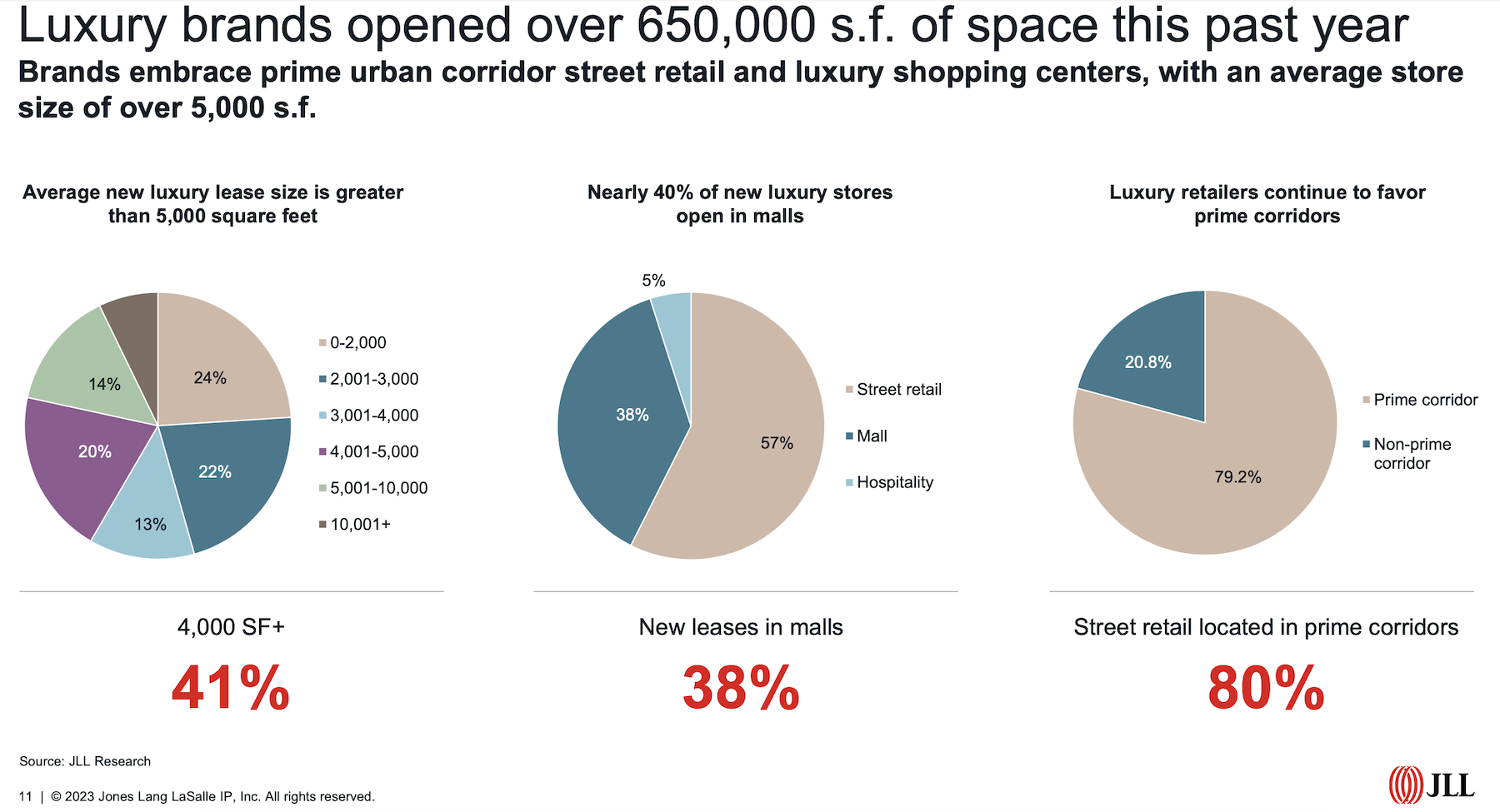

The United States accounted for the largest share of the global luxury market, 34% of overall sales, and JLL foresees ongoing growth to $83.33 billion in 2028 compared to $69.51 billion in 2022. Last year alone, luxury retailers added more than 650,000 sf of new selling spaces and stores with enhanced ecommerce capabilities, and JLL anticipates further expansion in prime retail corridors, suburban malls, and shopping centers.

LVMH, the global giant whose brands include Louis Vuitton and Tiffany, increased its net store count last year by 108 to 5,664 units worldwide. Kering Group, which controls brands that include Gucci and Bottega Veneta, added 100 stores, bringing its total to 1,659.

The average new luxury lease size is now greater than 5,000 sf.

Luxury retail getting more comfortable in the Sunbelt

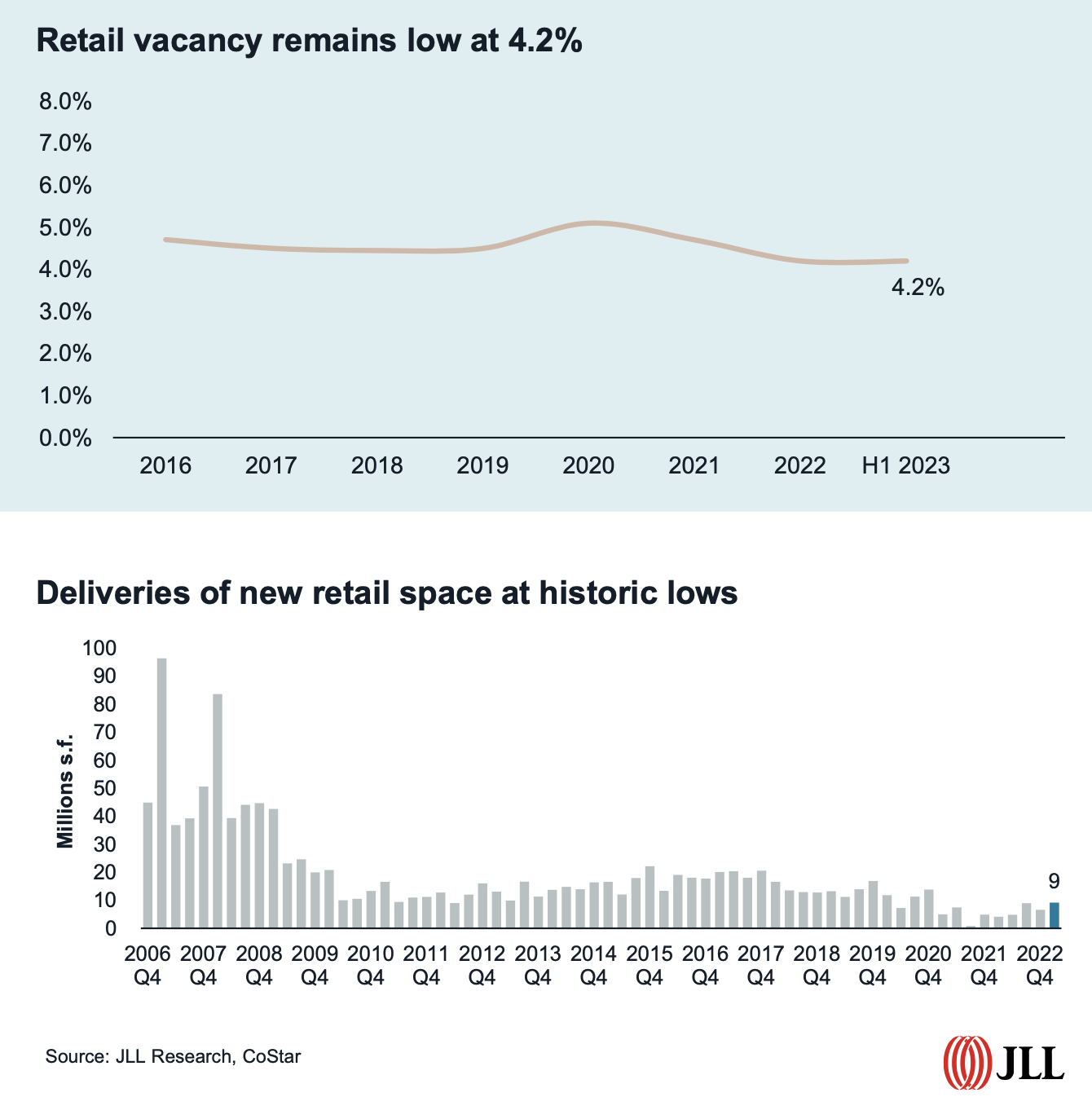

JLL suggests that the stars are aligned for bricks and mortar luxury retail. The retail sector as a whole continues to report solid fundamentals and low vacancy rates. Ecommerce, as a percentage of total retail sales, appears to have stalled at around 15%. And more than three-quarters of frequent luxury shoppers polled in a recent survey said they plan to visit a luxury store as often as or more frequently than they did last year.

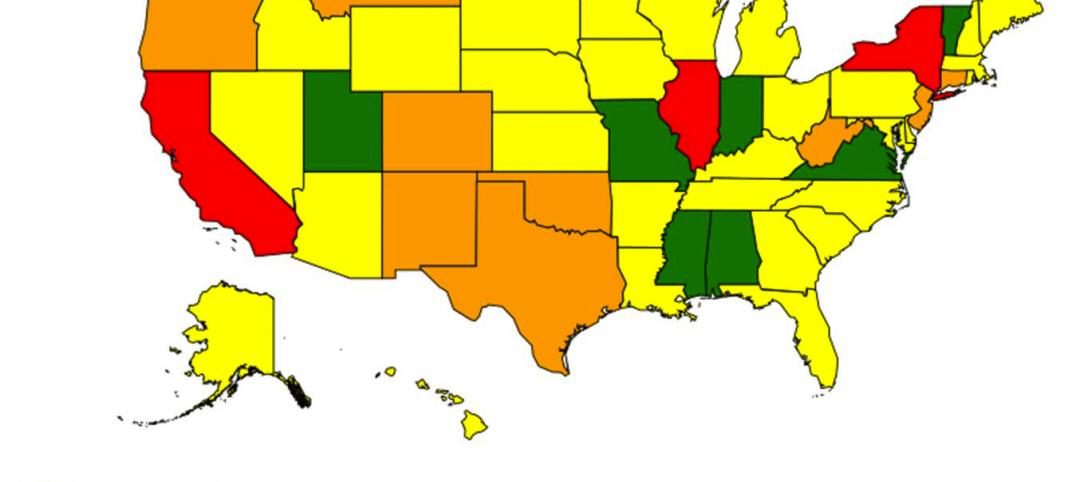

JLL is finding that while New York and California account for over half of all new luxury store openings in the U.S., the Sunbelt is seeing significant expansion in places like Atlanta, Miami, and Las Vegas. Surprisingly as well has been the willingness of luxury brands to open new stores in malls, which accounted for 38% of the space added last year.

A growing number of mall operators now devote entire wings to luxury brands. In Toronto, for example, The Oxford Properties-owned Yorkdale Shopping Centre is repurposing 100,000 sf of space to increase the mall’s luxury composition to 20% in 2025, from 13% today.

What’s also indisputable has been the preference of luxury retailers toward street retail located in prime corridors, which account for more than 45% of all new luxury leasing activity in the U.S. Prime corridors include New York City’s Times Square, which saw a 29.1% increase in corridor foot traffic between July 2022 and 2023. Boston’s Newberry Street corridor saw an 18% year-over-year increase in foot traffic. The Beverly Hills Triangle accounted for 41% of all luxury store openings in Los Angeles last year, including Chanel’s largest flagship store in the U.S., a 30,000-sf lease.

Quoting CoStar data, JLL notes that cities where rents are rising fastest, like Las Vegas, have also been magnets for luxury dealers.

Secondhand products offer sales alternatives

Last year 12% of new luxury leases were for luxury boutiques, a growing category within this sector, says JLL. Brands in this category include Kith, Elyse Walker, and The Webster.

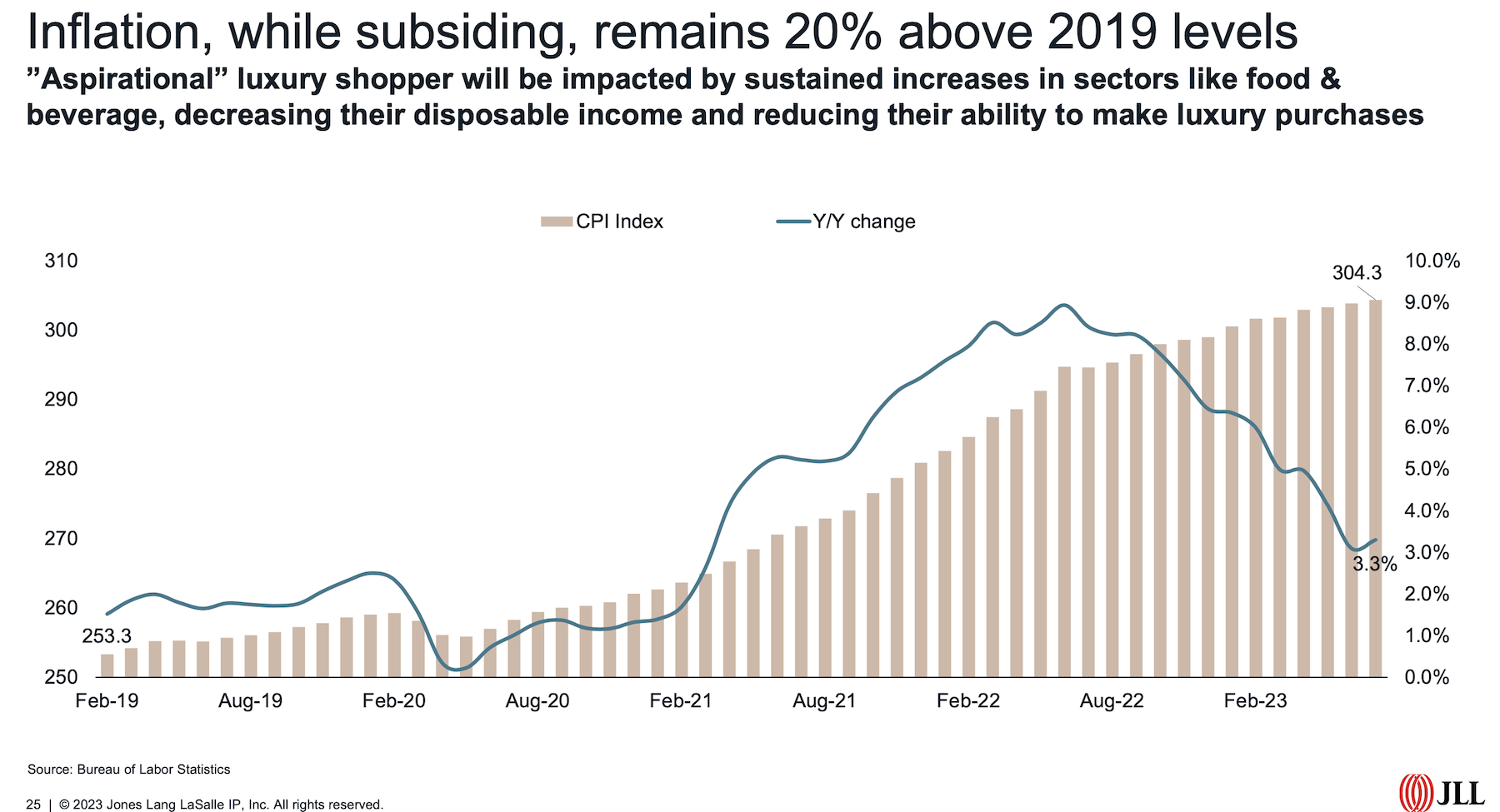

But there are some warning signs that could slow the luxury juggernaut. For one thing, there’s a lack of available retail space in an industry sector with historically low new deliveries. For another, so-called aspirational shoppers are still struggling with inflation at every retail level, not the least being luxury.

JLL reports that the market for secondhand luxury products grew by 28% in 2022. (Earlier this year, eBay launched “Certified by Brand,” which offers new, certified pre-owned, and limited-edition luxury products.) With more consumers concerned about environmental issues, brands that want to remain relevant must demonstrate a willingness to invest in the circular economy.

Related Stories

| Dec 28, 2014

AIA course: Enhancing interior comfort while improving overall building efficacy

Providing more comfortable conditions to building occupants has become a top priority in today’s interior designs. This course is worth 1.0 AIA LU/HSW.

| Dec 28, 2014

7 fresh retail design strategies

Generic ‘boxes’ and indifferent service won’t cut it with today’s savvy shoppers. Retailers are seeking a technology-rich-but-handmade vibe, plus greater speed to market and adaptability.

| Dec 8, 2014

How brick and mortar enables online retail

According to a shopping preferences study conducted by A.T. Kearney, as many as two-thirds of shoppers go to a physical store before or after making an online purchase, writes Gensler's Jill Nickels.

| Dec 2, 2014

Nashville planning retail district made from 21 shipping containers

OneC1TY, a healthcare- and technology-focused community under construction on 18.7 acres near Nashville, Tenn., will include a mini retail district made from 21 shipping containers, the first time in this market containers have been repurposed for such use.

| Nov 26, 2014

Need some pep on the job site? Check out this ruggedized coffeemaker on Kickstarter

The CoffeeBoxx single-serve brewer is billed as the world’s first ruggedized coffeemaker.

| Nov 18, 2014

New tool helps developers, contractors identify geographic risk for construction

The new interactive tool from Aon Risk Solutions provides real-time updates pertaining to the risk climate of municipalities across the U.S.

| Nov 10, 2014

Hotel construction pipeline hits five-year high

The hotel construction pipeline hit a five-year high in the third quarter, clocking in at 3,516 projects and 443,936 rooms, Lodging Econometrics reports.

| Nov 3, 2014

Cairo's ultra-green mixed-use development will be topped with flowing solar canopy

The solar canopy will shade green rooftop terraces and sky villas atop the nine-story structure.

| Oct 31, 2014

Dubai plans world’s next tallest towers

Emaar Properties has unveiled plans for a new project containing two towers that will top the charts in height, making them the world’s tallest towers once completed.

| Oct 29, 2014

Better guidance for appraising green buildings is steadily emerging

The Appraisal Foundation is striving to improve appraisers’ understanding of green valuation.