U.S. retail and food services sales in July, at $696.4 billion, were up 3.2% over the same month a year ago, according to Census Bureau estimates. Luxury retail, in particular, has been ascending, the beneficary of persistent and post-COVID pent-up demand and robust retail expansion, according to a new Luxury Report 2023 released by Jones Lang Lasalle (JLL) this week.

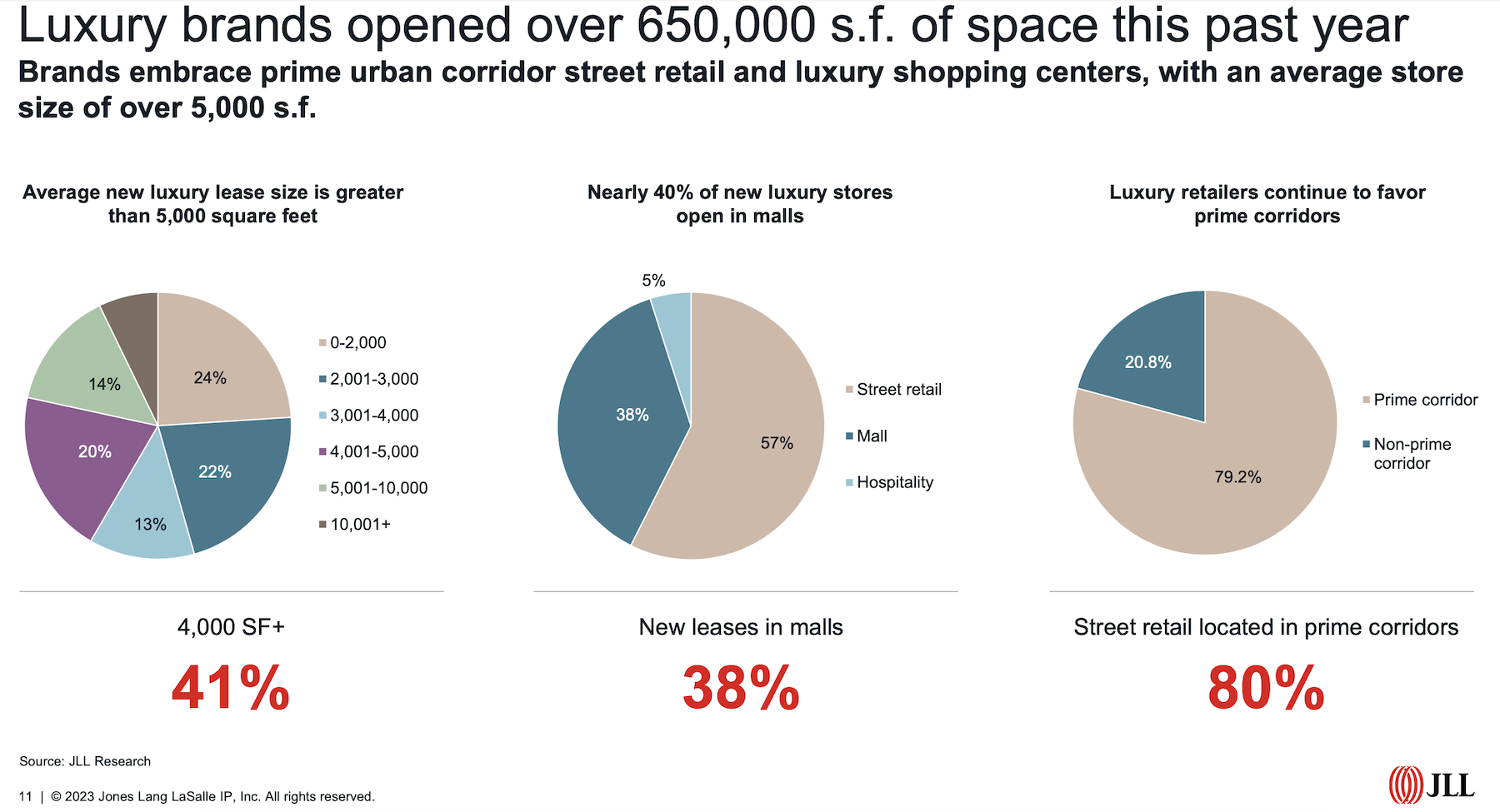

The United States accounted for the largest share of the global luxury market, 34% of overall sales, and JLL foresees ongoing growth to $83.33 billion in 2028 compared to $69.51 billion in 2022. Last year alone, luxury retailers added more than 650,000 sf of new selling spaces and stores with enhanced ecommerce capabilities, and JLL anticipates further expansion in prime retail corridors, suburban malls, and shopping centers.

LVMH, the global giant whose brands include Louis Vuitton and Tiffany, increased its net store count last year by 108 to 5,664 units worldwide. Kering Group, which controls brands that include Gucci and Bottega Veneta, added 100 stores, bringing its total to 1,659.

The average new luxury lease size is now greater than 5,000 sf.

Luxury retail getting more comfortable in the Sunbelt

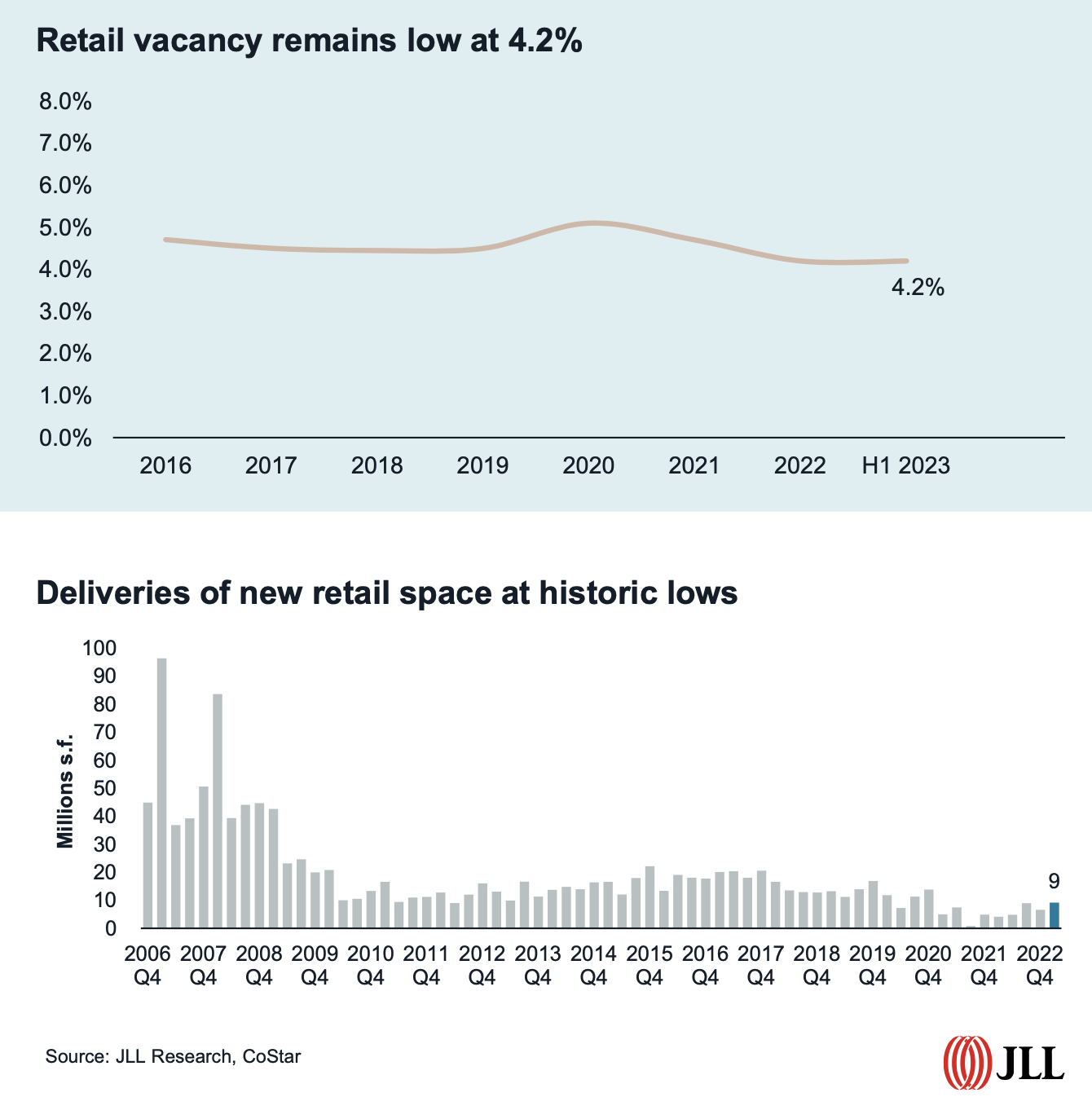

JLL suggests that the stars are aligned for bricks and mortar luxury retail. The retail sector as a whole continues to report solid fundamentals and low vacancy rates. Ecommerce, as a percentage of total retail sales, appears to have stalled at around 15%. And more than three-quarters of frequent luxury shoppers polled in a recent survey said they plan to visit a luxury store as often as or more frequently than they did last year.

JLL is finding that while New York and California account for over half of all new luxury store openings in the U.S., the Sunbelt is seeing significant expansion in places like Atlanta, Miami, and Las Vegas. Surprisingly as well has been the willingness of luxury brands to open new stores in malls, which accounted for 38% of the space added last year.

A growing number of mall operators now devote entire wings to luxury brands. In Toronto, for example, The Oxford Properties-owned Yorkdale Shopping Centre is repurposing 100,000 sf of space to increase the mall’s luxury composition to 20% in 2025, from 13% today.

What’s also indisputable has been the preference of luxury retailers toward street retail located in prime corridors, which account for more than 45% of all new luxury leasing activity in the U.S. Prime corridors include New York City’s Times Square, which saw a 29.1% increase in corridor foot traffic between July 2022 and 2023. Boston’s Newberry Street corridor saw an 18% year-over-year increase in foot traffic. The Beverly Hills Triangle accounted for 41% of all luxury store openings in Los Angeles last year, including Chanel’s largest flagship store in the U.S., a 30,000-sf lease.

Quoting CoStar data, JLL notes that cities where rents are rising fastest, like Las Vegas, have also been magnets for luxury dealers.

Secondhand products offer sales alternatives

Last year 12% of new luxury leases were for luxury boutiques, a growing category within this sector, says JLL. Brands in this category include Kith, Elyse Walker, and The Webster.

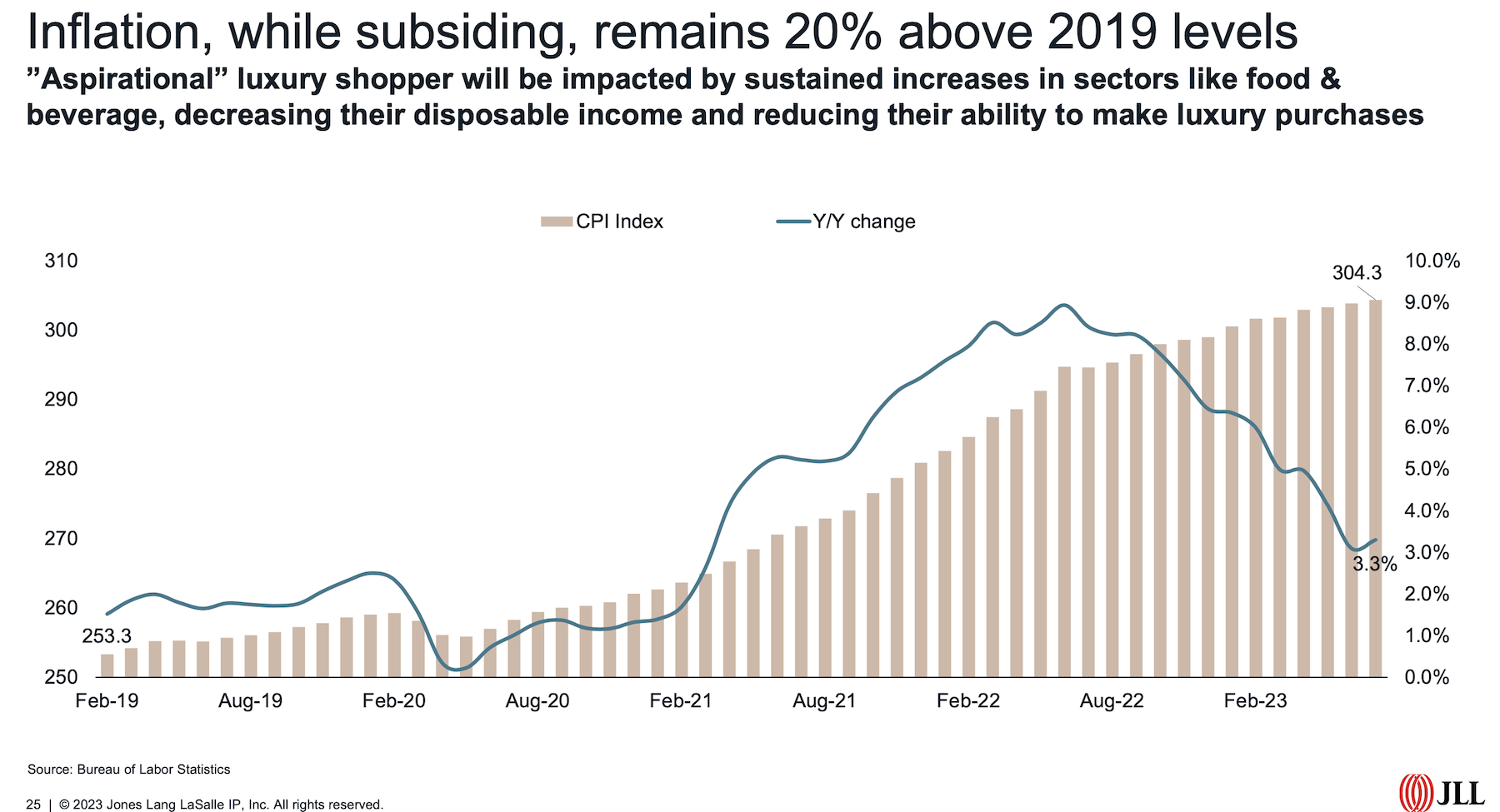

But there are some warning signs that could slow the luxury juggernaut. For one thing, there’s a lack of available retail space in an industry sector with historically low new deliveries. For another, so-called aspirational shoppers are still struggling with inflation at every retail level, not the least being luxury.

JLL reports that the market for secondhand luxury products grew by 28% in 2022. (Earlier this year, eBay launched “Certified by Brand,” which offers new, certified pre-owned, and limited-edition luxury products.) With more consumers concerned about environmental issues, brands that want to remain relevant must demonstrate a willingness to invest in the circular economy.

Related Stories

| Jul 18, 2014

Top Engineering Firms [2014 Giants 300 Report]

Fluor, Arup, Day & Zimmermann top Building Design+Construction's 2014 ranking of the largest engineering firms in the United States.

| Jul 18, 2014

Top Architecture Firms [2014 Giants 300 Report]

Gensler, Perkins+Will, NBBJ top Building Design+Construction's 2014 ranking of the largest architecture firms in the United States.

| Jul 18, 2014

2014 Giants 300 Report

Building Design+Construction magazine's annual ranking the nation's largest architecture, engineering, and construction firms in the U.S.

| Jul 17, 2014

A new, vibrant waterfront for the capital

Plans to improve Washington D.C.'s Potomac River waterfront by Maine Ave. have been discussed for years. Finally, The Wharf has started its first phase of construction.

| Jul 17, 2014

A harmful trade-off many U.S. green buildings make

The Urban Green Council addresses a concern that many "green" buildings in the U.S. have: poor insulation.

| Jul 7, 2014

7 emerging design trends in brick buildings

From wild architectural shapes to unique color blends and pattern arrangements, these projects demonstrate the design possibilities of brick.

| Jul 7, 2014

A climate-controlled city is Dubai's newest colossal project

To add to Dubai's already impressive portfolio of world's tallest tower and world's largest natural flower garden, Dubai Holding has plans to build the world's largest climate-controlled city.

| Jul 3, 2014

Gehry edits Canadian skyscraper plan to be 'more Toronto'

After being criticized for the original tower complex, architect Frank Gehry unveils a new design that is more subtle, and "more Toronto."

| Jul 2, 2014

SHoP designs what would be Brooklyn's tallest building

JDS Development partners with SHoP to construct a 70-story building at 775-feet tall, unprecedented for downtown Brooklyn.

| Jun 30, 2014

Research finds continued growth of design-build throughout United States

New research findings indicate that for the first time more than half of projects above $10 million are being completed through design-build project delivery.