Add to the growing list of forecasts about the fate of retailing in America a new report by the global consulting firm A.T. Kearney that suggests the survival of shopping centers and malls will be predicated on their “morphing” into Consumer Engagement Centers (CES) that are less about buying and selling products and more about creating experiences for consumers.

“The U.S. retail sector is moving from a ‘push’ model to a ‘pull’ model where consumers are demanding more curated experiences,” explains Michael Brown, a Partner with A.T. Kearney's retail group, and co-author of “The Future of Shopping Centers.”

The report stems from a larger study his firm conducted to examine and predict prospective consumer behaviors over the next 10-15 years, says Brown. The focus of the latest report is on Millennials, who will reach their peak spending years within the next decade.

The authors note that the U.S., at 23.5 sf of retail space per person, is already seriously overstored, compared to countries like Canada (16.8 sf/person), Australia (11.2 sf), the United Kingdom (4.6 sf), and Japan (4.4 sf). The U.S. also lags Europe when it comes to locating retail in proximity to transportation hubs, and building stores that are part of mixed-use developments.

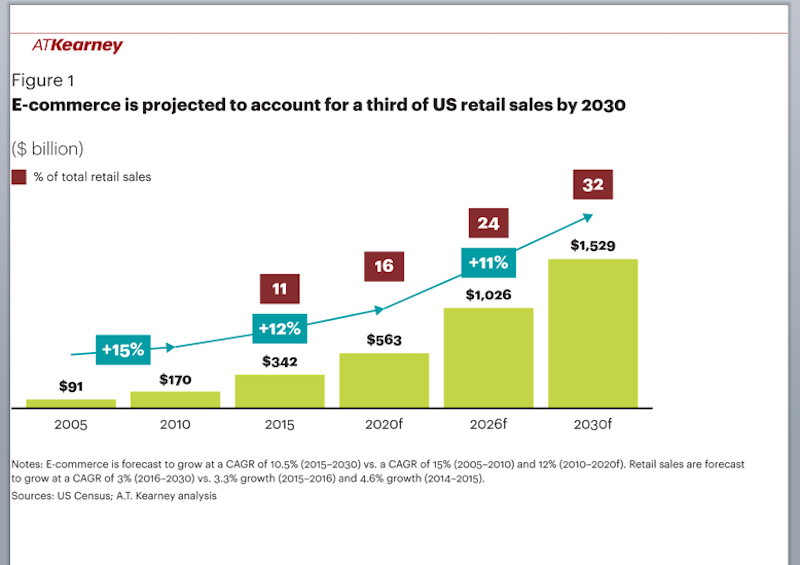

Looming in the background of A.T. Kearney's forecasts is the expanding encroachment of ecommerce. The report estimates that online purchases could account for 32% of total retail sales in the U.S. by 2030, or the equivalent of $1.53 trillion that year. That would be nearly triple the percentage in 2015, but Brown defends his firm's aggressive projections by noting that ecommerce has barely penetrated the grocery sector yet, but is likely to make a bigger splash there over the next several years, especially in light of Amazon’s $13.4 billion purchase of Whole Foods last year.

In addition, the report expects that, by 2030, at least two-fifths of all consumers will be digital natives who won’t draw distinctions between digital and physical retailing. Consequently, it is critical for retailers to master and embrace digital retailing not only to communicate with shoppers and transact business, but also to identify new customers, track purchases, and analyze patterns.

The report talks about how technology is creating “personalized digital ecologies” for consumers, which CES operators need to tap into along with autonomous, on-demand mobility technologies (from driverless cars to robots) that could play a much bigger role in future shopping experiences.

Online purchases could account for nearly one-third of all U.S. retail sales by 2030. Retailers need to embrace digital commerce to attract consumers who are less disposed to distinguish between on- and offline shopping experiences. Image: A.T. Kearney

Logistics will determine winners from losers

When it comes to product assortments, retailers now find themselves scrambling to respond to consumer fragmentation, which Brown explains is leading toward “micro segmentation” that has the potential to cut into big-brand hegemony. Consequently, retailers need to build a logistical infrastructure driven by data analytics that allows them to offer multiple brands they can switch in and out of relatively quickly as consumer buying trends change.

The report believes consumers are going to want a lot more say in the goods and services that retailers bring to market. Their veto power starts with their smartphones, which give them the alacrity to select, or block, any input they choose. Advances in smartphone technology—along with advances in 3D printing, machine-to-machine interfaces, and artificial intelligence—will not only give consumers greater expectations about the control they wield over what goods and services retailers make available to them, but also how those products are ultimately delivered.

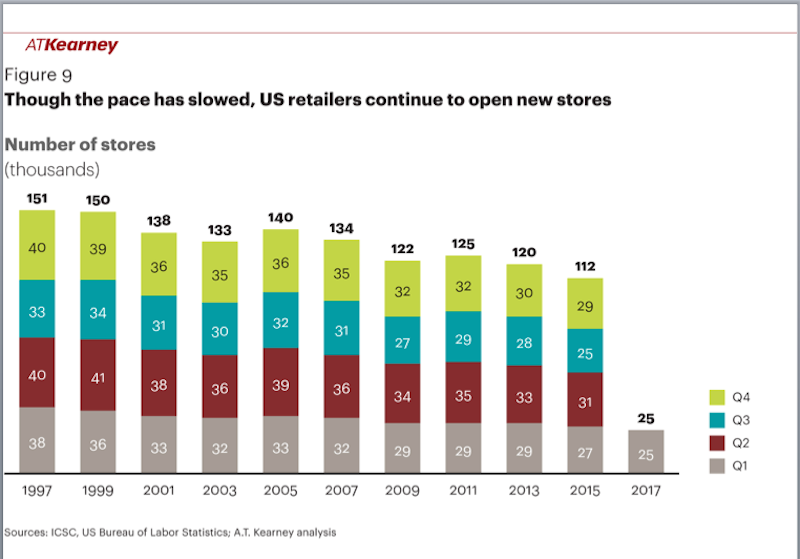

Physical stores aren’t going away; in fact, dealers are opening more stores in the U.S. And the picture about retailing’s future gets muddled when online retailers like Amazon and Boll & Branch are opening brick-and-mortar stores.

Even though the U.S. in overstored, dealers continue to open new outlets, although a growing number are using stores more as showrooms and distribution hubs for pickup by consumers who made their purchases online. Image: A.T. Kearney

But physical space, says Brown, is more likely to be used in the future to display merchandise and build experiences with consumers than to conduct actual buying and selling of products. He points specifically to the sporting goods retailer Foot Locker, which is reducing its store count but enlarging its remaining stores to enhance shoppers’ experience; and the home furnishings retailer Restoration Hardware, which has been opening “mansion” stores, 50,000- to 60,000-sf showrooms that support this dealer’s online selling strategy.

“Walmart and Amazon are successful because of their logistics,” says Brown, “and the speed and agility of a dealer’s infrastructure will be what’s important” going forward.

A.T. Kearney’s report divides successful future shopping centers into four distinct types:

•Destination centers that are regional malls with flagships, tenants that cater to specialized shopper groups, and possibly nontraditional anchors like theme parks. These destination centers could serve as digital distribution hubs, and even offer customers weekend experiences by tying into restaurants, hotels, and local entertainment;

•“Retaildential” centers, mixed-use facilities that are built to incorporate housing and are conveniently located near mass transit options;

•Value centers “that are anchored by an idea, not a retail nameplate,” the report states. Brown explains that value centers might cater to a specific ethnic group of customers, or to comsumers with like interests such as sports, fashion, or dining. These centers could include spaces for concerts, competitions, exhibits, and community events; and

•Innovation centers, that might be part-store, part research facility. They could include test stores and alternating-themed retail environments for the purpose of analyzing shoppers’ needs and behaviors over time.

Related Stories

Retail Centers | Nov 12, 2020

Concepts’ flagship takes gallery display approach

The streetwear retailer forges its online and brick-and-mortar presence.

AEC Tech | Nov 12, 2020

The Weekly show: Nvidia's Omniverse, AI for construction scheduling, COVID-19 signage

BD+C editors speak with experts from ALICE Technologies, Build Group, Hastings Architecture, Nvidia, and Woods Bagot on the November 12 episode of "The Weekly." The episode is available for viewing on demand.

Warehouses | Nov 9, 2020

Lowe’s rides ecommerce wave by expanding its distribution and delivery capacities

The retail giant will also open four more bulk warehouses, including a 1.2-million-sf DC in Alabama it is building with Clayco.

Retail Centers | Nov 2, 2020

Chick-fil-A introduces modular building program for rebuilding and remodeling existing restaurants

The first location to use this rebuild style reopens on Oct. 15 near Atlanta.

Adaptive Reuse | Oct 26, 2020

Mall property redevelopments could result in dramatic property value drops

Retail conversions to fulfillment centers, apartments, schools, or medical offices could cut values 60% to 90%.

Retail Centers | Sep 17, 2020

The Weekly show: Breaking the rules of retail, and the Household Model for assisted living facilities

This week on The Weekly, BD+C editors spoke with leaders from CallisonRTKL, MBH Architects, and McMillan Pazdan Smith on three topics: breaking the rules of retail, the Household Model for assisted living facility design, and designing labs to address the coronavirus and future health events.

Airports | Sep 10, 2020

The Weekly show: Curtis Fentress, FAIA, on airport design, and how P3s are keeping university projects alive

The September 10 episode of BD+C's "The Weekly" is available for viewing on demand.

Giants 400 | Aug 28, 2020

2020 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

The 2020 Giants 400 Report features more than 130 rankings across 25 building sectors and specialty categories.

Coronavirus | Aug 25, 2020

Video: 5 building sectors to watch amid COVID-19

RCLCO's Brad Hunter reveals the winners and non-winners of the U.S. real estate market during the coronavirus pandemic.

Retail Centers | Aug 19, 2020

How has shopping changed over the past 100 years? A look at the evolution of retail

From malls and big-box stores to online delivery and mall redevelopment: Here’s how the retail landscape has evolved—and where it’s likely headed.