Ben Franklin is often attributed as saying only two things are certain in life: death and taxes. While this quote rings true, it can be assumed Franklin didn’t predict some entities would be handed a tax bill of $71 million for property taxes alone, but that is exactly what Manhattan’s GM Building faced in 2016.

According to research conducted by COMMERCIALCafé, the GM Building had the highest property taxes in the country in 2016. Of the top 10 properties with the highest taxes, nine were associated with office buildings, but it is a residential community that takes the second spot on the list. Stuyvesant Town came in behind the General Motors Building, paying $60.5 million for property taxes in 2016.

The Metlife Building, 1345 Avenue of the Americas, and 1221 Avenue of the Americas, all in New York City, round out the top five.

Each property in the top ten resides in New York. In fact, you need to go down the list all the way to number 13 before arriving at a property not in New York, but Illinois. The Illinois entry to the list isn’t what you would expect, either. Not only was the first Illinois building on the list not the Willis Tower, but it wasn’t even a building in Chicago.

The first building on the list not in New York is the Exelon – Byron Nuclear Generating Station in Byron, Ill. The nuclear station paid $36.5 million in property taxes in 2016. Chicago’s Willis Tower doesn’t make an appearance until number 28 on the list, with $28.4 million paid in property taxes.

Minnesota’s Mall of America makes the list as the highest retail property at number 25 with $30 million in 2016 property taxes. Woodfield Mall, in Schaumburg, Ill., is the next closest retail property on the list at number 40 with $24 million paid in 2016.

The New York Marriott Marquis Hotel is the highest hotel on the list, at number 11, with a total of $36.6 million paid in 2016. The next closest was the New York Hilton Midtown Manhattan Hotel at number 39, with a total of $24.3 million.

Some buildings you may expect to see on the list, such as New York’s Chrysler Building or One World Trade Center, are nowhere to be found. This is because these structures, and other landmark buildings (Woolworth Building) are tax exempt. The Port Authority of New York & New Jersey, for example, owns One World Trade Center, so it doesn’t pay property taxes.

To view the entire Top 100 list, click here.

Related Stories

Market Data | Jul 24, 2023

Leading economists call for 2% increase in building construction spending in 2024

Following a 19.7% surge in spending for commercial, institutional, and industrial buildings in 2023, leading construction industry economists expect spending growth to come back to earth in 2024, according to the July 2023 AIA Consensus Construction Forecast Panel.

Codes and Standards | Jul 17, 2023

Outdated federal rainfall analysis impacting infrastructure projects, flood insurance

Severe rainstorms, sometimes described as “atmospheric rivers” or “torrential thunderstorms,” are making the concept of a “1-in-100-year flood event” obsolete, according to a report from First Street Foundation, an organization focused on weather risk research.

Multifamily Housing | Jul 13, 2023

Walkable neighborhoods encourage stronger sense of community

Adults who live in walkable neighborhoods are more likely to interact with their neighbors and have a stronger sense of community than people who live in car-dependent communities, according to a report by the Herbert Wertheim School of Public Health and Human Longevity Science at University of California San Diego.

Multifamily Housing | Jun 29, 2023

5 ways to rethink the future of multifamily development and design

The Gensler Research Institute’s investigation into the residential experience indicates a need for fresh perspectives on residential design and development, challenging norms, and raising the bar.

Apartments | Jun 27, 2023

Average U.S. apartment rent reached all-time high in May, at $1,716

Multifamily rents continued to increase through the first half of 2023, despite challenges for the sector and continuing economic uncertainty. But job growth has remained robust and new households keep forming, creating apartment demand and ongoing rent growth. The average U.S. apartment rent reached an all-time high of $1,716 in May.

Contractors | Jun 26, 2023

Most top U.S. contractors rarely deliver projects on time: new study

About 63% of leading U.S. contractors are delivering projects out of schedule, according to a survey of over 300 C-suite executives and owners in the construction industry by XYZ Reality. The study implies that the industry is struggling with significant backlogs due, in part, to avoidable defects, scan, and rework.

Industry Research | Jun 15, 2023

Exurbs and emerging suburbs having fastest population growth, says Cushman & Wakefield

Recently released county and metro-level population growth data by the U.S. Census Bureau shows that the fastest growing areas are found in exurbs and emerging suburbs.

Contractors | Jun 13, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of May 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in May, according to an ABC member survey conducted May 20 to June 7. The reading is 0.1 months lower than in May 2022. Backlog in the infrastructure category ticked up again and has now returned to May 2022 levels. On a regional basis, backlog increased in every region but the Northeast.

Industry Research | Jun 13, 2023

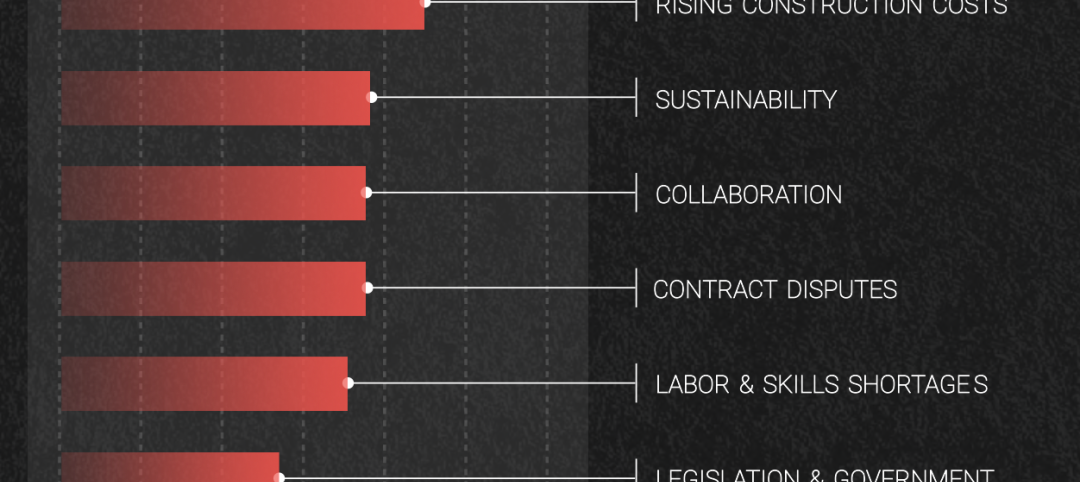

Two new surveys track how the construction industry, in the U.S. and globally, is navigating market disruption and volatility

The surveys, conducted by XYZ Reality and KPMG International, found greater willingness to embrace technology, workplace diversity, and ESG precepts.

| Jun 5, 2023

Communication is the key to AEC firms’ mental health programs and training

The core of recent awareness efforts—and their greatest challenge—is getting workers to come forward and share stories.